Consensus Protocols: PoW, PoS, DPoS - What's the difference?

Contents

- Introduction

- Proof of Work (PoW)Protocol

- Proof of Stake (PoS)Protocol

- Delegated Proof of Stake (DPoS)Protocol

- Comparison of PoW, PoS and DPoS

- The future of consensus protocols

- Conclusion

Introduction

Blockchain technology is based on consensus protocols - a kind of “rules of the game ” that determine how network participants reach agreement on the state of the transaction registry. The key characteristics of the blockchain depend on the choice of protocol: security, performance, and energy efficiency.

Among the most well-known consensus protocols are Proof-of-Work (PoW), Proof-of-Stake (PoS), and Delegated Proof-of-Stake (DPoS). Understanding how they work and the differences between them is critical for the successful use of blockchain technologies.

In this article, we will analyze the fundamentals of PoW, PoS and DPoS, compare their key characteristics and prospects for application in cryptoprojects.

Proof of Work (PoW)Protocol

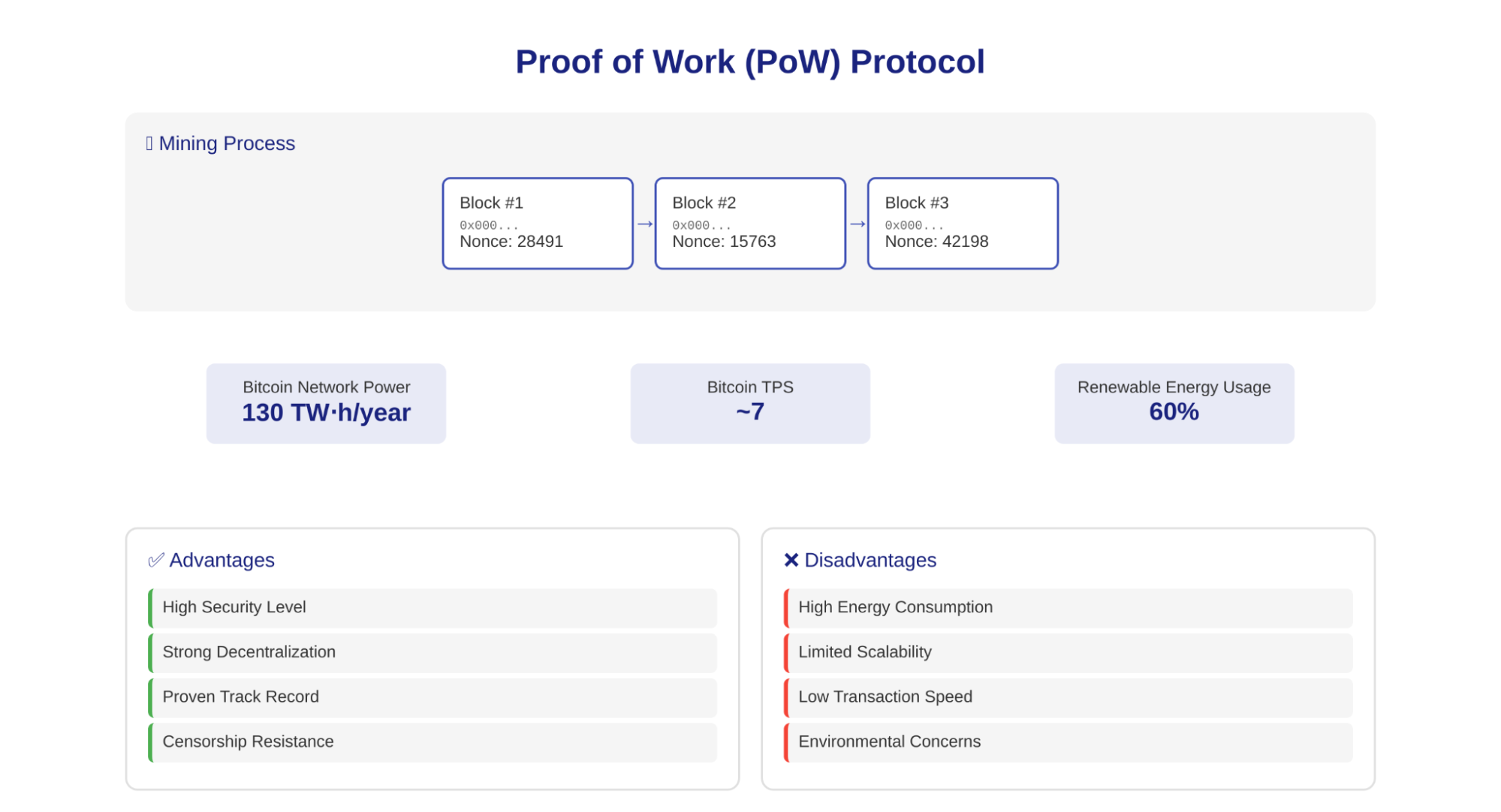

How PoW works

PoW is the original consensus protocol proposed by bitcoin creator Satoshi Nakamoto in 2008. Its essence lies in the fact that to create new blocks, miners must solve complex cryptographic problems using brute force. This process is called mining.

Each block in the PoW network contains the hash of the previous block, a list of transactions, and a unique number (nonce). Miners select a nonce so that the hash of the current block meets certain conditions (for example, it starts with several zeros). The first miner that finds a suitable hash transmits its block to the rest of the network nodes, which check its validity and add it to the blockchain.

The difficulty of the task is automatically adjusted so that the average block creation time remains constant (for example, 10 minutes in the bitcoin network). This is necessary to maintain predictable coin issuance and prevent a hashrate race.

Usage examples

The most famous implementation of PoW is Bitcoin. Thanks to PoW, bitcoin has been operating successfully for more than 13 years without a single failure, making it the most secure and reliable blockchain in the world. At the same time, during the entire network’s existence, there was not a single confirmed case of double spending or a successful 51% attack.

Another example of using PoW is Ethereum. From its launch in 2015 until 2022, Ethereum used a modified version of PoW with the Ethash algorithm optimized for GPU mining. However, due to growing problems with scaling and environmental friendliness, ETH developers decided to gradually switch to PoS.

Positive

The main advantage of PoW is the highest level of security and decentralization. For a successful attack on the PoW network, it is necessary to control more than 51% of the hashrate, which is almost impossible for large blockchains like bitcoin. In addition, PoW has proven to be resistant to censorship, technical glitches, and political pressure over the years.

PoW consensus is simple and elegant: each new block builds on the work done to create previous blocks. This ensures the immutability and integrity of the blockchain without the need for trust in any centralized authority.

Minuses

Despite its advantages, PoW also has significant drawbacks. First of all, it is a huge consumption of electricity. The Cambridge Center for Alternative Finance estimates that the bitcoin network alone spends about 130 TWh per year - more than countries like the Netherlands or the UAE. This is causing growing criticism from environmentalists and regulators.

In addition, PoW suffers from scalability issues. Due to block size restrictions and the frequency of their creation, the bandwidth of PoW networks remains quite low. So, Bitcoin is able to process only about 7 transactions per second, and Ethereum at peak load - up to 25 TPS. For comparison, centralized systems like Visa or Mastercard can handle thousands of TPS.

Attempts to increase the block size (as in Bitcoin Cash) or implement second-level off-chain solutions (Lightning Network for BTC, Plasma, and ZK Rollups for ETH) have not yet led to a breakthrough in scaling PoW blockchains. Against this background, new-generation protocols like PoS and DAG look like a more promising alternative.

However, it’s still too early to write off PoW. Many experts believe that it is indispensable for truly valuable and mission-critical applications. So, according to CoinShares, at the beginning of 2023, more than 60% of bitcoins were mined using renewable energy sources, and the total carbon footprint of the network was 40% lower than that of the traditional financial system.

Proof of Stake (PoS)Protocol

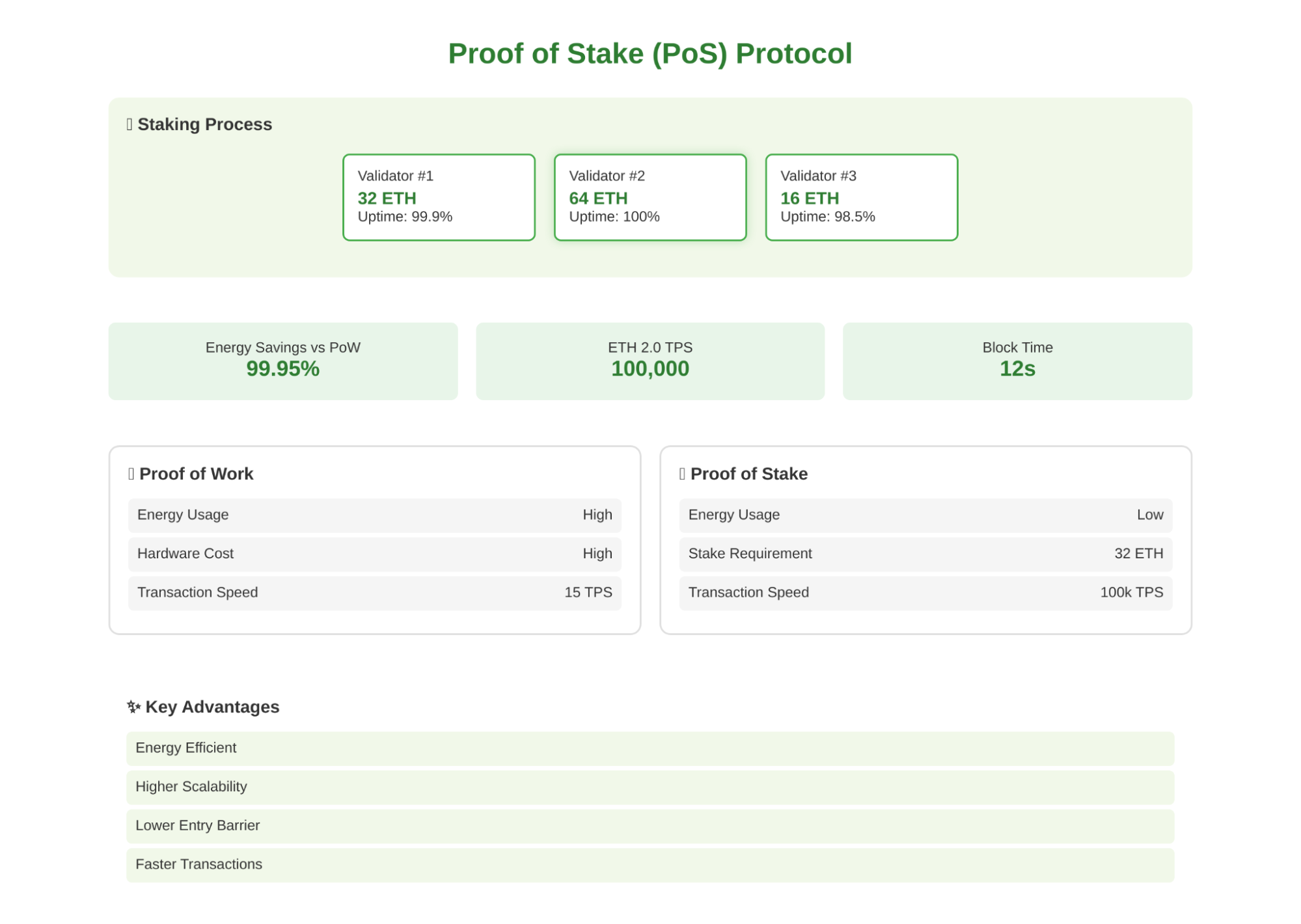

PoS Basics

Unlike Proof of Work (PoW), where miners compete to solve complex mathematical problems to create new blocks, in PoS, consensus is achieved using validators. Validators are network nodes that block (stake) a certain number of coins as collateral. The more coins placed on the stake, the higher the probability that the validator will be selected to create the next block and receive a reward.

Staking is the process of holding coins in a wallet to participate in transaction validation. In fact, this is an analog of a bank deposit, instead of interest in fiat, you receive a reward in blockchain tokens. The reward amount depends on the number of coins staking, the duration of staking, and the parameters of a particular network.

Usage examples

The most famous example of the transition to PoS is Ethereum 2.0. In December 2020, the zero phase of this upgrade (Beacon Chain) started, which introduced PoS in parallel with the main network on PoW. To launch a validator node in Ethereum 2.0, you need to deposit at least 32 ETH (about $100,000 at the exchange rate for April 2023). In the future, it is planned to completely merge these two chains with the rejection of PoW.

Another striking example is the Cardano blockchain, which uses a modified PoS algorithm called Ouroboros. Validators are selected based on a combination of randomness and steak size, which reduces the risks of centralization. At the same time, the minimum amount for staking in Cardano is only 1 ADA (about $0.4), which makes it more inclusive and democratic.

Positive

The main advantage of PoS over PoW is much lower power consumption. Validators do not need to constantly increase computing power, which makes PoS more eco-friendly and affordable. According to experts of the Ethereum Foundation, after the full transition to PoS, the network’s power consumption will decrease by 99.95%.

In addition, PoS provides higher speed and scalability by reducing block creation time and implementing sharding (splitting the blockchain into parallel chains). So, if the average block time in the Ethereum network on PoW is 13 seconds, and the throughput is 15 transactions per second (TPS), then on PoS, these indicators can improve to 12 seconds and 100,000 TPS, respectively.

Minuses

Despite the obvious advantages, PoS also has some disadvantages. In particular, there is a risk of centralization due to the concentration of a large number of coins in large players. Rich stakeholders can gain a disproportionate amount of influence over online decision-making.

For example, according to the service data Nansen.ai, at the time of the Beacon Chain launch in December 2020, the top 100 addresses accounted for more than 50% of all stashed ETH. This raises concerns about the network’s resilience to collusion or nothing-at-stake attacks.

However, PoS developers strive to minimize these risks through various mechanisms - rotation of validators, penalties for malicious behavior (slashing), restrictions on staking, promotion of decentralized pools, etc. Time and practice will show the effectiveness of these measures.

In general, PoS is a promising alternative to PoW, which can significantly increase the efficiency and scalability of blockchains. However, to fully realize its potential, many technical and socio-economic problems still need to be solved.

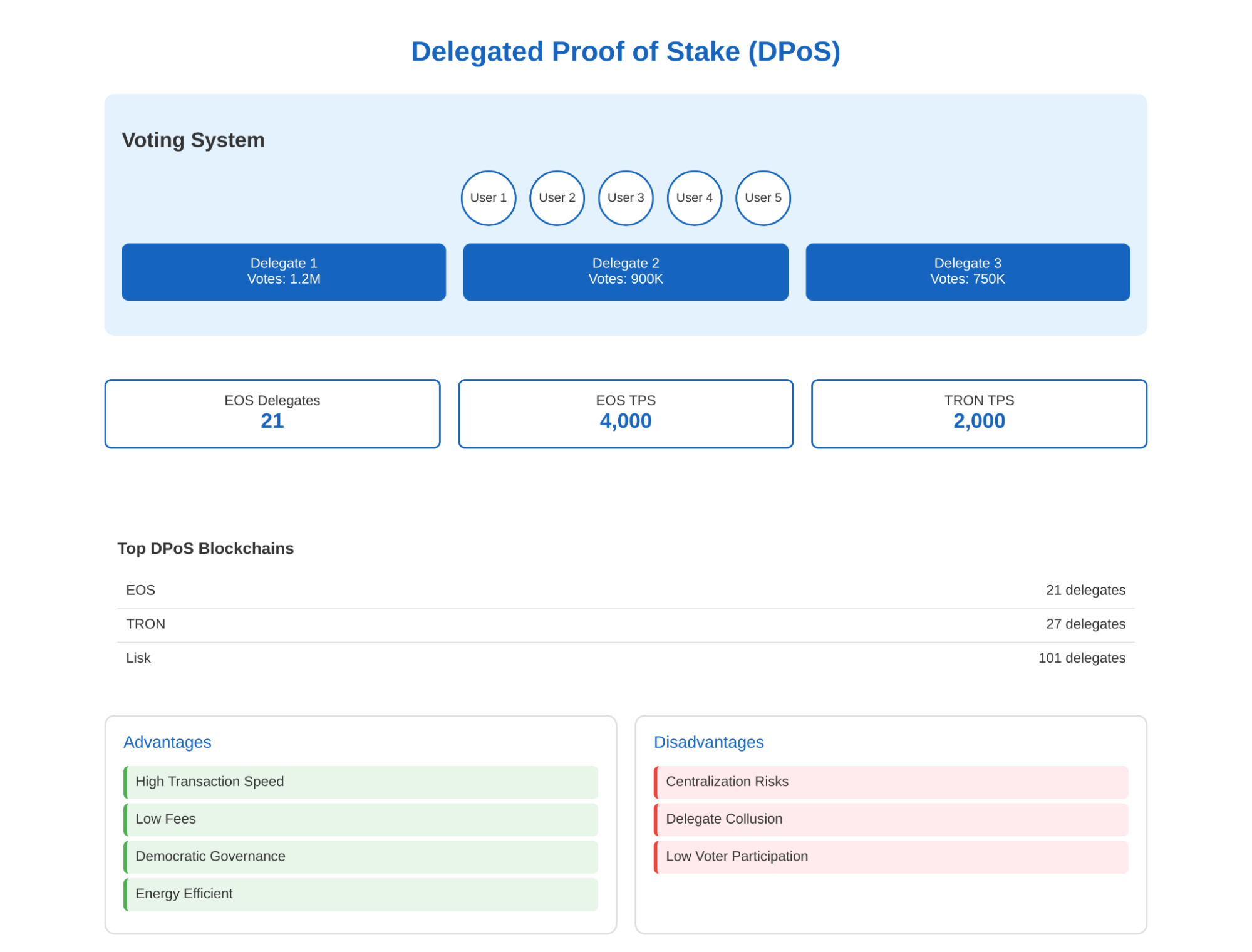

Delegated Proof of Stake (DPoS)Protocol

DPoS is a modification of PoS designed to make the consensus process more democratic and efficient. In DPoS, token holders choose delegates (witnesses) who will validate transactions and create blocks on their behalf.

The number of delegates is usually limited - for example, in EOS, there are only 21. To qualify for the role of a delegate, you need to have powerful equipment and a good reputation. Token holders vote for trusted delegates and can withdraw their votes at any time.

The leading blockchains on DPoS are EOS, Tron, Lisk, BitShares, and Steem. These projects are aimed at high throughput: EOS is capable of processing millions of transactions per second, and Tron - about 2000.

Fast performance is a key advantage of DPoS, along with low fees and the ability for ordinary users to influence network management through delegates. The creators of EOS position their blockchain as an operating system for industrial dApps.

However, DPoS also has a downside - an increased risk of centralization due to the small number of delegates. Major players can negotiate or bribe delegates to advance their interests at the expense of others. In addition, the token base and voting activity in DPoS networks are still low, exacerbating problems with decentralization.

Comparison of PoW, PoS and DPoS

To better understand the differences between PoW, PoS, and DPoS, let’s summarize their key characteristics in a table:

| Characteristic | Power Consumption | Transaction Speed (TPS) | Security | Decentralization | Application |

| PoW Usage | Very High | Low (< 100) | High | High | Bitcoin, Litecoin, Monero |

| PoS | Low | High (Up to 100,000) | Average | Average | Ethereum 2.0, Cardano, Solana |

| DPoS | Low | Very High (>1,000,000) | Average | Low | EOS, Tron, BitShares |

As you can see, PoW remains unsurpassed in terms of security and decentralization but loses out to PoS and DPoS in terms of speed and environmental friendliness. PoS is in the middle in all respects, and DPoS offers record-breaking performance at the cost of greater centralization.

Based on this, the following recommendations can be made for choosing a consensus protocol:

- PoW-based networks (Bitcoin, Litecoin) are best suited for storing large amounts of money and valuables. They are most resistant to attacks and pressure from regulators.

- To create smart contracts, DEX, and other dApps, you should use high-performance blockchains based on PoS (Ethereum 2.0, Solana, Avalanche). They will ensure low fees and fast execution of transactions.

- The DPoS protocol is optimal for niche projects (social networks, games, predictive markets) where maximum speed and low cost of operations are required. However, you need to take into account the risks of centralization and manipulation by delegates.

The future of consensus protocols

In the coming years, we will see a further evolution of consensus protocols in an attempt to find the optimal balance between security, scalability, and decentralization. One of the promising areas is hybrid protocols that combine elements of PoW and PoS.

For example, the Decred blockchain uses a hybrid PoW+PoS consensus. Blocks are generated by miners using the PoW algorithm, but then they are checked by PoS validators. This allows you to combine the high security of PoW with energy efficiency and accelerate PoS transactions.

Another example is the Casper consensus protocol developed by Ethereum creator Vitalik Buterin. Casper combines PoW at the initial stage with the transition to PoS as the complexity of calculations increases. This approach is designed to ensure a smooth and secure migration from PoW to PoS.

In addition, alternative consensus protocols such as Proof-of-Authority (PoA), Proof-of-Capacity (PoC), Proof-of-Reputation (PoR), and others are being actively explored. Each of them has its own characteristics and can potentially be applied in certain niches.

Innovation and adaptation to the changing needs of the blockchain ecosystem will play a key role in the development of consensus protocols. With the growing popularity of NFT, DeFi, GameFi, and metaverses, even faster, cheaper, and more convenient blockchains will be needed.

Developers are already experimenting with solutions such as sharding (splitting the blockchain into parallel chains), oracles (bridges to external data), inter-network communication, офчейнoff-chain scaling (L2), etc. Combining these innovations with flexible consensus protocols will open up new horizons for the blockchain industry.

Conclusion

The PoW, PoS, and DPoS consensus protocols have their own advantages and disadvantages. PoW is the most secure and decentralized, but slow and energy - intensive. PoS is much more efficient, but it is inferior to PoW in terms of network protection. DPoS delivers record-breaking speed at the cost of higher centralization.

Choosing the right consensus protocol is a key success factor for a blockchain project. It should take into account the goals, target audience, niche, and regulatory risks. The right solution will allow you to build a reliable and competitive platform with huge growth potential.