Order types in Trading

Today we will talk about existing types of orders, their impact on the price, and their importance to a trader.

It is not usual to talk about the mechanics of price movement in the trading community, although it is one of the most important.

When you understand the mechanics of price movement, you begin to understand the logic of the market and people. And that means trading strategies, and, most importantly, all types of analysis.

Without further ado, let’s get down to business!

Contents

Limit orders

Orders that form an order book. These orders are waiting to be filled by a market order at the price chosen by the limit order. It has two variations – Bid (limit order to buy), and Ask (limit order to sell). These divisions are calculated relative to the current price.

Market orders

Orders that are instantly executed at the price of the nearest limit order and directly move the price. Asset price = price of the last executed market order.

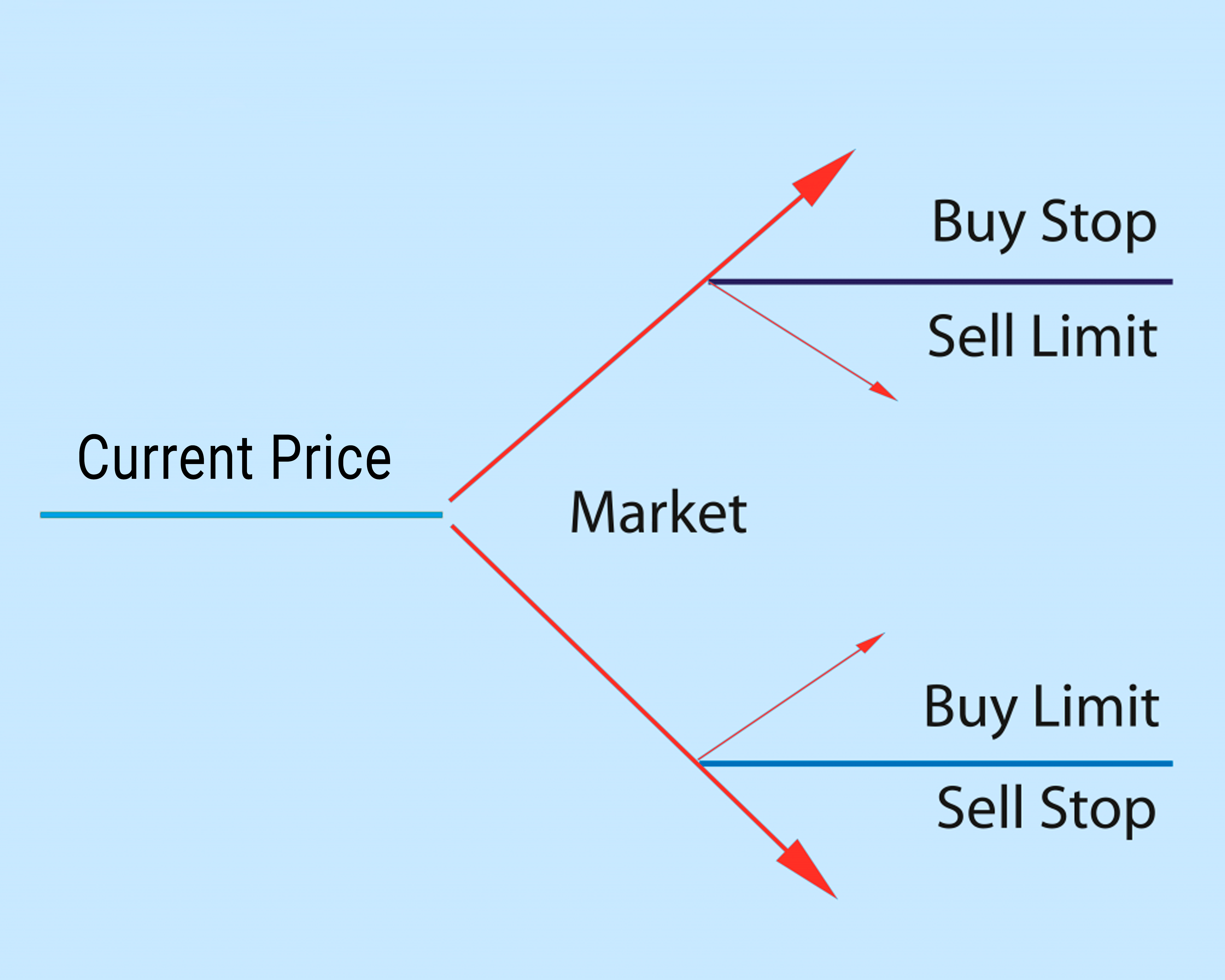

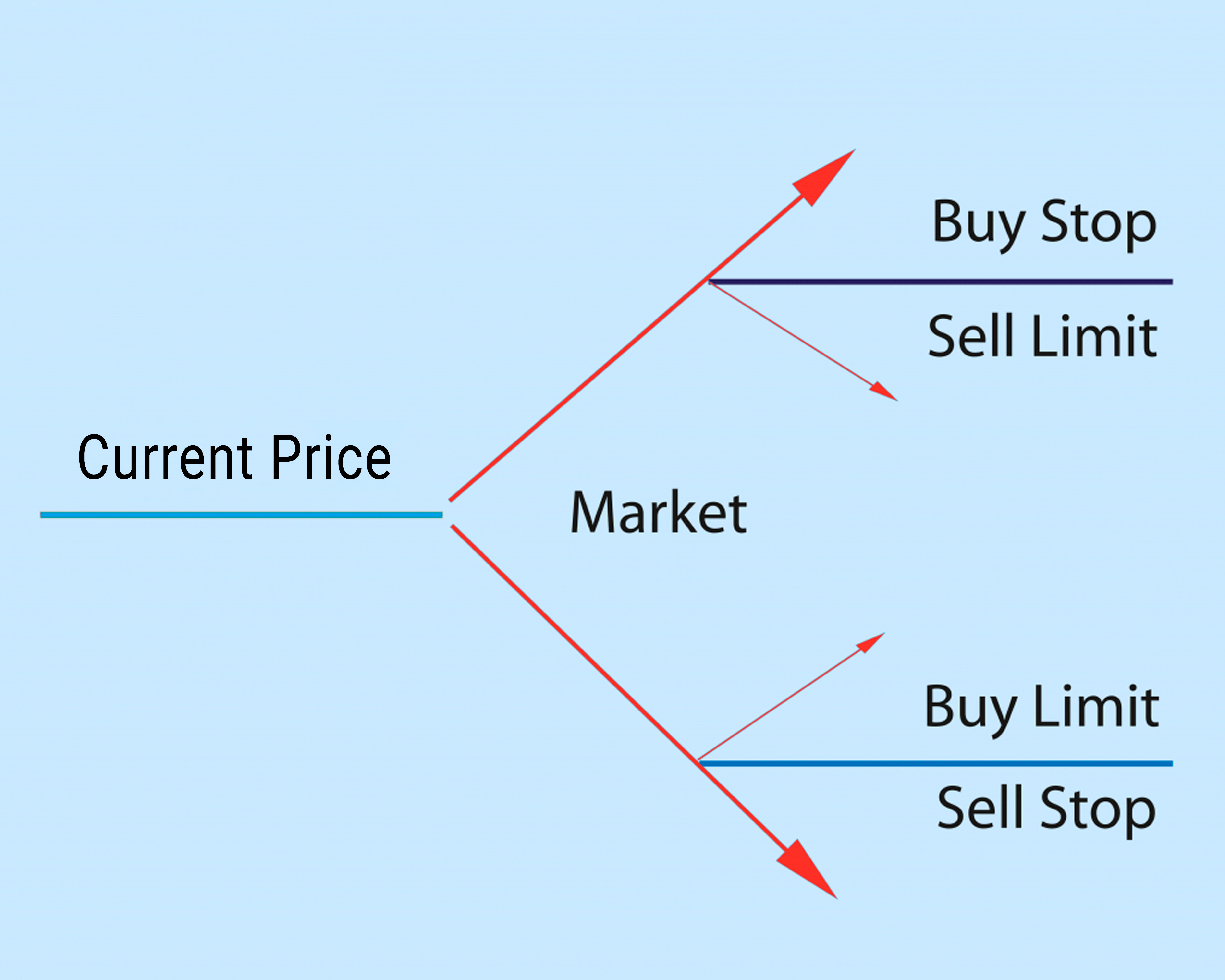

Pending orders

Let’s move on to the so-called “conditional orders”. The fact is that all the fundamentals form limit and market orders. Limit stop the price, market move the price. Everything else is just a variation of these two orders.

Here are their explanations:

Buy Stop – a pending market order to buy. When the price specified when placing this order is reached, a purchase will be executed at the market price. Usually used to implement stops.

Sell Stop – a pending market order to sell. When the price specified when placing this order is reached, a sale will be executed at the market price. Usually used to implement stops.

Buy stop limit – as soon as the price reaches the specified Ask, a limit order to buy at the selected price will be placed. Often used by beginners in the form of a stop, which is a big mistake. Such an order will cost the same as a market stop, only it will have a much greater chance of not working out.

Sell stop limit – as soon as the price reaches the specified Bid, a limit order to sell at the selected price will be placed. Such an order will cost the same as a market stop, only it will have a much greater chance of not working out.

Modifiers

Orders can have modifiers such as:

Post-only: a limit order with this checkbox will not be executed on the market even if you select the wrong price when setting the limit

Trailing: A market stop with this modifier will follow the price with the offset you choose until it is executed

And many more rare ones.

Conclusion

Now you understand exactly how each of the order types works. And this means, there are no barriers for you in the logical study of any market anomaly.

Whether it’s panic selling, limit walls, a trailing helicopter, or any other market situation – you can come up with your own theory on how it happened, analyze it, create a strategy based on it, and start making money.