What is inflation?

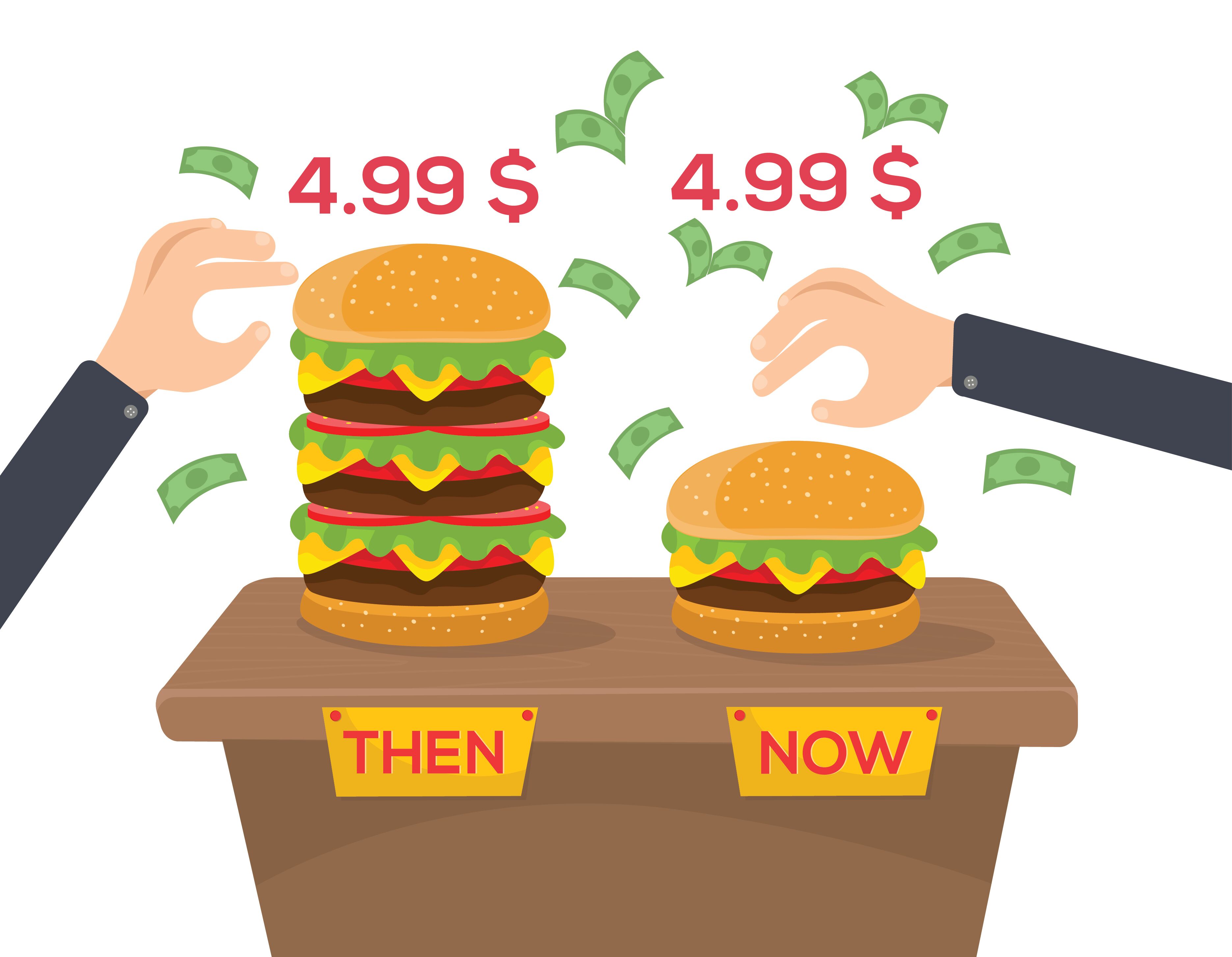

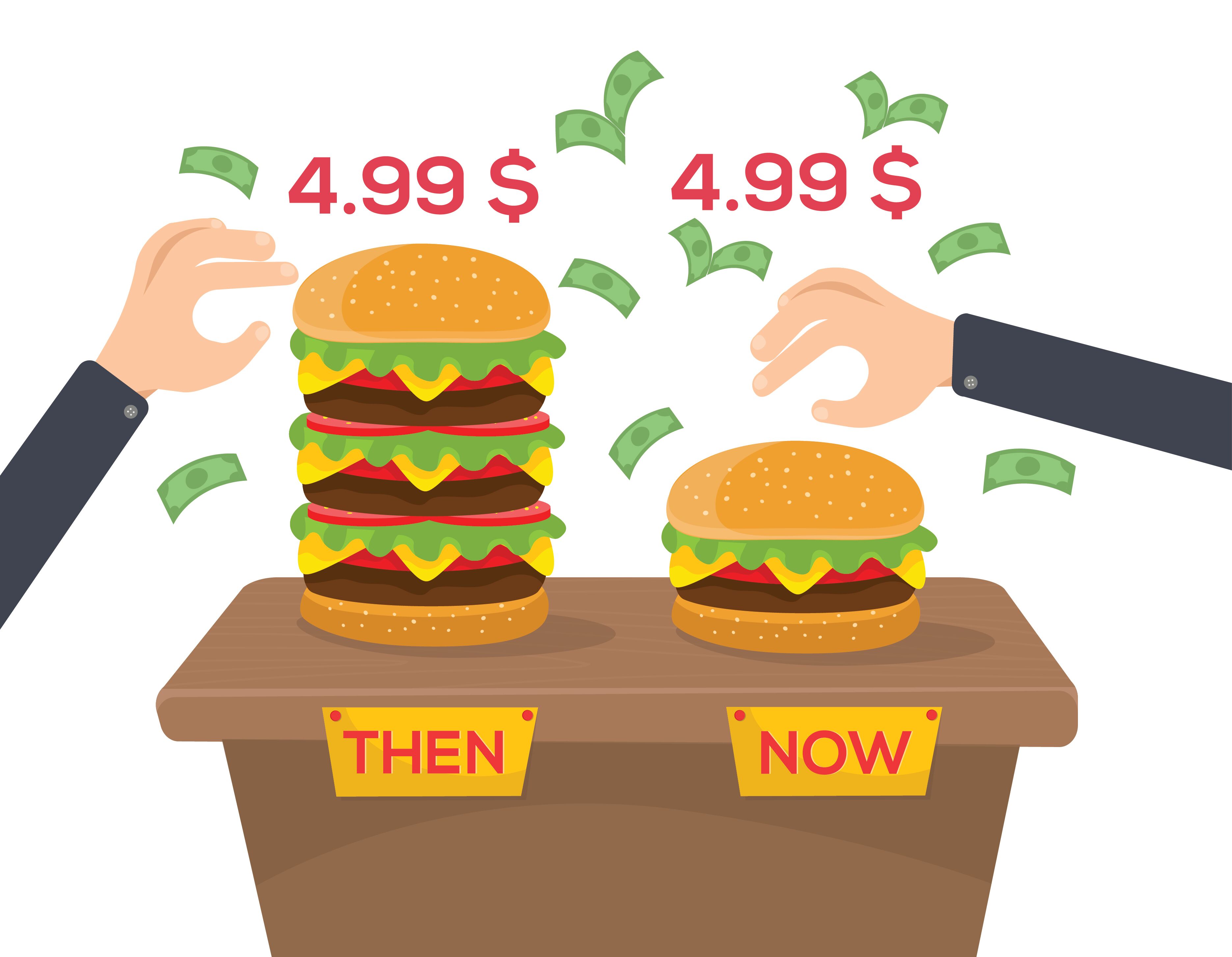

Let’s start with the fact that money is only a symbol of good, luxury, or opportunity. Money is a universal means of measuring value. If more money is printed, there will be no more goods and services that provide value. Accordingly, the price of them will increase, and with the money that you could afford before printing, after printing you will not be able to afford the same amount of value.

What happens to the money after printing? There is more of it, but the amount of value remains the same. Money loses its product value. This process is called inflation.

Money can lose its value not only because of the printing of new money – it can also be due to economic growth or stagnation, and many other complex economic reasons.

Contents

- Why inflation is extremely important for a trader and an investor?

- How does inflation affect cryptocurrencies?

- Conclusion

Why inflation is extremely important for a trader and an investor?

Since inflation primarily affects money, goods that provide value rise in price relative to money. That is, to fight off inflation, it is enough to spend money on liquid goods – like residential or commercial real estate, and in rare cases even movable property.

This means that investing or trading with an income of less than annual inflation does not make sense, and you can just save time.

On the other hand, usually hyperinflation attracts additional capital to the market. This happens because retail investors understand that their income may soon decrease due to inflation. This leads to an increased desire to invest money in an attempt to hedge against inflation.

This leads to a large influx of capital into the market, and an increase in asset prices accordingly (all these people are buying assets, and buying assets leads to an increase in prices). This means that investors who enter the market before hyperinflation earn extra money.

How does inflation affect cryptocurrencies?

There is no single answer. This is a point of contention among professional analysts that has been on the agenda for many years before and remains.

Some say that cryptocurrency is a protective asset, and during hyperinflation, money is poured into it.

Others say that cryptocurrency is a risky asset, and during the upheaval, capital is poured into the most reliable investments.

Conclusion

Inflation is a critical part of the economy, and one of the main reasons financial market strategies try to be as efficient as possible. There is no point in ignoring inflation. You need to adapt to it, which is the main task of the trader.