What is portfolio diversification?

Today we will talk about the most important part of investing, and an extremely important part of the medium and long-term trading styles – diversification.

Contents

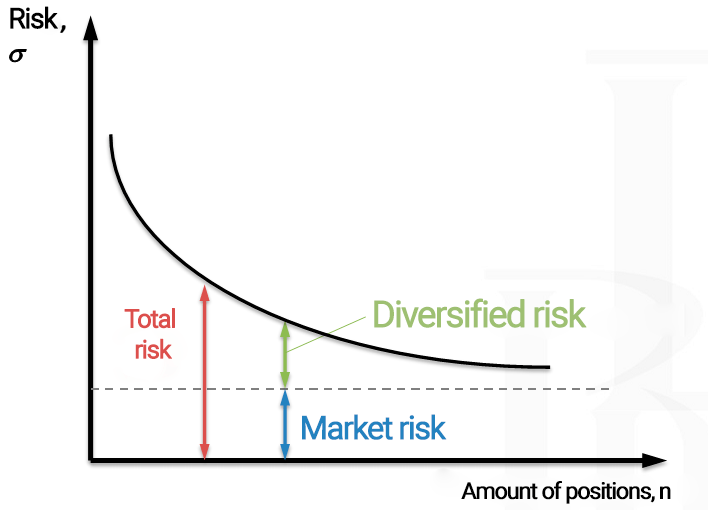

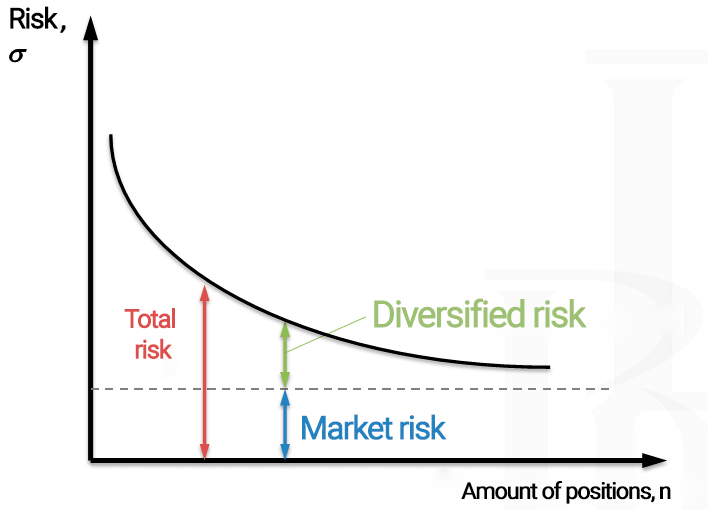

Diversification

Diversification is the reduction of risks by distributing them. Simply put, diversification is a model of investing money in different directions to reduce risk. This term is best seen with an example:No diversification option — I own bitcoin. Bitcoin fell, and I took a loss.Diversify Option — I own bitcoin, ether, and a hundred other assets. 40 of them fell, and 60 rose. I got a little positive. If one of the assets in my portfolio grew strongly, it would not bring significant profit. But at the same time, if several assets fell, they would not bring a significant loss. The point of diversification is to distribute as much risk with as little damage to returns as possible. Thus, protecting yourself from all too risky situations. The best example of diversification in life is insurance. You constantly pay a small amount to be in the black in case of an “unforeseen” situation.

How to properly diversify trades

Let’s start with the fact that your deposit should not be fully allocated to one strategy.A good trader usually has several strategies, which means a deposit is diversified by strategies. But this is not enough.What will happen to the deposit if the exchange on which the trader trades is scammed?What happens if the stablecoin in which the deposit is stored is hacked tomorrow?An undiversified deposit will receive a huge loss, or even completely collapse into oblivion. The diversified one, in turn, will react with a very small loss.An example of good diversification:25% of the deposit is kept in cash distributed across vaults, 25% in different banks, 25% in another investment area, and 12.5% in a hot or cold wallet in different cryptocurrencies. 6.2% is on the exchange, and 3% is allocated for each trading strategy, which should also be several. The positions of a well-diversified strategy are distributed among altcoins – transactions for the direction of the market movement are distributed over 10+ assets. This allows the strategy to earn with the correct analysis of the market, even if three out of ten trades were unexpectedly closed by a stop.

These rules allow the strategy to get rid of excess risk in the long run, which means earning more than an ordinary trader.If you think that it is impossible to trade on a 3% deposit, I hasten to please you. The leverage setting makes it easy to do this. Only a small difficulty is added with the constant transfer of cryptocurrency from the exchange and vice versa.

Conclusion

Diversification is an integral part of a trader’s job. If a trader wants to earn more than others, or just earn money, he needs to get rid of unnecessary risks.After all, extra risks = extra losses.Extra diversification allows you to get up in a difficult moment and start again, at the moment when its absence at a difficult moment will finish you off.