Ponzi and Pyramid Schemes in Crypto: How to Detect Them

Contents

- Introduction

- What a Ponzi Scheme Is

- What a Financial Pyramid Is

- Differences Between a Ponzi Scheme and a Pyramid

- Why Crypto Is Especially Vulnerable

- Key Signs of Crypto Ponzi Schemes and Pyramids

- How to Spot a Scam Before Investing

- Examples of Crypto Fraud Schemes

- How to Protect Yourself and Others

- Conclusion

Introduction

Investment schemes that exhibit signs of fraud frequently emerge in the cryptocurrency world. New technologies and the absence of strict regulation create a fertile environment for deceit. Many projects promise high returns but fail to disclose their funding sources.

Among the most common forms of fraud are Ponzi schemes and financial pyramids. To avoid falling into such a trap, it’s essential to understand how these schemes operate and recognise the warning signs to look out for.

What a Ponzi Scheme Is

A Ponzi scheme is a scam in which money from new participants is used to pay existing investors, often with the promise of higher returns. People invest expecting returns supposedly generated by investments, but payments come from new victims’ funds. All financial flows and decisions are controlled by one organiser, who manages distribution of the money.

As long as the flow of new money continues, the scheme seems reliable. Early participants receive payouts, share their success on social media, and create a trust bubble. Organisers promise stable returns—like 10% per week or doubling investments in a month. These “guarantees” fuel the hype.

The scheme is named after Charles Ponzi, who allegedly profited from differences in postal coupon prices in the early 20th century. He promised investors high profits, but no coupon trading took place. Instead, he paid returns to earlier investors using new investors’ money—until the money flow stopped.

In the crypto world, Ponzi schemes often disguise themselves as “innovative” projects, such as staking, DeFi, DAOs, and NFTs. They use complex terms, flashy websites, and fabricated statistics to conceal the absence of a genuine income source.

What a Financial Pyramid Is

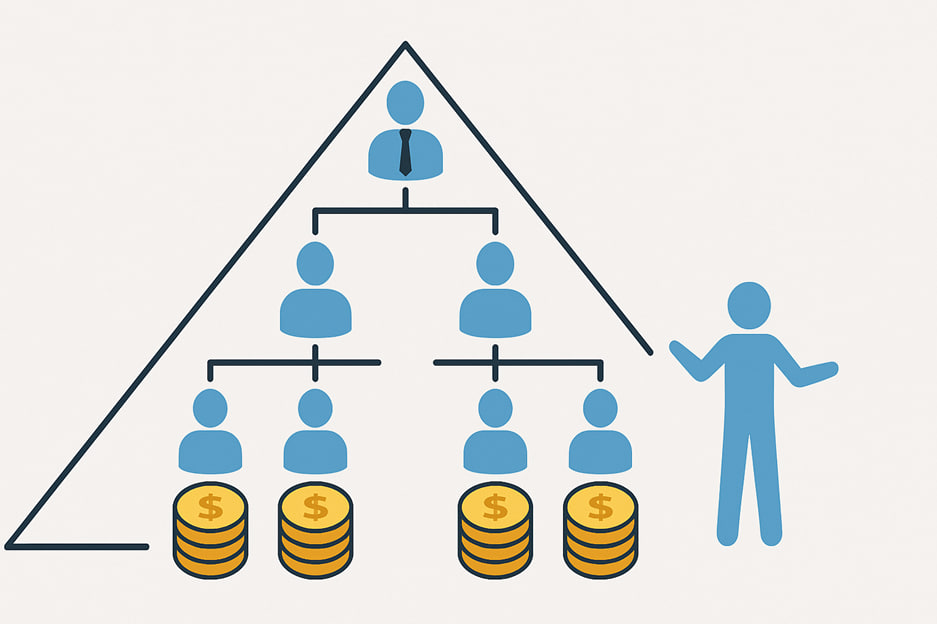

A financial pyramid is a model in which each person’s earnings depend directly on their activity in recruiting others. Unlike a Ponzi scheme, where one organiser controls everything, in a pyramid, every participant acts as both a distributor and a network builder.

In the crypto world, these pyramids often present themselves as investment platforms or “yield tokens.” The key feature is the referral program: newcomers receive rewards for inviting others and earn commissions from the activities of those they invite.

Such a structure requires continuous growth. For those at the top to get paid, more people must join below. When the influx of new participants slows down, money runs out, and the system collapses.

Pyramids hide behind messages like “financial freedom,” “unique chance,” or “passive income.” Creators build slick websites, publish fake roadmaps, and post fabricated graphs and reviews to mimic a legitimate business that doesn’t exist.

Differences Between a Ponzi Scheme and a Pyramid

Although both use new participants’ funds to pay older ones, Ponzi schemes and pyramids operate differently.

| Criteria | Ponzi Scheme | Financial Pyramid |

|---|---|---|

| Structure | Funds are allocated to one organiser, who manages all payouts. | Participants earn by recruiting others — money flows upward through networks. |

| Participant Motivation | People believe they are investing in a profitable system. | People know earnings depend on bringing others in. |

| Centralization | Centralised — one organiser controls everything. | Distributed — every participant builds their network. |

| Money & Promises | Promises fixed returns with exact figures. | Promises earnings from recruiting, without specific guarantees. |

Why Crypto Is Especially Vulnerable

Fraud schemes easily infiltrate cryptocurrency due to several factors:

- Anonymity

Many crypto projects don’t reveal their founders’ identities. Investors put money into the platform without knowing who is behind it. - Lack of regulation

In most countries, crypto is not classified as a security, meaning it falls outside strict financial laws. Fraudsters exploit this loophole to create deceptive schemes that, although not technically violating existing regulations, function as scams. - Complexity of technology

Blockchain, DeFi, and smart contracts can be complicated for beginners to understand. - Promise of high returns

Many enter crypto seeking quick profits. Scammers exploit this desire by promising huge, risk-free returns. Audiences unfamiliar with real mechanics easily fall for these promises. - Use of buzzwords

Ponzi or pyramid schemes often hide behind terms like DeFi, staking, automated strategies, or tokenomics. These words provide a shiny façade that conceals the fact that money is merely being recycled among participants.

Key Signs of Crypto Ponzi Schemes and Pyramids

Look out for these red flags:

- Guaranteed returns

If a platform promises a return of 3% daily, it’s a clear warning. No legitimate investment offers sustained high returns. - Unverified or fake income model

Phrases like “smart investments,” “AI-driven profits,” or “innovative strategies” without real proof—such as reports or transaction histories—are suspect. Investors are left to rely purely on the project’s claims. - Heavy emphasis on referrals

If the primary method of earning is through recruiting others, it’s a classic pyramid scheme. Watch especially for payouts linked to the number of people you bring in, not your investment. - Manipulated social proof

Fake testimonials, inflated user counts, and fabricated transactions create an illusion of success. - Generic whitepapers and flashy websites

Beautiful design doesn’t mean substance. If you see lots of hype, tech jargon, and no concrete details—or anonymous teams—that’s a warning sign.

A single red flag may not guarantee fraud, but multiple flags mean you should avoid the project.

How to Spot a Scam Before Investing

Use these checks before putting in money—it won’t guarantee safety, but it helps avoid obvious traps:

- Review the website and docs

Look for real details: how does the project generate revenue? If you see only buzzwords like “passive income” or “revolutionary tech,” that’s a red flag. - Evaluate tokenomics

If a project has a token, check who owns most of it, whether there’s vesting, and if it can be traded outside the platform. Tokens controlled largely by founders are at risk of collapse. - Check the smart contracts.

Reputable projects often undergo independent audits. If there’s no audit or it seems superficial, proceed with caution. Open-source code allows everyone to inspect the mechanics. - Research the team

Look for real people with verifiable experience. Do they have social media profiles or public accounts? Anonymous teams are risky. - Scrutinise promised returns

If you see claims of 10% weekly returns, ask for proof—where does that profit come from? “Secret algorithms” typically indicate a scam, not a legitimate investment. - Watch early participants

Look for wallets that were purchased early and have withdrawn significant funds. If those wallets are linked to the project team, it often signals insider manipulation.

Examples of Crypto Fraud Schemes

- Bitconnect

One of the most infamous scams promising fixed returns from a “trading bot.” Investors held BCC tokens, whose value surged on hype. When it collapsed in 2018, BCC dropped from $400 to $1 in a matter of days. The founders disappeared and later faced legal consequences. - PlusToken

A Chinese scam disguised as a mobile crypto wallet claiming automatic profits. It attracted users aggressively through referrals, taking in over $2 billion before collapsing. Organisers were arrested in 2020; it turned out there was no real investment happening—only redistribution of new investors’ money. - Forsage

A pseudo-decentralised pyramid built on Ethereum and BNB Chain. It promised earnings through a “smart contract marketing” system and referral bonuses. In reality, it was a multi-level pyramid and came under investigation in several countries.

These cases share common traits: sky-high promised returns, aggressive promotion, referral-driven earnings, and collapse when the flow of new funds ended.

How to Protect Yourself and Others

Getting caught in a scam is easy, primarily when hype and success stories circulate. Follow these rules:

- Don’t rush to invest

If the project pressures you to act quickly, that’s a red flag. Take your time to make decisions. - Verify everything

Research the project: Who is behind it? Is there an audit? How does the token economy work? What are the income and expenses? If these questions aren’t answered clearly, walk away. - Ignore hype and flashy promises.

Features like polished websites, glowing testimonials, or screenshots don’t guarantee legitimacy. There’s no filter for success. - Question excessive returns

If you’re told you’ll earn 20% a month, ask where the return comes from. If the answer is vague—“it’s a secret algorithm”—that’s a scam, not an investment. - Help others stay safe.

If someone you know is considering a suspicious project, have a calm chat. A simple explanation can save them from losing money.

Conclusion

Ponzi schemes and pyramids continue to appear in crypto because they exploit greed and ignorance. They promise easy money but take everything from you.

The core warning signs include guaranteed returns, referral-heavy structures, opaque models, and the glorification of early “winners.” Investing in such a project is always a risk, regardless of how appealing it may seem.

Critical thinking is your best defence. Earning in crypto is possible, but never easy. If a project can’t explain how it’s making money, it’s likely profiting off those who believe in it, not from real gains.