Taproot Assets: The Future of USDT in Lightning

Contents

- Introduction

- What Are Taproot Assets

- How Taproot Assets Work

- Taproot Assets and the Lightning Network

- Using Taproot Assets for USDT

- Pros and Cons of Taproot Assets

- The Future of Taproot Assets

- Conclusion

Introduction

What Are Taproot Assets and How Do They Relate to the Lightning Network

Taproot Assets is a protocol that enables the creation and transfer of tokens on the Bitcoin network. It operates as a layer on top of the main Bitcoin blockchain and leverages Taproot and the Lightning Network technologies. This means it’s now possible to issue digital assets, such as stablecoins like USDT, on Bitcoin and transfer them almost instantly with minimal fees.

Why This Protocol Was Needed

Bitcoin was initially designed solely for BTC transfers. However, the market has evolved significantly. Users now want to send BTC and other assets, such as dollars, as stablecoins. This has long been possible on other blockchains like Ethereum and Solana, but Bitcoin lacked such functionality. Taproot Assets fills this gap.

Goals and Advantages

The main objective is to expand Bitcoin’s capabilities without altering its core principles. The protocol enables token issuance while maintaining Bitcoin’s security and decentralization. Thanks to Lightning Network integration, all transfers are fast and nearly free. Another key benefit is enhanced privacy—Taproot conceals extraneous transaction details.

What Are Taproot Assets

How the Protocol Was Created

The project initially launched under the name Taro. Lightning Labs, a company with years of experience building tools for Bitcoin and the Lightning Network, developed it. The name was later changed to Taproot Assets to emphasize its connection to Taproot—a Bitcoin upgrade that introduced new possibilities for complex transactions and smart contracts.

Who Develops and Maintains Taproot Assets

Taproot Assets is maintained by the Lightning Labs team, one of the most respected developers in the Bitcoin ecosystem. The project is open-source, with code freely available for review and use. The broader community also actively participates, including developers, enthusiasts, and business representatives who test, propose improvements, and help build the surrounding infrastructure.

How It Differs From Other Solutions

On other blockchains, tokens are typically created using smart contracts. Taproot Assets takes a different approach—it uses Taproot to embed tokens within standard Bitcoin transactions. This not only reduces costs but also enhances privacy. Another key difference is compatibility with the Lightning Network—most other token solutions do not support such fast and inexpensive transfers.

How Taproot Assets Work

How Taproot Enables Asset Issuance and Transfers

Taproot is a Bitcoin upgrade allowing more complex transactions without overloading the network. Taproot Assets leverages this technology to “embed” tokens inside regular Bitcoin transactions. Externally, these look like standard BTC transfers, but internally, they may include the transfer of assets such as USDT.

This method is secure and straightforward. A user receives a token attached to a UTXO (Unspent Transaction Output), representing where the Bitcoin was sent. Only the holder of this UTXO can spend the token, which is convenient for both storage and transfer.

What Are Minting, Transfer, and Routing

Taproot Assets relies on three core components:

-

Minting — the issuance of tokens. An asset creator generates a special transaction that assigns the token to a specific address, making the asset live on the network.

-

Transfer — the handoff of the token to another user. This involves creating a new transaction that specifies the new owner. It’s similar to a BTC payment but includes a token identifier.

-

Routing — the transmission of tokens via the Lightning Network, allowing for fast, low-cost transfers.

Taproot Assets and the UTXO Model

Bitcoin uses the UTXO model, dividing coins into discrete pieces that can be spent individually. Taproot Assets preserves this structure—each token is simply linked to a specific UTXO. When that UTXO is paid, the token is transferred as well.

This method retains Bitcoin’s core properties: security, transparency, and user control. It also enables using existing Bitcoin tools, which are familiar to users.

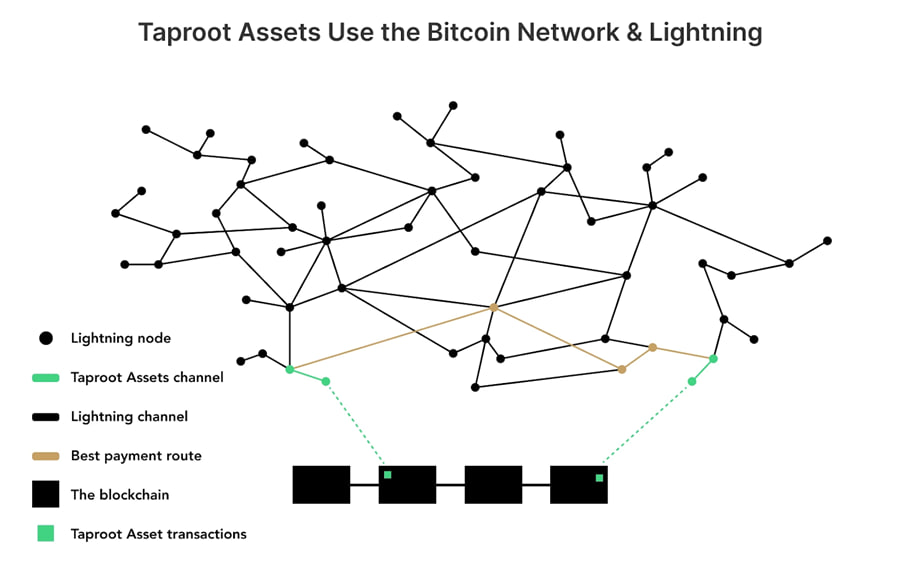

Taproot Assets and the Lightning Network

How Taproot Assets Work With the Lightning Network

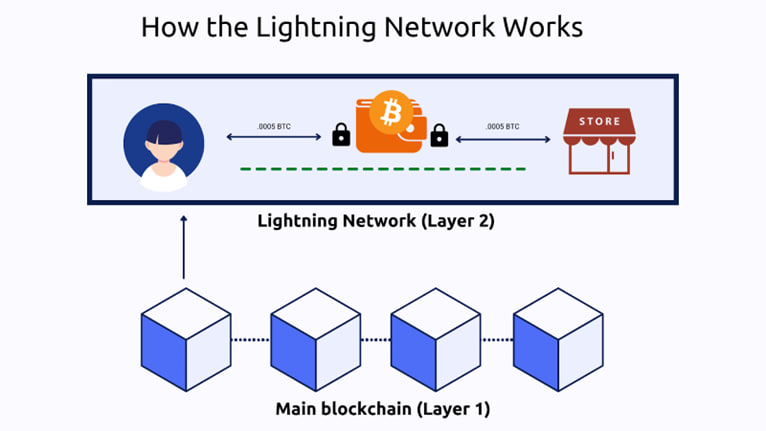

The Lightning Network (LN) is Bitcoin’s Layer 2 solution for fast and inexpensive payments. Taproot Assets integrates with LN, sending tokens just as quickly as BTC. There’s no need to wait for miners’ confirmations—transactions are processed almost instantly.

When you send a token over LN, it’s first encapsulated in a special payment channel. This channel links the sender with another user or a chain of nodes. Once the token reaches the recipient, the channel is closed and the transfer is finalized.

Why Use the Lightning Network for Tokens

The key benefit is speed—transfers take less than a second. The fees are also very low, often just fractions of a cent, which is particularly important for micropayments. Scalability is another advantage—the LN can support millions of transactions without burdening the main chain.

Additionally, the network offers improved privacy. Unlike standard blockchain transactions, LN payments are not recorded in a public ledger, making token usage more discreet.

Challenges and Solutions

Despite its potential, Taproot Assets faces several challenges. Few wallets currently support the protocol, requiring users to wait for more user-friendly tools.

Liquidity is another issue—not all nodes can handle these tokens yet. However, this is improving as interest and adoption grow. The development team is actively working to enhance the protocol and make it more accessible.

Using Taproot Assets for USDT

Why Issuing USDT on Bitcoin Matters

There has long been a demand for stablecoins on the Bitcoin network. Previously, this wasn’t possible—Bitcoin didn’t natively support third-party tokens. As a result, many users relied on other blockchains like Ethereum or Tron. With the advent of Taproot Assets, these assets can now be issued on Bitcoin.

The introduction of USDT on Bitcoin unlocks new possibilities and strengthens Bitcoin’s role as a universal settlement layer. USDT is price-stable and ideal for transactions, and running it on Bitcoin makes it accessible to millions of users familiar with the network.

How USDT Transactions Work Through Taproot Assets

USDT transfers use standard Bitcoin addresses and the UTXO model. When a token is sent, it is attached to the output of a Bitcoin transaction. Externally, this appears as a typical Bitcoin transfer, but a marker indicates that USDT is included internally.

With a wallet that supports Taproot Assets, users can receive, store, and send USDT just like Bitcoin, without needing separate networks or tokens. Everything operates within the Bitcoin blockchain, with the option to accelerate transfers via the Lightning Network.

Potential Use Cases

-

Micropayments: Taproot Assets makes it feasible to send tiny amounts of USDT without high fees—ideal for subscriptions, tips, donations, and other small transactions.

-

P2P Transfers: Users can send USDT directly to one another without banks or intermediaries. Transfers are fast and require minimal verification.

-

Bitcoin-Based DeFi: Taproot Assets enables the creation of decentralised applications within the Bitcoin ecosystem. This could include token swaps, lending, and other financial services with USDT as the primary asset.

Pros and Cons of Taproot Assets

Scalability and Low Fees

Taproot Assets uses a lightweight transaction structure, reducing the amount of data the network processes. This saves space and increases efficiency. Transaction fees are nearly zero when tokens are sent via the Lightning Network. This is especially beneficial for frequent or high-volume transfers.

Enhanced Privacy and Security

Taproot Asset transactions resemble standard Bitcoin payments, making it difficult for outsiders to detect the presence of a token. This boosts user privacy and protection against surveillance.

Security remains robust. All assets are stored within Bitcoin’s proven infrastructure. Unauthorized alterations are impossible without the proper private key. Additionally, tokens cannot be arbitrarily created—issuance requires a valid minting process, reducing the risk of inflation or fraud common in other networks.

Limitations and Risks

Despite its advantages, Taproot Assets is still in its early stages. Few wallets and services currently support the protocol, which may create user onboarding difficulties.

Liquidity remains limited—until trading volumes increase, it may be harder to exchange or sell tokens quickly. Mistakes in wallet setup or smart contract code could result in asset loss. Users must remain cautious and rely on trusted tools.

The Future of Taproot Assets

Growing the Taproot Assets Ecosystem

Although still nascent, Taproot Assets is attracting growing interest. More developers are building wallets, exchanges, and payment solutions that support the protocol.

Efforts are also underway to improve documentation and educational resources. These materials aim to simplify Taproot Assets integration for developers and users without deep technical expertise.

Impact on the Stablecoin Market and Lightning Network

Taproot Assets could reshape how stablecoins are used. Today, most tokens exist on non-Bitcoin chains. If USDT and others gain traction on Bitcoin, it could increase competition and give users more options when choosing a network based on convenience and cost.

Taproot Assets also expands the utility of the Lightning Network, making it more business-friendly. It introduces new payment methods and extends LN’s benefits—speed and low fees—not just to BTC but to all supported assets.

Conclusion

Taproot Assets is a significant advancement for Bitcoin. It allows users and developers to create and transfer tokens within the native Bitcoin ecosystem, offering greater flexibility.

The protocol relies on trusted technologies, is fast and cost-effective, and gains even more power through Lightning Network integration. Though still in its early days, it represents a decisive step toward broader functionality and adoption of Bitcoin as a multi-asset network.