Which Cryptocurrencies Are Suitable for Long-Term Investments

Contents

- Introduction

- What Are Long-Term Investments in Cryptocurrencies

- How to Choose a Cryptocurrency for Long-Term Investment

- Popular Cryptocurrencies Suitable for Long-Term Investments

- Tokens with Long-Term Potential

- Risks and Key Aspects of Long-Term Cryptocurrency Investments

- How to Minimize Risks in Long-Term Cryptocurrency Investments

- Conclusion

Introduction

The cryptocurrency market attracts investors from all over the world. Investing in digital assets offers the opportunity to earn profits, but also involves risks. Short-term trading depends on sudden price fluctuations, while long-term strategies allow investors to exploit potential growth.

Selecting the right cryptocurrencies for long-term holding plays a key role. Not all digital assets can retain their value over the years. Some projects disappear, while others lose relevance due to competition. Understanding the characteristics of the market is essential to avoid mistakes.

What Are Long-Term Investments in Cryptocurrencies

Acquiring digital assets with the expectation of future growth is known as long-term investing. Investors do not intend to sell their coins at the first price fluctuations. The primary goal is to generate returns over several years. Generally, investments held for at least three years are considered long-term.

The cryptocurrency market is highly volatile, and sharp price swings occur regularly. However, projects with strong fundamentals, well-designed technology, an active community, and practical use cases have a greater chance of stable growth.

How to Choose a Cryptocurrency for Long-Term Investment

Before purchasing digital assets, it is important to evaluate several key factors.

Liquidity

High demand for a cryptocurrency ensures easy conversion into other assets. High liquidity prevents drastic price changes, even when large amounts are traded. If liquidity is low, selling can become challenging, and a significant transaction may cause the price to drop significantly.

Security

The level of network protection directly affects a cryptocurrency’s reliability. Established projects implement robust encryption algorithms and strong defenses against cyberattacks. Hacks, coding errors, and vulnerabilities in smart contracts pose risks, making it crucial to examine a project’s technical structure.

A team of skilled developers enhances security. Regular code updates, bug fixes, and system testing help prevent technical failures. The better the security measures, the lower the risk of losing funds.

Growth Potential

Promising projects solve real-world problems and offer unique functionalities. Technological innovations, fast transaction speeds, seamless integration with other systems, and user-friendly platforms attract new users.

Some cryptocurrencies focus on financial services, while others develop platforms for smart contracts or decentralized applications. The broader the asset’s use cases, the greater its chances of expansion.

Project History

The longer a cryptocurrency has existed, the more historical data is available for analysis. Established projects have survived market downturns, adapted to industry changes, and maintained investor interest.

Short-term popularity spikes do not guarantee long-term stability. Some assets experience rapid growth but lose value due to weak community support or a lack of technological advancement. Long-term projects with steady growth are generally more attractive for investment.

Development Team

Experienced professionals with strong reputations increase investor confidence. Specialists who have worked in leading technology firms or financial institutions bring expertise and resources to build a resilient system.

Active development, partnerships, and the implementation of new technologies demonstrate a serious commitment from the team. Transparency, participation in industry conferences, and regular progress reports validate a project’s credibility.

Partnerships and Ecosystem

Major corporations collaborate only with reliable blockchain networks. If a project is involved in large-scale initiatives and attracts reputable partners, this confirms its long-term potential.

A well-developed ecosystem strengthens a cryptocurrency’s position. When applications, services, and payment solutions operate within the network, demand for the asset remains strong. The more users and businesses adopt the technology, the more stable the market position becomes.

Attracting institutional investors also signals strong credibility. Large funds, banks, and tech giants conduct thorough evaluations before investing; if prominent players support a cryptocurrency, its chances of growth increase significantly.

Popular Cryptocurrencies Suitable for Long-Term Investments

Some digital assets have proven their resilience and demand over time. They offer broad utility, high security, and strong support from major market participants.

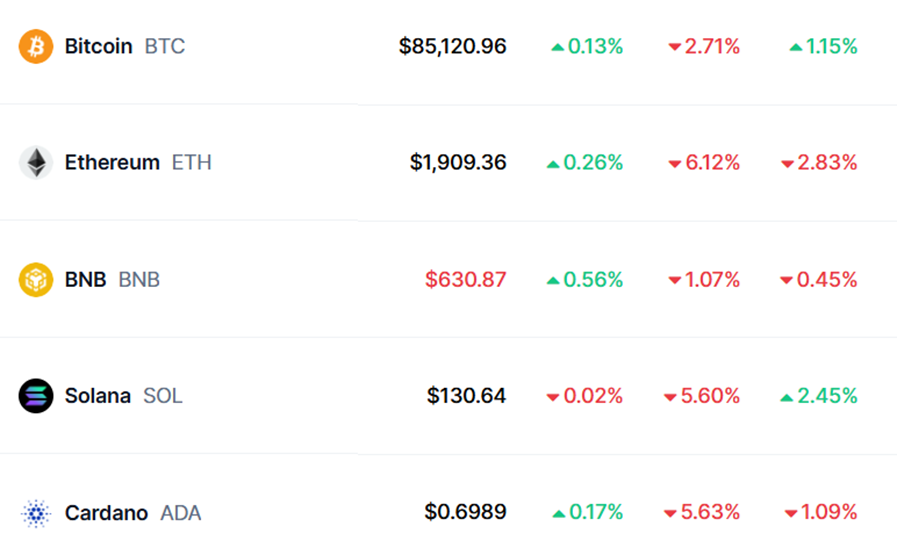

Bitcoin (BTC)

The first and most well-known cryptocurrency remains the leader by market capitalization. A limited supply of coins protects it from inflation, and its long history confirms its ability to withstand market crises. BTC is often considered a digital equivalent of gold, making it an attractive option for capital preservation.

Ethereum (ETH)

This platform serves as the foundation for numerous blockchain projects. Developers use it to create decentralized applications. Network upgrades improve transaction speed and reduce fees. Ethereum’s dominance in the DeFi and NFT sectors ensures high demand for ETH.

Binance Coin (BNB)

This asset is linked to the largest cryptocurrency exchange. Over the years, a vast ecosystem has developed around BNB. The exchange continuously expands the coin’s use cases, positively influencing its value.

Solana (SOL)

This blockchain processes thousands of transactions per second. Low fees attract developers of decentralized applications. Large investors support the project, and Solana benefits from a strong and engaged community, which plays a crucial role in its development.

Cardano (ADA)

The project focuses on security and reliability. Development follows rigorous academic research. Upgrades are implemented in stages to minimize potential errors. ADA is used in financial and government systems, reinforcing its long-term viability.

Tokens with Long-Term Potential

Some projects may not rank among the largest by market capitalization but introduce unique technologies. These innovations address critical blockchain challenges and secure a significant market position.

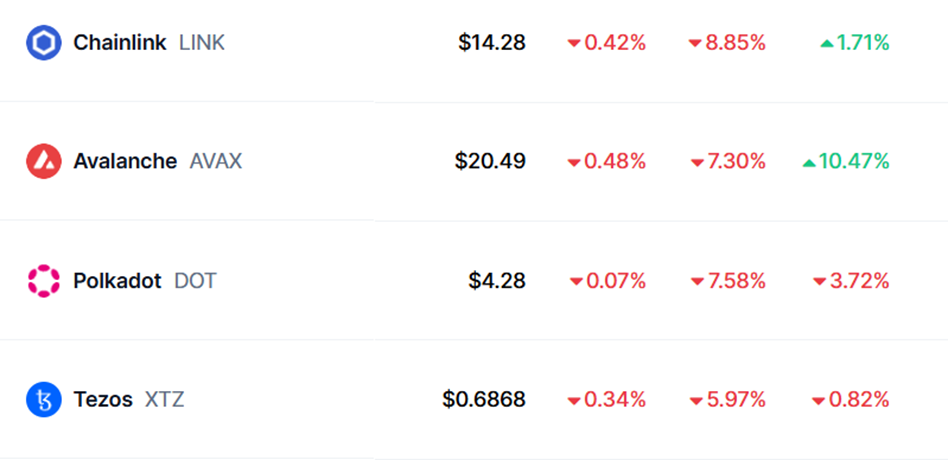

Chainlink (LINK)

This system enables blockchain networks to connect with external data sources. Such functionality is essential for brilliant contract execution. Financial institutions and decentralized service developers actively use Chainlink’s solutions.

Avalanche (AVAX)

The network facilitates rapid transactions at minimal costs. Its flexible architecture allows developers to create new blockchains with customized parameters. This feature makes Avalanche attractive to businesses and developers.

Polkadot (DOT)

This network enables data exchange between different blockchains. Its technology simplifies interoperability between platforms and enhances the capabilities of decentralized applications.

Tezos (XTZ)

The platform supports upgrades without network splits, reducing the risk of conflicts and improving system stability. The protocol is designed with security in mind, offering protection against vulnerabilities.

These projects have strong growth potential. Technological advancements and expanding real-world applications could drive their value higher over time.

Risks and Key Aspects of Long-Term Cryptocurrency Investments

The cryptocurrency market attracts investors with its high return potential, but also presents several challenges. Long-term investment in digital assets requires understanding the industry’s unique characteristics. The value of cryptocurrencies depends on multiple factors, including demand, technological developments, government regulations, and global economic events.

Mistakes in selecting assets can lead to capital loss. Some projects lose relevance, face developer abandonment, or shut down entirely. Without proper risk analysis, long-term investing turns into a gamble.

Market Volatility in Cryptocurrencies

Price fluctuations occur rapidly. Even the most prominent digital assets experience instability. Within days, a cryptocurrency’s value can increase several times or drop by dozens of percentage points.

Market capitalization remains lower than traditional financial instruments, making cryptocurrency prices highly sensitive to large transactions. A significant buy or sell order can trigger sharp price swings.

News events also play a crucial role. Positive developments boost investor confidence and drive demand, while adverse reports often lead to panic selling. Due to high volatility, short-term price predictions are unreliable.

The history of cryptocurrency markets includes periods of rapid growth followed by deep corrections. In 2017 Bitcoin reached an all-time high, only to lose more than two-thirds of its value in the following months. A similar pattern occurred in 2021.

A long-term strategy helps investors avoid reacting to short-term price swings. Choosing projects with strong technological foundations reduces the impact of volatility.

Cryptocurrency Regulations and Their Market Impact

Cryptocurrency markets lack unified global regulations. Each country enforces its laws, either fostering growth or imposing restrictions.

Some governments recognize digital assets as financial instruments and establish legal frameworks. Others implement outright bans, causing capital outflows from their markets.

Regulatory decisions significantly impact prices. Announcements of potential restrictions often lead to market downturns, while favorable policies attract new participants.

Crypto exchanges must comply with regulations in the countries where they operate. Know Your Customer (KYC) requirements and tax reporting obligations create challenges for users who prefer anonymity. Some platforms cease operations in regions with strict regulations.

Government oversight can help eliminate fraudulent projects and increase trust in cryptocurrencies. However, excessive restrictions may hinder industry development. Investors should monitor legal changes and assess their potential consequences.

Technological Risks and Security Threats

Cryptocurrency networks rely on complex security algorithms but are not entirely immune to threats. Platform hacks, coding errors, and blockchain attacks pose risks to asset holders.

Hackers exploit vulnerabilities in smart contracts to gain unauthorized access to user funds. Large projects conduct regular security audits, but flaws still emerge.

Exchange hacks remain a significant concern. Centralized platforms store substantial amounts of cryptocurrency, making them attractive targets for cybercriminals. In the past, security breaches have resulted in losing millions of dollars.

Ensuring asset safety requires choosing secure storage solutions, using trusted exchanges, and staying informed about potential security threats.

How to Minimize Risks in Long-Term Cryptocurrency Investments

A well-planned approach reduces the likelihood of losses. Implementing reliable strategies helps preserve capital even in challenging market conditions.

Portfolio Diversification

Allocating funds across different assets helps reduce the impact of market fluctuations. If the value of one asset declines, others can help offset the losses. Investing in multiple cryptocurrencies minimizes potential losses in case of issues with individual projects.

Selecting coins with different technologies and use cases enhances portfolio stability. Some cryptocurrencies facilitate fast transactions, others offer financial sector solutions, and some support decentralized applications. This strategy mitigates risks, as difficulties in one sector will not affect the entire portfolio.

Placing all capital into a single cryptocurrency, even if it appears secure, is not advisable. In the past, many promising projects encountered challenges that led to significant price drops. Spreading investments across multiple assets reduces the likelihood of substantial losses.

Cold Storage for Assets

The security of digital assets is crucial. Online wallets offer convenience but remain vulnerable to hacker attacks, and even major exchanges do not always provide reliable protection.

Cold wallets offer a higher level of security. Hardware devices operate without a constant internet connection, reducing the theft risk. Fund access is only possible with the physical device and a unique security code.

Additional security measures further protect assets. Strong passwords, multi-factor authentication, and backup copies reduce the risk of losing access. With proper security practices, the likelihood of asset theft remains minimal.

Investing in Cryptocurrencies with Strong Teams and Communities

Projects led by experienced developers inspire greater confidence. A strong team can solve technical challenges, adapt to market changes, and drive technological advancements. Even promising ideas may fail without active professionals to develop and support them.

The community plays a key role in a cryptocurrency’s success. Popular projects receive backing from investors, developers, and users. Active discussions, regular updates, and ecosystem growth increase the chances of long-term success.

Established cryptocurrencies have clear development roadmaps, partnerships, and ongoing technological upgrades. Due to support from professionals and engaged users, such projects are more resilient to crises.

Choosing coins with transparent histories, clear objectives, and strong communities reduces risks. Continuous technological development, collaborations with major companies, and regular updates increase the likelihood of future value growth.

Conclusion

Long-term cryptocurrency investments require careful planning. Market fluctuations, government regulations, and technological challenges create obstacles, but strategic decisions help minimize potential losses. Selecting reliable assets, securing funds, and diversifying investments improve portfolio resilience.

Promising projects with active communities and strong teams can maintain value even during temporary market declines. Technological advancements and new partnerships enhance growth potential. However, making informed investment decisions is impossible without thorough research and understanding cryptocurrency market dynamics.

This material is not financial advice. Investors should conduct independent research, assess risks, and consider personal financial goals. While we have highlighted popular and promising cryptocurrencies, the final choice is yours. Conducting your analysis helps avoid mistakes and build a solid investment portfolio.