What is open interest?

It’s worth starting with the fact that in today’s article we will focus primarily on futures.Open interest analysis is a very interesting feature that helps many cryptocurrency traders improve the efficiency of their strategies.

Contents

OI

Open interest is the total volume of futures positions. That is, open interest displays the number of open futures positions on the asset at the current moment. Since in futures the volume of shorts is always equal to the volume of longs, open interest can only help in finding a place to set. To say in which direction it is carried out will not work, because it is carried out in an equal volume in two directions.How can this help analyze an asset?The fact is that some traders are confident in the influence of derivatives on the price of a spot asset. With the help of OI, you can track the position taken by participants or a major player, determine, using a third-party analysis, the intended side in which a major player is gaining, and follow his position with him. The leaders in terms of cryptocurrency futures volume are Binance and CME. Binance provides real-time open interest information for all pairs, CME in turn does this with a delay.

The principle of formation of the OI

If the volume of futures positions on the pair increases, OI goes upIf the volume of futures positions on the pair decreases, OI goes downAnd yet, there is a lot of debate in the cryptocurrency community about the effectiveness of such analysis. Some say that open interest helps them analyze the future direction of movement, others say that futures under normal conditions do not have a significant impact on the price of a spot asset, and a major player cannot predict market intentions.

OI analysis

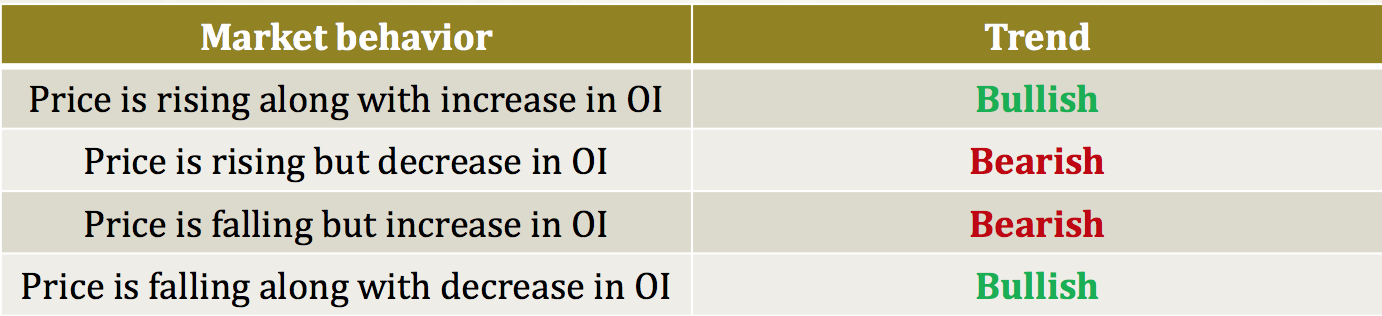

One of the possible methods of price forecasting through OI analysis is the ratio of OI to the price of an asset, and drawing conclusions based on the impact of OI on the price. The picture shows one of the main methods of such conclusions, but there are many others.

The effectiveness of such an analysis should be considered for each individual future because OI is highly dependent on the contract or exchange.Many say that a true analysis of OI can only be with the summation of all contracts (there are such services), many say that one particular contract tells everything better. In any case, the choice is yours.

Conclusion

Everyone should test the effectiveness of open interest analysis for themselves. Analyzing such data will not harm you in any way, but there is a good chance that it will greatly help in improving the efficiency of your trading, and trading strategy as such.Perhaps you will discover a pattern that brings super profits and take first place in the ranking on our service.