What is averaging up and down in trading?

For many years, traders around the world have been arguing about the benefits of averaging. Today we will consider in detail each of the arguments of all sides of the dispute, and also give answers to the questions:What is averaging-upWhat is averaging-downShould they be used and when?

Contents

Averaging-down

Averaging is a change in the average price of entry into a position by increasing the volume of the position in places with a negative ROE. It is used to earn more in case of working out a trading idea. It turns out the entrance to a larger volume, and therefore a greater profit in the end.

This screenshot shows the grid. But at the moment of execution of the first order, the rest will become averaging relative to it.

Averaging-up

Averaging-up – averaging the position at the moment when the ROE of the position is in the positive zone. This is done to maximize profits when trading a trend or recoilless movement.

Automation

There are a huge number of robots and strategies that work on the principle of averaging.Even binary options strategies work on it (kappa)Grid bots are, including bots working on the principle of averaging.But they all have a huge vulnerability. If the averaging algorithm incorrectly recognized the direction of price movement, it is eventually liquidated. The fact is that strategies that work on the principle of averaging usually use margin and leverage, respectively. And this means that if the outcome is negative, the algorithm will get into the margin up to its ears, and if it is not lucky, the result will be extremely negative.

Arguments of each side of the dispute

The arguments for averaging are increased earnings with a high win rate, an increased number of possible trading strategies for earning, expanded opportunities in scalpingIt should be clarified that the two sides agree that averaging is very contradicting for beginners. The averaging function should only be opened after 2 years of trading experience.

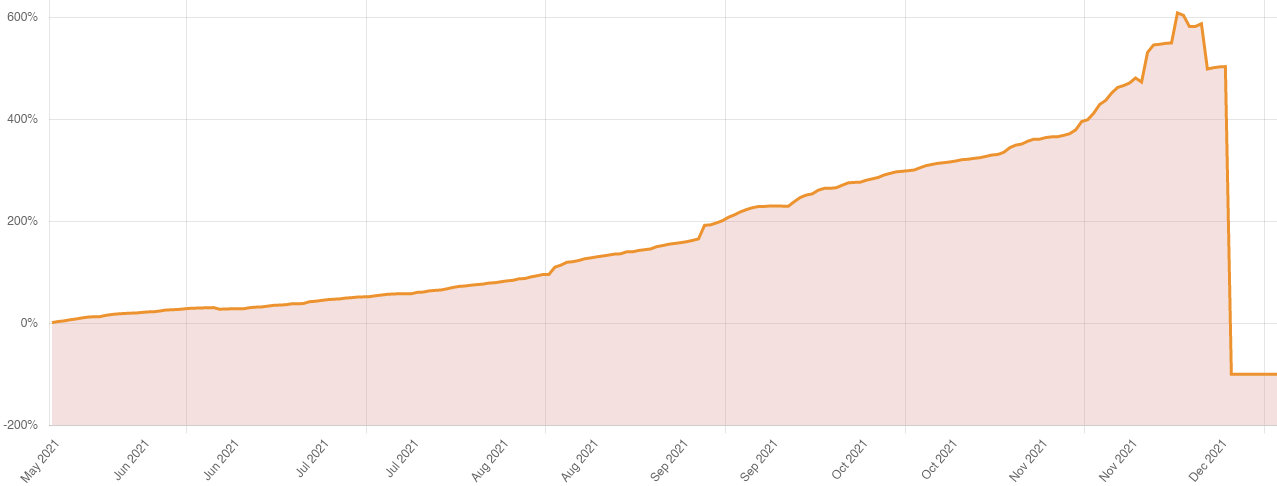

The arguments against averaging are mostly risk limits, which are the most important rules in trading. First of all: You cannot unify the risk per stop when trading with averaging. Each time it will take only a part of the averages, which means that the take-profit will also be only a part of the maximum volume. However, the stop will always occur at the maximum volume. The negative mathematical expectation comes into play somewhere at this moment.It is psychologically incredibly difficult to trade with averages. You will simply always want to cancel the stop.Well, in the end, strategies with averaging very often end up like this:

Conclusion

Averaging is a very aggressive element of trading for professionals.A beginner should not use averaging under any circumstances.Averaging can bring more to the pros, but in the long run, this can only be achieved with a very, very well-thought-out system of risks.