How Flash Loans Work and Can You Make Money from Them?

Contents

- Introduction

- Mechanics of Flash Loans

- Practical application of Flash Loans: basic usage examples

- Risks and limitations of Flash Loans

- Earning Potential on Flash Loans

- Popular Flash Loans Platforms: A brief overview and differences

- How to get started with Flash Loans

- Conclusion

Introduction

Flash Loans (instant loans) are a tool in the field of decentralized finance DeFi. They allow users to borrow significant amounts without providing collateral but with one important condition: the loan must be repaid in a single transaction. In this article, we will analyze the mechanics of Flash Loans and evaluate the earning potential of Flash Loans.

Mechanics of Flash Loans

Flash Loans are unsecured loans that are issued and repaid in a single transaction. They are available on various blockchain platforms, such as Ethereum, and are used primarily in the field of arbitration, loan liquidation, and debt refinancing.

Key Features of Flash Loans:

- No collateral – the borrower is not required to provide collateral, as in traditional loans.

- Instant execution – a loan is issued and repaid in a single transaction.

- Programmability – operations are managed by smart contracts that automatically fulfill loan conditions.

Unlike regular loans, Flash Loans do not require approval from a bank or lender. They are issued and redeemed automatically using smart contracts.

The main difference is the need to return funds within a single transaction, which makes such loans a tool for instant capital optimization rather than for long-term financing.

How Flash Loans work: a single transaction and the need for a refund

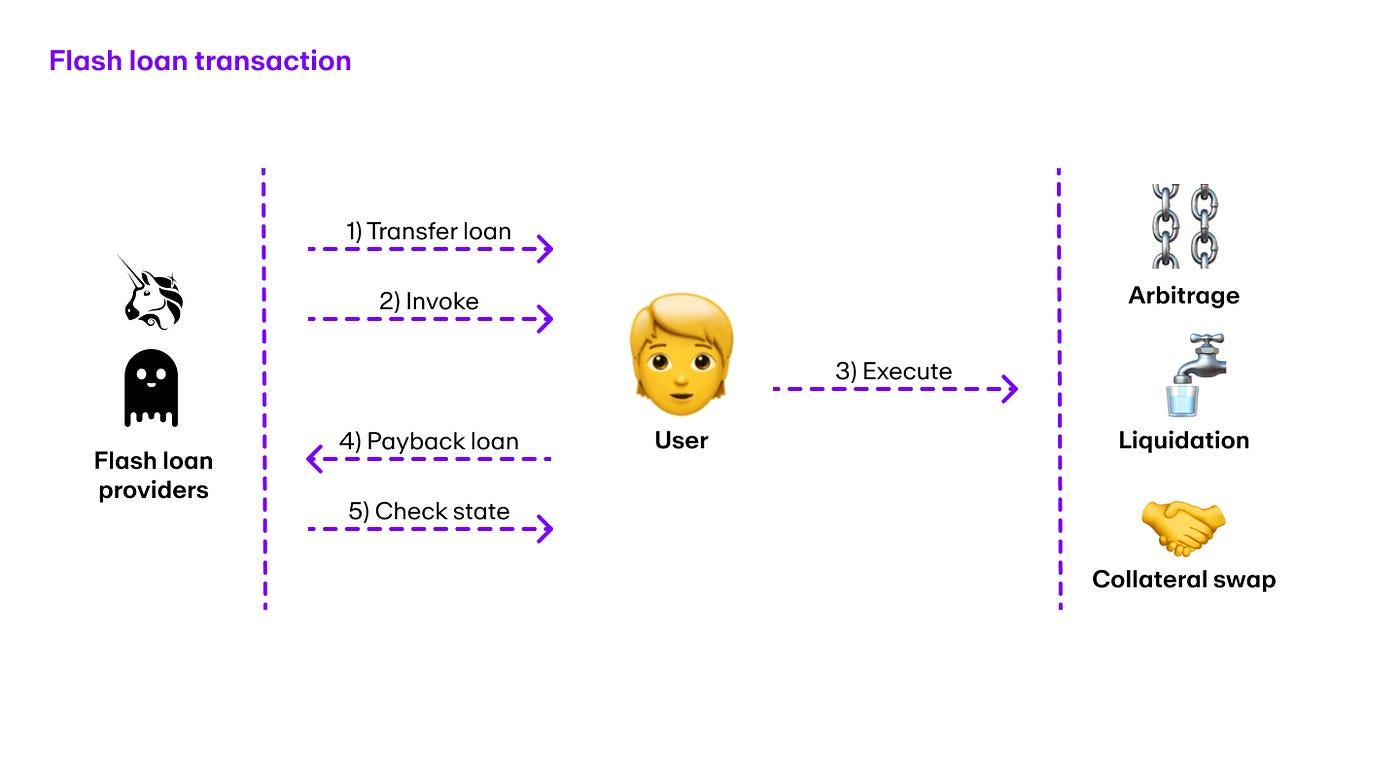

Flash Loans work according to the following algorithm:

- The borrower initiates a Flash Loan request via a smart contract.

- The smart contract allocates borrowed funds and simultaneously prescribes the conditions for their return.

- The borrower uses the loan to perform financial transactions, such as arbitrage between DEX platforms.

- At the end of the transaction, the borrowed funds are refunded, including the lender’s commission.

- If the borrower does not return the funds, the smart contract automatically cancels the entire transaction, returning the state of the blockchain to its original state.

Thus, flash loans are a secure mechanism through which the lender does not risk losing funds.

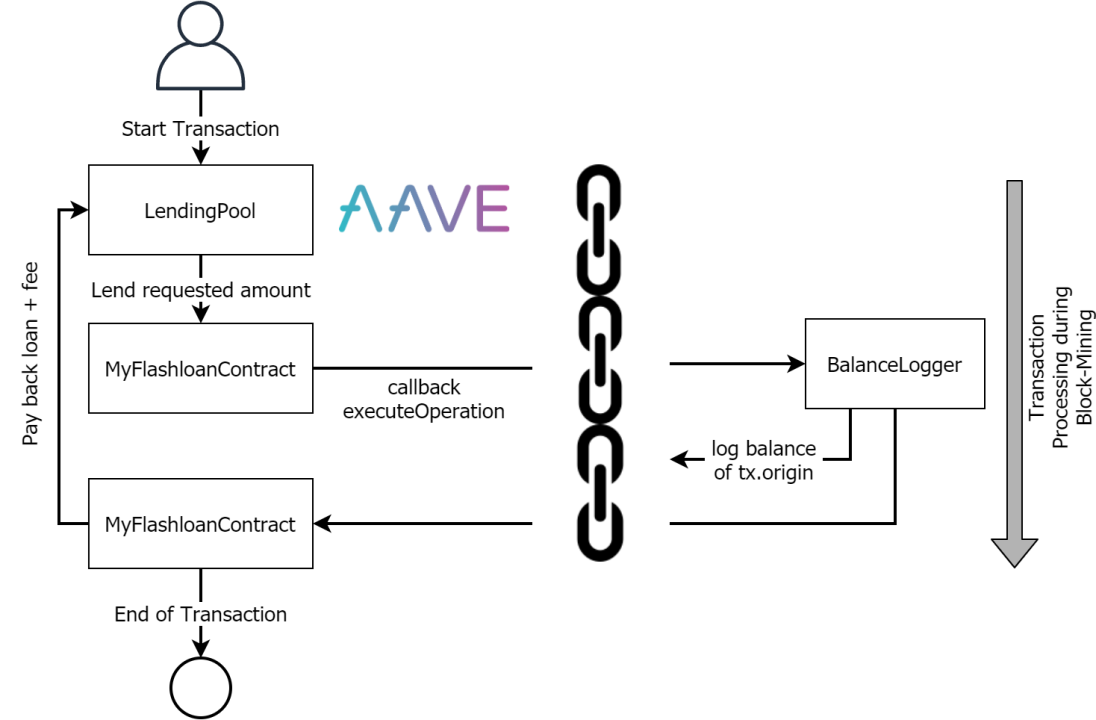

The role of Smart contracts in securing Flash Loans

Smart contracts play a key role in the operation of Flash Loans, ensuring security, transparency and automatic execution of terms.

- Automatic fulfillment of loan conditions.

Smart contracts are programmed in such a way as to monitor the implementation of all stages of the transaction. If the borrower does not return the funds at the end of the transaction, the transaction is automatically canceled, and the funds remain with the lender.

- No intermediaries.

Flash Loans eliminate the need for trusted third parties, such as banks or financial institutions. All operations occur directly between the user and the protocol.

- Transparency and reliability.

All loan data is recorded on the blockchain, which makes the process transparent and available for analysis. This reduces the risk of fraud and manipulation.

- Flexible programming.

Smart contracts allow you to develop complex strategies, including arbitrage transactions and automated financial transactions.

Practical application of Flash Loans: basic usage examples

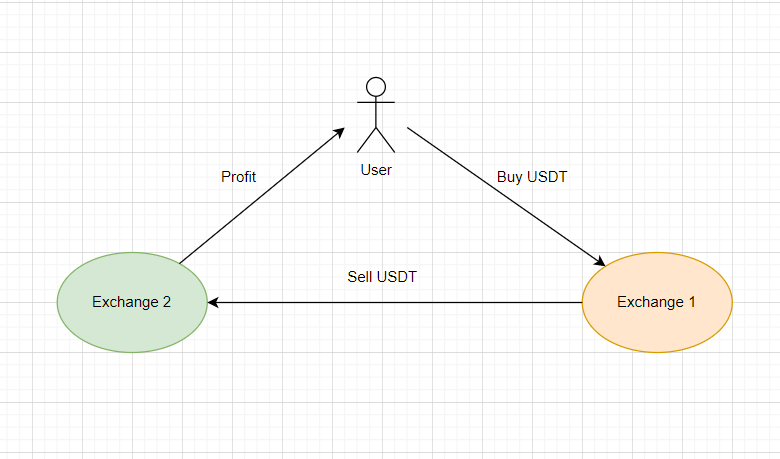

Arbitrage: Using Flash Loans to profit from price differences on different exchanges.

Flash Loan arbitrage allows traders to instantly profit from price differences in the same cryptocurrency on different exchanges. This is possible thanks to instant access to large amounts of money without the need to block your own capital.

This method of arbitrage works only if there is sufficient liquidity and speed of operations. Errors in the code or high commissions can make the strategy unprofitable.

In 2020, a prominent cryptocurrency trader used Flash Loan to arbitrage between two decentralized exchanges. On one exchange, the token was undervalued by 2%, while on another, its price was higher. He took out a Flash Loan for 1000 ETH, bought tokens on the first exchange, and then sold them on the second, earning a profit from the price difference. He returned the entire amount to the same block but kept the difference in profit for himself.

Secured loans: refinancing a position or replacing collateral.

Flash Loans allow users to instantly refinance their loan positions or change collateral without having to enter additional funds. This is especially useful in DeFi protocols such as Aave, MakerDAO, and Compound, where borrowers pledge crypto assets as collateral.

Refinancing the loan.

Suppose a user took out a loan in DAI secured by ETH in the Aave protocol but found that the interest rate on the loan is lower in Compound. It can use Flash Loan as follows:

- Takes a Flash Loan in DAI.

- These funds are used to pay off the loan in Aave and unlock the issued ETH.

- Moves ETH to Compound and takes out a new loan in DAI at a better rate.

- Uses the resulting DAI to repay the Flash Loan while saving on interest payments.

Replacement of collateral

Let’s say a borrower mortgaged ETH to get a loan in DAI but expects the price of ETH to fall and wants to replace it with a more stable asset, such as WBTC.

- Takes a Flash Loan in DAI.

- Repays the current loan, releasing the pledged ETH.

- Exchanges ETH for WBTC.

- Deposits the WBTC as new collateral and takes out the loan again in DAI.

- Returns Flash Loan and its position is now secured with WBTC instead of ETH.

Debt liquidation: earning money by liquidating borrowers positions.

In most DeFi protocols, such as Aave, MakerDAO, and Compound, users can take out loans by providing cryptocurrency as collateral. However, if the price of the pledged asset falls below a certain threshold, their position is subject to liquidation. At this point, the protocol allows third parties to pay off part of the borrower’s debt and receive part of the collateral at a discount in return. Flash Loans make this process accessible even to those who do not have equity.

In DeFi protocols such as MakerDAO, borrowers are required to maintain a certain level of collateral to avoid liquidation. In 2020, one of the DeFi participants used Flash Loan to eliminate borrowers ’ positions in MakerDAO:

- The borrower was unable to maintain the required collateral ratio, and its position was threatened with liquidation.

- Another participant used Flash Loan to take out a loan to cover the debt and liquidated the borrower’s position.

- For this, he received liquidation bonuses in the form of DAI, which was received after deducting the cost of the loan, commission, and other costs.

Risks and limitations of Flash Loans

Using Flash Loans brings many opportunities, but it also comes with a number of risks and limitations. Read more about them below:

High implementation complexity for beginners

In order to use Flash Loans effectively, you need a good understanding of smart contracts and DeFi protocols. The Flash Loans platform requires programming, creating smart contracts, and executing them in a single transaction.

Beginners may find it difficult to correctly implement the contract logic, which leads to errors, loss of funds, or lost profits. Also, improper use can lead to losses, especially in the case of arbitration, where every decision depends on the accuracy of calculations.

Technical risks: errors in the smart contract code

When creating smart contracts for Flash Loans, you may encounter errors in the code, such as incorrect calculations or poorly implemented loan repayment conditions. This may affect the successful execution of the transaction.

Errors in the smart contract can lead to an unsuccessful attempt to complete the transaction and loss of funds. For example, if the smart contract does not return the Flash Loan at the right time. Also, errors in contracts can lead to the loss of user funds if vulnerabilities occur in the code.

Potential vulnerabilities and abuses

Flash Loans can be used by attackers to manipulate the market, create an attack using a flash loan, or exploit vulnerabilities in the smart contracts of other users or platforms.

One well-known example is the MakerDAO attack, where attackers used Flash Loans to manipulate the price of assets, which affected the protocol’s liquidity. As a result, the stability of the protocol was compromised.

Restrictions on liquidity on platforms

Despite the attractiveness of Flash Loans, there is a risk of insufficient liquidity on the platform, which can lead to a failure of the transaction. For example, decentralized exchanges may not have enough liquidity to complete an arbitrage transaction in a single transaction.

If the liquidity on a particular platform or pool is insufficient to perform all operations in Flash Loan, the transaction may not be executed. This can lead to a failure where borrowed funds cannot be used for arbitrage, refinancing, or debt liquidation.

Flash Loans are a powerful tool for obtaining interest-free short-term loans, but their use requires high technical skills and knowledge of the features of DeFi protocols. Risks associated with technical errors, smart contract vulnerabilities, insufficient liquidity, and high fees can reduce profitability or lead to losses.

Earning Potential on Flash Loans

Success in earning money on Flash Loans depends on many factors, including technical knowledge, strategy, and market conditions. Let’s look at the potential for earning money on Flash Loans, what are the requirements for successful work, and what examples of earnings exist.

Analysis of earning opportunities: who earns money from them and how?

- Traders and arbitrageurs:

Traders use Flash Loans for arbitrage on different decentralized exchanges or between different DeFi protocols. They borrow large amounts of assets, buy at a lower price on one platform, and sell at a higher price on another.

- Participants in debt liquidation:

DeFi protocols require borrowers to maintain a certain level of collateral. If this level decreases, their positions can be liquidated. Participants can use Flash Loans to liquidate such positions and profit from liquidation penalties.

- Bot developers and creators:

Developers can create automated bots for arbitrage trades or position liquidations. These bots can work effectively on a variety of platforms using Flash Loans, and at the same time work without constant human intervention.

However, to successfully earn money using Flash Loans, you need to meet several requirements:

- Knowledge of smart contracts:

You need to understand how smart contracts work, how to write them, and how they interact with DeFi protocols. Experience in creating and deploying smart contracts on platforms such as Ethereum, Solana, Binance Smart Chain, and others is important.

- Programming skills:

You need skills with programming languages such as Solidity (for Ethereum) to create effective smart contracts that can automatically perform operations with Flash Loans.

- Understanding DeFi and financial protocols:

Knowledge of how platforms such as Aave, MakerDAO, Uniswap, Sushiswap, and others work is extremely important. You need to understand how liquid pools, loan rates, collateral, and liquidation mechanisms work and how to use these features to make a profit.

- Analytical skills:

To work effectively with Flash Loans, you need to be able to analyze and predict market fluctuations and price differences between platforms for successful arbitrage or liquidation.

Practical examples of earning money

Arbitrage via Flash Loans:

One real-world example was recorded in 2020 when a trader used Flash Loans to arbitrage between Uniswap and Sushiswap. He borrowed $ 1 million with a Flash Loan and made about $ 100,000 from the price difference between the platforms. He successfully completed the transaction, paying only gas fees, and made a profit from the difference in prices.

Liquidation of positions via Flash Loans:

In 2021, several users used Flash Loans to liquidate positions in Aave and MakerDAO. They used Flash Loans to borrow funds and liquidate borrowers whose positions were subject to liquidation due to insufficient collateral. For example, a liquidator could borrow funds through a Flash Loan, liquidate the borrower’s position, and then return the Flash Loan with a liquidation fee.

Profitability: Is the effort spent worth the revenue generated?

Only if you have programming skills and knowledge of DeFi, for experienced users with good technical skills and market knowledge, DeFi Flash Loans can be very profitable.

Profitability depends on a variety of factors, including commissions, liquidity, and market conditions. For beginners, this can be a difficult and risky process, but for experienced traders and developers, Flash Loans can be a great way to make a profit.

Popular Flash Loans Platforms: A brief overview and differences

Flash Loans are available on several decentralized financial (DeFi) platforms, each of which has its own characteristics. Let’s look at the most popular ones.

Aave-Flash Loans Market Leader

Aave is one of the leading DeFi protocols for lending, and it was he who first implemented the concept of Flash Loans in 2020. Today, Aave remains the most popular solution for using Flash Loans due to its high liquidity, multi-asset support, and easy integration for developers.

How do Flash Loans work in Aave?

Loan request:

- The user requests a loan in Aave without collateral.

- The system allocates the requested asset from the liquidity pool.

Use of funds:

- The borrower can use Flash Loan for arbitrage, position liquidation, refinancing, or other strategies.

Refund of funds:

- At the end of the transaction, the borrower must return the full amount + 0.09% commission.

- If it does not return the loan in a single transaction, the transaction is canceled, and the funds are returned to the pool.

Advantages of Aave Flash Loans

- High liquidity – Aave supports a huge number of assets, which makes Flash Loans reliable and convenient.

- Flexibility – you can borrow almost any asset, including ETH, DAI, USDC, WBTC, and others.

- Low commission – only 0.09% for using Flash Loan.

- Extensive integration – Aave works with Uniswap, Curve, Balancer, MakerDAO, and many other protocols

dYdX-Flash Loans with trading capabilities

dYdX is a decentralized exchange (DEX) focused on margin trading, lending, and borrowing. The platform supports Flash Loans but in a narrower format.

How do Flash Loans work in dYdX?

The user requests a loan

- dYdX allocates the requested asset from the liquidity pool.

Using Flash Loan

- the borrower may use the funds for arbitration, liquidation, or refinancing.

Loan repayment

- at the end of the transaction, the loan is refunded in full without collateral.

If the loan is not repaid

- the transaction has been canceled, and no changes have been committed.

What is the special feature of Flash Loans in dYdX?

- No commission – dYdX does not charge a fixed fee for Flash Loans (unlike Aave, where the commission is 0.09%).

- Limited asset selection – dYdX supports fewer tokens than Aave.

- Optimized for traders-Flash Loans on dYdX are most often used for arbitrage and position liquidation.

Uniswap-Indirect Flash Loans via Smart Contracts

Uniswap is the largest decentralized exchange operating on the automated Market maker (AMM) model. While Uniswap does not directly offer Flash Loans, users can use its smart contracts to execute arbitrage strategies.

How do Flash Swaps work in Uniswap?

The user requests an asset

- They can receive tokens from the Uniswap pool without making a pre-deposit.

Use of assets

- The received tokens can be used for arbitrage, liquidation, or other strategies.

Payment or refund

The borrower can either:

- Return the equivalent amount of tokens in a single transaction

- Pay for them with another asset.

If the conditions are not met

- The transaction is canceled, and the funds are returned to the pool.

Advantages of Flash Loans in Uniswap

- No deposit is required. Unlike classic loans, Flash Swaps allows you to get an asset without providing collateral.

- Flexible returns. You can either return the borrowed asset or pay for it with another token, which gives you more opportunities to optimize transactions.

- No commission for the loan. Uniswap does not charge a fixed fee for using Flash Swaps (unlike Aave, where the commission is 0.09%).

- High liquidity. Uniswap is the largest DEX, providing access to huge pools of liquidity, which makes operations reliable.

Other platforms with Flash Loans

Balancer - Flash Loans for liquidity management

- Allows you to conduct arbitrage operations between bullets.

- Suitable for automated portfolio management.

Cream Finance - a highly flexible alternative to Aave

- Supports more tokens, but has less liquidity.

- Allows Flash Loans for yield farming strategies.

Euler Finance - Flash Loans with advanced features

- Ability to customize loans.

- It is characterized by increased security due to anti-attack mechanisms.

Which platform should I choose?

| Platform | Commission | Liquidity | Main Application |

| Aave | 0.09% | High | Arbitrage, Liquidation, Refinancing |

| dYdX | 0% | Average | Margin trading, Uniswap Arbitrage |

| Uniswap | 0% | High | Flash Swaps, DEX-Arbitrage |

| Balancer | 0% | Average | Arbitrage in liquidity pools |

| Cream Finance | 0.03% | Average | Yield Farming, Arbitrage |

| Euler Finance | 0.045% | Average | Safe Flash Loans |

If you need maximum liquidity and a wide selection of tokens – Aave.

If you need free Flash Loans and trading tools, use dYdX.

If you work with DEX and AMM – Uniswap (Flash Swaps).

Depending on your strategy, you can combine multiple platforms to maximize your profit.

How to get started with Flash Loans

Basic steps for beginners

Step 1: Learn the Basics of DeFi and Smart Contracts

Before diving into Flash Loans, it’s important to understand how smart contracts, liquidity pools, and credit protocols work.

- Understand the main DeFi platforms: Aave, dYdX, and Uniswap.

- Understand the concept of Automated Market Maker (AMM) and lending protocols.

Step 2: Install the Development Environment

To work with Flash Loans, you will need an environment for writing and testing smart contracts. Install:

- Node.js and npm are used to run the local environment.

- Hardhat or Foundry – tools for developing and testing smart contracts.

- Metamask-a wallet for interacting with the blockchain.

- Alchemy or Infura is used to connect to the Ethereum network.

Step 3: Learn Solidity

Flash Loans are implemented using smart contracts written in Solidity. Main topics to study:

- Functions and variables in Solidity.

- Interaction with smart contracts (for example, Aave Pool, Uniswap Router).

- Error handlers (revert, require).

Step 4: Testing Flash Loans on the test Network

- Use the test network (Goerli, Sepolia) instead of the main one so that you don’t lose real money.

- Get test tokens (ETH, USDC) via taps.

- Deploy your first smart contract with Flash Loan and test it.

Basic programming tools and languages

Programming languages:

Solidity is the main language for writing smart contracts.

JavaScript / TypeScript – for interacting with contracts via Web3.js or Ethers.js.

A python - an alternative option for backend integration via Web3.py.

Tools:

Hardhat / Foundry – convenient environments for developing and testing smart contracts.

Remix IDE is an online Solidity compiler for simple tests.

Ethers.js / Web3.js - libraries for working with Ethereum.

The Graph is for working with blockchain data.

Sources for training

Documentation:

Aave Docs is the official documentation on Flash Loans in Aave.

Uniswap Docs – information about Flash Swaps.

Solidity Docs – a guide to the Solidity programming language.

Ethereum.org -general guide for development in Ethereum.

Examples and tutorials:

Patrick Collins-Solidity Course – the best free course on Solidity and Flash Loans.

Flash Loans on Aave (GitHub) – code examples for working with Aave V3.

YouTube channels:

- EatTheBlocks (Flash Loans, DeFi development).

- Dapp University (smart contracts and blockchain projects).

- Moralis Web3 (Ethereum и Solidity).

Online courses:

Solidity на Coursera, Udemy, freeCodeCamp.

CryptoZombies - an interactive course on Solidity.

DeFi Developer Course – specialized courses on DeFi development.

To get started with Flash Loans, it’s important to learn Solidity, understand DeFi protocols, and test your skills on the testnet. With the right tools and training, you can create advanced strategies based on instant loans.

Conclusion

Flash Loans is a powerful tool in the DeFi ecosystem that allows users to instantly borrow assets without collateral and use them in a single transaction. They open up opportunities for arbitrage, liquidations, refinancing, and other strategies that do not require initial capital.

However, the successful application of Flash Loans requires a deep understanding of the blockchain, smart contracts, and DeFi ecosystem. The high technical complexity and potential risks make this tool available primarily to experienced users.