What is FOMO and FUD, and How Do They Interfere with Trading?

Contents

- Introduction

- What is FOMO?

- What is FUD?

- How FOMO and FUD interfere with trading and how to get rid of them

- Conclusion

Introduction

Financial markets present new challenges almost every day: sharp price fluctuations, unexpected news, and a continuous flow of information. Behind the numbers, charts, and market strategies lies something much more complex — the psychology of the trader. Fear and greed, impatience and self-control — these invisible emotional forces influence success in trading. No matter how advanced algorithms and technical indicators might be, human emotions play a key role in making trading decisions. Among such emotional states, FOMO and FUD are most frequently encountered, aiming to cause traders to doubt the correctness of their actions.

What is FOMO?

FOMO (Fear of Missing Out) is a psychological state characterized by the fear of missing an opportunity to profit, especially after sharp and significant price changes in trading assets. There are no clear guarantees of profit, but traders are psychologically tormented by the feeling that “there might be a chance to profit from this.”

Imagine you’re sitting in a café and you see a huge line forming outside a neighboring restaurant. Suddenly, everyone starts saying that there’s a unique promotion going on there — they’re giving away free pizza. Without thinking twice, you rush over, afraid of missing out on this opportunity, but it’s possible that the pizza is already gone or the promotion doesn’t even exist. Similarly, in trading, upon seeing a rapid rise in an asset’s price, traders fear missing out on the coveted “slice” of profit and start buying due to the fear that they missed a significant surge. These situations occur often in the cryptocurrency market due to its high volatility, where assets can change in price by 20% within half a day, especially with low-liquidity cryptocurrencies.

FOMO often arises among traders when an asset’s price reaches round numbers. Recently, when Bitcoin exceeded the $100,000 mark, it became sensational news. For instance, a trader named Mike missed this moment and didn’t profit. He felt euphoria and thought: “If Bitcoin has already reached $100,000, then $110,000 is just around the corner.” Encouraged, Mike bought Bitcoin with all the funds in his account at $101,500, hoping to get rich quickly. But the next day, the price dropped to $91,000, leading to a loss. Most traders influenced by FOMO try to “jump on the last train” because they’re afraid of missing the only chance to earn money, without realizing that a correction might follow.

In this example, the fear of missing out on profits can ultimately lead a trader to thoughtlessly purchase an asset with the idea that its price might increase even further, ignoring the fact that it has already grown significantly. Thus, under the influence of FOMO, trading decisions are made based on emotions rather than sound analysis and strategy, resulting in trading errors and loss of funds.

What is FUD?

FUD (Fear, Uncertainty, and Doubt) refers to a strategy aimed at spreading negative and often unfounded information to decrease traders’ and investors’ confidence in a particular asset, prompting panic selling in the market.

How FUD Affects Market Perception

In financial markets, FUD manifests through the spread of alarming news, rumors, or statements that evoke fear and uncertainty among market participants. For example:

- Reports of a potential ban on cryptocurrencies in a particular country.

- News about hacker attacks on exchanges or cryptocurrency projects.

- A lack of reliable information that makes investors nervous and doubtful about their decisions.

During periods of market instability, FUD amplifies the negative effect, pushing traders to make rash decisions, such as selling assets at low prices. This can result in missed opportunities in the long term if the market recovers.

Examples of FUD in the Financial Sector

The media plays a key role in shaping FUD, particularly through the publication of statements by influential figures and the use of sensational headlines. Here are a few examples:

- Elon Musk’s Statement (May 12, 2021)

During a 15% drop in Bitcoin’s value, the media widely circulated Musk’s announcement that Tesla would no longer accept Bitcoin as payment due to environmental concerns related to mining. This caused panic among investors. - Sensational Headlines

Headlines like “Ethereum Will Drop to Zero” or “Cryptocurrency Ban” attract attention, even if the article’s content does not support such claims. For example: * On September 24, 2021, media outlets reported on a “cryptocurrency ban in China” although in reality, it was merely a notice about regulating risks associated with virtual currency trading. - Emotional Impact

Even if an article has a balanced message, the audience often reacts only to the headline, which amplifies the FUD effect.

It can be noted that the news was published at the stage of correction completion, and just a week after the publication of the pseudo-news about the “ban on cryptocurrency transactions in China,” Bitcoin and other cryptocurrencies resumed their growth. Thus, traders and investors might have succumbed to panic but then could have experienced FOMO for not participating in the growth as it continued.

There have been instances of publications aimed at lowering reputation to decrease the price of cryptocurrency. For example, posts on the social network X (Twitter) by users JW and Skew, which spread rumors that the cryptocurrency exchange Binance is selling off its Bitcoin reserves to support its native token BNB. To which Changpeng Zhao, of course, quickly refuted these rumors, calling it FUD.

How FOMO and FUD interfere with trading and how to get rid of them

No one can predict the future with certainty, and no one can give better advice than the traders and investors themselves after conducting their own research and observations.

Key Recommendations for Traders and Investors:

Keeping a trading journal can help identify not only the type (short-term, medium-term, or long-term) of trades that yield the most profit, but also the periods in which the market is most lucrative.

Developing a clear trading strategy with goals and risk management calculations instead of trading on emotions, which range from overwhelming euphoria to intense panic as prices hit new extremes and news is published related to sharp price changes.

Be prepared not only to timely lock in profits but also to withstand downturns if you have a clear understanding of further long-term growth.

If you’re an investor and news can serve as a financial instrument, only seek information from original sources, as many media outlets present information inaccurately or incompletely.

However, trading in a market dominated by FUD is a unique skill and art, requiring not only mental fortitude with a trading strategy for profitable trades but also good technical equipment, a proper workspace, and well-functioning software. Often during news releases, market reports, such as the announcement of changes to the Federal Reserve’s interest rate, trading terminals and exchange applications may experience issues.

The FOMO syndrome can be managed, and many traders often find psychological solutions; however, FUD during significant cryptocurrency price changes can greatly complicate analysis and action forecasting for inexperienced traders due to a sharp rise in volatility. Therefore, if you lack confidence in your technical and software setup, are prone to concerns, and have little experience in financial market trading, it is advisable to be extremely cautious during periods of high volatility.

Periods of high volatility during FUD can, conversely, be a positive signal for trading for experienced short-term traders and short-term trading algorithms due to increased volatility and a higher number of trades. But what should those who wish to profit from the financial market during such periods do if they do not have extensive positive trading experience and suitable technical equipment?

In such cases, we recommend using our innovative TradeLink Marketplace, which allows you to choose different types of strategies: from long-term investments to algorithms aimed at short-term trades (scalping—a type of trading that involves earning from a large number of trades over a short period of time). Thus, the likelihood of benefiting increases even without the appropriate skills, rather than relying on intuition and making thoughtless and illogical trading operations.

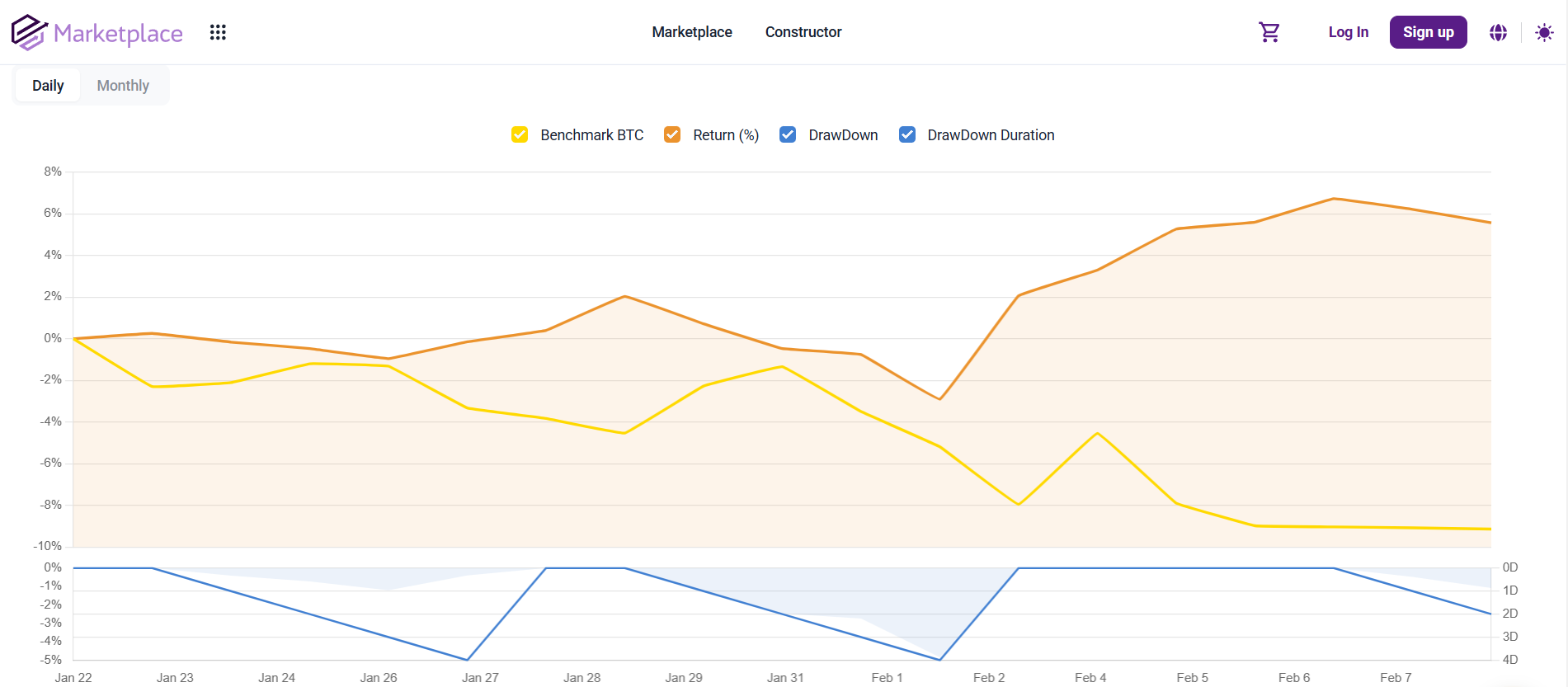

When analyzing the profitability of cryptocurrency trading algorithms during the heightened volatility from January 26 to February 4 and the FUD news about the US president imposing import tariffs, it was noted that the algorithm from Algotoria could have brought a decent profit to investors during these volatile days.

Conclusion

In the world of trading, emotions can become either a powerful driver of progress or a dangerous obstacle on the path to success. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) are two of the most common psychological phenomena faced by traders. Understanding and managing these emotions are critically important aspects of successful trading.

By studying the behavioral aspects of FOMO and FUD, traders can learn to identify moments when emotions begin to outweigh rationality and take steps to minimize their influence. Such steps include developing a trading strategy, establishing a clear risk management plan, and leveraging the opportunities offered by algorithmic strategies.

Ultimately, mastering emotions and evolving as traders allows them to make more balanced and informed decisions, which can significantly enhance their positive outcomes in the realm of financial market trading.