The Future of Trading Tokenized Securities (STO)

Contents

- Introduction

- Why are STOs of interest to Investors and regulators

- The technological basis of STO

- How Tokenized Securities Work: Blockchain and Smart Contracts

- Advantages of tokenization

- Examples of technologies and platforms used

- Regulation and legal framework of STO

- How do STOs differ from ordinary securities?

- What will change in STO regulation?

- Advantages and challenges of STO

- Markets and industries affecting STO

- Application of STO in various sectors

- Forecasts and the future of STO

- How can the STO market develop?

- The role of STO in the global economy and possible changes in investment strategies

- Technological innovations affecting the STO

- Conclusion

Introduction

Security Token Offering (STO) is the process of issuing digital tokens representing rights to tangible assets such as stocks, bonds, or real estate. Unlike traditional cryptocurrencies and utility tokens, STOs comply with securities legislation’s requirements.

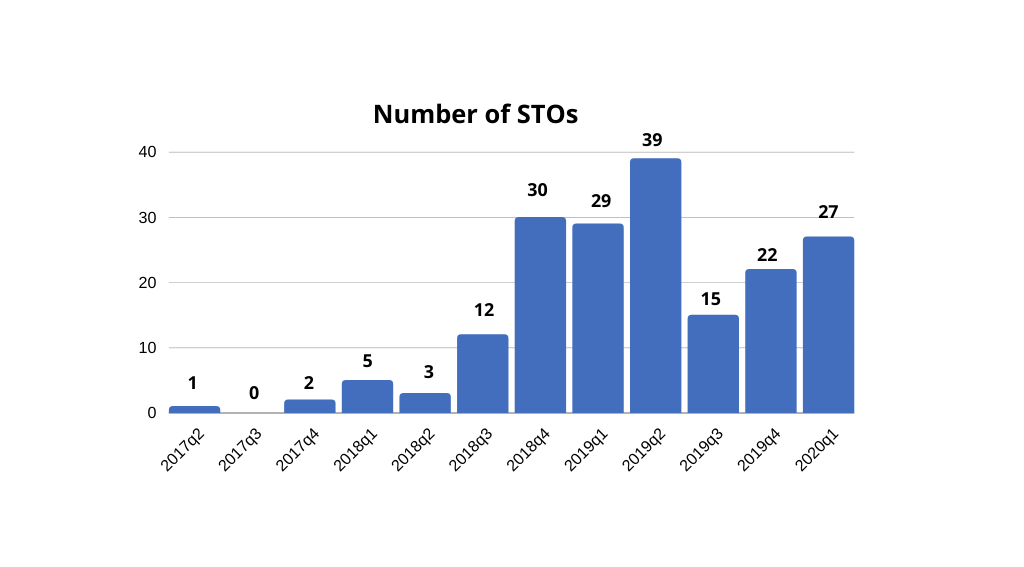

The tokenized asset market is at an early stage of development but is showing steady growth. The leading platforms for STOs, such as INX, Securitize, and tZERO, are already attracting the attention of institutional investors. Regulatory authorities, including the SEC and ESMA, are developing regulations that increase the credibility of the STO as a legitimate investment instrument.

Why are STOs of interest to Investors and regulators

-

For investors, STOs offer more transparent investment conditions, lower fees for intermediary services, and access to global markets. Tokenized assets provide liquidity and the possibility of fractional ownership.

-

For regulators: Unlike ICOs, STOs are subject to strict anti-money Laundering (AML) and “Know Your Customer” (KYC) regulations. This reduces the risks of fraud and increases the security of investments.

Asset tokenization promises to make investments more accessible, secure, and global. However, the market is still in its infancy, and its further development depends on many factors. Let’s take a closer look at them.

The technological basis of STO

Tokenized securities (STOs) are based on blockchain technology and smart contracts, which makes them more transparent, efficient, and affordable than traditional financial instruments. Let’s examine how they work, what advantages they provide, and which platforms are already being used to release them.

How Tokenized Securities Work: Blockchain and Smart Contracts

The blockchain provides a decentralized and immutable register of transactions, allowing you to track asset ownership in real time. Smart contracts are programmable contracts that automatically execute the terms of a deal without intermediaries. In the context of STO, this means:

-

Asset tokenization is the creation of digital tokens linked to real securities (stocks, bonds, real estate, etc.).

-

Transaction automation — smart contracts provide automatic accrual of dividends, corporate rights management, and other functions without the involvement of third parties.

-

Data security and immutability — information about owners and transactions is stored on the blockchain, eliminating the possibility of forgery or unauthorized changes.

Advantages of tokenization

-

Liquidity: Traditional assets such as real estate or venture capital investments are difficult to sell quickly and at a bargain price. Tokenization allows assets to be broken down into smaller parts, making them available to a larger number of significant investors.

-

Cost reduction: Blockchain eliminates the need for intermediaries (banks, brokers, notaries), reducing transaction processing and asset management costs.

-

Speeding up processes — transactions with tokenized securities are faster, as there is no need for paper documentation and lengthy checks.

Examples of technologies and platforms used

To date, there are several blockchain platforms designed to issue and trade tokenized securities:

-

Ethereum is the most popular platform for issuing STOs using the ERC-1400 and ERC-1404 token standards, which ensure compliance with regulatory requirements.

-

Polkadot offers a more flexible infrastructure with the possibility of cross-chain interaction, which makes STOs more scalable.

-

Tezos attracts STO issuers due to its built—in support for updatable smart contracts and high security level.

-

Algorand is a platform focused on speed and low fees, which makes it convenient for tokenized assets.

The technological basis of STO allows the securities market to evolve, making investments more transparent, cheaper, and more accessible. However, for their widespread adoption, regulatory aspects must be considered, which we will discuss in the next section.

Regulation and legal framework of STO

Since STOs are digital analogues of traditional securities, they are regulated by government agencies and laws, like ordinary stocks, bonds, or funds.

What laws govern STO?

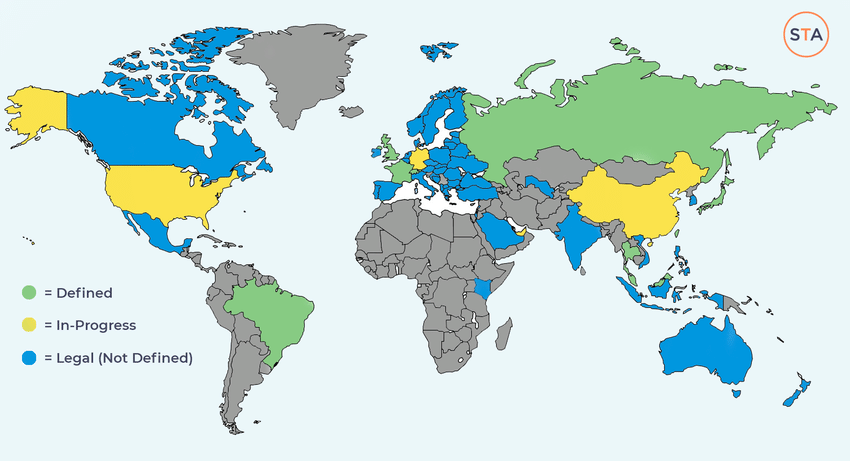

STO regulation depends on the country, but everywhere the basic principle is investor protection and compliance with anti—money laundering (AML) and customer identification (KYC) regulations.

USA (SEC — Securities and Exchange Commission)

STOs are considered securities and are regulated by the Securities Act of 1933.

To issue tokenized assets, companies must register with the SEC or take advantage of exceptions such as:

-

Reg D — sale only to qualified investors.

-

Reg S — for placing tokens outside the United States.

-

Reg A+ — allows you to raise up to $75 million, but requires regulatory approval.

European Union (MiFID II, ESMA)

In the EU, STOs are regulated by the MiFID II Directive, just like ordinary securities. The European Regulator (ESMA) requires STO companies to comply with investor protection and financial reporting standards.

Singapore and Japan

-

Singapore (MAS) has created friendly conditions for STOs but requires licenses and compliance with AML/KYC.

-

Japan (FSA) considers STOs traditional stocks and obliges companies to undergo certification.

Russia

The Law on Digital Financial Assets (CFA) regulates the issuance of tokenized assets, but their status as securities has not yet been entirely determined.

How do STOs differ from ordinary securities?

Although from a legal point of view, STOs are securities, they have several differences:

-

Form - Instead of paper documents or electronic entries in the registry, STOs are issued as tokens on the blockchain.

-

Automation - dividend payments, shareholder voting, and other processes can be performed through smart contracts.

-

Global accessibility - if traditional stocks are traded on stock exchanges, STOs can be traded on specialized blockchain platforms and are available to investors worldwide.

What will change in STO regulation?

As the STO market is only developing, new rules may appear in the future:

-

The creation of unified international standards - Now, each country regulates STO in its way, but gradually, common principles may appear.

-

Licensing of STO exchanges - it is possible that STO platforms will have to obtain official licenses to operate.

-

Integration with Digital Currencies (CBDC): If states start actively issuing digital currencies, they can be used for STO settlements.

-

The number of countries supporting STO is growing. Some countries (for example, Singapore and Switzerland) are already creating favorable conditions for STO, and this trend is likely to continue.

Thus, STO regulation is in the process of being formed. Strict regulations make the market safer, but uncertainty in the laws slows down its development.

Advantages and challenges of STO

Tokenized securities (STOs) offer investors and companies new opportunities that traditional financial instruments do not. However, despite these advantages, the STO market faces a number of challenges, including technical difficulties and regulatory issues. In this section, we’ll look at the pros and cons of STOs.

Advantages of STO

Accessibility for a wide range of investors

-

The minimum entry threshold in traditional markets may be high (for example, buying real estate or shares in private companies).

-

STOs allow assets to be split up and small shares sold, making investments affordable even for retail investors.

Global liquidity

- Stocks on stock exchanges are traded only at certain hours and within specific markets.

- STOs run on the blockchain, so they can be bought and sold 24/7 anywhere in the world.

Reducing barriers and costs

- Traditional securities transactions require intermediaries (banks, brokers, notaries), which increases costs.

- In STO, these processes are automated using smart contracts, which reduces costs and makes transactions faster.

Transparency and security

- Ownership and transaction data are recorded on the blockchain, eliminating forgery and fraud.

- Smart contracts ensure the automatic fulfillment of the transaction terms without third parties’ intervention.

The main challenges of STO

Security and technical risks

- Blockchain and smart contracts are susceptible to hacker attacks. Code errors can lead to asset loss.

- Loss of private key = loss of access to assets. Recovery mechanisms exist for traditional finance, but they are still limited in the blockchain.

Trust in new technologies

- Many investors and companies are still cautious about STO, as the technology is new and poorly understood.

- Institutional investors are afraid of market instability and unregulated platforms.

Regulatory uncertainties

- Different countries have different laws on STO, and it is not always straightforward how to apply them.

- Many governments are just beginning to develop legal regulations for tokenized assets.

Lack of mass adoption

- Unlike traditional stocks and bonds, the STO market is still tiny.

- Lack of liquidity on specialized platforms can make it difficult to make quick trades.

STOs offer a more convenient, cheaper, and transparent way to invest, but the market faces trust, regulatory, and technological risk issues. However, these barriers will gradually be overcome with the development of legislation and technology.

Markets and industries affecting STO

Tokenized securities (STOs) are used in various industries, from real estate and startups to art. They not only simplify access to investments but also transform traditional financial markets. This section will examine where STOs are already used, how they affect classical financial instruments, and which partnerships help their development.

Application of STO in various sectors

Realty

-

Traditionally, real estate investments require significant investments and complex legal procedures.

-

With the help of STO, buildings or land plots can be tokenized, split into small shares, and made accessible even to small investors.

-

Example: Platforms in the USA and Europe already allow you to buy shares in real estate through the blockchain.

Startups and venture investments

-

Classical venture financing is limited to accredited investors.

-

STOs allow startup stocks to be tokenized, making them accessible to a global range of investors.

-

Example: Some crypto funds already use STOs to raise funds, bypassing traditional IPOs.

Art and digital assets

-

The market for art objects and collectible assets has traditionally suffered from liquidity problems.

-

Using STO, you can tokenize paintings, sculptures, or other valuable objects by selling shares.

-

Example: In 2021, several well-known galleries began tokenizing works of art, making them available to investors.

STOs also impact traditional financial markets. Banks and investment companies are beginning to explore blockchain’s possibilities, and stock exchanges are developing infrastructure for trading tokenized assets. Already, some large financial institutions are testing STOs as an alternative to classical instruments, indicating this sector’s future growth.

Although tokenization has not yet replaced traditional markets, partnerships between blockchain platforms and financial institutions show that interest in STO continues to grow. This is one signal that tokenized assets may become an integral part of the global financial system in the coming years.

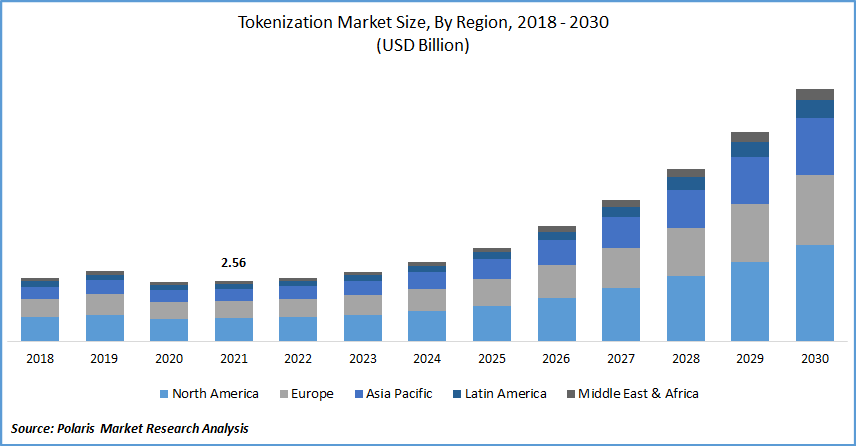

Forecasts and the future of STO

The tokenized securities (STO) market is in the early stages of development, but it is already attracting great interest due to its advantages, such as accessibility, liquidity, and cost reduction. In the coming years, we can expect significant growth in this market as more companies and investors begin to realize its potential.

How can the STO market develop?

The tokenized asset market is likely to continue to grow due to the expansion of the use of STO in various sectors. With the development of legal regulation and improved infrastructure for trading tokenized assets, we will see more use cases of STOs in areas such as real estate, startups, art, and even environmental projects. Institutional investors, who are still cautious about this market, will likely start participating, accelerating the process of legitimizing the STO.

The role of STO in the global economy and possible changes in investment strategies

STOs can dramatically change investment strategies and become an important part of the global financial ecosystem. They will provide faster and cheaper ways to raise capital and enable investors to easily diversify their portfolios by investing in various types of assets, from stocks and bonds to real estate and art.

It is predicted that in the future, STOs will be actively used not only to receive funds from retail and institutional investors but also to create new investment products such as tokenized bonds, funds, or even currencies. Thanks to smart contracts, this will also open up new opportunities for investment strategies with a high degree of automation.

Technological innovations affecting the STO

One key factor determining the future of STO is its integration with new technologies such as artificial intelligence (AI) and decentralized finance (DeFi).

- Artificial intelligence can be used to analyze large amounts of data about the STO market and investors, optimize trading strategies, and predict market trends. This will make the market more efficient and attractive for different types of investors.

- Decentralized finance can significantly change the way operations with tokenized assets are conducted, allowing transactions to be carried out without intermediaries and creating financial instruments accessible to all network participants. This will improve accessibility and reduce the cost of operations, which in turn will accelerate the implementation of STO.

Conclusion

Tokenized securities open up significant opportunities for investors and companies by offering new, more affordable, and liquid investment methods. Although the STO market is still at an early stage of development, its potential is obvious. With technology and legal regulation development, STOs can transform financial markets by providing greater transparency, speeding up processes, and reducing costs. In the coming years, we will see how these instruments will become an important part of the global economy, providing new ways to attract capital and diversify investments.