Cryptocurrency Markets of Different Countries: Which Are the Most Promising Trading Platforms?

Contents

- Where are the most promising trading platforms?

Introduction

The cryptocurrency market continues to grow rapidly, attracting both institutional and retail investors around the world. Every year, not only the capitalization of digital assets is growing, but also the number of trading platforms offering various conditions for trading. However, choosing the right exchange remains a key factor for successful trading, as it directly affects commissions, liquidity, security, and available trading tools.

In this article, we will look at the crypto markets of different countries and analyze which platforms offer the best conditions for traders.

Criteria for evaluating Crypto sites

Choosing an exchange for trading cryptocurrencies depends on several key factors that affect the convenience, security, and profitability of trading. Consider the main criteria:

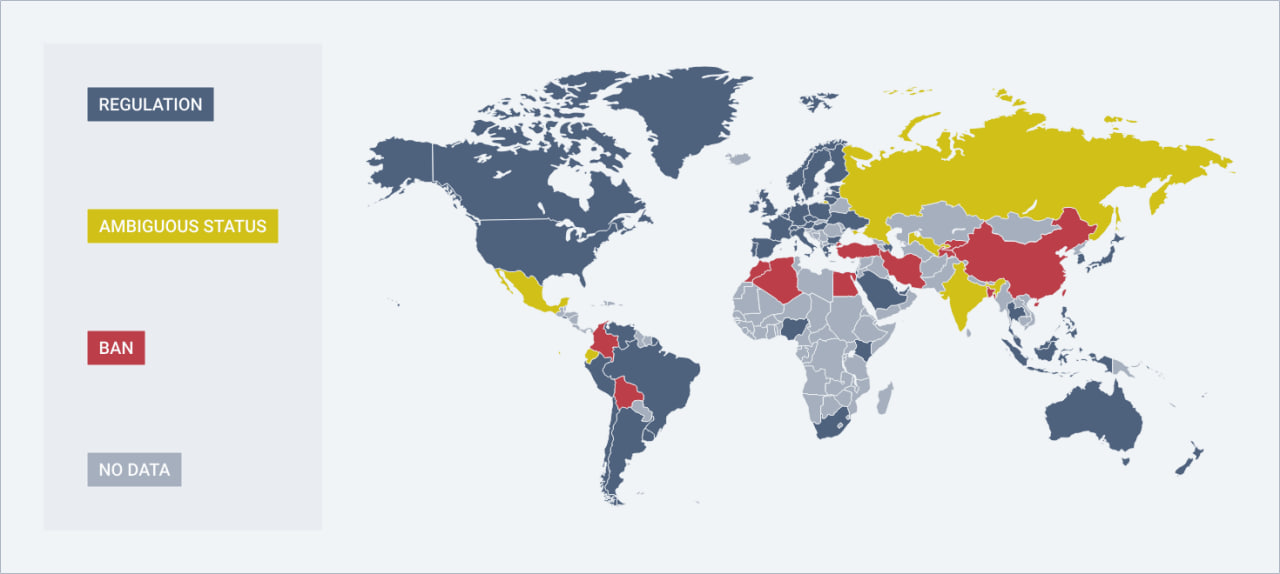

- Regulation and legal status - crypto exchanges operate under different legal conditions in different countries, which affects the protection of users, the tax burden, and the stability of the platform.

- Security and protection of assets is an important factor, including measures against hacking, the availability of funds insurance, and ways to authenticate users.

- Transaction and withdrawal fees – each exchange sets its own rates for transactions, deposits and withdrawals, which can significantly affect the profitability of trading.

- Availability of trading tools – the availability of futures, options, staking, leverage and other opportunities expands the choice of strategies.

- Liquidity level – the higher the trading volume, the faster and more profitable you can make deals, especially for large investors and active traders.

These criteria help you objectively evaluate trading platforms and choose the most profitable and safe options for trading.

When choosing a crypto exchange, it is important to take into account the available trading tools. For example, the TradeLink platform offers convenient solutions for automated trading and asset management, which makes it attractive for both beginners and experienced traders.

Crypto markets around the world

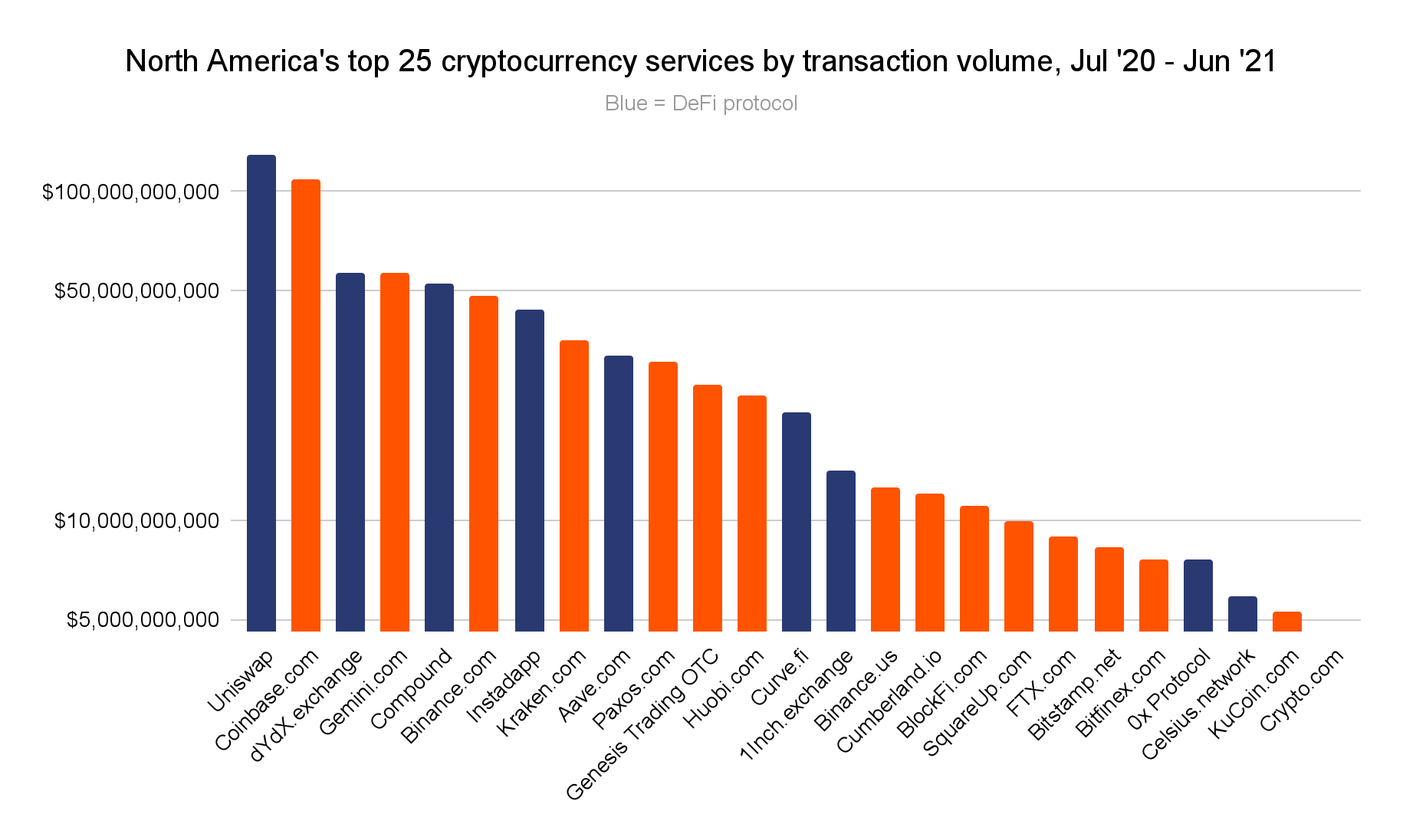

US Crypto Market

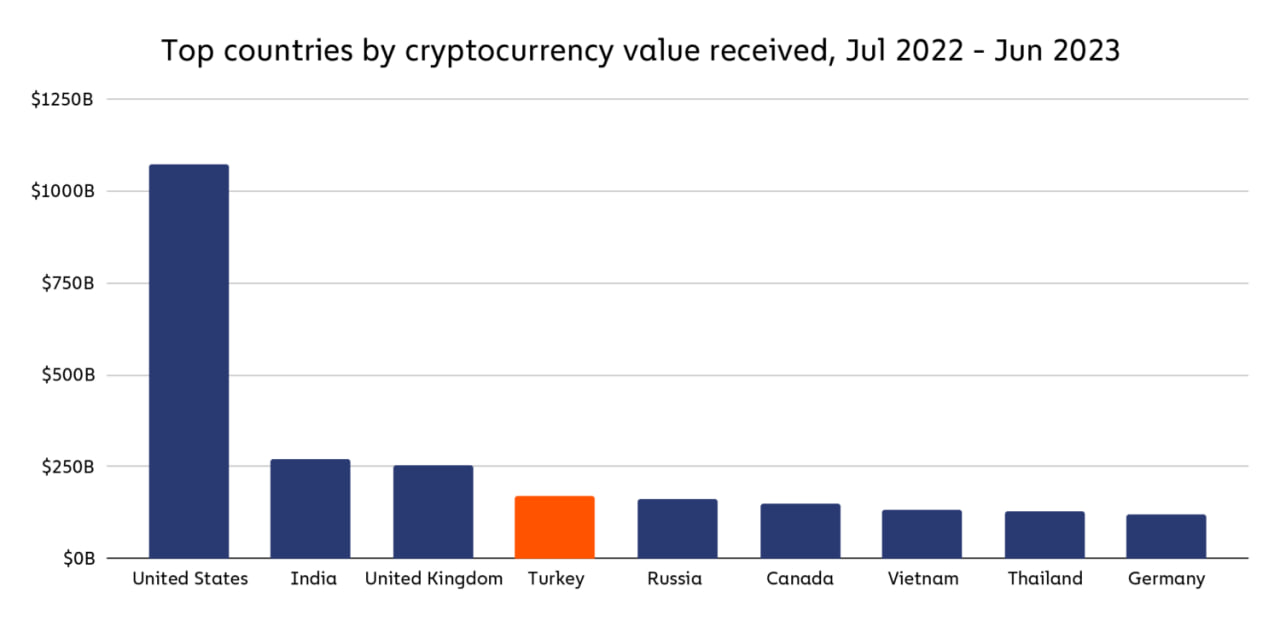

The US is one of the largest and most regulated cryptocurrency markets in the world. Strict laws provide security and transparency, but at the same time impose significant restrictions on trading.

The main cryptocurrency platforms in the United States

- Coinbase is the largest regulated exchange with a user-friendly interface, suitable for both beginners and experienced traders.

- Kraken — offers a wide range of tools, including margin trading and futures.

- Binance.US — the American version of the global Binance, but with reduced functionality due to strict legal requirements.

Regulation and safety

American crypto exchanges are subject to strict regulations, including:

- Full compliance with KYC (Identity Verification) and AML (Anti-money Laundering) procedures.

- Regulatory oversight includes the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

- Ban on the use of anonymous cryptocurrency services, including confidential coins and mixers.

This level of control reduces the likelihood of fraud and illegal operations but limits the freedom of traders.

Advantages of trading on US exchanges

- High level of security and protection of user funds.

- Transparency of exchanges and clear regulation.

- Access to large and liquid platforms with a wide range of tools.

Disadvantages of trading on US exchanges

- Severe restrictions prevent access to global exchanges such as Binance and Bybit.

- High taxes on cryptocurrency transactions.

- Verification requirements and privacy restrictions.

The US dollar is suitable for traders who value security and transparency. However, restrictions on the use of some exchanges and high taxes can make trading less convenient.

European Union

The European Union is one of the leading centers of cryptocurrency trading due to its transparent regulation and high liquidity. With the introduction of the single regulatory act MiCA (Markets in Crypto-Assets Regulation), the market has become more predictable and secure.

Regulation and legal status

- MiCA is a pan-European law that introduces strict requirements for exchanges, stablecoin issuers, and crypto service providers.

- Enhanced KYC/AML requirements, which increases transparency but limits anonymity.

- Ban on anonymous wallets and non-custodial services.

Liquidity and market conditions

- The main EU exchanges have high liquidity, which makes them attractive for large traders.

- The euro remains one of the main fiat currencies used for trading in the crypto market.

- The infrastructure is well developed, but due to strict regulation, some platforms lose their competitive advantage over Asian and American exchanges.

Advantages

- Clear legal framework and uniform rules for all EU countries.

- High liquidity and reliability of ad platforms.

- Support of major European financial institutions.

Disadvantages

- Enhanced controls and strict identification requirements.

- Ban on some anonymous crypto assets and services.

- Limited access to global exchanges for some EU countries.

The EU crypto market is stable and regulated, which makes it attractive for long-term investors and large traders. However, strict laws can create inconveniences for those who seek more flexible trading conditions.

Asian Crypto Market

The Asian region plays a key role in the global crypto industry, with high trading activity and large transaction volumes. However, regulations vary greatly from country to country: South Korea and Japan have strict regulations, while China imposes strict restrictions on cryptocurrency trading.

South Korea

South Korea is one of the most active crypto markets in the world, with high liquidity and significant trading volume.

- Popular exchanges: Upbit, Bithumb, Coinone.

- Features: Korean traders actively participate in crypto trading, which leads to a high demand for digital assets and sometimes causes a “Korean premium” (the difference in the price of cryptocurrencies between Korean and international exchanges).

- Regulation: Strict government control, licensing of exchanges, mandatory KYC and AML procedures, and a ban on anonymous trading.

- Pros: Reliable local exchanges, high trading volume, stable legal environment.

- Cons: Limited access to global platforms and difficulties for non-residents in registering on Korean exchanges.

Japan

Japan is one of the most highly regulated crypto markets, but at the same time stable and safe for traders.

- Popular exchanges: Coincheck, bitFlyer, Liquid.

- Features: Japan was one of the first countries to officially recognize Bitcoin and other cryptocurrencies as a legal means of payment. All crypto exchanges must obtain a license from the Financial Services Agency (FSA), which guarantees a high level of user protection.

- Regulation: Strict requirements for exchanges, mandatory separation of client and corporate assets, strict KYC and AML procedures.

- Pros: High level of security, protection of traders ’ rights, stable legislation.

- Cons: Limited choice of exchanges due to strict licensing, relatively high commissions, and less active trading compared to South Korea.

China

China is one of the most difficult markets for crypto trading due to strict restrictions from the authorities.

- Restrictions: In 2021, the Chinese government completely banned trading and mining of cryptocurrencies, which forced many exchanges to leave the country or adapt. Binance, Huobi and other platforms have stopped serving Chinese users.

- Workarounds: Many Chinese traders use decentralized exchanges, VPNs, and offshore platforms. In addition, P2P trading and stablecoins are popular for conducting transactions without the participation of centralized exchanges.

- Pros: Chinese traders are still active in global markets and use foreign platforms.

- Disadvantages: High risks, difficulties with access to liquid platforms, and increased control by the authorities.

Asia remains an important center of crypto trading despite various regulatory barriers. South Korea and Japan offer reliable but tightly controlled platforms, while China forms a shadow market through offshore and P2P operations.

Middle East

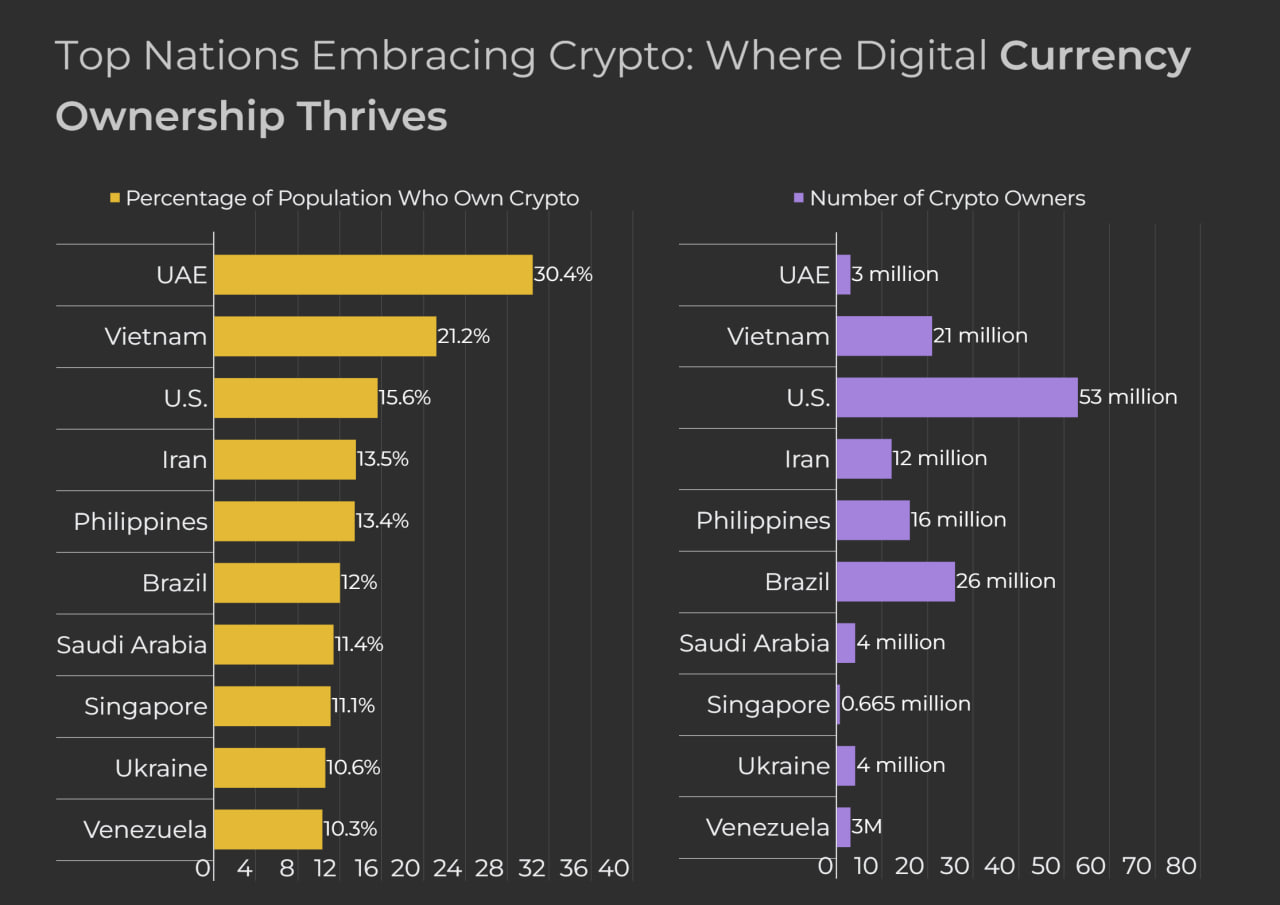

The UAE is actively developing the cryptocurrency industry, creating favorable conditions for business and trading. Thanks to a stable economy, low taxes, and transparent regulation, the country attracts not only retail traders but also large institutional investors.

Popular exchanges and infrastructure

- BitOasis is a leading regional crypto exchange focused on the Middle East.

- Major international exchanges, such as Binance, Kraken, and Crypto.com, receive licenses to work in the UAE.

- Dubai and Abu Dhabi create special zones, such as DMCC Crypto Center and ADGM, which attract crypto companies and startups.

Regulation and safety

- The UAE has VARA, the regulatory body responsible for licensing crypto platforms.

- The authorities implement strict AML / KYC rules, reducing fraud risks and ensuring market transparency.

- Official licenses provide users with a higher level of security compared to unregulated sites.

Advantages

- High level of regulation – protection of investors and legalization of large crypto operations.

- Friendly tax policy – no tax on profits from cryptocurrency operations.

- High liquidity – a large number of international traders and investors.

Disadvantages

- Limited access to some exchanges – not all global platforms are officially licensed in the UAE.

- Evolving regulation – policy changes are possible in the coming years.

Overall, the UAE is becoming one of the most promising regions for crypto trading due to transparent regulation, convenient business conditions, and high investor activity.

CIS countries

Russia: local and international platforms

The cryptocurrency market in Russia remains active, despite complex regulation. There is no complete ban on owning cryptocurrencies in the country, but their use as a means of payment is limited.

Popular platforms

- Many Russian traders use Binance, Bybit, and OKX despite the restrictions.

- Local services, such as Garantex, are focused on working within the country.

- P2P platforms such as LocalBitcoins (before closing) and Binance P2P remain popular for buying and selling cryptocurrencies.

Regulatory features

- The law “On Digital Financial Assets” partially regulates crypto operations, but the market remains a gray area.

- There is no official ban on trading, but the authorities are tightening control over the turnover of digital assets.

- Banks and financial institutions restrict operations with cryptocurrencies, which complicates the deposit and withdrawal of funds.

Advantages

- High activity of private traders.

- Ability to work through P2P and OTC transactions.

Disadvantages

- Regulatory uncertainty and possible new restrictions.

- Limited access to international exchanges through traditional financial systems.

Kazakhstan: features of regulation of the crypto market

Kazakhstan has become one of the leading centers of crypto mining after the ban on mining in China. The country’s authorities actively regulate the industry, creating a legal framework for the operation of exchanges and exchangers.

Popular platforms

- Binance has obtained a license in Kazakhstan and officially operates in the country.

- Local exchanges, such as Intebix, are aimed at Kazakhstani users.

- Partnership projects are being developed between the state and crypto platforms, including the Astana International Financial Center (AIFC).

Regulation and prospects

- Kazakhstan has introduced the licensing of crypto exchanges, which has increased the level of user security.

- The state taxes mining and develops mechanisms for controlling crypto transactions.

- Cryptocurrencies are not banned, but banks are working with them through special pilot projects.

Advantages

- A legalized market with official exchanges.

- Developed mining infrastructure.

Disadvantages

- Limited integration with international financial systems.

- Possible changes in the tax policy for crypto investors.

In general, Kazakhstan remains one of the most friendly CIS regions for cryptocurrency trading, while in Russia traders are forced to work in conditions of uncertainty.

South America

Brazil and Argentina: growth of the crypto market amid economic instability

In South America, cryptocurrencies have become not only an investment vehicle, but also an alternative to traditional currencies amid high inflation and financial crises. This is especially true in Brazil and Argentina, where local currencies are subject to strong devaluation.

Brazil

- One of the most developed countries in the region in terms of crypto regulation.

- In 2022, a law was passed recognizing cryptocurrencies as a means of payment.

- Binance, Mercado Bitcoin, and other local exchanges are very popular.

- High level of institutional interest and integration with banks.

Argentina

- Citizens actively use Bitcoin and stablecoins (USDT, USDC) to protect their savings from inflation.

- The government imposes strict currency restrictions, which stimulate the demand for cryptocurrencies.

- Binance is a key trading platform, along with local exchanges such as Ripio.

- The popularity of P2P trading is due to restrictions on buying dollars.

Binance’s role in the region

- Binance is the largest crypto exchange in South America, offering support for fiat currencies.

- It provides P2P services, which is especially important in countries with strict currency restrictions.

- Develops integration with local financial systems.

Advantages of the South American Crypto Market

- High demand for cryptocurrencies as a means of protection against inflation.

- Relatively loyal regulation in Brazil.

Disadvantages of the South American Crypto Market

- Financial instability can lead to new restrictions.

- Some countries have a high risk of government bans.

South America remains one of the most promising regions for cryptocurrencies, especially in countries with weak national currencies.

Where are the most promising trading platforms?

The choice of country or region for crypto trading depends on many factors: regulation, liquidity, availability of tools, tax policy, and security level. Let’s look at which regions are most promising in terms of growth and ease of trade.

Comparison of countries and regions by key parameters

| Region | Regulation | Liquidity | Availability for Traders | Popular |

| US Exchanges | Strict | High | Restricted (SEC, Licenses) | Coinbase, Kraken, Binance.US |

| EU | Average (MiCA) | High | Availability, but with KYC / AML | Bitstamp, Bitpanda |

| Asia (South Korea, Japan) | Strict | High | Restricted Access for Non-residents | Upbit, Bithumb, Coincheck |

| China | Banned Officially | Shadow Liquidity | Restricted (VPNs, Offshore) | OTC trading, DeFi, DEX (dYdX, Uniswap) |

| United Arab Emirates (Dubai, Abu Dhabi) | Loyal | High | Offer is Attractive for BitOasis | , Binance |

| CIS institutions (Russia, Kazakhstan) | A variety | of | Services are Available, but with risks | Binance, Bybit, local exchanges |

| South America (Brazil, Argentina) | Emerging | Medium | High Demand for P2P | Binance, Mercado Bitcoin |

Growth Prospects for Crypto Platforms in Developing Countries

- The UAE is actively developing crypto regulation and attracting international exchanges.

- South America (Brazil, Argentina) is a growing market due to inflation and weak national currencies.

- Southeast Asia (Vietnam, Philippines) — fast-growing crypto markets with a low level of regulation.

China: Restrictions and finding workarounds for trading

Officially, trading in cryptocurrencies is prohibited in China, but the market continues to exist thanks to:

- OTC platforms: P2P trading via WeChat and Telegram.

- Decentralized Exchanges (DEX), such as dYdX and Uniswap.

- Offshore platforms that traders can access via VPN.

Best countries for Institutional trading and retail investors

- For institutions: the US, EU, and UAE — strict laws, a high level of security and liquidity.

- For retail traders: South America, CIS, Southeast Asia — convenient P2P platforms and low entry barriers.

Thus, the most promising sites are regions where liquidity, accessibility, and stability of regulation are combined. The UAE and EU are convenient for large players, while South America and Asia are convenient for private traders.

Conclusion

The choice of a promising trading platform depends on many factors: the level of regulation, liquidity, availability of tools, and ease of use. The US and EU provide a high level of security but impose strict restrictions. Asia (South Korea, Japan) offers active markets but with strict regulations. The UAE is becoming a new hub for institutional investors, and South America is experiencing rapid growth amid economic instability. The market is officially banned in China but continues through OTC trading and DeFi.

Tips for traders:

- Set your priorities – security, fees, and I/O convenience.

- Take into account the legal status of cryptocurrencies in the selected country.

- Check your liquidity – the higher the trading volume, the easier it is to make trades.

- Pay attention to commissions – sometimes hidden costs reduce profitability.

- Use multiple platforms for risk diversification and ease of use.

Choosing an exchange and country for trading is a balance between security, convenience, and market opportunities.