Launchpad: What It Is and How to Join Token Sales

Contents

- Introduction

- What Is a Launchpad

- How a Launchpad Works

- What is a Token Sale

- Advantages of Participating in Token Sales via Launchpads

- How to Participate in Token Sales via Launchpad

- Risks and Warnings When Participating in Token Sales

- Examples of Successful Token Sales and Their Results

- Conclusion

Introduction

General Description of the Launchpad Concept

A Launchpad is a platform where new crypto projects launch the sale of their tokens, typically before the token becomes available on exchanges.

The Launchpad acts as a bridge between investors and cryptocurrency projects. It allows users to participate in the early stages of new ventures, while the projects themselves receive funding for development.

Why Launchpads Are Important for the Crypto Market and Projects

For the crypto market, a Launchpad is a way to promote new ideas. Cryptocurrency projects often struggle to raise funds and build an audience. A Launchpad solves both problems. Projects receive investment, while users get a chance to acquire project tokens at an early stage.

The Launchpad has become an essential component of the crypto economy. It supports ecosystem development by introducing new tokens, technologies, and communities.

What Is a Launchpad

Definition of a Launchpad in the Context of Cryptocurrency

A Launchpad is a dedicated platform that helps crypto companies sell their tokens at an early stage. Depending on the platform type, this stage is called an IDO (Initial DEX Offering) or IEO (Initial Exchange Offering). The Launchpad handles project vetting, prepares the token sale, and carries it out.

A Launchpad is an opportunity for users to purchase tokens before they are listed. At this stage, the price is usually at its lowest. Later, the token may be listed on exchanges and rise in value if the project succeeds.

History and Development of Launchpad Platforms

The concept of a Launchpad emerged in 2019, when exchanges began offering specialized platforms for launching tokens. The first were Binance Launchpad and Huobi Prime. They organized IEOs, where the exchange verified the project and conducted the token sale.

Over time, decentralized launchpads began to appear. These operate through smart contracts. Projects upload their information directly, and users participate in the IDO via a crypto wallet. This simplified participation and gave projects more flexibility.

Today, there are dozens of such platforms. Among the most popular are DAO Maker, Polkastarter, Coinlist, and Seedify. Each has its rules, but the core idea remains: providing early access to tokens.

The Role of Launchpads in the Blockchain Project Ecosystem

A Launchpad fulfills several functions:

-

First, it helps raise funds for development. Projects receive financing even before the product is launched. This is crucial, as starting without initial investment is extremely difficult.

-

Second, it helps find early users. People who purchase tokens become part of the community. They anticipate price growth, follow the project closely, and spread the word.

-

Third, a Launchpad handles part of the due diligence. It selects projects so participants aren’t exposed to scams. This increases trust and reduces risk.

A Launchpad is a launch platform. Without it, many projects would struggle to enter the market and find support.

How a Launchpad Works

Core Mechanisms and Processes on the Platform

The processes on Launchpad platforms are similar. To participate, users need to follow a few simple steps. First, they connect their crypto wallet or exchange account. Then, they select a project and find out when the token sale will begin. Often, there is a registration phase before the sale starts. Participants submit their information and complete identity verification.

After that, they wait for the launch and prepare the required amount in cryptocurrency, usually USDT, BNB, or ETH. Participants contribute their funds and receive the project’s tokens when the sale window opens. Sometimes this happens instantly, while other times the tokens are distributed in portions—this approach is called vesting. It helps prevent sudden sell-offs and protects the token price from dropping.

Security Principles and Standards

Launchpad platforms aim to select only reliable projects. This helps protect participants from scams and low-quality tokens. To be listed on a Launchpad, a project must undergo a strict vetting process.

First, the Launchpad team reviews all available information about the project. It must have a functioning website, active social media accounts, and a clear roadmap. Founders must disclose their identities and provide background on their experience. Anonymous teams are almost always rejected.

Next, the platform evaluates the tokenomics. The project must explain how many tokens will be issued and how they will be allocated among investors, the team, and the ecosystem. The conditions mustn’t give the founders too many tokens with immediate access. This reduces the risk of them dumping the tokens and abandoning the project.

The Launchpad also requires a clear plan for using funds. Project creators must explain where the money will go: development, marketing, security, product support, etc. This ensures that participants understand the project is not simply raising money “just in case”.

One of the mandatory steps is a smart contract audit. This is a technical code review where independent experts look for vulnerabilities. Without such an audit, most Launchpads will not allow a project to proceed with a token sale. Sometimes the audit is conducted by top firms like CertiK or Hacken.

Examples of Popular Launchpads

Binance Launchpad is one of the most well-known platforms. It is owned by the major exchange Binance. Token sales for projects like Axie Infinity, BitTorrent, and StepN have been held here. Participants must hold the BNB token to gain access.

Polkastarter is a decentralized platform operating on Ethereum and other networks. It features a simple interface and many gaming and NFT-related projects. Participants must complete verification and get whitelisted.

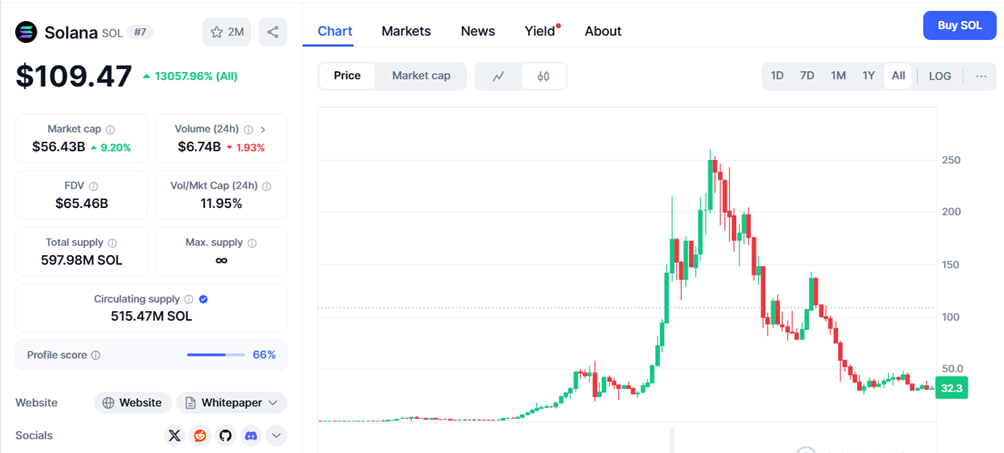

CoinList is a platform for high-quality token sales. Projects such as Solana, Flow, and Mina have conducted sales here. CoinList requires strict identity verification, but projects are carefully selected.

What is a Token Sale

Definition and Key Features of a Token Sale

A token sale is the early-stage sale of a project’s tokens. It’s similar to a pre-order: people purchase tokens before they appear on exchanges, often giving the opportunity to buy the asset at the lowest price.

Token sales have specific dates and conditions. Participants know how many tokens will be available and at what price. There are minimum and maximum purchase limits. After the sale ends, tokens are distributed among participants.

Differences from ICO, IEO, IDO, and Other Fundraising Methods

ICO (Initial Coin Offering) was the first method for selling tokens. The project would raise funds through its website. However, due to many scams, trust in ICOs declined.

IEO (Initial Exchange Offering) is a token sale conducted via a crypto exchange. The exchange vets the project, accepts funds, and distributes tokens, making it considered safer than an ICO.

IDO (Initial DEX Offering) is a sale through a decentralized platform. There’s no centralized exchange—everything is managed via smart contracts. This allows more freedom, but also brings more risk.

Advantages of Participating in Token Sales via Launchpads

Access to Early Token Offerings

Regular users rarely gain access to tokens at early stages. A Launchpad provides that opportunity, allowing users to buy tokens before their price increases. If the project succeeds, the token’s price can multiply.

Security and Platform Reliability

Launchpads reduce risks by vetting projects, requiring audits, ensuring conditions are met, and protecting participants from scams. Many platforms also implement KYC (Know Your Customer) procedures.

Users interact with the exchange on centralised Launchpads. This is convenient, as the exchange holds funds, facilitates swaps, and ensures security.

Opportunities for Investors and Crypto Projects

Investors get a chance to invest early. They can review project materials, ask questions, and decide whether to participate.

Crypto projects gain funding, users, and community attention through Launchpads. They don’t have to search for investors on their own—they just pass the selection process and run a campaign on the platform.

How to Participate in Token Sales via Launchpad

Step-by-Step Guide: Registration, KYC, and Project Selection

To participate in a token sale through a Launchpad, follow these steps:

-

Create an Account. Register on the platform—an exchange (e.g., Binance) or a decentralized Launchpad (e.g., Polkastarter).

-

Complete Identity Verification (KYC). Most platforms require verification, which usually involves uploading an ID document and a selfie. This is a protection measure against fraud.

-

Connect a Wallet. If participating via a decentralized Launchpad, you’ll need a Web3 wallet like MetaMask. Connect it to the platform.

-

Select a Project. Browse the list of available token sales. Each project publishes its start date, token price, purchase limits, and other details.

-

Prepare Funds. Ensure your balance contains the required amount in the specified cryptocurrency—commonly USDT, BNB, ETH, etc.

-

Participate. On the token sale start day, contribute funds and confirm participation. Some platforms use lotteries or queue systems. Others offer guaranteed access if you hold platform tokens.

Participant Requirements

Different Launchpads have varying conditions, but some requirements are standard. First, identity verification (KYC) is almost always mandatory—participation is impossible without it.

Also, holding platform tokens (e.g., BNB or POLS) is usually required—the more you have, the higher your chances. Some projects require staking tokens or joining a lottery. In addition, residents of certain countries may be restricted due to local regulations.

Important Points When Participating in Token Sales

- Time Limits: Token sales often last only a few hours. It’s crucial to know the exact start time in advance.

- Contribution Limits: Each participant may face a minimum and maximum purchase limit.

- Sale Format: Models vary: FCFS (first-come, first-served), lottery, guaranteed allocation. Be sure to understand the format beforehand.

- Vesting: Tokens may not be distributed immediately, but over several months. This affects potential profit calculations.

Risks and Warnings When Participating in Token Sales

Potential Risks

- Fraud: Some projects are fake. The team may disappear with the funds, leaving worthless tokens behind.

- Overvaluation: Some projects look good on paper but lack real products. Token prices may drop sharply after listing.

- Technical Issues: Sometimes, platforms crash or freeze during the sale, preventing participation.

- Vesting and Lockups: Tokens might be locked for extended periods, limiting your ability to sell even when the price rises.

How to Minimize Risks and Verify Project Reliability

- Research the Team: Check who’s behind the project. Make sure they have experience and transparent public profiles.

- Evaluate the Idea and Tokenomics: Understand how the project will use the tokens and how they’ll be distributed.

- Read the Whitepaper: This is the project’s main document. It outlines goals, timelines, and structure.

- Look at Investors: If the project is backed by major funds, it’s a good sign.

- Check for Audits: Make sure smart contracts are audited by independent firms.

Tips for Beginners

For those new to Launchpad projects, caution and preparation are key. Start with small amounts—this will help you understand the process without significant risk and gain experience with your first deals.

To stay informed and not miss important updates, subscribe to the social media channels of both the platform and individual projects. This will help you react to changes in time and make informed decisions.

Avoid expecting quick profits: even seemingly solid projects don’t guarantee price growth. Stay rational and don’t let emotions guide you. Always study the rules of the specific platform before participating—conditions can vary greatly, and understanding the details helps prevent mistakes.

Examples of Successful Token Sales and Their Results

Successful Launchpad Project Cases

Axie Infinity (AXS) Held its token sale on Binance Launchpad in 2020. The initial price was about $0.10. Within a year, the token rose above $100, one of the most successful launches on the platform and a highlight of the GameFi sector.

StepN (GMT) In 2022, the token was sold for $0.01 on Binance Launchpad. Within a few months, the price reached $3. Participants made hundreds of Xs in returns. The project gained popularity with its move-to-earn concept.

Solana (SOL) Solana’s token sale occurred on CoinList in 2020, with tokens priced around $0.22. A year and a half later, the price exceeded $200. Due to its speed and low fees, Solana became one of the most talked-about blockchain networks.

How These Projects Impacted the Crypto Market

Such cases attract attention to the crypto market and launch new trends.

Axie Infinity gave a boost to GameFi. StepN showed that tokens can be tied to real-life activity. Solana proved that Ethereum alternatives can be faster and more user-friendly for mass adoption.

This encourages an influx of investors, developers, and new ideas into the industry.

Conclusion

A Launchpad provides access to new projects and investment opportunities. It’s a convenient tool for both crypto projects and everyday users. But with opportunities come risks. To avoid losses, it’s essential to research the project, monitor conditions, and act cautiously. With the right approach and some experience, you can use Launchpads wisely and benefit from them.