How the Maximum Drawdown Limit Works on the TradeLink Marketplace

An essential element of risk management for any investment is the Maximum Drawdown (MDD) – the percentage change between a peak balance and its lowest point before the next increase.

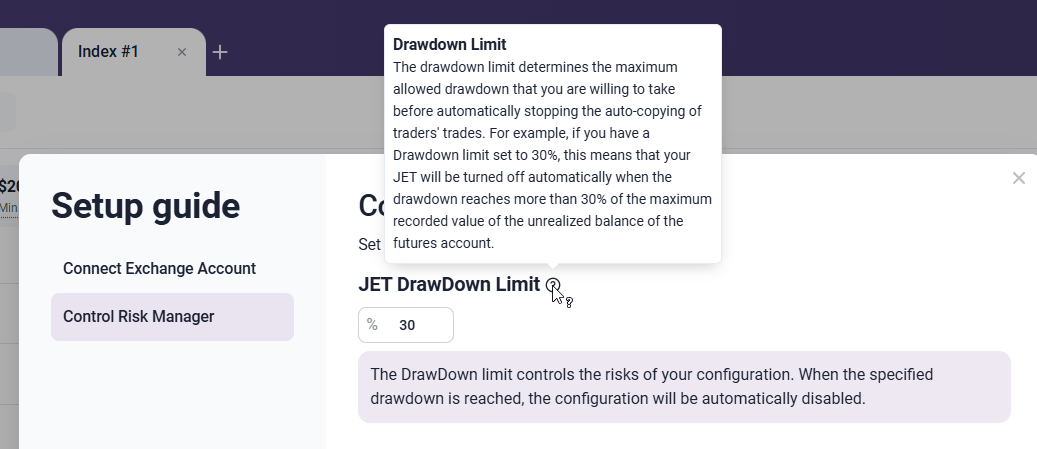

On the TradeLink marketplace you can set a maximum drawdown limit that automatically stops investment in the index or strategy if unrealized losses reach the specified threshold.

Contents

- How the drawdown limit is calculated

- How deposits and withdrawals affect the drawdown limit calculation

- Setting the drawdown limit to 100%

- Position closure upon reaching the limit

- Potential limitations in the drawdown limit trigger

- Need assistance?

How the drawdown limit is calculated

The concept of a maximum drawdown limit is designed to protect account balance from excessive losses. The allowable loss threshold is set as a percentage before starting the investment. The allowable loss threshold is set as a percentage before starting the investment. The system tracks the highest balance achieved on the account and calculates the acceptable percentage of losses from this peak using the High-Water Mark mechanism. Let’s break it down with examples:

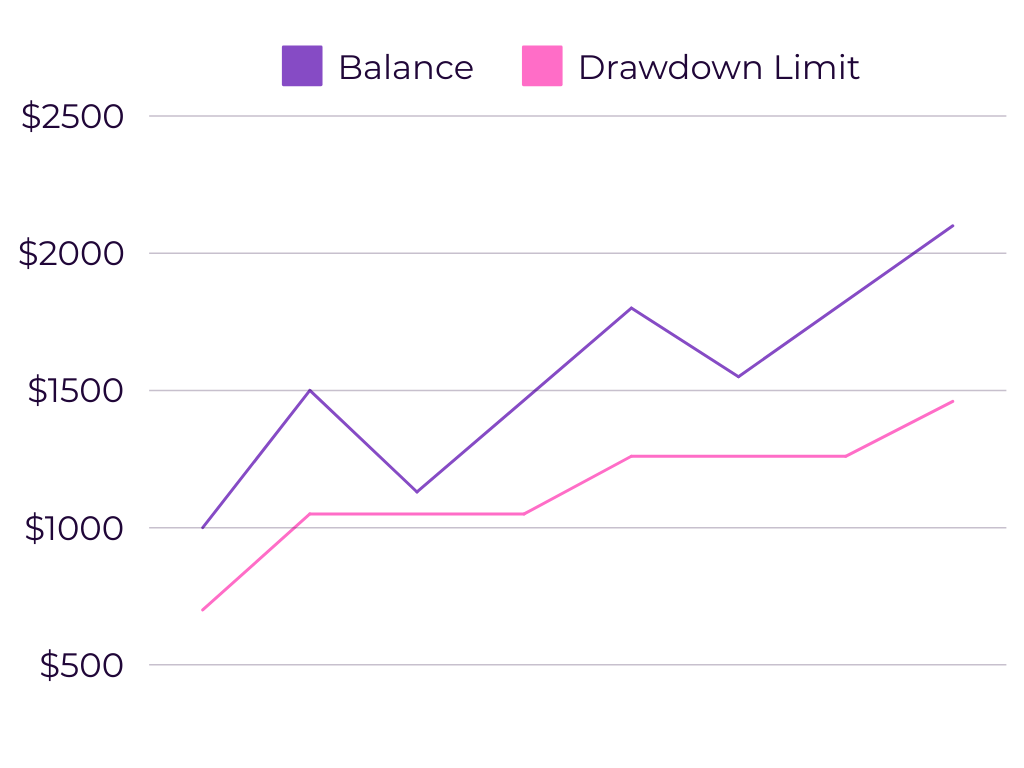

At the start of an investment, the realized futures balance is $1,000, and the DrawDown Limit is set at 30%.

When the unrealized balance drops to $700 (30% lower), all copied positions on the account will be automatically closed.

If the realized balance increases to $1,500 due to realized profits or additional funds deposited into the futures account, the limit is recalculated: the new stop threshold will be 30% of $1,500, or $1,050.

When the unrealized balance falls to this level, the system will close all positions.

How deposits and withdrawals affect the drawdown limit calculation

Any change in the account balance, whether from trading gains or a deposit, impacts the drawdown limit. The system treats deposits as balance increases, which can reset risk management parameters if a significant deposit raises the High-Water Mark.

Similarly, withdrawals are treated as balance decreases, which might trigger an early stop of an investment if the remaining balance falls below the set threshold. To prevent this, it’s crucial to monitor the drawdown limit before withdrawing funds or restart the investment to properly reset the risk management parameters.

Setting the drawdown limit to 100%

If the drawdown limit is set at 100%, the risk control mechanism will not activate because the stop threshold is effectively zero. In this scenario, changes in balance (realized profit, unrealized loss, deposit, or withdrawal) will not affect the investment status. Copy trading will continue regardless of the drawdown until the account reaches a point where trading becomes physically impossible, such as a zero balance.

Position closure upon reaching the limit

When the drawdown threshold is met, the system closes all copied positions on the account within approximately 3 seconds and sends you a notification. No additional action is required on your part – your balance is protected from further losses, and all copied positions are automatically closed. You can restart the investment and set a new drawdown limit as needed.

Potential limitations in the drawdown limit trigger

The system sends a command to close all positions as soon as the drawdown exceeds the set limit. However, certain factors may affect the mechanism’s timely execution:

- Market slippage: During rapid price movements, market orders may not close positions at the expected price, leading to minor increases in the drawdown.

- Exchange downtime or API outages: Complete exchange halts or API interruptions can delay the risk-management mechanism. While the system sends closure requests, the execution timing depends on the exchange’s processes.

Thus, while the system ensures risk and loss management in most cases, it cannot guarantee protection against all unforeseen circumstances beyond the platform’s control.

Need assistance?

If you have additional questions about how risk management works on the TradeLink marketplace, please don’t hesitate to contact our support team. We’ll be happy to assist you!