What Are Central Bank Digital Currencies (CBDC)?

Contents

- General information about central bank digital currencies (CBDC)

- Types of CBDCs

- Benefits of CBDC

- Risks and Challenges of CBDC

- Global examples and experiments with CBDC

- How might CBDCs affect the future of the financial system?

- Conclusion

General information about central bank digital currencies (CBDC)

Definition and main characteristics

A central bank digital currency is an electronic form of national currency that is issued, regulated, and guaranteed by the central bank of a country or currency union. For example, in the United States, a potential digital dollar, and in the Eurozone, a digital euro, the draft of which is under active discussion. CBDC is not just a record in a bank account or electronic money in an app like PayPal, but a full-fledged legal tender equivalent to cash but existing exclusively in digital form.

The technological underpinnings of CBDC can vary. Some countries, such as China, use hybrid systems that incorporate distributed ledger technology (DLT) elements, such as blockchain, to ensure transparency and secure transactions. Others, such as Sweden, prefer centralized platforms to retain full control over the system. Either way, CBDC has a number of key characteristics:

- Government backing: CBDC has the same legal validity as cash or bank reserves and is backed by the central bank, which guarantees stability and trust.

- Digital: the lack of a physical medium makes CBDC convenient to store and use via digital wallets, mobile apps, or even dedicated devices.

- Programmability: CBDCs can be configured to perform specific tasks, such as automatic utility payments or usage restrictions (e.g., only for food under social programs).

- Versatility: depending on the model, CBDC can be made available to both ordinary citizens and financial institutions.

The difference between CBDC and cryptocurrencies

At first glance, CBDCs and cryptocurrencies appear to be related concepts: both exist in a digital format, both may utilize blockchain or other advanced technologies. However, their nature, purpose, and mechanisms of operation are radically different. Let us consider the main differences:

- Governance: CBDC is fully centralized and controlled by a central bank, whereas cryptocurrencies such as Bitcoin or Ethereum are decentralized and managed by a network of participants - miners or validators. Bitcoin, for example, has no single issuer and its issuance is limited by an algorithm (21 million coins).

- Stability of value: CBDC is pegged to local currency at a 1:1 ratio (e.g., 1 digital yuan = 1 regular yuan), which eliminates volatility. Cryptocurrencies, on the other hand, are extremely volatile: Bitcoin fluctuates between $80,000-$90,000 in March 2025, and its price can change by 10% in a day. The closest cryptocurrencies to the CBDC are stablecoins like Tether (USDT), but even they are sometimes volatile.

- Anonymity: CBDC involves a certain level of user identification in accordance with anti-money laundering (AML) and countering the financing of terrorism (CFT) laws. Cryptocurrencies, on the other hand, especially those such as Monero or Zcash, offer a high level of anonymity, making them popular in the underground economy.

- Purpose: Cryptocurrencies were created as an alternative to traditional finance or a tool for investment and speculation. CBDCs, on the other hand, are being developed to modernize the existing monetary system, increase its efficiency and accessibility.

For example, if you pay for a pizza using Bitcoin, the transaction can take several minutes to an hour due to blockchain confirmation, require a fee, and the purchase price will change due to volatility. With CBDC, the payment will be instant and the price will be fixed in local currency.

The role of central banks in the issuance of digital currencies

Central banks have been responsible for issuing money and managing monetary policy for centuries. With the emergence of CBDCs, their role is not only preserved, but also transformed. They become not just currency issuers, but also operators of complex technological systems that ensure the issuance, circulation and control of digital money.

The main functions of central banks in implementing CBDC:

- Issuance and regulation: determining the volume of issue, rules of circulation and integration with other forms of money.

- Stability: maintaining confidence in the currency and preventing inflationary or deflationary spikes.

- Technology infrastructure: creating and supporting platforms for storing and using CBDCs, including digital wallets and transaction processing systems.

- Control and supervision: enforcing financial laws, combating illegal transactions and protecting users’ rights.

The introduction of CBDC also helps banks adapt to global trends. For example, in countries where cash has almost disappeared (Sweden, Norway), central banks are looking for ways to maintain their role in the economy. CBDC becomes a response to the growing popularity of private digital currencies, such as stablecoins, which threaten the state’s monopoly on issuing money.

Types of CBDCs

CBDCs can be divided into two main types depending on their target audience and functions: retail and wholesale. Each of them solves different tasks and has its own peculiarities.

Retail CBDCs - for use by the public

Retail CBDCs are designed for a wide range of users - citizens, small businesses, individual entrepreneurs. They act as a digital equivalent of cash and can be used for everyday transactions: payment for goods and services, transfers between people, storage of savings. The main purpose of retail CBDCs is to increase the availability of financial services and simplify payments.

Features of retail CBDCs:

- Affordability: does not require a bank account, which is important for people in remote areas or with low income.

- Instantaneous: transactions take place in real time, without the delays typical of bank transfers.

- Flexibility: can be integrated with existing payment systems such as Visa or Mastercard.

Wholesale CBDCs - for interbank settlements and other financial transactions

Wholesale CBDCs are targeted at financial institutions - banks, clearing organizations, investment funds. They are used for large transactions such as interbank transfers, securities settlements or international payments. The main objective is to increase the speed and reduce the cost of these transactions.

For example, in 2024, the Bank for International Settlements (BIS) successfully tested wholesale CBDC in the mBridge project involving the central banks of China, Thailand and the UAE. Transactions that used to take days were completed in seconds.

Features of wholesale CBDCs:

- Efficiency: reducing the number of intermediaries and simplifying clearing.

- Security: use of blockchain or other technologies to protect data.

- Scalability: the ability to process millions of transactions per day.

The difference between retail and wholesale CBDCs can be compared to the difference between cash in the wallet and reserves in the banking system. The former serve for everyday life, the latter for “wholesale” financial processes.

Benefits of CBDC

The implementation of CBDC promises many benefits for both citizens and the economy as a whole. The key ones are the following:

Enhancing financial inclusion

According to the World Bank’s 2024 data, about 20% of the world’s adults lack access to banking services due to poverty, remoteness or lack of documentation. CBDC can change this situation. You don’t need a bank account to use digital currency - all you need is a smartphone or a simple device with a digital wallet. For example, in India, where mobile payments are already popular thanks to the UPI system, CBDC could be the next step towards full financial inclusion.

Accelerating payments and reducing costs

Traditional bank transfers, especially international ones, can take hours to days and are costly due to intermediary fees. CBDC allows transactions to take place instantly and at almost no cost. For example, in China, digital yuan is already being used to pay in stores, and users note the speed and convenience compared to cards.

Increased transparency and security

Digital currencies provide the ability to track transactions in real time, which helps combat money laundering, tax evasion and terrorist financing. Encryption and blockchain technologies make CBDCs virtually incorruptible, unlike cash.

Money supply control and anti-money laundering measures

Central banks get more accurate data on the flow of money in the economy, which makes it easier to manage monetary policy. For example, in times of crisis, CBDC can be used for direct payments to citizens, as China tested during the pandemic by distributing digital yuan to residents of pilot regions.

Risks and Challenges of CBDC

Despite the benefits, CBDCs also carry significant risks that can cause problems in the implementation of this technology.

Privacy threats and data protection

Storing transaction data in a centralized system raises concerns. If the central bank or government were to gain full access to citizens’ financial histories, it could lead to abuse. In China, for example, critics of the digital yuan point to the risk of increased control over the population.

Possible cybersecurity issues

The digital nature of CBDCs makes them a target for hackers. A successful attack on the system could undermine confidence in the currency and the economy as a whole.

Impact on the banking sector and monetary policy

If citizens start switching to CBDCs en masse, commercial banks could lose deposits, which would weaken their ability to lend. This would also complicate interest rate management, as central banks would lose some of their traditional leverage.

Potential economic risks

The introduction of CBDC may cause instability during the transition period. For example, if the population abruptly refuses cash or bank accounts, it may provoke a liquidity crisis in the banking sector.

Global examples and experiments with CBDC

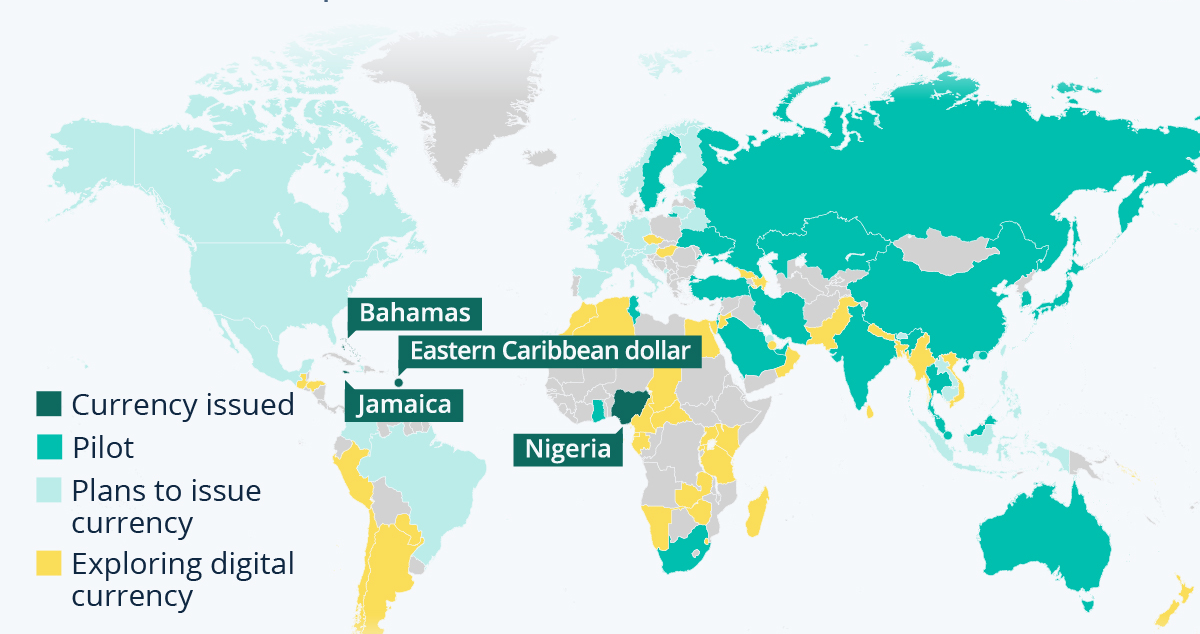

Examples of countries that have implemented or are testing CBDCs

- China: The digital yuan (e-CNY) has been tested since 2020 in cities such as Shenzhen and Shanghai. By March 2025, transaction volume has exceeded 100 billion yuan, and the currency is used to pay for goods, services and even taxes.

- Sweden: Riksbank has been developing the e-crown since 2017, responding to the near disappearance of cash. Pilot projects show success, but implementation is slow due to the focus on security.

- European Union: The European Central Bank (ECB) plans to launch the digital euro by 2026. Consultations with banks and businesses to create a single platform have begun in 2024.

Successes and failures in these countries

China is leading the adoption of digital currencies, with millions of outlets already accepting e-CNY. Sweden is showing steady progress, but is not yet ready for a full launch. The EU is moving cautiously, avoiding hasty decisions, which is slowing down the process.

How might CBDCs affect the future of the financial system?

Impact on global and local economic processes

CBDCs can accelerate the digitalization of the economy, change the structure of banking services and strengthen the role of the state. However, they can also increase competition between currencies: for example, the digital dollar or yuan can displace weak national currencies in developing countries.

Potential for improving the efficiency of international settlements

Wholesale CBDCs simplify cross-border payments by reducing costs and processing time. The mBridge project has shown that such transactions can be 10 times cheaper and faster than through the most used SWIFT system.

Conclusion

Central bank digital currencies are not just a technology trend, but a fundamental shift in the evolution of money. They promise to make finance more accessible, speed up payments and increase control over the economy, but they also carry risks for privacy, security and the banking sector. Global experience from China to Sweden shows that CBDCs are already becoming a reality.

The success of digital currencies will depend on how countries balance innovation and challenge. In the coming years, we will see whether CBDCs become the new global standard or remain an experiment, but one thing is already clear: financial systems are evolving with the world.