Bot Trading: Pros, Cons, and the Most Effective Algorithms in 2025

Contents

- Introduction

- Advantages of bot trading

- Disadvantages of bot trading

- The most effective bot trading algorithms in 2025

- Criteria for choosing a bot for trading

- Tips for using bots effectively for trading

- Conclusion

Introduction

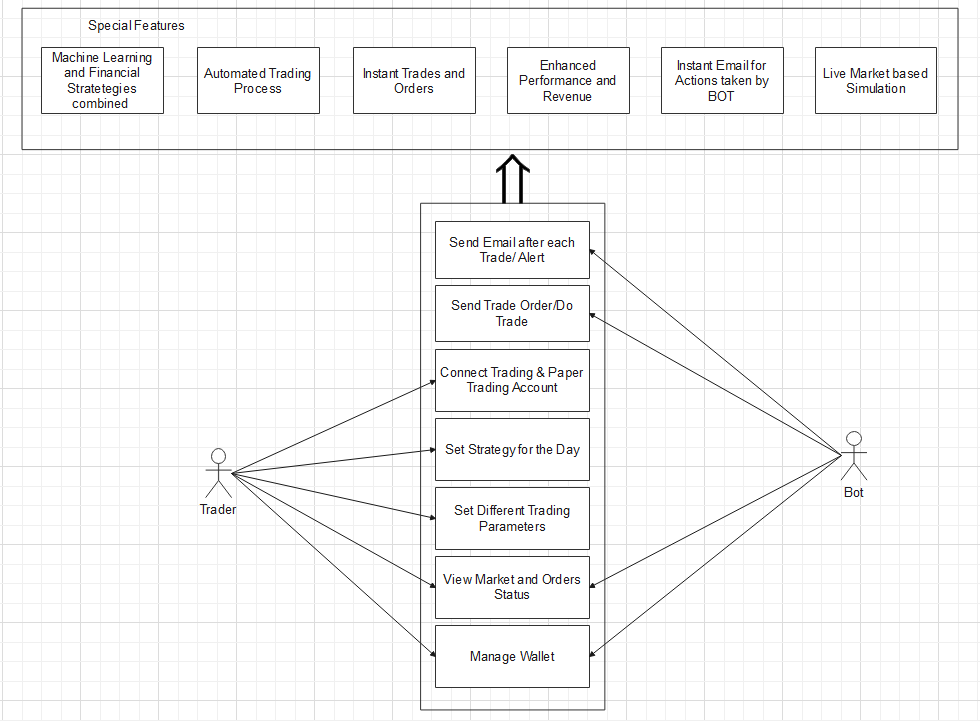

Bot trading is the use of automated programs to trade financial markets, including cryptocurrencies, stocks, and forex. These bots work according to pre-defined algorithms, analyzing the market and executing trades without human input.

Automated trading will continue to gain momentum in 2025. Thanks to the development of artificial intelligence, machine learning, and cloud computing, trading bots have become more accurate, faster, and more accessible, even for retail investors. Many traders use bots to execute strategies, reduce emotional impact, and optimize profits.

Automation has led to increased liquidity, reduced spreads, and increased competition among traders. However, along with the advantages, there are new challenges: the impact of algorithms on volatility, market manipulation, and the need to carefully choose reliable bots.

In this article, we will look at how trading bots work, their types, advantages and disadvantages, and how to choose the right bot for automated trading.

Advantages of bot trading

- Speed and Efficiency

- Trading bots process data and execute trades in milliseconds, which is impossible for a human. This is especially important in highly volatile markets such as cryptocurrencies.

- Lack of emotions

- Bots trade strictly according to set algorithms, excluding the influence of human emotions, such as fear or greed, which often lead to irrational decisions.

- Round-the-clock operation

- Unlike traders who need to rest, bots work 24/7, which is especially useful in cryptocurrency markets that do not have days off.

- Using complex strategies

- Bots can analyze multiple trading indicators, work with different strategies (arbitrage, market making, trend trading), and perform calculations that are too complex for a human in real time.

- Time optimization

- Automated trading allows traders to save time, as they do not need to constantly monitor charts and news.

- Increased Accuracy

- Algorithmic trading reduces the likelihood of human-related errors, such as accidental clicks or incorrect calculations.

- Access to historical data and backtesting

- Most bots allow you to test strategies based on historical data, helping you evaluate their effectiveness before launching them in real-world conditions.

- Trade diversification

- One bot can work in several markets at once and trade different assets at the same time, which reduces risks and increases the profit potential.

Despite these advantages, it is important to understand that bot trading is not a guarantee of success. In the next section, we will look at its disadvantages and possible risks.

Disadvantages of bot trading

- The need for careful configuration

- Bots do not work “out of the box” – they need to be properly configured, tested, and adapted to changing market conditions.

- Depending on market conditions

- , bots work well in certain scenarios but can fail when there is a sharp change in trend or high volatility.

- Risks of software errors and bugs

- Errors in the code or failures in algorithms can lead to incorrect transactions, capital losses, or even a complete drain of the deposit.

- High competition

- Powerful professional algorithms created by institutional investors work in the market, which makes it more difficult for private traders to get stable profits.

- The need for monitoring

- Despite automation, bots require regular monitoring, as they can make unprofitable trades or do not take into account important fundamental factors.

- Depending on the Internet connection and speed

- Connection delays, server failures, or disabling the exchange’s API can lead to loss of trading opportunities or unexpected losses.

- Security risks

- Using API keys to manage the bot can become a vulnerability: if data falls into the wrong hands, attackers can gain access to the user’s funds.

- A false sense of security

- Beginners often rely on bots as “passive income” without studying the market or understanding strategies, which can lead to large losses.

- The cost of using

- High-quality trading bots can be expensive (both in the form of a subscription and a one-time purchase) and may also require additional equipment, such as a VPS, for stable operation.

- Limited analysis of news and events

- Most bots are focused on technical analysis and cannot take into account important news, regulatory changes, or statements from major players that strongly affect the market.

Despite the existing shortcomings, bot trading continues to evolve, and new algorithms are becoming more complex and efficient.

The most effective bot trading algorithms in 2025

In 2025, the most popular algorithms are those that can not only follow the trend but also take into account complex market signals. Next, we will look at the most effective bot trading strategies that show high results in the current market conditions.

1. Arbitration bots: features of their work and their effectiveness.

Arbitrage bots track the difference in prices for the same cryptocurrency on different exchanges and make trades to make a profit from it. They automatically buy an asset where it is cheaper and sell it where it is more expensive.

Main types of arbitration:

- Inter -exchange – buying an asset on one exchange and selling it on another.

- Intra -exchange – using the price difference within one exchange.

- Triangular – a series of transactions with different assets to make a profit.

Arbitrage is traditionally considered one of the most reliable strategies, as it does not depend on long-term market trends. However, its effectiveness depends on several factors:

- Speed of execution of trades – price gaps do not last long, and the bot must act faster than competitors.

- Commissions and spreads – if they are too high, the potential profit may disappear.

- Delays in depositing / withdrawing funds – in inter-exchange arbitration, the speed of cryptocurrency transfer between exchanges plays a crucial role.

- Access to liquidity – if the trading volume is low, the bot may not have time to buy / sell the desired asset at a favorable price.

Arbitrage bots remain an effective tool, but their successful use requires high-speed data processing, access to multiple exchanges, and commission accounting.

2. Grid Bots: strategies for making a profit on the sidewalk

Grid bots are algorithms that automatically place a grid of buy and sell orders in a given price range. They are most effective in the flat market, where the price fluctuates within a certain corridor.

How do grid bots work?

1. Defining a range:

First, the price range within which the trade will take place is selected.

2. Placing orders:

The bot places buy orders below the current market price and sell orders above it, thus creating a grid.

3. Execution of orders:

When the price of assets moves up or down, the bot makes trades-buys at low levels, and sells at high levels, taking a small profit.

4. Repeating the cycle:

When one order is executed, the bot automatically places a new one within the specified grid.

Advantages of grid bots:

- Sideways profit: Grid bots work great in side markets where the price fluctuates in a limited range.

- Minimization of human intervention: The bot works automatically, which simplifies the trading process.

- Flexibility: Bots can be customized for different markets, and the optimal interval and strategy can be chosen.

Disadvantages of grid bots:

- Inefficiency in trending markets: If the price goes out of the set range and starts moving in one direction, the bot may not have time to adapt.

- Risk of losses due to sharp movements: In case of strong trends, the grid strategy can lead to losses, as the bot will not be able to close positions with a profit.

- The need for careful configuration: Successful operation of the bot depends on the correct configuration of parameters, such as the range, intervals, and order sizes.

Grid bots allow you to profit from price fluctuations without having to follow trends. However, for their successful operation, it is important to choose the right parameters and monitor the market condition in order to minimize the risks of losses in the event of sudden price movements.

3. Algorithms with artificial intelligence: using machine learning for forecasting.

Artificial intelligence algorithms based on machine learning use historical data, analyze it, and build models that can predict future price movements in cryptocurrency markets. AI and MO help traders and bots adapt to constantly changing market conditions and make decisions based on more complex and accurate analyses.

How do algorithms work with AI?

1. Data collection:

AI algorithms collect and analyze huge amounts of data, including historical prices, news, social media data, trading volumes, and other factors.

2. Model Training:

Based on the collected data, the MO model is trained to identify patterns and dependencies. For example, it can recognize patterns or correlations between market actions and external factors.

3. Real-time Trading:

Based on forecasts, AI bots automatically open or close positions on the exchange, making decisions with high speed and accuracy.

Algorithms with artificial intelligence and machine learning in bot trading are able to analyze huge amounts of data, adapt to market changes, and work automatically. However, for the successful application of such technologies, it is necessary to take into account the high complexity of configuration and the risk of possible errors associated with incorrect training of the model.

4. Algorithms for high-frequency trading (HFT): features and prospects

High-Frequency Trading — HFT) is a method of trading in which algorithms make a huge number of transactions in very short periods of time, usually milliseconds. Using advanced technologies and powerful computing power, HFT algorithms strive to profit from the slightest price fluctuations.

Features of HFT algorithms:

- Latency Minimization: One of the main features of HFT is the ability to minimize system latency. The lower the delay, the faster the algorithm can respond to price changes and complete trades. This is achieved by optimizing software and hardware solutions and selecting the fastest network channels.

- Using complex models and data: HFT algorithms use large amounts of data and complex mathematical models to make decisions. This can include data on market orders, changes in quotes, news, and technical indicators.

- Arbitrage: Arbitrage is one of the key strategies in high-frequency trading. HFT algorithms can track minor price differences on different cryptocurrency exchanges and instantly execute trades to make a profit. For example, if Bitcoin is traded at a different price on two different exchanges, the algorithm can buy on the exchange with the lower price and sell on the other with the higher price.

- Market making: Within HFT, algorithms can work as market makers, providing liquidity in the market by placing buy and sell orders at different price levels. These algorithms aim to make money on the spread — the difference between the buy and sell price.

Prospects of HFT in the cryptocurrency market:

- Increased liquidity and reduced spreads: High-frequency trading contributes to increased liquidity, which reduces the spreads between buy and sell prices on cryptocurrency exchanges. This, in turn, reduces costs for other traders and improves market stability.

- Technology development: HFT technologies are becoming more advanced every year. The development of artificial intelligence and machine learning opens up new horizons for creating more adaptive and intelligent algorithms. These technologies can allow HFT algorithms to analyze many more factors and make decisions with greater accuracy.

- Fight against manipulation: High-frequency trading can help fight market manipulation. For example, algorithms can track illegal or unethical price manipulation and respond quickly, which increases the security and integrity of cryptocurrency markets.

- Participation of large players: In the future, large financial institutions and hedge funds will increasingly use HFT algorithms to work in the cryptocurrency markets. This can lead to a significant increase in trading volume and accelerated introduction of new technologies to the market.

Thanks to the improvement of computing technologies and the use of complex algorithms, HFT has a huge potential in the cryptocurrency sphere. However, with the development of this practice, we should expect more stringent regulations aimed at increasing transparency and preventing market manipulation.

Criteria for choosing a bot for trading

There are many bots on the market, each of which has its own characteristics and purpose. To make the right choice, you need to consider several key factors:

Type of strategy:

There are different types of trading strategies, and it is important to choose a bot that suits your style. For example, if you want to use arbitrage, look for a bot that supports arbitrage strategies. If your goal is to profit from side markets, then grid bots will do. For trend trading, you need to choose a bot that uses indicators such as moving averages or Bollinger Bands.

Supported exchanges:

Make sure that the bot supports the exchanges where you are actively trading. Some bots only work with certain platforms, such as Binance, Kraken, or Coinbase. It is better to choose multi-functional bots that can work with multiple exchanges if you want to diversify your trades.

An intuitive interface is a key factor when choosing a bot. It should be easy for you to set up and manage the bot. Good platforms usually offer visualized dashboards and easy-to-configure algorithms, which makes managing the trading process accessible even for beginners.

Functionality:

Check if the bot supports all the necessary features for your approach. For example, you may need features such as automatic stop losses, take profits, setting limit orders, or risk management functionality. The more features the bot has, the more flexible and convenient trading will be.

Reputation and reviews:

Study other users ’ reviews of the bot to understand its effectiveness and reliability. Read forums, blogs, and independent reviews. It is important to understand how the bot behaves in practice, and not only according to the stated characteristics.

Security:

In cryptocurrency trading, security is of paramount importance. Make sure that the bot uses encryption, two-factor authentication (2FA), and other security measures. It is also important that the bot does not require your personal private keys but uses API keys with limited access rights.

Cost:

Study the payment model. Some bots offer free versions with limited functionality, while others require a monthly subscription or charge commissions on profits. It is important to understand in advance what costs are expected of you and assess whether they will justify the expected profit.

Support:

A good support team helps you quickly resolve any issues that may arise. Make sure that the bot has an available support service (chat, email), and learn how quickly it responds to requests.

Flexibility and customization:

Sometimes, standard settings are not sufficient for specific market conditions. Choose a bot with the ability to customize it to suit your needs: for example, setting up trading parameters or creating custom strategies to adapt the algorithm to any changes in the market.

Considering all these factors, you can choose the trading bot that is most suitable for your trading style, ensuring stability and security of transactions.

Tips for using bots effectively for trading

Start by testing on a demo account.

Before using the bot on a live account, be sure to test it on a demo account or with small amounts of money. This will allow you to get used to the settings and check the bot’s performance in the real market without risking significant funds.

Set up risk management.

Always use stop losses, take profits, and other capital protection mechanisms. Even if the bot works on the basis of complex algorithms, there is always the risk of unpredictable market movements. Risk management will help you minimize losses and save capital in a highly volatile environment.

Analyze your results regularly.

Don’t rely solely on the bot to make trading decisions. Regularly analyze its results, adjust parameters if necessary, and track the effectiveness of the strategy. Bots can perform very well in some market conditions and poorly in others.

Use the bot on verified exchanges.

Choose reliable cryptocurrency exchanges with a good reputation and liquidity. Less well-known or unreliable platforms may have problems executing orders, which may affect the bot’s performance.

Keep up to date and stay tuned.

Bot developers often update their algorithms to improve their performance or to meet changing market conditions. Stay tuned for new versions and updates to take advantage of all the latest improvements and features.

Conclusion

In conclusion, bot trading is a powerful tool for efficient trading in the cryptocurrency markets, offering many advantages such as automation, access to sophisticated strategies, and the ability to trade around the clock. However, like any other tool, bots have their own risks and limitations, which require care and a competent approach. To get the most out of it, it’s important to choose your bot carefully, set it up with risk in mind, and monitor its performance regularly.