How to Profit from Cryptocurrency Price Fluctuations: Basics of Scalping

Contents

- Introduction

- What is scalping?

- How do cryptocurrency fluctuations work?

- Scalping tools and software

- How to use scalping to make money on cryptocurrency fluctuations?

- Trader’s psychology in scalping

- Scalping platforms and Exchanges

- Conclusion

Introduction

Cryptocurrency markets are known for their high volatility, which is why they are attractive to traders who want to make money from fluctuations in the exchange rate. Unlike traditional financial markets, where changes can be smoother, cryptocurrencies are able to show significant price changes over short periods of time. Such conditions open up great opportunities for strategies focused on short-term trading, one of which is “Scalping”.

What is scalping?

Scalping is a method of trading that involves making a profit from short-term and often fast trades made during the day. During a trading session, a trader can use this strategy to make a large number of transactions and earn money on a small price change.

Unlike long-term investments, where traders hold their positions for months or years or swing trading, where trades last for several days, scalping requires constant concentration and quick decision-making to make a profit.

Advantages of scalping:

- The ability to earn money on small market movements;

- Minimization of risks associated with geopolitical changes, news and other risks of long-term trading;

- A high level of profitability and the ability to make quick profits, if the trader has an understanding of what he is doing.

Disadvantages of scalping:

- High influence of exchange commissions on the trader’s profitability, often the commission can take most of the profit from the transaction;

- The need for constant concentration and discipline during the trading session;

- High levels of stress and emotional stress.

In the famous book ” Exchange Secrets. High Frequency and Intraday Trading” by Lawrence Connors and Linda Raschke mentions the following about scalping:

“The main task of a scalper is not to try to catch big moves, but to consistently take small profits again and again.”

“Trading requires composure. The more emotions, the higher the probability of error.”

High market volatility is important for scalping. In times of high volatility, the impact of exchange commissions becomes less noticeable, which means that the potential yield increases.

How do cryptocurrency fluctuations work?

Unlike the stock market, which is controlled by government agencies (the SEC in the US, the Central Bank in Russia, etc.), cryptocurrencies exist in a decentralized environment. This means that:

- There are no stabilizing mechanisms – the stock market has a lot of rules and restrictions, and there are also limits on daily price fluctuations, but in the crypt-no.

- The market operates 24/7 – unlike traditional exchanges, where trading takes place according to a schedule, the cryptocurrency market does not stop, which increases the probability of sudden movements.

Most of the participants in the crypto market are traders, not long-term investors. This results in:

- Rapid price changes. For example, to frequent pumps and dumps.

- Massive impact of news. For example, a tweet by Elon Musk or a rumor about a new regulation can cause strong exchange rate fluctuations and volatility.

It is also important to note that the cryptocurrency market lacks a fundamental valuation. For example, shares of companies have a real business model and financial indicators (P/E, EBITDA), on the basis of which investors make decisions.

There are no classic financial metrics in the cryptocurrency market, and the value of cryptocurrencies is determined by trust, not by corporate returns and reporting. This makes cryptocurrencies more vulnerable to manipulation and rumors, which in turn creates a favorable environment for scalping.

Scalping tools and software

Professional scalpers use specialized software that allows them to go beyond the standard chart analysis. In their work, they take into account not only charts and traditional indicators, but also pay special attention to real exchange events. For this purpose, such tools as the exchange glass (order glass) and the order feed are actively used, which help to track current changes in supply and demand, as well as quickly respond to market movements.

These programs include:

- Cscalp;

- TigerTrade;

- MetaScalp;

- And others.

Other methods of analysis play a secondary role. For example, a scalper can monitor the market using the RSI, MACD indicators, and use moving averages to find points of greatest interest among trading participants. However, key decisions about making transactions and their direction are made based on the data of the transaction book and feed.

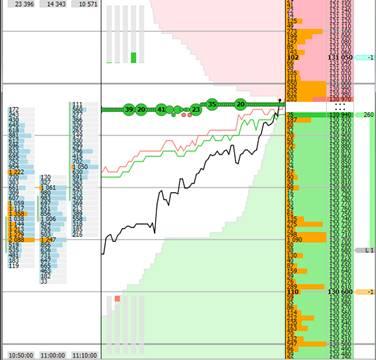

Example of the scalping software interface:

These tools are used together to get a more complete picture of the market. The exchange glass and order feed also allow scalpers to analyze current liquidity and determine key support and resistance levels. This helps to identify moments when large participants or a large number of ordinary participants start active actions, which can signal a potential increase in volatility.

How to use scalping to make money on cryptocurrency fluctuations?

Scalper trading strategies are not diverse, and if you explain them in simple words, you can distinguish three main categories:

1. Rebound from density

This strategy is based on the principle that a price that encounters a density of orders (such as large buy or sell orders) can bounce back from these levels. The scalper looks for moments when the market encounters such levels and expects a quick price rebound in its direction.

Example of a large order in a scalping software

2. Trading with the participant (spoofer, algorithm)

This strategy involves observing the behavior of large market participants (such as institutional traders or algorithms) and trying to follow them. Usually, the participant shows himself by placing large orders in the glass, which leads to a price change, or by making large purchases or sales in the market with a certain pattern.

3. Spread collection

This strategy consists of trying to make money on small price changes within the spread (the difference between the buy and sell price). When using this strategy, it is necessary, for example, to buy at the lowest price of the spread and sell at the highest price of the spread. Such strategies are often used on cryptocurrency exchanges with low liquidity, where the difference in the spread value can reach several percent.

Example of what the spread looks like in a Cscalp software:

The market is a complex and dynamic structure, where rare opportunities for earning money are becoming increasingly difficult to access due to the development of technology and increasing competition. Strategies require deep analysis and adaptation to current conditions, as well as strict compliance with risks to minimize losses.

Modern algorithms such as HFT, arbitrage algorithms, and market makers take advantage of the smallest price changes, analyzing data and making decisions in fractions of seconds. These unique strategies are created by professionals and are not publicly available.

Some of them are available on the TradeLink Marketplace platform, which provides a unique opportunity to invest in ready-made trading algorithms and strategies. This allows you not only to diversify your investments, but also to earn passive income by sharing the profits with experienced developers. The platform offers transparent terms, detailed analytics, and the ability to choose algorithms that match your investment goals and risk level. Thus, even without deep knowledge of trading, you can become a part of the world of algorithmic trading and increase your capital together with professionals.

Trader’s psychology in scalping

As we have already identified, this style of trading as scalping requires high discipline and emotional stability. High speed of decision-making and constant monitoring of the market can cause stress, which will lead to emotional overload. In scalping, as in any other style of trading, you need to:

- Risk management: It is important to set stop losses and take profits. Have a goal and plan for each trade.

- Be disciplined: Don’t get emotional, even if the deal isn’t going well for you.

- Keep your cool: With high volatility, it’s important to stay calm and follow a pre-defined strategy.

To reduce the impact of emotions on trading, you need to keep a transaction diary. It will help you determine which points in the trading process lead to the greatest mistakes, and which strategies are most successful. It also contributes to a better understanding of your own strengths and weaknesses as a trader, helps you track your progress and optimize your trading approaches. It is important that the entries are detailed and include not only technical points, but also feelings that arise during the decision-making process.

Scalping platforms and Exchanges

There are a huge number of exchanges on the cryptocurrency market, but some of the most popular ones stand out, such as Binance, Bybit, OKX, Gate.io, MEXC, Bitget, and KuCoin. Each of these platforms has its own characteristics, and the choice depends on the trader’s goals.

The most liquid exchanges include Binance, Bybit and OKX. These platforms have huge trading volumes, which makes them attractive for long-term investors and those looking for stability. However, high liquidity also means that it is more difficult for scalpers to find successful trading opportunities, as such situations are less common. If your goal is to profit from short-term price fluctuations, then there may be some difficulties.

Less liquid exchanges include Gate.io, MEXC, Bitget, and KuCoin. On these platforms, trading volumes are lower, which may seem less attractive to large investors. However, for scalpers, this creates certain advantages: trading situations that are suitable for quick trades are much more common. Lower liquidity makes it possible to make money on small price fluctuations, which is important for those who actively trade for short periods of time.

When choosing an exchange, it is important to take into account the amount of capital you plan to work with, as well as the level of volatility that you need to trade effectively. It all depends on the liquidity, the chosen platform and your trading skills, because in high liquidity conditions it is more difficult to find the ideal entry point, and in low liquidity conditions it is important to be able to properly manage risks.

Conclusion

Scalping is a powerful tool for making money in the cryptocurrency market, but it requires deep knowledge, discipline, and a willingness to take risks. The high volatility of cryptocurrency markets makes them ideal for this strategy, but success depends on the ability to quickly analyze the situation and make decisions.

If you are willing to work hard and constantly learn, scalping can be a profitable way to trade in the cryptocurrency markets. And in situations where you have little time, but you want to invest in cryptocurrency and earn money without spending extra time on trading and training, pay attention to our TradeLink Marketplace service. Our platform offers a unique investment opportunity through specially selected transparent and risk-resistant algorithmic indexes. You can join them using your personal exchange account, without having to transfer funds to third-party accounts. This provides not only convenience, but also an increased level of security for your assets.

When you first register and start investing, you automatically become a member of the “30 days 0% commission on your profit” promotion. This means that all income earned during the first month remains entirely yours — without any hidden fees or deductions.

We strive to make investing affordable and profitable for everyone by providing state-of-the-art tools that help minimize risks and maximize profits. Our algorithmic indexes are regularly updated and adapted to changes in the market, so that you can be sure of the stability and prospects of your investments.

For more information about our services, terms of cooperation and benefits, please visit our TradeLink website.

Join us today and start your journey to financial success with comfort and confidence!