Crowd Psychology in Crypto: Market Influence

Contents

- Introduction

- Basics of Crowd Psychology in Investingх

- How the Crowd Drives Cryptocurrency Trends

- Cases and Examples

- Methods of Protection Against Emotional Decisions

- Conclusion

Introduction

Definition of Crowd Psychology and Its Influence on Financial Markets

Crowd psychology refers to the behavior of individuals within a group, where people begin to think not as individuals but as part of a collective flow. This often leads investors to mimic each other’s actions in financial markets. One person buys an asset because everyone else is doing the same. Another sells out of fear of losing money, like the rest. As a result, market movements are driven mainly by participants whose decisions are based on emotions, news, and current events.

Characteristics of the Crypto Market: High Volatility and Emotional Investors

The crypto market differs from other markets due to its high volatility. Prices can change significantly several times within a month, a day, or even an hour.

Most participants in this market are ordinary people who often lack experience in investing or trading assets. They are more susceptible to emotional influence. Their decisions are frequently driven not by logic, but by fear or greed. These characteristics make the crypto market especially sensitive to crowd sentiment.

Purpose of the Article – To Explore How the Collective Sentiment of Retail Investors Shapes Trends in Cryptocurrencies

Many believe that trends in the crypto market are created solely by news or large players. In reality, regular investors play a significant role. Their emotions, reactions to news, and online behavior shape the overall sentiment. This article explains how collective emotions and mass actions lead to the rise or fall of cryptocurrencies.

Basics of Crowd Psychology in Investingх

Behavioral Factors: Fear, Greed, Euphoria, Panic

In financial markets, decisions are often driven by emotions. When prices rise, greed sets in. People fear missing out on profits and start buying. Then comes euphoria — the belief that growth will continue forever. But the market changes. When it reverses, investors feel fear. They sell to protect what remains. This escalates into panic. People close positions at a loss, without thinking about the consequences. These four emotional states repeat over and over.

Social Proof Effect: How Mass Trend-Following Affects the Market

People often trust the opinion of the majority. In the market, this looks like the following: if everyone buys a particular asset, others do the same without any fundamental analysis. This kind of behavior amplifies price movements. One trend pulls another behind it. When many participants act in the same way, it creates the illusion that the direction is correct. This may be just the crowd effect, not a valid reason for the asset’s growth or decline.

The FOMO Phenomenon (Fear of Missing Out) and Its Consequences

One of the strongest emotions in the crypto market is FOMO. This stands for “Fear of Missing Out” — the fear of missing an opportunity. People feel pressure when they see others profiting from an asset’s rise. They think they must join in too. As a result, they often enter a trade too late, at the peak of the trend.

Such actions often lead to losses. People buy at the top and then lose money when the price drops. FOMO pushes investors to take risks without a plan or analysis, which is one of the leading causes of losses in the crypto market.

How the Crowd Drives Cryptocurrency Trends

Bull Run (Bull Market): How Mass Optimism Drives Prices Up

When the market begins to rise, most participants gain confidence. People see the growth and start to believe it’s just the beginning. They keep buying, hoping for even greater profits. This leads to accelerated growth. Other investors observe what’s happening and join in as well. In this way, the crowd’s actions push the price up. Even weak projects attract attention, because everyone wants to “catch the moment.” Logic takes a back seat. What matters is buying in time. This collective optimism turns regular growth into a bull run.

Bear Market: The Impact of Panic and Investor Capitulation

When the market starts to fall, emotions shift quickly. Hope is replaced by fear. People see their investments losing value. They begin to sell — some out of fear of losing everything, others because they follow what others are doing. This amplifies the decline. Panic spreads among more and more participants. At a certain point, some investors simply give up. They close their positions and leave the market. This is called capitulation. In such moments, assets lose most of their value because most want to escape the losses.

Manipulation and Pump & Dump Schemes: How Large Players Use the Crowd

Large players often use a Pump & Dump scheme — artificially pumping the price and dumping the asset. It all starts with hype creation: Telegram chats, Twitter, and forums spread information that some little-known token is “about to explode.” The crowd sees the growth and starts actively buying, which pushes the price even higher. When the asset peaks, the large players sell their positions, securing profits. After that, interest quickly fades, and the price crashes. Those who entered last are left with losses.

Cases and Examples

Bitcoin Price Surge in 2021: The Impact of Social Media and Hype

The beginning of 2021 was marked by a powerful rise in Bitcoin’s price. In January, BTC was trading at around $29,000, and by April, it had reached a new all-time high of approximately $64,800. This growth was accompanied by massive media buzz: social networks, YouTube, Telegram channels, and news outlets constantly published updates about institutional investments, such as Tesla’s $1.5 billion Bitcoin purchase.

During this period, the number of new addresses on the BTC network increased by 35% in just one month. This indicates a substantial influx of retail investors eager to “catch the last train.” It was precisely this mass enthusiasm and trust in the trend that made this bull run possible.

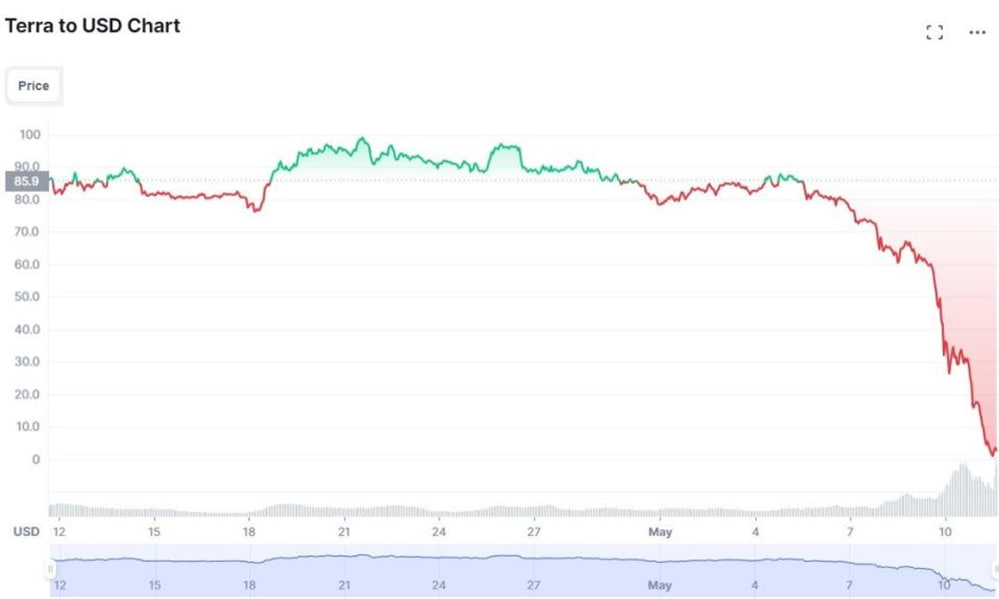

The Collapse of Terra (LUNA) in 2022: The Effect of Mass Panic

In May 2022, one of the most high-profile crashes in the crypto market occurred — the collapse of the Terra ecosystem. The stablecoin UST, which was supposed to maintain a $1 peg, began to lose its anchor. When the price dropped below $0.90, panic erupted on the network. The crowd reacted instantly: investors began to sell both UST and the associated token LUNA en masse to minimize losses.

The market collapsed within a few days. LUNA, which was priced at $80 in April 2022, fell to zero within a week. That’s a loss of over 99.99%, all due to the crowd’s cascading reaction. Every investor, seeing the actions of others, tried to “get out” first, which only accelerated the fall. Even statements from the project’s founder, Do Kwon, couldn’t stop the wave of fear.

This case became a classic example of how a loss of trust and the triggering of a collective survival instinct can destroy even a seemingly stable project.

Meme Coin Movements (Doge, Shiba Inu) Under the Influence of Communities

Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) are perfect examples of how a united community can drive a coin’s price to unimaginable heights:

- Dogecoin surged from $0.004 to $0.73 — an increase of over 18,000% since the beginning of 2021.

- SHIB increased in value more than 75,000 times from April to October 2021, turning $10 into millions.

All of this happened without fundamental value. The reason for the growth was mass involvement: Reddit, Twitter, and Discord communities promoted the coins and organized flash mobs and challenges. Every tweet from Elon Musk mentioning DOGE triggered an immediate market reaction. People bought based on emotions without understanding the essence. The crowd that believed in the power of memes created and sustained the trend.

Methods of Protection Against Emotional Decisions

Portfolio Diversification and Risk Hedging

One of the most common mistakes is going all-in on a single asset. This approach makes the portfolio vulnerable. If the asset drops, the entire capital is lost. When a portfolio contains different coins, the risks are spread out. One asset may fall while another rises — the overall result remains stable. This helps to stay calm during market corrections.

Hedging is a way to protect capital from significant drawdowns. The idea is to predefine potential losses or keep some funds in stable assets. For example, during a market rally, a trader can keep part of their portfolio in stablecoins, creating a “cushion” in case of a pullback. Hedging also includes using stop-loss orders or opening opposite positions in the future. If the price moves against expectations, losses from one trade can be offset by gains from another.

Experienced traders often keep a portion of their capital off the market. This allows them to enter a trade at the right moment. The key is not to keep all your funds in one basket and to be ready for any situation. That way, even during a downturn, you can remain calm.

Using Fundamental and Technical Analysis

Buying a token just because it’s trending often results in losses. To avoid such situations, projects must be analyzed. Fundamental analysis helps assess whether a token is worth attention. Examining the project’s website, the team, developer activity, and the contract’s audit is essential. A good project demonstrates openness and transparency.

Technical analysis involves working with charts. Even simple tools like support and resistance levels already provide an understanding of where it’s best to enter. One should pay attention to volume, trends, and candlestick patterns. These help avoid mistakes such as buying at the top or selling at the bottom.

By combining both types of analysis, you can make more informed decisions. Even a basic understanding already reduces the influence of emotions. You won’t be acting blindly — because you’ll have the facts.

Developing an Investment Strategy and Sticking to It Without Emotions

Without a plan, everything turns into chaos. One day you’re buying, the next — selling, and ultimately, you’re left with losses. To avoid this, you need a clear strategy. It should answer three key questions:

-

How much are you willing to invest?

-

What is your goal?

-

When will you exit the trade?

This strategy should be simple and easy to understand. If you’ve decided in advance: “I’ll sell at +30% or at -10%,” then the market won’t be able to throw you off course.

Following a plan protects you against impulsive decisions. Even if everyone around you is panicking, you know what to do. A plan prevents you from chasing FOMO or selling at a loss out of fear. It turns investing from a game into a process with rules.

Conclusion

The crowd can send the market soaring — and just as quickly bring it crashing down. In the crypto market, this happens especially often due to high volatility and the presence of many retail investors.

Understanding how psychology works is essential to avoid getting lost in this flow. Emotions drive the market. However, cold calculation, strategy, and knowledge help preserve and grow capital.

The key is not to give in to mass sentiment. Don’t buy just because “everyone’s buying,” and don’t sell because “everyone’s afraid.” You are not the crowd. You are an investor, and only you determine your result.