Beginner’s Step-by-Step Crypto Portfolio Guide

Contents

- Introduction

- What is a Crypto Portfolio

- Preparing to Build a Crypto Portfolio

- Step-by-Step Plan to Build a Crypto Portfolio

- How to Minimize Risks

- Tips for Beginners in 2025

- Conclusion

Introduction

Cryptocurrencies are increasingly becoming a part of personal investment strategies. People are looking for new ways to grow their money, and digital assets offer such an opportunity. This is especially relevant in 2025, as more platforms simplify access to the crypto market.

Unsystematic investments in cryptocurrency often lead to losses. To avoid this, it is essential to understand how to build a crypto portfolio properly. This helps control risks and make informed decisions.

This article will explain a crypto portfolio, why it is necessary, and how a beginner can get started.

What is a Crypto Portfolio

A crypto portfolio is a collection of digital assets that an investor buys and holds. It may include Bitcoin, Ethereum, other tokens, stablecoins, and even NFTs.

The main goal of a portfolio is not just to buy cryptocurrency, but to allocate funds in a way that avoids dependence on a single asset. If one token drops in price, others can help maintain the overall balance. This is called diversification.

For example, a portfolio might consist of 50% Bitcoin, 30% Ethereum, and 20% other coins. This approach provides greater stability. Even in a volatile market, losses in one asset can be offset by gains in another.

Creating a crypto portfolio is the first step towards smart investing. It helps with planning, risk management, and staying calm in unstable situations.

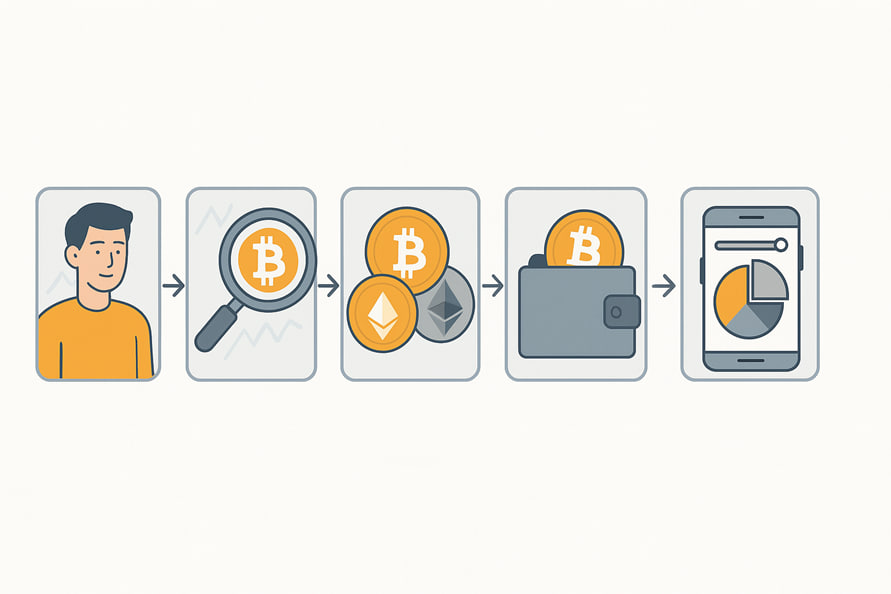

How a Beginner Can Build a Crypto Portfolio

You can start investing in cryptocurrency with a small amount. The key is a conscious approach. Beginners should focus on coins with high liquidity and a long history. For example, Bitcoin and Ethereum are well-established coins widely used and traded on all major exchanges. However, they are subject to price fluctuations, which must be considered.

Before buying, it’s essential to define your goals. Some invest short-term, hoping for quick growth, while others aim to preserve capital for several years. The portfolio structure is built accordingly. If the priority is potential growth, a portion of more volatile tokens may be added. If lower risk exposure is desired, more stable instruments are appropriate.

A brokerage account is unnecessary — it’s enough to register on a crypto exchange and complete basic verification.

Investing in crypto allows one to study the market, learn to manage risks, and make fact-based decisions. It’s important not to rush or invest everything at once. Creating a small starter portfolio and growing it gradually as experience accumulates is better.

Preparing to Build a Crypto Portfolio

Defining Goals and Budget

Before investing in crypto, it’s essential to define your objectives. Some want to try short-term trading, others aim to preserve part of their capital for years, while others want to build a financial cushion for the future. Your goal influences the choice of assets and strategy.

If the objective is to profit from short-term price swings, it makes sense to consider more volatile tokens. For long-term holding, assets with high market capitalization and steady demand—such as Bitcoin or Ethereum—are more suitable.

Regardless of strategy, you should only invest funds you can afford to lose. This rule applies at the start and as the portfolio grows. The crypto market remains high-risk, and no one is immune to losses.

The optimal approach is to start with a small amount you’re comfortable allocating without harming your budget. Depending on your circumstances, this could be $50, $100, or $500. The key is not to invest everything at once, borrow money, or risk funds meant for basic needs.

Choosing a Reliable Crypto Exchange

A cryptocurrency exchange is a platform where the primary operations occur: buying, selling, trading, and depositing/withdrawing funds. For a beginner, choosing a reliable and user-friendly platform is essential.

Key factors to consider:

-

Availability of two-factor authentication and other account security tools

-

Simple and intuitive navigation

-

Transparent fees for trades and transfers

-

Support for P2P platforms or bank card deposits

-

Reputation and operational history of the exchange

Top 3 Exchanges for Beginners:

-

Binance The most popular exchange with a wide selection of coins. Suitable for buying, selling, and storing crypto. Offers a basic interface for beginners, P2P exchange support, and the ability to start with small amounts.

-

Bybit A convenient exchange with a simple interface. Supports major cryptocurrencies and allows for fast P2P purchases or sales. Suitable for those taking their first steps in investing.

-

OKX A platform with a wide selection of coins and educational materials. Suitable for new users who want not just to buy crypto but also to understand how the market works.

Where to Store Cryptocurrency: Exchange or Wallet

Cryptocurrency can be stored either on an exchange or in a separate wallet. Each option has pros and cons.

Storing on an exchange is convenient—installing additional apps is unnecessary, and everything is readily accessible. This method suits active trading and small amounts. But there are risks: the exchange can restrict access, impose limits, be subject to sanctions, or even get hacked.

A wallet gives you complete control over your funds. It’s either a standalone app (hot wallet) or a physical device (cold wallet), where keys are stored only by the user. The exchange cannot block such funds — only the owner has access.

-

Hot wallets (e.g., Trust Wallet, MetaMask) run on phones or computers. They’re convenient but potentially vulnerable to viruses or phishing.

-

Cold wallets (e.g., Ledger, Trezor) are standalone devices that are not constantly connected to the Internet. They’re suitable for long-term storage of large sums.

When creating any wallet, a seed phrase is issued — a set of words used to restore access. It must be written down by hand and stored in a secure place. Losing this phrase means losing access to your crypto.

Step-by-Step Plan to Build a Crypto Portfolio

Step 1: Study the Cryptocurrency Market

Before investing, it’s essential to understand how the market works. Cryptocurrency is not a guaranteed way to make money — it’s a high-risk asset. Understanding its mechanics, terminology, and market logic helps avoid many mistakes.

Start by learning a cryptocurrency: why it was created, what problem it solves, and how its blockchain works. Most projects have a website, documentation (whitepaper), team information, and development history. Though detailed documentation doesn’t guarantee success, these materials help assess the project’s transparency and maturity.

Two main approaches can be applied:

-

Fundamental analysis — studying the project’s goals, developer activity, media presence, community, and industry adoption

-

Technical analysis — working with charts, support/resistance levels, volume history, and price movements

Beginners should start with educational resources, such as articles, blogs, and reputable video reviews. It’s also important to stay updated with news—external events often influence the market.

Step 2: Choosing Cryptocurrencies to Invest In

Initially, it is wise to focus on assets with high capitalization and liquidity. These are widely used coins, traded on most exchanges, and have a stable track record.

-

Bitcoin (BTC) — the first and most recognizable crypto asset

-

Ethereum (ETH) — the second-largest coin by market cap, the foundation of the largest smart contract platform

Later, you can explore other projects: Solana, Avalanche, Chainlink, etc. They differ in technology, goals, and growth potential.

The optimal number is 3–5 coins. This allows a deeper understanding of each and simplifies portfolio management.

Step 3: Diversifying the Portfolio

The crypto market is volatile, and asset allocation helps smooth out fluctuations. Diversification is not a guarantee of profit but a way to control risk.

You can use a conditional structure:

-

50% in the most stable assets (e.g., Bitcoin)

-

30% in technologically strong and actively developing coins (e.g., Ethereum)

-

20% in riskier but potentially promising projects

The allocation depends on your strategy. A conservative investor may focus on major coins and stablecoins, while an aggressive one may allow for a higher share in low-cap altcoins.

The main rule is not to build a portfolio around one asset. Doing so reduces overall resistance to market swings.

Step 4: Buying Cryptocurrency

To buy crypto, you need to register on a crypto exchange and complete identity verification (this is usually required). Then, you fund your account via bank card, P2P service, or other available methods.

After funding, you can proceed with purchasing. Exchanges offer different types of orders:

-

Market order — buy at the current market price

-

Limit order — buy at a set price when the market reaches the desired level

Purchased coins can be kept on the exchange or transferred to an external wallet. Exchange storage is fine for short-term trading, but a personal wallet is preferable for long-term investments, as it provides more control over assets.

Step 5: Managing and Monitoring the Portfolio

Buying coins is just the beginning. Regularly monitoring the portfolio and adjusting its structure when necessary is essential.

Some apps track asset value and portfolio performance:

Sometimes it makes sense to rebalance — redistribute asset shares if some have grown or dropped significantly. This helps manage risks and maintain strategic balance.

Decisions to take profit or partially exit positions should be made individually, based on your goals, investment horizon, and current market conditions. There is no universal rule.

Proper portfolio management isn’t about chasing the maximum return — it’s about systematic work with risk in mind. Discipline, moderation, and fact-based decision-making matter most in a volatile market.

How to Minimize Risks

Principal Risks of Crypto Investments

Investing in cryptocurrency involves high volatility. Prices can change by tens of percent within a short time, in either direction. This can be due to market panic, actions of major players, technical failures, or sudden news.

There are also technological risks. Crypto assets are entirely digital — losing wallet access, device infection, or key leakage can result in irreversible loss of funds. Even major exchanges and wallets occasionally suffer attacks.

Scams are also common: fake projects, cloned websites, worthless tokens, and “guaranteed return” schemes. These often spread via social media or ads disguised as legitimate products.

Additionally, there are regulatory risks. Some countries may restrict crypto circulation, block exchange access, or impose strict identification rules.

How to Reduce Risk: Basic Measures

-

Use secure services

Only work with reputable exchanges and wallets. Enable two-factor authentication and don’t follow random search links. A reliable option is to open websites via DefiLlama — it aggregates verified DeFi projects and indicates official domains, helping avoid phishing (especially for cloned projects or ad campaigns). -

Store assets independently

Keeping all your funds on an exchange is risky. Cold wallets (e.g., Ledger, Trezor) are better for long-term storage offline and are protected from remote attacks. -

Thoroughly research projects

Before investing, review the project: developer activity, documentation, independent reviews, feedback, and contributor history. Aggressive marketing, “guaranteed profit” promises, and anonymous teams are red flags. -

Distribute funds responsibly

Don’t invest more than you can afford to lose. This applies not only to your initial investment but also to future portfolio expansion. Even reputable assets can drop significantly in value. -

Monitor news and regulations

Keep up with changes in exchange policies and your country’s laws. New restrictions can impact platform access or complicate fund withdrawals.

Tips for Beginners in 2025

Crypto Market Trends

In 2025, the crypto market will move away from superficial trends and focus on directions with real infrastructure value. Below are key trends influencing crypto portfolio development and the industry’s evolution.

Tokenization of Real-World Assets (RWA)

Tokenization allows real assets—such as bonds, funds, and real estate—to be represented as tokens on the blockchain. This opens access to traditional markets via decentralized platforms.

Project examples:

-

Ondo Finance — tokenized U.S. government bonds

-

Maple Finance — blockchain-based lending and debt markets

-

Centrifuge — tokenization of real financial instruments for DeFi

AI Integration

AI is becoming deeply integrated in crypto, from automated data analysis to optimizing trading strategies and DAO management. This is not a temporary trend but a natural evolution of digitalization.

Project examples:

-

Fetch.ai — autonomous agents and AI infrastructure

-

Ocean Protocol — decentralized data exchange for model training

-

Numeraire — a collective AI fund with a blockchain-based model

DePIN (Decentralized Physical Infrastructure Networks)

These projects create decentralized physical infrastructure, such as networks for storage, computing, and the Internet. Users earn by providing real-world resources.

Project examples:

-

Helium — decentralized telecom network

-

Render — distributed GPU computing for graphics and AI

-

io.net — computational resource network for ML and neural networks

Common Mistakes of Beginner Investors

One of the most common mistakes is emotional buying. When prices surge or something trends in the news, many buy without researching the asset. When the price drops, they rush to sell, locking in losses.

Lack of diversification is also frequent. Putting the entire sum into one token increases portfolio vulnerability. Another mistake is the absence of a strategy: random decisions without a clear investment goal.

Such situations can be avoided with a simple rule: make decisions based on analysis, not emotions. Even a small but well-thought-out portfolio offers better chances of preserving and growing funds.

Conclusion

Investing in cryptocurrency is a long-term process, not a way to get rich quickly. Each stage is essential — from market research and asset selection to diversification and security.

It’s better to start small, learn the tools, and choose reliable coins and platforms. This approach helps reduce risks and build a sustainable strategy.

With experience comes confidence. Gradual progress and consistency are the foundation for success in the crypto market.