Cryptocurrency derivatives: what they are and how to trade them

The cryptocurrency market is developing rapidly, offering traders and investors more and more new instruments for gaining profit. Cryptocurrency derivatives are one of the most promising and in demand. These complex financial products offer great opportunities, but at the same time require a deep understanding of the principles of their work and the associated risks.

Contents

- What are derivatives?

- Cryptocurrency derivatives: peculiarities

- How to trade cryptocurrency derivatives?

- Risks and benefits of cryptocurrency derivatives trading

- Regulation of cryptocurrency derivatives

- Prospects for future regulatory developments

- Conclusion

What are derivatives?

Definition of derivatives

Derivatives (derivative financial instruments) are contracts whose value depends on the price of the underlying asset. The underlying asset can be securities (stocks, bonds), commodities (oil, gold, grain), currencies, interest rates, market indices and other financial instruments.

Simply put, a derivative is an agreement between two parties who undertake to buy or sell the underlying asset at a certain point in the future at a predetermined price. It is not necessary to own the underlying asset, it is enough to correctly predict the movement of its price.

According to the definition of the Bank for International Settlements, a derivative is “a financial contract that is linked to a specific financial instrument or indicator or commodity and through which specific financial risks can be sold or bought independently.

The key characteristics of derivatives are:

- Maturity: a derivative has a fixed maturity, after which the contract is exercised or terminated.

- Derivative: the value of a derivative is determined by the price of the underlying asset, but is not identical to it.

- Riskiness: derivatives can be used both to reduce (hedge) risks and to take speculative risks with the expectation of making a profit.

- Flexibility: the terms of a derivative contract (terms, volumes, strike prices) can be customized to meet the needs of counterparties.

How derivatives work in traditional markets

The mechanism of derivatives’ operation is easiest to consider using the example of a futures contract. Suppose a wheat farmer wants to fix in advance the price at which he will sell his crop in the fall. He enters into a futures contract for wheat with a flour mill at a price of $500 per ton.

If by the time the contract is fulfilled the price of wheat on the market falls to $400/ton, the farmer will still receive the agreed $500, and the mill will be forced to buy grain more expensive than the market. If the price rises to $600, the farmer will lose some profit, but the mill will save money.

Thus, futures allow both the seller and the buyer to reduce their price risks, although not always to the same extent. At the same time, they do not necessarily have to physically deliver or receive grain. In the exchange market, participants can close a position with an offset transaction and receive only the difference in price.

The role of derivatives in the financial industry

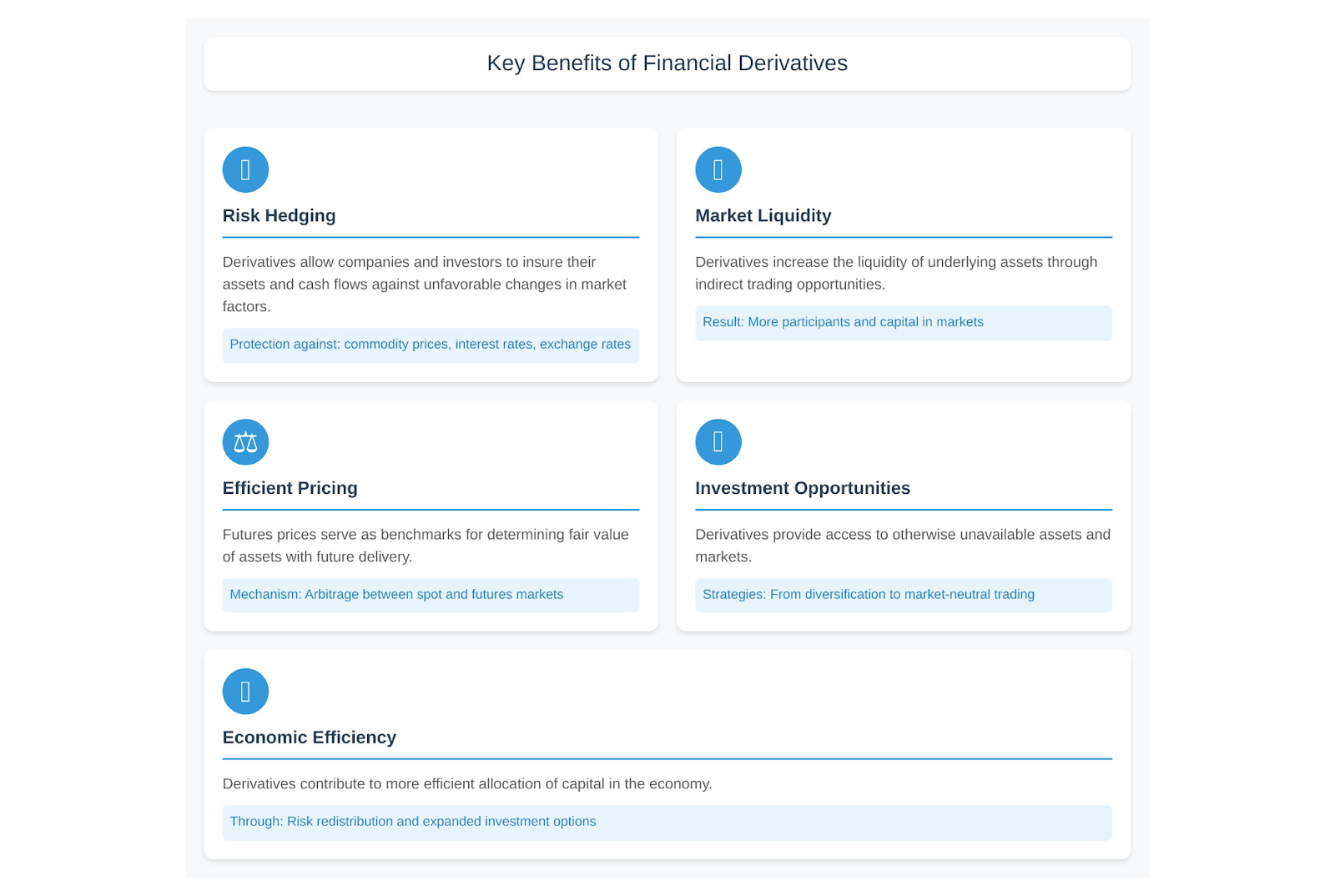

Derivatives play a critical role in today’s financial system, performing a number of critical functions:

- Risk hedging. Derivatives allow companies and investors to insure their assets and cash flows against unfavorable changes in market factors – commodity prices, interest rates, exchange rates, etc.

- Increasing market liquidity. Derivatives increase the liquidity of underlying assets because they can be traded through derivatives rather than directly. This attracts more participants and capital to the markets.

- Efficient pricing. Futures prices serve as a benchmark for determining the fair value of assets with future delivery. Arbitrage between spot and futures markets brings prices to equilibrium.

- Expanding investment opportunities. Derivatives give investors access to assets and markets not available for direct investment. They enable complex investment strategies ranging from simple diversification to market-neutral trading.

- Improving the efficiency of the economy. By redistributing risk and providing investment and borrowing opportunities, derivatives contribute to a more efficient allocation of capital in the economy.

According to the statistics of the Bank for International Settlements, the total volume of the global OTC derivatives market in terms of the nominal value of the underlying assets at the end of 2020 amounted to 582 trillion dollars. This indicates the enormous scale and importance of the derivatives market for the global financial system.

Cryptocurrency derivatives: peculiarities

Cryptocurrency derivatives are similar to traditional derivatives in many ways, as they are based on the same principles of maturity, derivatives and risk management. However, they have a number of essential features due to the specifics of the cryptocurrency market:

- High volatility of the underlying asset. Cryptocurrencies are characterized by much higher price volatility compared to traditional assets. This creates additional risks, but also opens up opportunities for speculative trading.

- Round-the-clock trading. Unlike traditional exchanges, cryptocurrency exchanges operate 24/7, which allows trading derivatives at any time of the day.

- Lack of uniform regulation. Cryptocurrencies are traded mostly on unregulated exchanges, which increases risks for traders but gives them more freedom.

- Cryptocurrency settlement. Margin collateral and payments on crypto derivatives are primarily made in cryptocurrencies rather than fiat.

- Increased leverage. Crypto exchanges often offer leverage up to 100x and above, which is rarely seen in traditional markets due to high risks.

Differences between cryptocurrency derivatives and traditional derivatives

| Parameter | Cryptocurrency derivatives | Traditional derivatives |

| Underlying asset | Cryptocurrencies (Bitcoin, Etherium, etc.) | Stocks, bonds, currencies, commodities |

| Volatility | Very high | Moderate |

| Place of trade | Predominantly unregulated crypto exchanges | Regulated exchanges and over-the-counter market |

| Trading sessions | 24 hours a day, 7 days a week | During business hours of the stock exchanges, intermittently |

| Leverage | Up to 100x or more | Usually no more than 50x |

| Calculations | Predominantly in cryptocurrencies | In fiat currencies |

Popular types of cryptocurrency derivatives

| Futures | A commitment to buy or sell a cryptocurrency at a specific date in the future at a fixed price. Bitcoin (BTC) and ether (ETH) futures are the most popular. They are traded both on cryptocurrency exchanges (Binance, OKEx, Huobi) and on traditional exchanges (CME Group). |

| Perpetual swaps (perpetual swaps) | A type of futures with no expiration date. A swap position can be opened and closed at any time. The funding mechanism ensures that the swap price is linked to the spot price of the cryptocurrency. |

| Options | Contracts that give the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a specified price (strike) on a specific date. Bitcoin and ether options are traded on Deribit, OKEx, Binance and a number of other crypto exchanges. |

| Contracts for Difference (CFDs) | An agreement to exchange the difference in the price of a cryptoasset between the opening and closing of a position. CFDs do not involve the physical delivery of cryptocurrency, only the calculation of the financial result. They are offered by many forex brokers and apps like that. |

How to trade cryptocurrency derivatives?

Cryptocurrency trading can bring high profits, but it requires serious preparation and discipline. Here are step-by-step instructions for beginner traders:

Choosing a cryptocurrency platform for derivatives trading

- Determine your goals and expectations from trading. Decide what instruments you will be trading, what time period you expect to use, and how much you are willing to invest.

- Study ratings and reviews of cryptocurrency exchanges and brokers. Pay attention to the reputation, reliability, convenience of the platform, spreads and commissions, deposit and withdrawal methods. The leading platforms for trading cryptocurrencies are Binance, BitMEX, Huobi, OKEx, FTX, Bybit.

- Go through registration and verification on the chosen platform. As a rule, you need to provide email, phone and ID. Enable two-factor authentication to protect your account.

- Deposit the required amount to the trading balance. Many exchanges accept deposits in cryptocurrencies (BTC, ETH, USDT), some – in fiat via bank transfer or card.

Position opening: long or short

- Select an instrument to trade (for example, BTCUSDT open-ended swap). Study the contract specification – ticker, size, price step, position size limits and leverage.

- Analyze the current market situation, price and trading volume chart. Use technical and fundamental analysis tools (support/resistance levels, indicators, news background, etc.).

- Determine the direction of the transaction: - Long position (long) – if you expect the price of the asset to rise

- Short position (short) – if you expect the price to fall4. Specify the desired position size in contracts or units of the underlying asset. Keep in mind that crypto exchanges usually have default leverage (e.g. 20x). The higher the leverage – the higher the profit/loss for the same position size.

- Place an order at Market or Limit price. The order will be executed in whole or in part as soon as there is a counter bid at your price in the market.

- Monitor your open position and place stop-losses and take-profits as necessary. Close the trade when your profit targets have been reached or the loss has reached the acceptable limit.

Main derivatives trading strategies

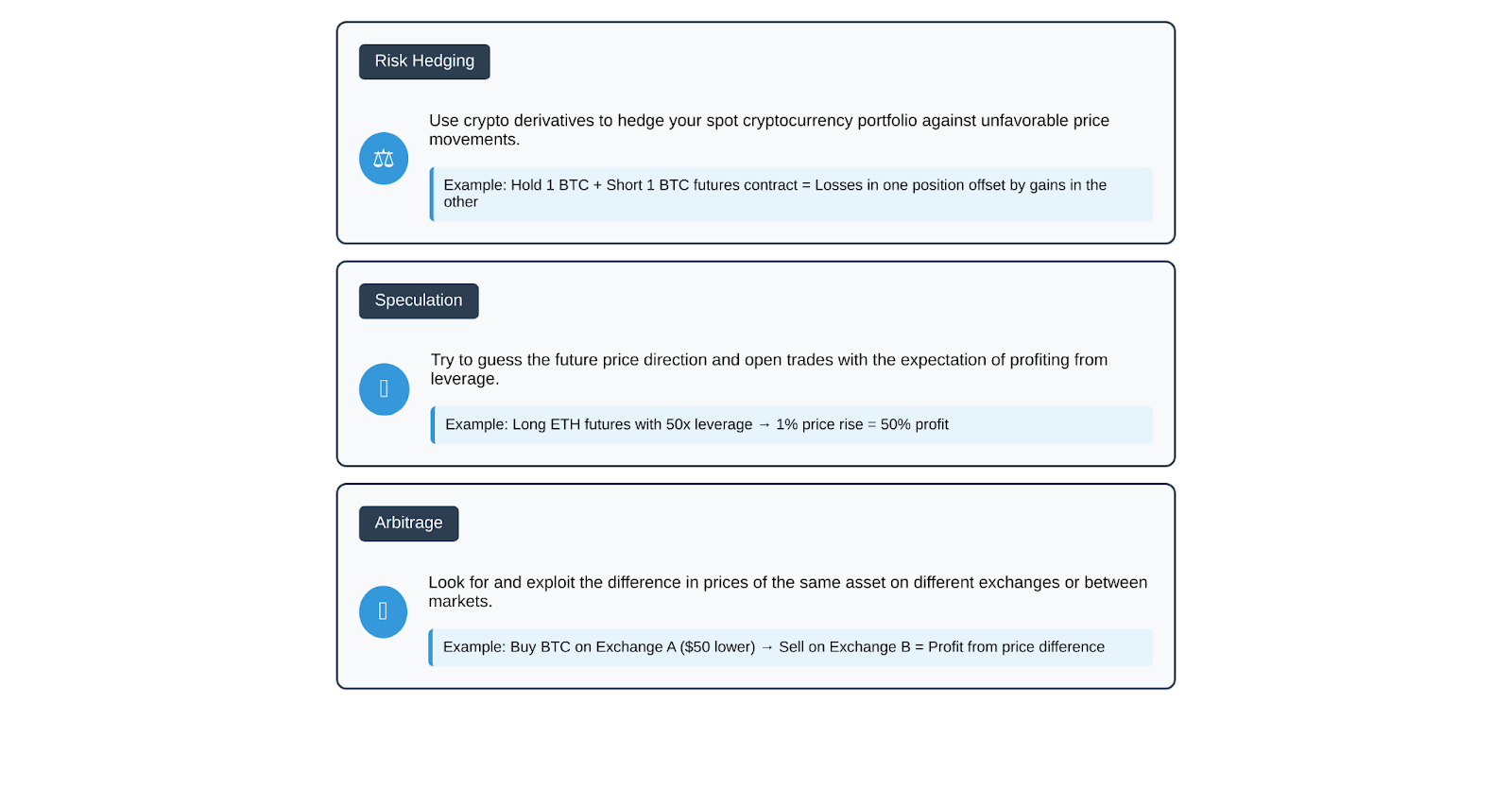

- Risk Hedging. Use crypto derivatives to hedge your spot cryptocurrency portfolio against unfavorable price movements. For example, if you have 1 BTC, you can short 1 bitcoin futures contract – then losses in one position will be offset by gains in the other.

- Speculation. Try to guess the future price direction and open trades with the expectation of profiting from leverage. For example, you can open a long on ether futures with 50x leverage – then if the price of ETH rises by 1%, your profit will be 50%.

- Arbitrage. Look for and exploit the difference in prices of the same asset on different exchanges or between spot and futures markets. For example, if the price of BTC on exchange A is $50 lower than on exchange B, buy on A and immediately sell on B – the difference in price will be your risk-free profit.

Risk management in cryptocurrency derivatives trading

- Diversify your portfolio across different crypto assets and exchanges. Do not keep all assets in one place.

- Always use stop-losses and take-profits to limit possible losses and lock in profits in time.

- Control the position size and leverage taking into account the volatility of the asset. The higher the leverage – the faster you can get a margin call and lose all the funds in your account.

- Avoid pyramiding (building up a losing position). If the market goes against you, it is better to close the deal and incur a limited loss than to wait for a price reversal.

- Constantly improve your financial literacy, learn the basics of technical and fundamental analysis of markets.

Risks and benefits of cryptocurrency derivatives trading

Cryptocurrency trading is a highly profitable, but also high-risk activity. Before starting, it is important to soberly assess all potential benefits and risks.

Advantages

- High profit potential. Thanks to the leverage and volatility of cryptocurrencies, traders can earn tens and hundreds of percent on invested capital in a short period of time. For example, with 100x leverage, the profit can be 10,000% with a price movement of only 100%.

- Accessibility. To start trading crypto derivatives, you need a relatively small starting capital. Many exchanges offer contracts from $1-10, while spot trading requires buying at least 1 crypto coin (currently thousands of dollars for 1 BTC).

- Liquidity. Leading crypto exchanges provide high liquidity on major instruments like bitcoin and ether futures. Daily trading volumes on Binance, Huobi, and OKEx are in the billions of dollars, spreads are minimal, and orders are executed quickly.

- Flexibility. Cryptocurrencies are suitable for a variety of trading and investment strategies – from intraday trading to long-term investing. Traders can combine different types of orders, use leverage and open both buy (long) and sell (short) trades.

- 24/7 access. Unlike stock markets, cryptocurrency exchanges operate 24/7, allowing you to trade at any convenient time and promptly respond to market events.

Risks

- High volatility. Cryptocurrency prices can move very quickly and unpredictably. Sudden collapses or rises of tens of percent are not uncommon in this market. When trading with leverage, this can lead to massive liquidation of positions and loss of all capital.

- Unpredictability of the market. Cryptocurrency rates are influenced by many irrational factors – from celebrity tweets to news about exchange hacks. Often, the reasons for price movements remain unclear. This makes forecasting and making trading decisions difficult.

- Possible legal issues. In many countries, the status of cryptocurrencies and crypto derivatives is not fully defined, and trading them can fall into a “gray zone”. Exchanges may suddenly restrict access to traders from certain jurisdictions. Declaration of profits and payment of taxes is another area of concern.

- Hacking and fraud risks. Crypto exchanges are regularly subject to hacking attacks, which can result in traders losing their funds. There is always the risk of running into a fraudulent platform that will disappear with customers’ money. Own mistakes like losing access keys are not uncommon either.

- Technical failures. Due to high loads, trading platforms of crypto exchanges can “hang” or produce failures at times of high volatility. This prevents traders from closing positions in a timely manner and leads to losses.

Regulation of cryptocurrency derivatives

The legal status of cryptocurrency derivatives remains uncertain in many countries around the world. Regulators are trying to find a balance between investor protection and the development of innovations in the financial sphere. At the same time, approaches to regulation can vary greatly.

Legal frameworks in different countries

| U.S. | The Commodity Futures Trading Commission (CFTC) treats cryptocurrencies as an exchange-traded commodity and allows trading of regulated crypto derivatives on approved exchanges like the CME. On unregulated crypto exchanges, the issue remains unclear. |

| European Union | The Commodity Futures Trading Commission (CFTC) treats cryptocurrencies as an exchange-traded commodity and allows trading of regulated crypto derivatives on approved exchanges like the CME. On unregulated crypto exchanges, the issue remains unclear. |

| UK | The Financial Conduct Authority (FCA) banned the sale of crypto derivatives to retail investors in 2020, deeming them too risky. Professional traders can continue to trade. |

| China | The People’s Bank of China banned crypto exchanges from trading leveraged derivatives in 2017. Cryptocurrencies themselves are in a gray zone, and their status is constantly changing. |

| Japan | The Financial Services Agency (FSA) introduced a number of restrictions for crypto exchanges in 2020 – in particular, the maximum leverage of 4:1. At the same time, crypto derivatives are legal and actively traded. |

Challenges of cryptocurrency derivatives regulation

- The cross-border nature of the market. Crypto exchanges are often registered offshore and serve traders from all over the world. This makes it difficult for national regulators to control their activities.

- Volatility of the underlying asset. The high price risks of cryptocurrencies are also transferred to crypto derivatives. Regulators fear that inexperienced investors can quickly lose all their money.

- Risks of manipulation and fraud. The cryptocurrency market is known for cases of price manipulation like pump&dump and spoofing. Unregulated exchanges have higher risks of fraudulent schemes and hacks.

- Problems with valuation. The lack of agreed standards and reliable price benchmarks complicates fair valuation of crypto derivatives and makes it difficult to determine the obligations of the parties.

- Links to the underground economy. The anonymity of cryptocurrencies attracts black market participants like drug dealers. Regulators fear that cryptocurrencies could be used for money laundering.

Prospects for future regulatory developments

It is possible that regulation of crypto-derivatives in developed countries may be further tightened due to their riskiness for mass investors. Additional restrictions or even bans on trading by unqualified persons may be introduced.

On the other hand, the development of the industry requires clearer and more transparent rules of the game. It is expected that major crypto exchanges will continue to obtain regulatory licenses to operate legally in key jurisdictions. Custodial and clearing services will increase the security of traders.

Regulators may begin to look deeper into trading activity on crypto exchanges, monitoring manipulation and insider trading. Attention will also be paid to combating fraudulent schemes and scams.

International cooperation between regulators to develop common rules and standards will be strengthened. Specialized self-regulatory organizations may emerge to develop norms and monitor fair competition.

Precedent: the BitMEX case

In October 2020, the US Commodity Futures Trading Commission (CFTC) filed charges against cryptocurrency exchange BitMEX and its owners. They are suspected of illegal trading in crypto derivatives with US citizens and violating KYC/AML rules.

According to the CFTC, BitMEX allowed US traders to bypass blockchain and open contracts with leverage up to 100x without proper identity verification. This created risks for investors and facilitated money laundering.

Following the allegations, trading volumes on BitMEX dropped by 50%, and the exchange itself began implementing mandatory user verification. This is a landmark precedent that demonstrates the increased regulatory attention to the cryptocurrency industry.

Thus, cryptocurrency derivatives regulation is in its infancy and will likely continue to evolve towards greater investor protection. It is important for traders to stay abreast of changes in the laws and choose exchanges that have a good reputation and the necessary licenses.

Conclusion

In general, cryptocurrency derivatives are a high-risk but potentially high-return instrument that requires a deep understanding of the market and strict discipline. Each trader must independently assess his or her risk tolerance and carefully choose strategies to work with. Given the youth and uncertainty of the market, crypto derivatives trading should be approached with great caution.