What are the coefficients for the analysis of the trading system?

Every year financial markets become more efficient, and so more competitive. Cryptocurrency is no exception. In order to have time to develop along with the market, you need to constantly analyze your trading strategies for possible improvements and increase efficiency.After all, the main task of a trader is to adapt to the market in time and make money on it. And now to the point:

Contents

- How to analyze your strategy?

- What are the coefficients

- How to automate the process of collecting and analyzing statistics?

- Conclusion

How to analyze your strategy?

Let’s start with a basic level: every trader should inspect their strategies every month and work on their mistakes. Which position was redundant? And which one did you miss? But why was this stop knocked out? What should be done to prevent this from happening next time?And of course, the most important factor in such an analysis is the analyzed period, the number of transactions for this period, and the result.

Thus, a trader can find new market inefficiencies, patterns, and analyze his own psychology and actions well.But still, you need to take it more globally – you need to analyze quarterly segments of statistics, and semi-annual, and even annual ones.

This is where trading strategy evaluation coefficients come to the rescue.

What are the coefficients

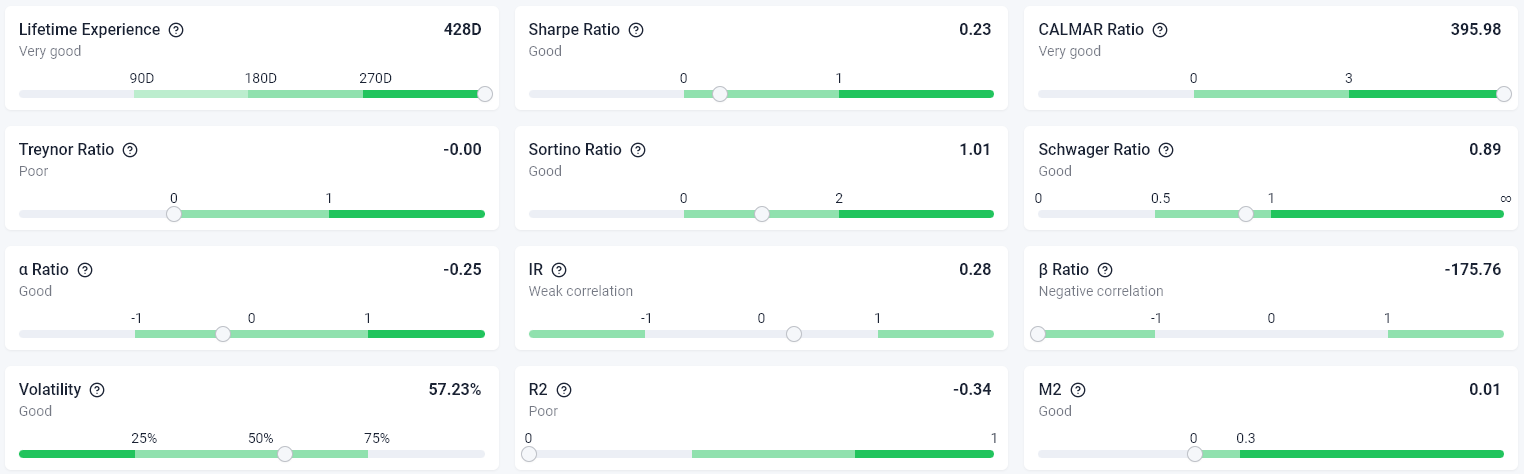

Sharpe – displays the ratio of return to risk

Treynor – displays the ratio of average return to systematic risk

Schwager – displays the ratio of the average monthly drawdown to the average monthly risk

Alpha – displays the profitability of the strategy relative to the profitability of the market

How to automate the process of collecting and analyzing statistics?

Our platform has been collecting the most diverse statistics of your strategies for more than three years.

The platform is completely free and always will be. On it, you can analyze any desired indicator of your strategy statistics for any period of time, and even more, in just 5 minutes. All of the above odds and many more are available now.

Conclusion

Analysis of statistics is the most important part of the profession of a trader. You can’t stay behind even for a minute. After all, do not forget that in order to earn money, a trader must be among top 5% of the traders who really take money out of the market.