Индекс страха

The Fear Index or VIX is a predictive characteristic of changes in volatility in the stock market. The analysis method consists of evaluating options over 30 days and shows the “market sentiment” regarding future volatility.

In simple words, if an investor is afraid for his holdings, he hedges his assets by buying options. The Put option is suitable for these purposes. When the majority of depositors are concerned about the market situation, the demand for Put rises, and the demand for Call declines.

If the investor is confident in the direction of the market, then Call premiums to go up and Put options go down. If investors are at a loss, then quotes go up for both types of options, but someone always prevails.

Индекс VIX рассчитывается по количеству открытых опционов определенного типа.

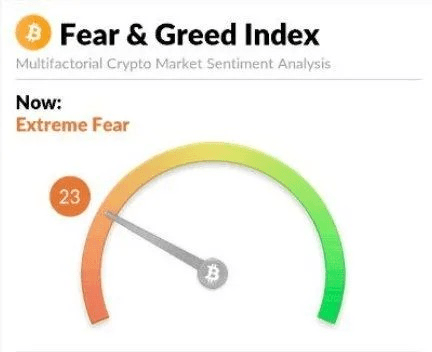

Для оценки текущей ситуации на рынке есть такая шкала страха со 100-балльной системой:

• 8-20 – optimistic investor sentiment.

• 20-30 – the negative mood of stock market participants;

• 30-40 – anticipatory thoughts of depositors;

• more than 40 – a real panic in the market.

Учтите, что каждый индекс и финансовый инструмент стремятся к усредненным значениям, которые показывают средние скользящие линии.

The minimum VIX of 8 pips is a “non-combustible” amount, and this value will never fall below this value. The maximum value was recorded in 2008 against the backdrop of the economic crisis. Then the VIX reached 89 points. Most often, the index tends to a range of 15-40 points. If the value is less than 20, this indicates the confidence of investors in the growth of the trend in the medium and long term.