What is DeFi (Decentralized Finance) and how to earn on it?

Contents

- Introduction

- What is DeFi?

- Key components of the DeFi ecosystem

- How to make money on DeFi?

- DeFi risks and limitations

- How do I start using DeFi?

- The future of DeFi

- Conclusion

Introduction

DeFi (Decentralized Finance) is a fast-growing ecosystem of financial applications and services built on the blockchain. It aims to change the traditional financial system by offering more open, transparent, and accessible financial instruments for everyone.

Key benefits of DeFi include eliminating middlemen, reducing costs, and improving security and privacy. However, there are also challenges - the volatility of cryptocurrencies, the risks of smart contracts, and regulatory problems. In this article, we will look at what DeFi is, how to make money from it, and what opportunities this innovative technology opens up.

What is DeFi?

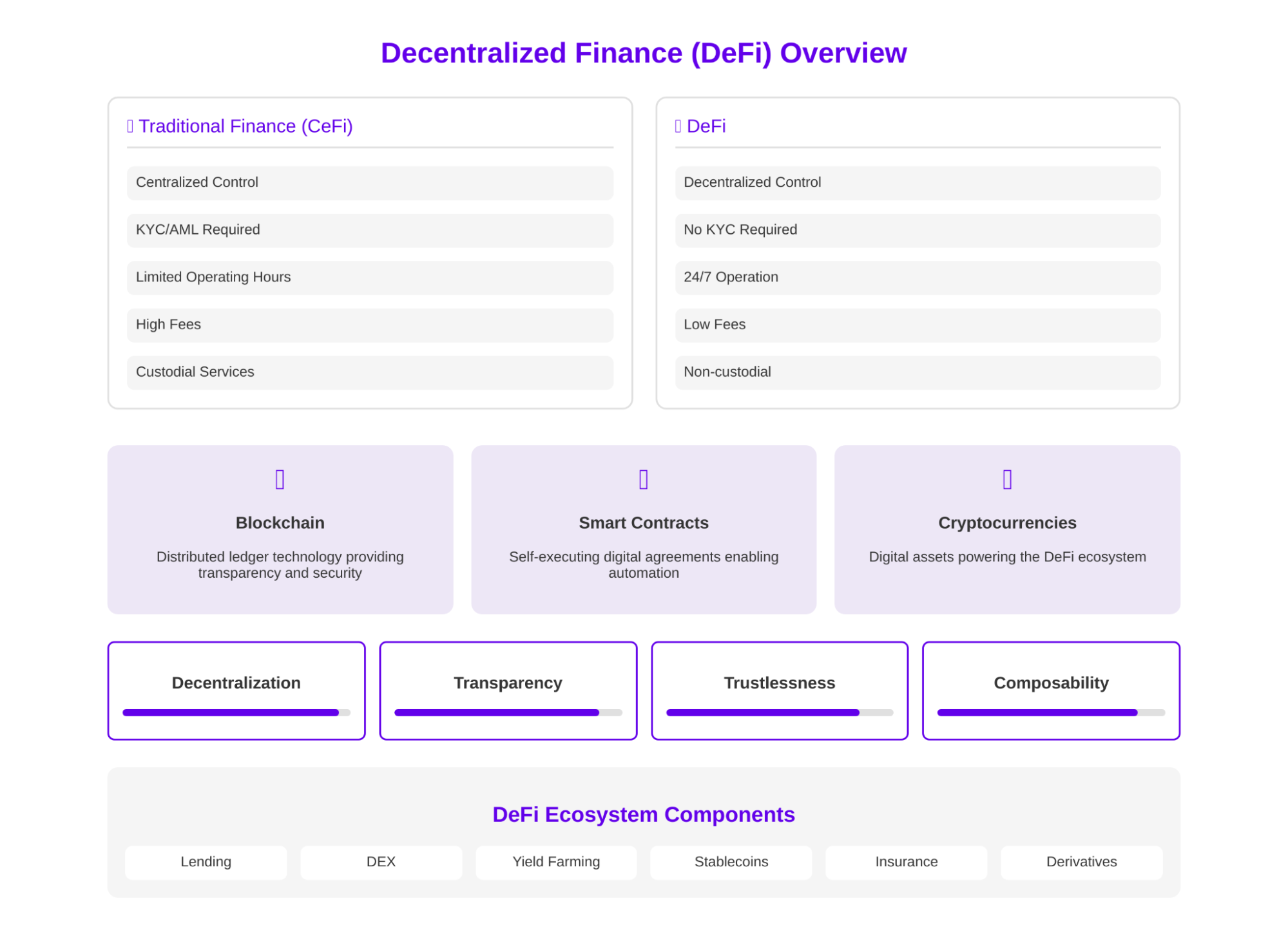

DeFi (Decentralized Finance) is a general term for blockchain-based financial services created as an alternative to the traditional financial system. Key features of DeFi:

- Decentralization: lack of centralized control and intermediaries, such as banks or exchanges. Participants interact directly through the blockchain.

- Openness and transparency: Open source DeFi protocols allow any user to audit and verify transactions.

- Distrust (trustless): there is no need to trust counterparties or centralized institutions, security is provided by mathematical algorithms.

- Compositionality: the ability to create new financial products by combining existing DeFi protocols as a “money lego.”

Unlike traditional finance (CeFi), in DeFi:

- The user retains full control over their assets through non-custodial wallets.

- Transactions are conducted almost instantly and work 24/7.

- There are no KYC/AML requirements, and confidentiality is ensured.

- Low fees and entry barriers, accessibility for everyone.

DeFi is based on three key technologies:

- Blockchain is a distributed ledger that provides transparency, immutability, and security for transactions without intermediaries.

- Smart contracts are self-executing digital contracts that allow you to automate transactions and create complex financial applications.

- Cryptocurrencies are digital assets that act as a means of exchange, fixing value, and securing smart contracts in the DeFi ecosystem.

Key components of the DeFi ecosystem

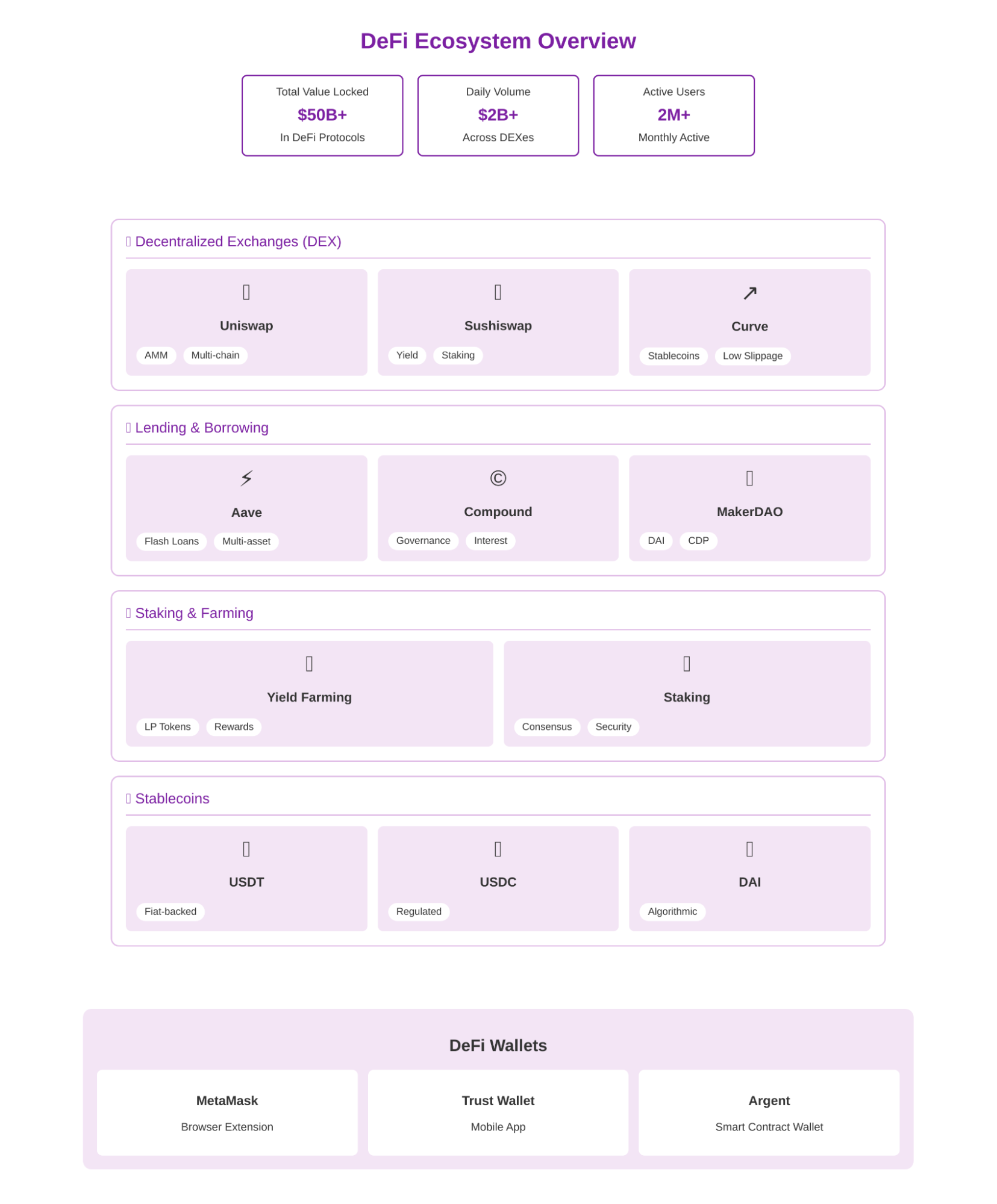

The DeFi ecosystem consists of many interconnected protocols and services. Here are the main ones:

-

Decentralized exchanges (DEX) are blockchain-based trading platforms that allow users to exchange crypto assets directly from their wallets without transferring funds to a third party. Examples: Uniswap, Sushiswap, Curve.

-

Lending and loan platforms-protocols that allow users to lend their crypto assets and take out loans against collateral without intermediaries. Interest rates are determined algorithmically based on supply and demand. Examples: Compound, Aave, and MakerDAO.

-

Stablecoins are cryptocurrencies that are pegged in price to fiat currencies or other assets. They solve the problem of cryptocurrency volatility and serve as a convenient tool for fixing the value in DeFi. The most popular currencies are USDT, USDC, and DAI.

-

Protocols for staking and farming:

- Staking - holding crypto assets to ensure the security and consensus of the network with rewards, similar to a bank deposit.

- Yield farming - providing liquidity to DEX pools or lending protocols to receive interest payments and rewards in native platform tokens.

-

Asset management tools - aggregators and automated investment services that allow you to conveniently track and optimize the placement of assets in different DeFi protocols to maximize profits. Examples: Yearn Finance, Zapper.

-

DeFi wallets - non-custodial cryptocurrency wallets with integration of DeFi services for secure storage and convenient interaction with DeFi protocols directly from the wallet interface. MetaMask, Trust Wallet, and Argent are popular.

All these components together form a unique decentralized ecosystem for providing various financial services without intermediaries and restrictions of the traditional financial system.

How to make money on DeFi?

DeFi opens up many opportunities for earning money on cryptoassets. Let’s look at the main strategies for making a profit in decentralized finance.

Staking: income on token retention

Staking is the process of blocking cryptocurrencies to ensure the security and validation of transactions in blockchain networks with a Proof-of-Stake (PoS) consensus algorithm. Token holders receive a reward for participating in staking, similar to bank deposits. The rates of return vary depending on the specific network and staking conditions, but on average, they are 5-20% per annum.

Popular blockchains for staking: Ethereum 2.0, Cardano, Polkadot, Cosmos, Tezos.

Liquidity farming: providing liquidity and receiving rewards

Yield farming is the practice of providing crypto assets to liquidity pools on decentralized exchanges (DEX) or lending protocols to receive interest payments and rewards in native platform tokens.

Liquidity farming is not so simple, it has a risk such as impermanent loss, which occurs due to changes in the ratio of asset prices in the pool. There are also risks of hacking smart contracts, changing protocol rules, and reducing profitability due to high competition. Before starting farming, it is important to carefully study the platform, its mechanisms and assess possible losses.

Profitability is generated by commissions from trading on DEX or interest on loans. Additionally, farmers can receive platform management tokens. The average yield of farming can reach 30-100% per annum, but it is important to take into account the risks of temporary or permanent depreciation of tokens due to the volatility of the crypto market.

Lending and borrowings: receiving passive income from issuing loans

DeFi-lending platforms such as Aave, Compound, allow users to lend their crypto assets and receive interest. Loan rates depend on supply and demand for a particular asset and are automatically set by the protocol.

How it works:

Users lock their crypto assets in the platform’s smart contracts, which are then used to issue loans to other participants. Interaction takes place without intermediaries, which reduces costs and increases transparency. Interest rates can vary depending on market conditions, and returns are often higher than in traditional financial systems.

On average, the income from lending is 3-10% per annum. Risks include the volatility of cryptocurrencies used as collateral and potential vulnerabilities in smart contracts.

Investing in DeFi tokens: analysis of promising projects

Investing in native tokens of promising DeFi projects in the early stages can bring significant profits due to the growth of the token price as the platforms develop and adapt.

One of the key success factors is timely identification of projects with innovative solutions and a strong development team. To do this, you need to take into account market trends, regulatory changes, and the level of community confidence in the project.

However, this is a high-risk strategy that requires a deep analysis of the fundamental indicators of projects, their team, competitive advantages, and market potential. It is important to apply the principles of portfolio diversification and invest only available funds.

DEX Trading: Strategy and Risks

Trading on decentralized exchanges allows you to earn money on fluctuations in the prices of cryptocurrencies. Unlike centralized exchanges, DEX operate on the basis of smart contracts and liquidity pools, providing users with full control over their funds.

For effective trading, it is important to use the principles of money management, stop losses to limit losses, and technical and fundamental market analysis. It is necessary to take into account the risks of high volatility, price slippage in large transactions due to limited liquidity, as well as the vulnerability of smart contracts.

Using TradeLink Passport analytical tools can help you evaluate your trading results and optimize your strategy.

DeFi risks and limitations

Despite all the advantages and opportunities, the DeFi ecosystem is still at an early stage of development and is associated with a number of risks and limitations that must be taken into account when interacting with decentralized financial instruments.

Smart contract risks

Smart contracts are the mainstay of DeFi protocols, but they can contain bugs and vulnerabilities in the code that can potentially lead to loss of funds. The audit of smart contracts by independent experts reduces these risks, but does not eliminate them completely. Examples of major hacks and exploits of smart contracts include attacks on the Maker, Compound, and dForce protocols.

Cryptocurrency Volatility

The high volatility of cryptoassets used in DeFi can lead to significant fluctuations in the value of collateral and the potential liquidation of positions in lending protocols. Sharp price collapses can cause a cascade effect of liquidations and instability of the entire ecosystem. The use of stablecoins and conservative collateral ratios helps reduce these risks.

Regulatory issues

Most DeFi projects operate in a regulatory gray area, and their legal status remains uncertain in many jurisdictions. Potential restrictions and sanctions from regulators may negatively affect the development and adaptation of DeFi. It is important to monitor changes in legislation and use DeFi tools in accordance with legal regulations.

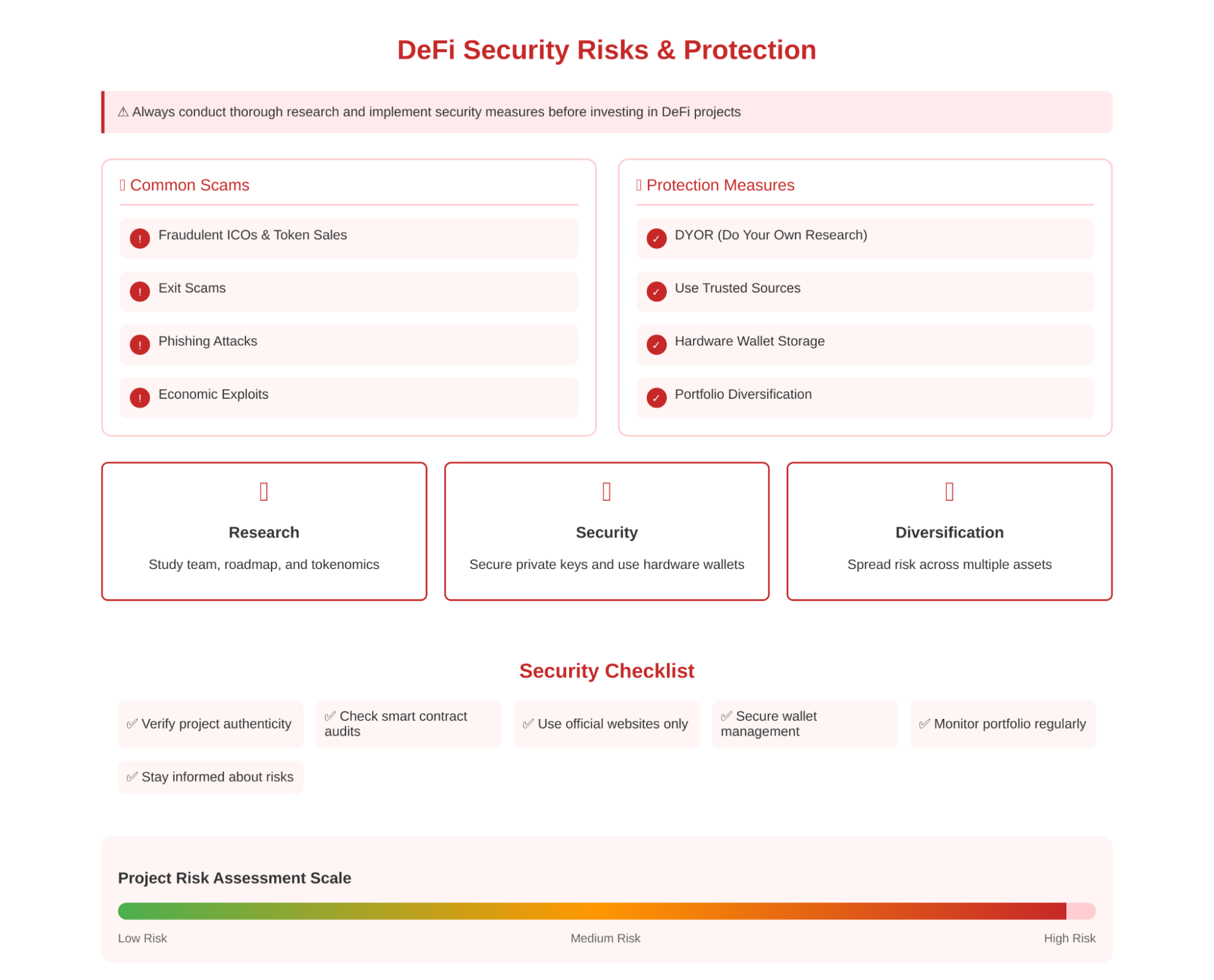

Possible fraud schemes and how to avoid them

The rapid growth in the popularity of DeFi attracts many fraudulent projects that seek to take advantage of the hype and lack of user awareness. Typical schemes include:

- Scam projects and fraudulent ICOs that disappear with investors ’ money after fundraising.

- Exit scams are when developers leave the project and drop the value of their tokens after they are distributed.

- Phishing and theft of private keys through fake websites, extensions, and mobile apps.

- Economic attacks on vulnerable protocols with weak incentive systems.

To minimize the risks of fraud, you should:

- Conduct a thorough analysis (DYOR) of the fundamental indicators of projects before investing, study the team, roadmap, and mechanisms of tokenomics.

- Use only verified and reliable sources of information, official websites, and protocol applications.

- Store crypto assets on hardware wallets and monitor the security of private keys.

- Diversify your portfolio and invest only free funds that you are not afraid of losing.

How do I start using DeFi?

To start your journey in the world of DeFi, you need to understand the basic concepts, choose the right tools and platforms, and master the basic skills of secure interaction with decentralized protocols.

Choosing the right platform and wallet

The first step is to choose a blockchain platform and ecosystem for working with DeFi. The most developed and popular ecosystem is the Ethereum ecosystem, on which most of the leading DeFi protocols are built. Alternatives are Binance Smart Chain, Solana, Polygon, and Avalanche.

To interact with DeFi, you will need a non-custodial cryptocurrency wallet that supports the selected network and allows you to interact with smart contracts. The most popular options are:

- MetaMask is a browser extension and mobile application that supports many networks, including Ethereum and BSC.

- Trust Wallet - a mobile wallet integrated with popular DeFi protocols.

- Ledger and Trezor-hardware wallets are used for maximum security when storing cryptoassets.

Tips for beginners: risk management, security and minimal investment

If you are new to DeFi, start with small amounts and gradually build up your experience and understanding of risks. Here are some tips for getting started safely and efficiently:

- Carefully study the basics of how protocols work before using them. Understand the mechanisms of their functioning, tokenomics, and potential risks.

- Start with the minimum investment that you are willing to lose in the event of failure. The optimal amount to start with is$200-500.

- Do not store large amounts on hot wallets, but use hardware wallets for long-term storage.

- Set gas limits when signing transactions to avoid unexpected expenses.

- Use only proven and reliable protocols that have passed a security audit.

- Diversify your portfolio between different protocols and strategies to reduce risks.

- Regularly monitor your positions and use risk management tools: stop losses and take profits.

- Keep an eye out for updates and updates on the protocols you invest in, so that you can respond to potential issues in a timely manner.

The future of DeFi

DeFi is rapidly developing and transforming traditional ideas about financial services. Despite the current risks and limitations, decentralized finance has a huge potential for further growth and revolutionary changes in the global financial system.

Opportunities and prospects for development

- Expanding the availability of financial services for people who are not covered by traditional banking. DeFi opens up opportunities for billions of people in developing countries to be financially included.

- Reduce the cost of financial transactions and eliminate intermediaries by automating processes using smart contracts.

- Increase the transparency and security of financial transactions due to the open and decentralized nature of the blockchain.

- Development of new financial instruments and markets, such as synthetic assets, decentralized derivatives, and insurance products.

- Integrate with Traditional finance (CeFi) through regulated DeFi protocols and partnerships with institutional players.

The role of DeFi in the global financial system

As the current challenges evolve and overcome, DeFi can become a significant part of the global financial ecosystem, complementing and gradually replacing traditional centralized services.

- DeFi is becoming an attractive alternative to bank deposits and loans, offering higher rates and lower barriers to entry.

- Decentralized exchanges (DEX) can compete with centralized platforms in terms of trading volumes and liquidity, especially in the field of token trading.

- Stablecoins and DeFi-based lending protocols can become a new infrastructure for global payments and settlements, reducing dependence on correspondent banks and SWIFT.

- Tokenization of real assets (real estate, securities, art objects) on the blockchain opens up opportunities for creating more efficient and liquid markets.

- Central banks can use DeFi’s expertise to develop their own digital currencies (CBDCs) by integrating them into decentralized financial protocols.

New trends and innovations

The DeFi ecosystem is constantly expanding to cover new niches and areas. Here are some of the most promising trends:

- Non-fungible tokens (NFTs) are unique digital assets that represent ownership of various objects in the digital and physical world. NFTs are used in art, collecting, gaming, and other fields, creating new markets and business models.

- GameFi (decentralized games) - game projects on the blockchain, where players can earn and exchange in-game assets in the form of NFTs and cryptocurrencies. Games like Axie Infinity, Decentraland, and The Sandbox attract millions of users and create entire game economies.

- DeFi aggregators are services that combine and optimize interaction with various DeFi protocols, simplifying the user experience and increasing the efficiency of operations. Examples: 1inch, Yearn Finance, Rari Capital.

- Inter-network protocols and blockchain scalability solutions (Polkadot, Cosmos, Polygon) allow you to link different DeFi ecosystems and improve network throughput for processing growing transaction volumes.

- The unlimited potential of DeFi, combined with other cutting-edge technologies such as AI, IoT, and big data, opens the way for even more innovative and personalized financial products and services.

DeFi’s development path will not be smooth and fast - there are still many challenges ahead related to regulation, security, usability, and user education. However, the huge prospects and fundamental advantages of decentralized finance allow us to be optimistic about the future of this industry.

Conclusion

DeFi is a dynamic ecosystem that transforms traditional finance by eliminating intermediaries and making financial services more accessible, transparent, and efficient. Despite the risks and limitations, decentralized finance offers huge opportunities for innovation, financial inclusion, and the creation of a fairer global economy. The future of DeFi looks promising, and each of us can become a part of this revolutionary industry, starting with the basics and gradually immersing ourselves in the world of decentralized financial protocols.