Learning liquidation: Binance

Probably, there are few lucky people who in their rich experience of futures trading, have not received the infamous liquidation call. However, do not “despair”, there is always a first time for everything, and in this article, we will try to analyze the liquidation scenarios in detail.

Generally speaking, the exchange triggers the process of liquidation of a position when the money in the trader’s account becomes less than the amount necessary to maintain the position, this minimum amount is called maintenance margin. The methods of its calculation may differ from exchange to exchange, but today we will try to explain it in detail on the exchange where most crypto-retail are liquidated, namely on Binance.

The liquidation algorithm on this exchange have been recently enchanced, so it could gradually liquidate position now. When the mark price reaches the terminal liquidation price, the position will be reduced by an immediate or cancel order (we’ll get to that later) with a large liquidation fee, which will then be deducted from the remaining maintenance margin. Note that insurance clearence fee differs on various instruments, and can be seen here. The volume of maintenance margin is calculated based on the volume of the position, and the larger the volume, the more collateral is needed, you can find out about the levels of the position here.

For example, let’s try to calculate the amount of maintenance margin and how much money we will have after the liquidation of cross-margin position with a liquidation price of 9036,14$

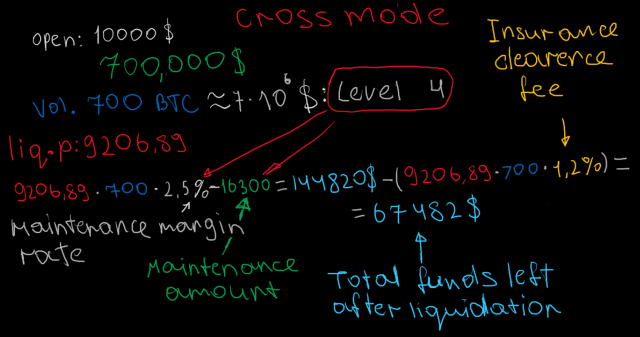

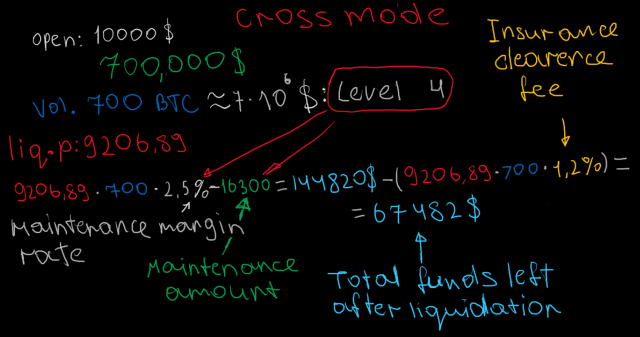

25.3 dollars is the required maintenance margin, but with the deduction of the insurance clear, there is only 0$ left on the balance. Now let’s consolidate our knowledge and calculate the total balance after the liquidation of a position for a larger amount. At the same time, we will see that the balance can be more than just zero after the liquidation.

Note that the liquidation price is much higher, the rate of supporting margin and the minimum supporting margin has increased accordingly, as well as the fact that the fee for insurance coverage has taken away as much as 11% of the original balance. Of course, most qualified traders may argue that there is a subtle point with the Immediate or cancel order, which places the maximum number of contracts exactly at the current price and immediately closes when the supply ends, which is important for large positions like in the example above, because the market is unlikely to instantly take up such a volume. Therefore, after reducing the position by the random volume of contracts and subtracting insurance clear only from the volume of reduced contracts, the system again calculates the necessary amount of maintenance margin and checks whether you have enough money to keep the position up and if enough, it completes the process of liquidation.

To sum it up, it is rarely a good idea to let liquidation close your position for you, the main reason for that is the huge commissions charged by the exchange from this procedure. A good idea is to refrain from unreasonably high leverage and build your trading strategy without the risk of liquidation, but if getting liquidated is inevitable, it is better to put a stop-market order right before the liquidation price and save some money. Also we would not recommend use liquidations as improvised stops for you positions in isolated mode, since it’s a lot more expensive that using regular stop orders.

Hope that article were useful. Good luck to all 😉

P.S. There is 21 entries of word – “liquidation”