What Is Ethereum and Why It Matters in Crypto

Contents

- Introduction

- What is Ethereum

- Ethereum as a Blockchain Platform

- ETH as the Native Currency

- Differences from Bitcoin: Goals and Functions

- Launch History and Development

- How Ethereum Works

- Smart Contracts and dApps

- Ethereum and Web3

- Ethereum’s Role in the Crypto Economy

- Recent Updates and Ethereum’s Growth

- Ethereum’s Outlook and Challenges

- Conclusion

Introduction

Ethereum has become the foundation of a large part of the crypto world. It powers smart contracts, decentralised exchanges, and other blockchain applications. Without it, it’s hard to imagine Web3 and most modern tokens. Ethereum doesn’t just store data — it allows entire digital systems to run.

In this article, we’ll break down how Ethereum works, how it differs from other projects, and why it’s seen as a pillar of the crypto economy. We’ll also explore its history, functions, and role in driving the industry forward.

What is Ethereum

Ethereum is a decentralised platform based on blockchain. It allows developers to create and run smart contracts — programs that execute automatically when certain conditions are met. Banks, companies, or governments do not control the project.

The main idea of Ethereum is to let people build their digital services without intermediaries. It’s a flexible tool that can be used to create anything — from games to financial applications.

Ethereum as a Blockchain Platform

The Ethereum blockchain is a network where each block contains a list of transactions and other data. Every participant keeps a copy of these blocks so that no one can change the information on their own.

Inside Ethereum runs the Ethereum Virtual Machine (EVM). It executes smart contract code. Developers write their own rules, and the EVM runs them without error.

This approach sets Ethereum apart from most blockchains, which are built mainly for transferring value. With Ethereum, it’s possible to make any kind of application using open-source code.

ETH as the Native Currency

The Ethereum blockchain uses a native currency — ETH. It’s needed to pay for all operations. Every time someone sends a transaction or runs a contract, they pay a small fee in ETH. This is called a gas fee.

ETH can also be used like any cryptocurrency — to store or transfer value. But within Ethereum’s ecosystem, it plays a larger role. It powers the entire network.

Differences from Bitcoin: Goals and Functions

Ethereum is often compared to Bitcoin, since both have shaped the crypto space. But their goals and approaches are very different:

| Category | Bitcoin | Ethereum |

|---|---|---|

| Main Goal | Digital alternative to money | Platform for building applications |

| Purpose | Transfer value without intermediaries | Develop and run decentralised services |

| Token Limit | Yes (maximum 21 million BTC) | No fixed limit; issuance is regulated differently |

| Flexibility | Limited | High, designed for growth |

| Ecosystem | Main asset — BTC | Supports tokens, projects, blockchains, and the Web3 stack |

Launch History and Development

Ethereum was proposed by Vitalik Buterin in 2013. He shared the idea as a technical paper. Soon, other developers joined him. Together, they raised funds through a crowdsale and launched the network in 2015.

Since then, the platform has been constantly evolving. One of the most significant changes was the transition to Proof of Stake — a more eco-friendly and sustainable model. Developers also improved scalability, fees, and security. These upgrades helped Ethereum keep its lead in the decentralised technology space.

How Ethereum Works

Network Architecture

Ethereum is a network of connected computers. Each participant stores a copy of the data to keep the system running without a central authority. This structure is called a blockchain. It consists of blocks, each of which contains a list of operations that happened over a short time.

There is no central server. Instead, participants verify each other’s actions. This makes the system stable and resistant to external control.

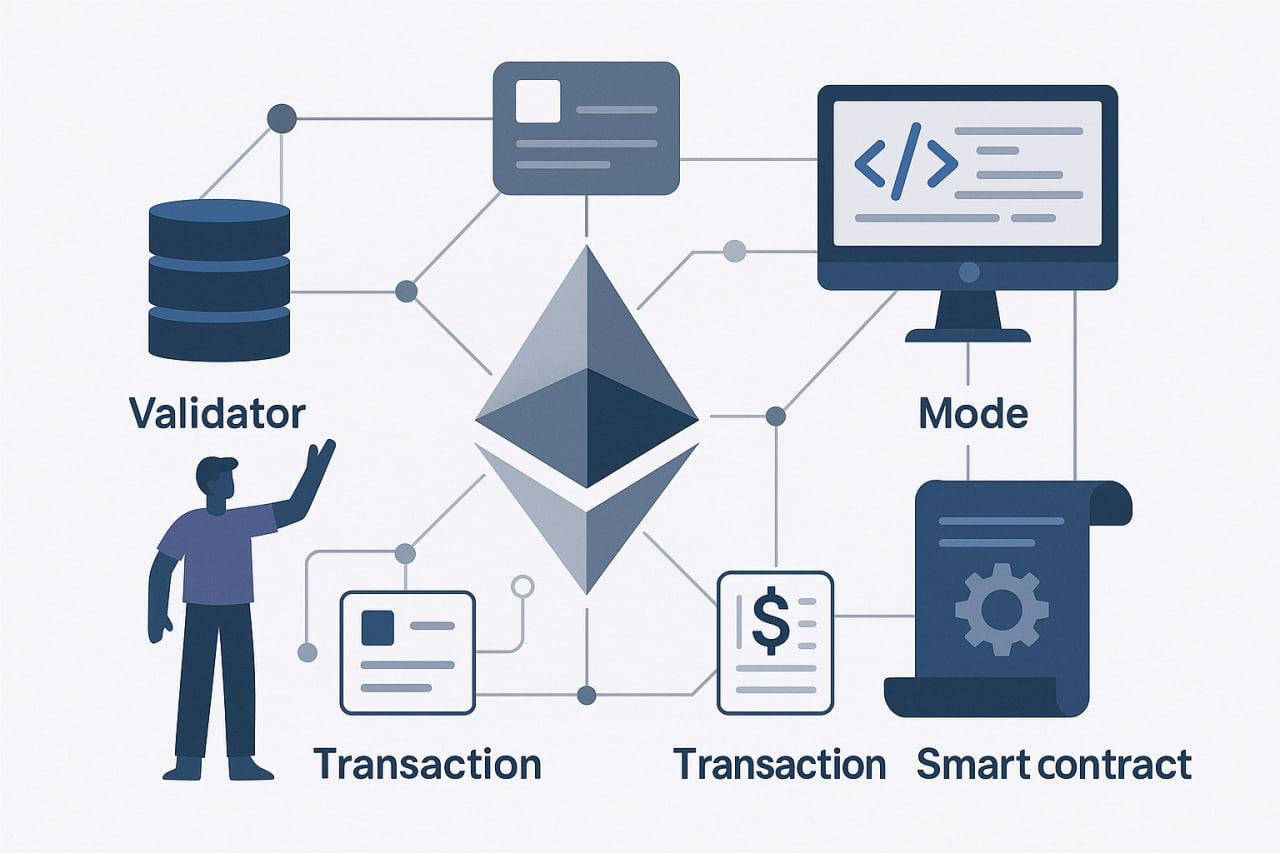

Role of Validators, Blocks, and Transactions

Every action in Ethereum is a transaction. A user might send tokens, run a contract, or interact with an application. All transactions are grouped into blocks. Validators check these blocks.

Validators are users who make sure the network works honestly. To become a validator, one must deposit ETH as a bond. This protects the system from dishonest behaviour. Once validated, the block is added to the chain and becomes part of the shared data.\

Ethereum Virtual Machine (EVM)

Ethereum includes a special system called the Ethereum Virtual Machine (EVM). Think of it as a computer inside the blockchain. It runs the code written by developers and ensures it works the same way on every device.

The EVM ensures that smart contracts run consistently across the network. Without it, building decentralised applications (dApps) would be impossible — each user would get different results.

Proof of Stake and Transition from Proof of Work

Ethereum originally used Proof of Work, like Bitcoin. Computers solved complex problems to add a new block. This consumed a lot of energy.

Now, Ethereum uses Proof of Stake. Instead of mining, users lock up ETH and become validators. The network randomly picks one of them to check the next block. This makes Ethereum faster and more energy-efficient.

This shift reduced hardware demands and improved scalability.

The Role of Gas Fees

In Ethereum, nothing happens for free. Every transaction or contract execution requires a fee, called gas. Gas is an internal unit that measures the amount of computing power an operation uses.

A gas fee has two parts: the amount of gas used and the price per unit. The amount depends on the complexity of the action. For example, sending ETH uses less gas than interacting with a dApp.

Gas price is measured in gwei. One ETH equals one billion gwei. When the network is quiet, gas prices are low. When many users are active, prices rise. This balances demand: those who pay more go first.

That’s why gas fees can fluctuate rapidly. During busy times, even simple actions can be costly. To avoid overpaying, users track gas prices using tools like the Ethereum gas tracker, which shows current fees for basic transactions and smart contract usage.

Gas isn’t just a payment — it protects the network from overload. Without it, anyone could flood Ethereum with requests. But with gas, users pay for their share, and the network stays stable.

Smart Contracts and dApps

What are smart contracts

A smart contract is a program that executes conditions without human involvement. Suppose the code says “if A, then B,” that’s precisely what will happen. The agreement cannot be changed after deployment. Everything operates strictly according to predefined rules.

Smart contracts became the foundation of decentralised applications. They make it possible to build systems where no one manages operations manually.

How they are launched and work in Ethereum

To launch a smart contract, the developer writes the code and uploads it to the blockchain. This is a regular transaction. After that, the contract receives its address, and any user can interact with it.

When someone sends a request, the contract processes it through the EVM. Everything works transparently: anyone can verify the code and its result.

Examples of popular dApps

Many decentralised applications are running on Ethereum. They are independent of companies and servers. All actions go through smart contracts, and the user retains complete control over their funds.

Here are a few examples of popular dApps:

- Uniswap — a token exchange without intermediaries. All transactions occur directly between wallets.

- OpenSea is the largest platform for buying and selling NFTs. It’s used for trading digital art, collections, and in-game assets.

- Aave — a lending and borrowing service. It allows users to earn from tokens or borrow cryptocurrency using collateral.

- Lido — a staking platform for Ethereum. It enables users to earn yield from network participation without launching their validator.

Security and vulnerabilities

Ethereum is considered a secure platform, but even here, errors are possible. Everything depends on the smart contract code. If a developer makes a mistake, an attacker can exploit it.

There are also attacks on decentralised applications. To prevent issues, projects undergo audits of their smart contracts to identify weaknesses before launch.

Ethereum’s reliability grows every year, but users must understand the risks and only interact with verified services.

Ethereum and Web3

Ethereum is the foundation of the Web3 ecosystem

Ethereum became the foundation of Web3—a new version of the internet where users control their data, wallets, and rights. Unlike the old model, there’s no central entity that stores and controls the information.

In Web3, anyone can connect to the decentralised network and interact with services directly. This became possible thanks to smart contracts and the open structure of Ethereum. Any developer can build their application without needing permission from a platform or government.

Use in identification, data storage, DAOs

In Ethereum, the wallet address becomes the identifier—via MetaMask or Rabby, for example. It replaces the login and password. The user stores the key and controls access.

This same address works for logging into apps, participating in votes, and confirming actions. Everything functions without accounts or centralised databases.

One notable area is DAOs (Decentralised Autonomous Organisations). They run on smart contracts. People unite to govern projects through voting. Participants decide for themselves where to go and how to allocate resources.

Impact on ownership and content models

Ethereum transforms the concept of ownership. Previously, it was hard to prove rights to a digital file—now it’s possible. With blockchain and NFTs, anyone can verify they own an asset: an image, a video, or even a music track.

Content is no longer platform-dependent. An author can upload a work, sell it directly, and receive payment without intermediaries. This reflects a new model where control and ownership shift to users.

Ethereum’s Role in the Crypto Economy

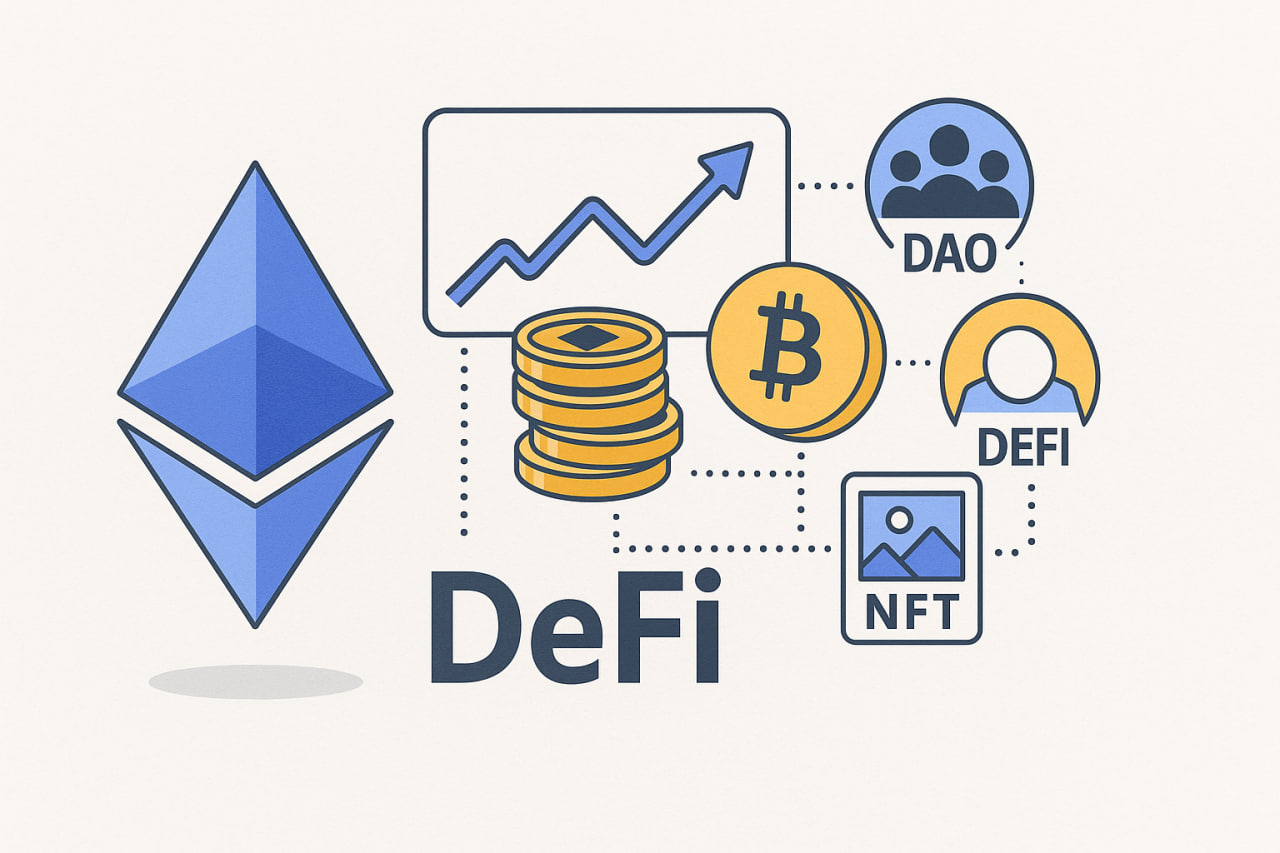

Use in DeFi, NFTs, DAOs, GameFi

Ethereum became the primary engine for many crypto sectors. It powers DeFi applications that offer lending, staking, and token exchanges. No bank or intermediary is needed—everything runs on code.

In the world of digital art, Ethereum was the first platform to host major NFT projects. It introduced unique tokens that represent ownership of digital objects.

In GameFi, Ethereum launched the first games with in-game tokens and earning potential—setting a standard later adopted by other blockchains.

The same goes for DAOs: these decentralised organisations were initially built on Ethereum. It provided the foundation: smart contracts, voting systems, and a transparent architecture that others began to replicate.

TVL volumes, active users, infrastructure

Ethereum remains the most extensive network in terms of total value locked (TVL). As of July 2025, its TVL exceeds $84 billion, according to DefiLlama. TVL reflects how much capital users entrust to the protocols operating in the network.

Yes, other blockchains are evolving too, but Ethereum continues to hold the top spot. It accounts for more than half of all DeFi liquidity, which stands at $142 billion as of today.

Moreover, Ethereum consistently attracts the highest number of active users. They connect to apps, swap tokens, and participate in DAOs. A robust infrastructure surrounds the network: wallets, bridges, indexers, data feeds, and interfaces. All this makes Ethereum the central element of Web3.

Standard-setting participation (ERC-20, ERC-721)

Ethereum was the first to introduce token standards that became foundational for the entire crypto infrastructure. Developers were given clear rules for issuing assets—from cryptocurrencies to NFTs.

- ERC-20 — the standard for fungible tokens. Suitable for creating currencies, stablecoins, and utility tokens. Thanks to this, tokens are easily integrated into wallets, exchanges, and DeFi protocols.

- ERC-721 — the standard for non-fungible tokens (NFTs). Enables the creation of unique objects—for example, digital art, collectable cards, or in-game items.

These formats became universal solutions. Wallets, exchanges, and dApps across Ethereum and other networks adopted them.

Recent Updates and Ethereum’s Growth

Pectra Update

In May 2025, Ethereum rolled out the Pectra update, including execution and consensus-level changes.

Smart wallets are now supported. An address can include built-in logic—like spending limits, multi-signature requirements, or recovery options.

The maximum stake for validators was raised to 2048 ETH. Node operations became easier, and management became more reliable.

The update also improved interaction with Layer 2 and reduced costs for users and developers.

Price growth: causes and triggers

The price of ETH rose about 50% since early July 2025, reaching around $3,800. The main driver was a substantial inflow of capital into spot ETFs on Ether. These funds began accumulating ETH rapidly, investing nearly $2 billion into the market in a short time.

Additionally, companies started adding ETH to their balance sheets. They see Ether as a strategic asset—alongside Bitcoin. This boosted confidence among other market participants.

At the same time, interest in DeFi increased. Users started using apps more often, locking liquidity, and returning to Web3. All these factors pushed the price up. The market shows renewed interest in Ethereum—not just from retail, but also from institutional players.

Ethereum’s Outlook and Challenges

Scalability and Layer 2

Ethereum became faster and cheaper thanks to updates and the growth of Layer 2 solutions—but core limitations remain. The leading network cannot handle mass flows without rollup platforms. Arbitrum, Optimism, and others absorb most of the load, but they sometimes cause friction—especially for first-time crypto users.

There’s still no perfect balance between speed, ease of use, and decentralisation. Some L2 solutions are faster but rely on centralised nodes. Others are more secure but sacrifice convenience. Scalability remains Ethereum’s top technical challenge.

Integration into finance and government systems

Banks, exchanges, and major fintech companies are already using Ethereum. The platform is hosting tokens backed by real-world assets, such as dollars, gold, and stocks. This gives banks a way to issue digital instruments without building new blockchains.

Private and public projects are testing Ethereum in payments, identity, and data storage. Some countries use the network for digital bonds and inter-agency settlements. Ethereum demonstrates flexibility and compatibility with the needs of the real economy.

Regulatory risks

As Ethereum’s influence grows, so does regulatory pressure. Governments interpret the platform in different ways. In the U.S., Ethereum has been recognised as a commodity, while in Europe, discussions are ongoing about classifying ETH as a payment instrument.

The new wave of regulation targets tokens, validators, DeFi protocols, and wallets. Most developers already factor in legal risks when building applications. Ethereum’s future partially depends on how authorities decide to treat the technology—as a threat or a foundation for financial modernisation.

Conclusion

Ethereum has become the backbone of the digital economy. It brings together technology, finance, and new forms of human interaction. With it, decentralised apps, smart contracts, and entire financial ecosystems have emerged. All of these functions without banks, intermediaries, or corporations.

Today, Ethereum plays a key role in Web3. It powers services where users control their data and assets. It opens access to investment, gaming, trading, and project governance—all via open code and transparent rules.

Why does this matter? Because anyone can join this system. You don’t need a bank account or access to an exchange. All it takes is a wallet and a connection to the network. Ethereum redefines the boundaries and gives us a chance to build a financial world based on trust and code—not paperwork and offices.