Alligator indicator: what it is and how to use it

A significant part of the time the stock market is flat when the direction of the trend is not clearly expressed. Therefore, traders use indicators as filters to probe the market. For example, the Alligator indicator, which we will talk about today.

This tool was created by Bill Williams, who wrote the famous book Chaos Theory. Initially, the indicator was used only in the stock market, but now it is also widespread in Forex. Improper use of the tool threatens the investor with a loss of funds, so we understand the topic in more detail.

Description

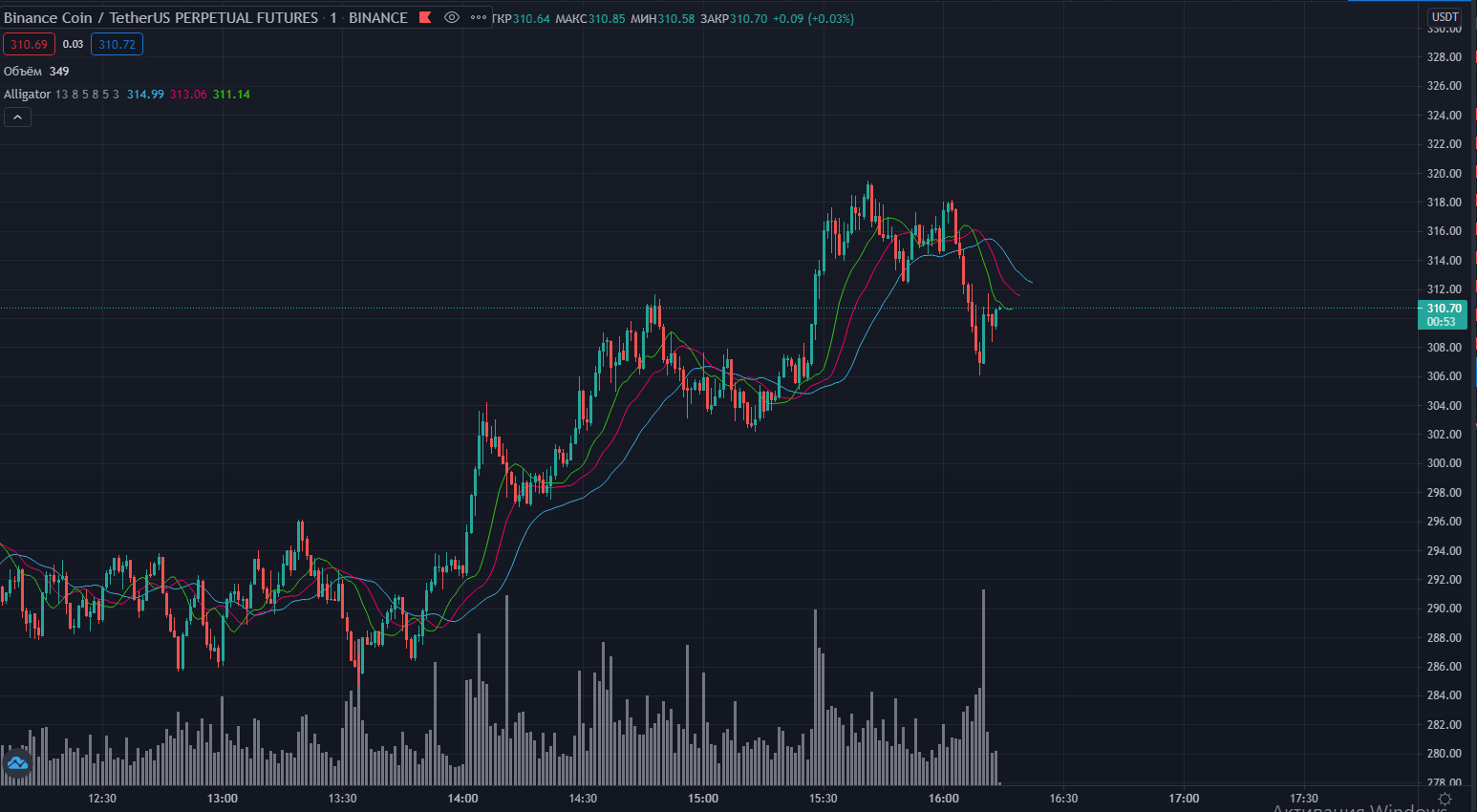

Alligator consists of three moving average lines, which the creator gave names to parts of the mouth of a famous reptile:

Lips (period 5, shift 2) – smoothed green line;

Teeth (period 8, shift 5) – smoothed red line;

Jaw (period 12, shift 8) – smoothed blue line.

The purpose of the indicator is to search for trend movement. When the three lines intertwine with each other, this indicates a “dormant” state of the market. Accordingly, when the moving averages are straightened, a trend movement begins.

The patterns are as follows:

If the “jaw” rises, and the “lips” and “teeth” roll down, then this is a downward movement;

If the blue line goes down, and the other two are up, this is an upward trend;

The longer the market “sleeps”, the longer it will take to “satisfy hunger”.

The main drawback of the Alligator indicator is its lagging and signal ambiguity (it often shows false signals). Other analytical tools are used to filter them, which reduces the likelihood of errors and increases the trader’s chances of making a profit.