Which countries officially accept Bitcoin?

Cryptocurrencies have been rapidly gaining popularity in recent years, with more and more countries beginning to recognize them as official means of payment. The first and most well-known cryptocurrency, Bitcoin plays a key role in this process. In this article, we will look at which countries have already accepted BTC as a legal means of payment and analyze the benefits and risks of such a decision.

Contents

- Bitcoin and its role in the modern economy

- Why Countries Consider Bitcoin as Official Currency

- Benefits of Bitcoin Legalization for Countries

- Problems and risks of bitcoin adoption

- How other countries treat bitcoin

- Prospects for the use of bitcoin at the state level

- Conclusion

Bitcoin and its role in the modern economy

Bitcoin is a decentralized digital currency created in 2009 by Satoshi Nakamoto. Unlike traditional currencies, Bitcoin is not controlled by central banks or governments, but operates on blockchain technology. This makes Bitcoin transactions secure, transparent, and not subject to inflation. Due to its unique properties, Bitcoin is gradually gaining recognition as an alternative means of saving and payment. Many investors view it as digital gold, capable of protecting against economic instability and the depreciation of traditional currencies. In addition, Bitcoin opens up new opportunities for trading on platforms such as TradeLink Pro, where users can passively earn stable interest.

BTC/USD 1W

Why Countries Consider Bitcoin as Official Currency

Countries, especially developing ones, are increasingly turning their attention to Bitcoin for several reasons:

- Bitcoin can facilitate the financial inclusion of populations that do not have access to traditional banking services. This is especially important for countries with a high share of the informal economy.

- Using BTC reduces dependence on the US dollar and other reserve currencies. This allows countries to strengthen their sovereignty and reduce the influence of external economic factors.

- The adoption of cryptocurrencies can attract foreign investment and stimulate the development of the technology sector. Countries that legalize Bitcoin become more attractive to innovative companies and talented specialists.

- BTC enables fast and cheap cross-border transfers, which is especially important for countries with a large share of remittances from migrant workers. This can reduce costs and speed up the movement of capital.

Thus, the recognition of Bitcoin as an official means of payment opens up new opportunities for states for economic development and integration into the global digital economy.

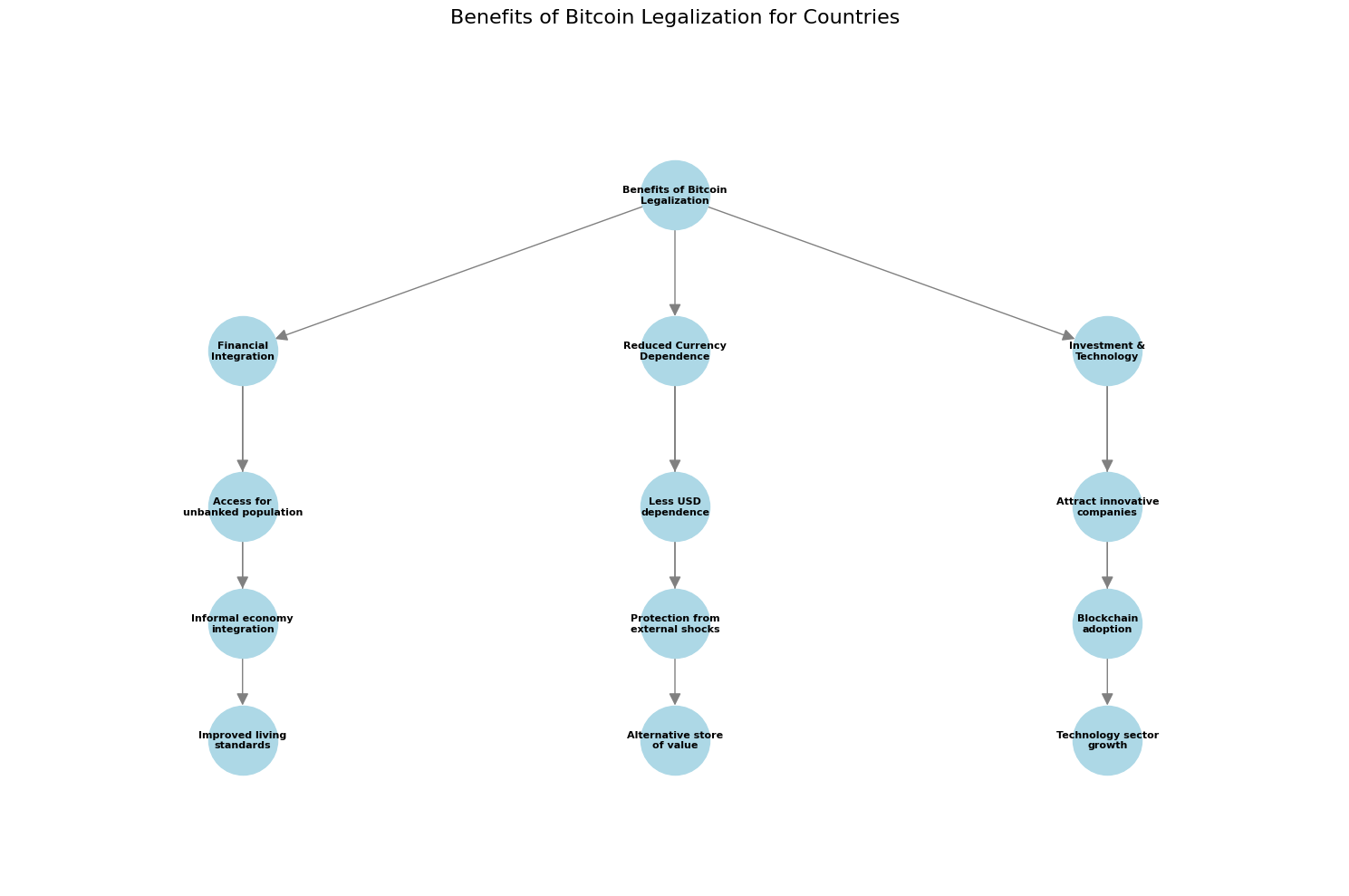

Benefits of Bitcoin Legalization for Countries

Recognizing Bitcoin as a legal tender could benefit countries by accelerating financial integration, reducing reliance on traditional currencies, and attracting investment in technology development.

Accelerating financial integration

Legalizing Bitcoin can help involve the population underserved by traditional financial services in the country’s economy. This is especially relevant for developing countries with a high share of the informal economy. Thanks to BTC , people who do not have access to bank accounts will be able to make transactions, save money, and participate in economic activity. This will accelerate the financial inclusion process and improve the population’s standard of living.

Reducing dependence on traditional currencies

Using Bitcoin allows countries to reduce their dependence on the US dollar and other reserve currencies and reduce the impact of external economic shocks. The volatility of traditional currencies and the political decisions of other countries can negatively affect the economies of countries tied to these currencies. As a decentralized cryptocurrency, Bitcoin is not subject to such influence and can serve as an alternative means of saving and exchange.

Attracting investment and developing technologies

Legalizing Bitcoin can signal international investors about the country’s readiness for innovation and technological development. Countries that recognize cryptocurrencies become more attractive to innovative companies and talented specialists. This facilitates the inflow of capital and the creation of new high-tech industries. In addition, the implementation of blockchain technologies, which are the basis of Bitcoin, can improve the efficiency of public administration, improve data protection and reduce corruption.

Benefits of Bitcoin legalization for Countries

Problems and risks of bitcoin adoption

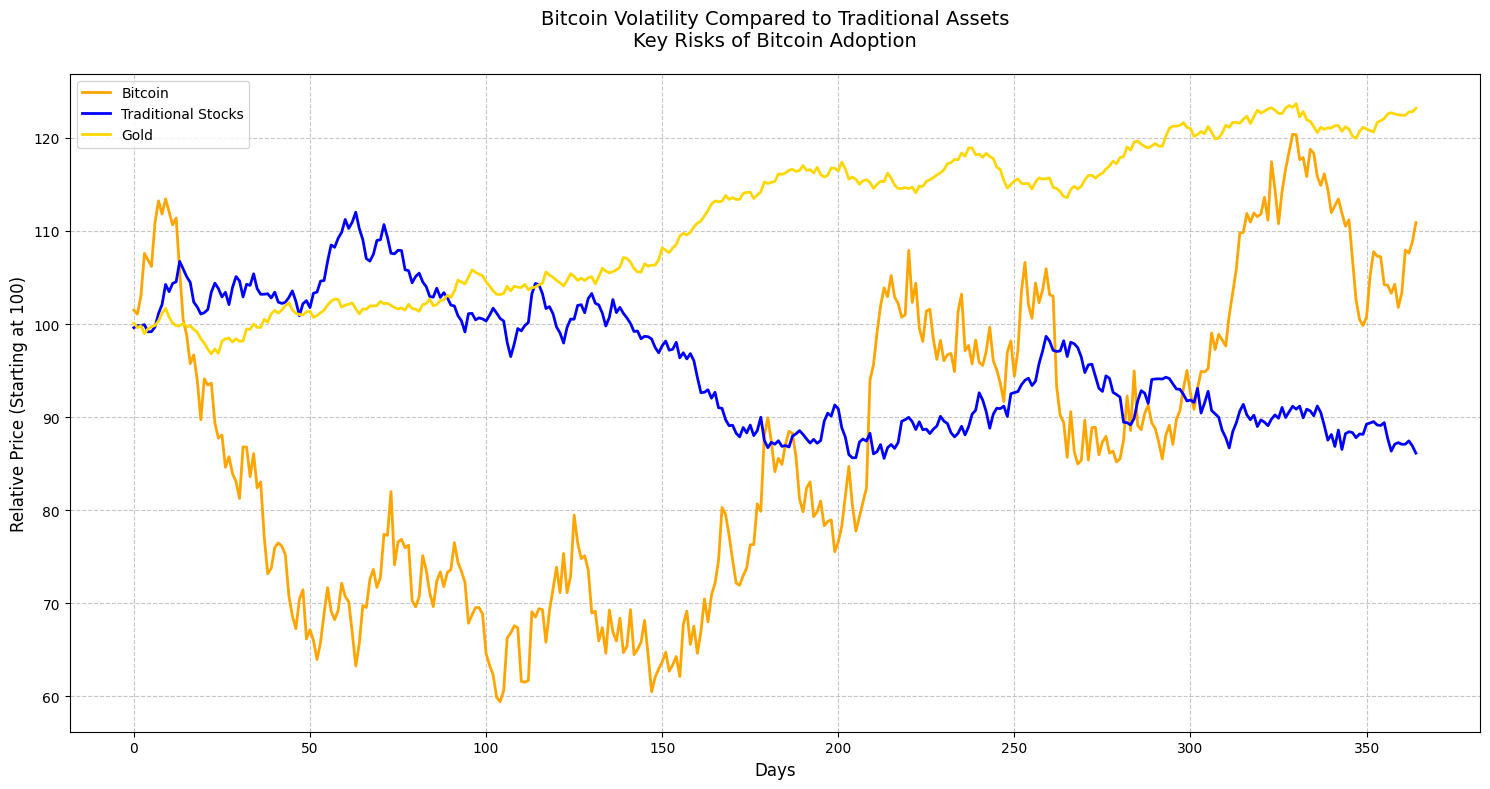

Despite the potential benefits of legalizing Bitcoin, countries must also consider the challenges and risks of adopting cryptocurrency as a legal means of payment. Key concerns include Bitcoin’s volatility, lack of global regulation, and the potential for cryptocurrency to be used for illegal activities.

Cryptocurrency volatility

BTC and other cryptocurrencies are characterized by high volatility, i.e., a tendency for sharp price fluctuations. This volatility can pose risks to a country’s economy and financial stability. Sharp fluctuations in the bitcoin exchange rate can negatively affect the purchasing power of the population, complicate budget planning, and lead to uncertainty in the business environment. States legalizing bitcoin need to develop mechanisms to manage the risks associated with cryptocurrency volatility.

Bitcoin Volatility Compared to Traditional Assets

No global adjustment

There are currently no uniform international standards for cryptocurrency regulation, which creates uncertainty for countries adopting Bitcoin. Differences in regulatory approaches can lead to conflicts with existing financial institutions and impede integration with the global economy. Countries legalizing Bitcoin should work closely with international organizations to develop harmonized regulations and standards for using cryptocurrencies.

Possibility of use in illegal activities

The anonymity of Bitcoin transactions can attract criminals who use cryptocurrency for money laundering, terrorist financing, tax evasion, and other illegal transactions. This poses a threat to the security and stability of a country’s financial system. States need to develop effective mechanisms to counter the use of Bitcoin for criminal purposes, including measures to identify users, track suspicious transactions, and cooperate with law enforcement agencies.

Despite these risks, many experts believe that the benefits of Bitcoin legalization outweigh the potential problems. Countries that have decided to take this step should carefully consider the strategy of cryptocurrency regulation and create a favorable environment for the development of innovations in this sphere.

The TradeLink Pro platform can help you mitigate the risks associated with Bitcoin trading by providing reliable investment strategies.

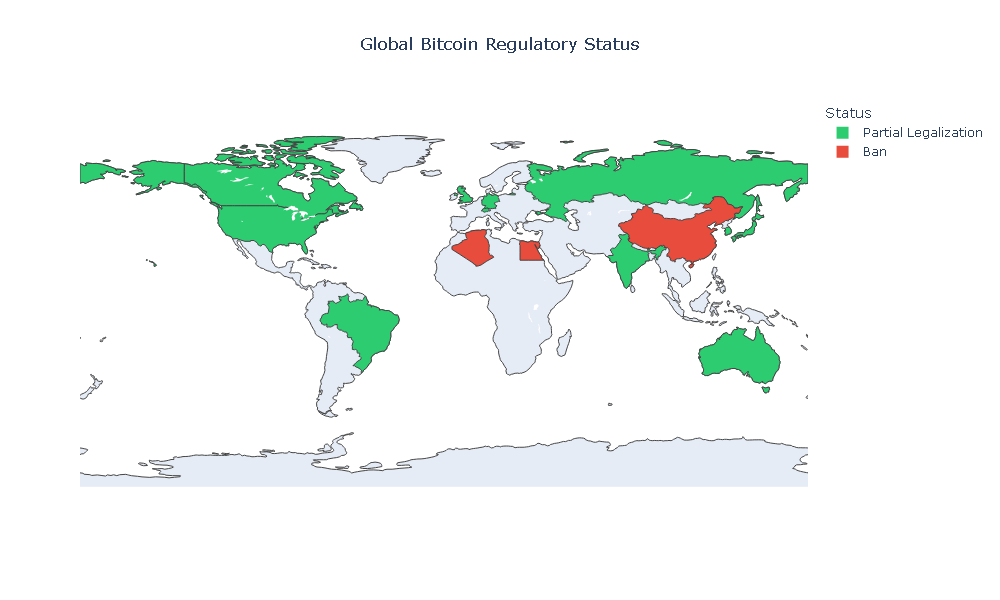

How other countries treat bitcoin

Attitudes towards Bitcoin and other cryptocurrencies vary from country to country. While some countries have partially legalized the use of Bitcoin, others have banned cryptocurrency transactions.

Partial legalization

Many developed countries recognize Bitcoin as property or an asset, but do not consider it legal tender. In these countries, cryptocurrency transactions are regulated and taxed, and companies dealing with Bitcoin must obtain special licenses.

- USA: Bitcoin is treated as property for tax purposes. Cryptocurrency exchanges must obtain licenses and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Japan: In 2017, Japan recognized Bitcoin as a legal tender. Cryptocurrency exchanges must be registered with the Financial Services Agency and comply with AML/KYC regulations.

- Germany: Bitcoin is considered private money subject to capital gains tax. Cryptocurrency companies must obtain licenses from the Federal Financial Supervisory Authority (BaFin).

Partial legalization allows countries to benefit from the development of the cryptocurrency industry while controlling the risks associated with money laundering and the financing of illicit activities.

Cryptocurrency ban

Some countries, fearing the risks associated with cryptocurrencies, completely prohibit their use and circulation on their territory. They argue their position with the need to protect financial stability and prevent illegal activities.

- China: In September 2021, China declared all cryptocurrency transactions illegal and banned cryptocurrency exchanges and ICOs. However, owning cryptocurrencies is not illegal.

- Algeria: Since 2018, buying, selling, using, and owning cryptocurrencies has been banned in Algeria. Violators face fines and imprisonment.

- Egypt: Egypt’s Islamic legislature issued a fatwa banning transactions involving Bitcoin and other cryptocurrencies, citing their potential use in illegal activities.

Prospects for the use of bitcoin at the state level

As more countries recognize the potential of cryptocurrencies, many experts are wondering which nations could be next to legalize Bitcoin and what role international organizations will play in regulating it.

Which countries could be next?

A number of developing countries, especially in Latin America and Africa, have shown interest in legalizing BTC . These states see the adoption of cryptocurrencies as a way to stimulate economic growth, attract investment and increase financial accessibility for the population.

| Country | Regulation Status | Key Events | Usage Examples |

| Paraguay | Regulated by law | June 2021: Approval of cryptocurrency bill | – Bitfarms opened a mining center in Paraguay in 2022 – Local stores started accepting BTC payments via Lightning Network |

| Panama | In legalization process | September 2021: Adoption of crypto bill | – Selina hotel chain started accepting crypto payments – Launch of first regulated crypto exchange CryptoSX Panama |

| Tanzania | Under consideration | June 2021: President’s statement on cryptocurrencies | – Growth of P2P Bitcoin trading on LocalBitcoins – Opening of cryptocurrency educational centers |

| Kenya | No clear regulation | 2021-2022: High level of public adoption | – BitPesa for cross-border transfers – BTC usage in retail through M-PESA |

The role of international organizations in the regulation of cryptocurrencies

International financial institutions such as the International Monetary Fund (IMF) and the World Bank recognize the potential of cryptocurrencies, but call for caution and the development of global regulatory standards. These organizations can play a key role in creating unified rules for Bitcoin use at the state level.

- IMF: The Fund actively explores the opportunities and risks associated with cryptocurrencies and provides technical assistance to countries interested in regulating them. The IMF emphasizes the need for international cooperation in this area.

- World Bank: The Bank is exploring the potential of blockchain technology to improve the efficiency of financial services and reduce poverty. In doing so, the organization calls for the development of appropriate rules to regulate cryptocurrencies.

- Financial Action Task Force (FATF): The FATF has set standards to prevent the use of cryptocurrencies for money laundering and terrorist financing. Countries legalizing Bitcoin should follow these recommendations.

Conclusion

Legalizing Bitcoin as an official means of payment is a significant step for any country and could have far-reaching consequences for its economy and financial system. In this article, we reviewed the experiences of El Salvador and the Central African Republic and analyzed the potential benefits and risks of adopting cryptocurrencies at the state level.

Summary of Bitcoin’s impact on national economies

The legalization of Bitcoin in El Salvador and CAR demonstrates states’ growing interest in cryptocurrencies as a tool for economic development. Key potential benefits include accelerating financial integration, reducing dependence on traditional currencies, and attracting investment in technology.

However, given Bitcoin’s volatility and the lack of established cryptocurrency regulation, it is too early to draw definite conclusions about the long-term consequences of these decisions. Countries considering legalizing Bitcoin need to carefully weigh the potential benefits and risks and develop robust mechanisms to protect consumers and prevent illegal activity.

Possible changes in the future financial landscape

As cryptocurrencies proliferate and blockchain technology evolves, we may see significant changes in the global financial system. Some of the possible transformations include:

- Increase in the number of countries accepting bitcoin and other cryptocurrencies as legal tender.

- Development of international cryptocurrency regulation standards and strengthening cooperation between countries in this area.

- Reducing the role of traditional financial intermediaries and increasing the efficiency of cross-border transfers.

- Emergence of new financial products and services based on blockchain technology.

- Increased competition between states to attract cryptocurrency companies and investors.

In conclusion, bitcoin legalization is a complex and multifaceted process that requires careful analysis and planning. El Salvador’s and CAR’s experiences serve as important examples for other countries considering the adoption of cryptocurrencies. As this field evolves, the international community should strive to create a balanced and secure ecosystem of digital assets that fosters economic growth and improves the well-being of people around the world.