What is arbitrage trading and how does it work?

In the world of cryptocurrency trading, arbitrage offers unique opportunities for profit. The essence of this strategy is to exploit price imbalances between different trading venues, where the same digital asset can be traded at different prices.

The cryptocurrency market is an ideal ecosystem for arbitrage trading. Its distinctive features – high volatility and 24/7 operation – create favorable conditions for traders. A multitude of trading platforms with different conditions and quotes, combined with a relatively low entry threshold compared to traditional financial markets, make cryptocurrency arbitrage particularly attractive.

Contents

- Principles of arbitrage trading

- Arbitrage in the crypto market

- How does the arbitrage strategy work?

- Arbitrage tools and platforms

- Advantages and disadvantages of arbitrage trading

- Risks of arbitrage trading in the crypto market

- Conclusion

Principles of arbitrage trading

Arbitrage trading is based on the idea that markets are not always efficient and asset prices can differ. Traders exploit these discrepancies to make profits. The basic principles of arbitrage:

- Searching for price differences on different exchanges or within one site.

- Simultaneous opening of opposite positions (buying and selling an asset).

- Closing positions when prices equalize and fixing profits.

The cryptocurrency market consists of many exchanges, each of which sets its prices based on supply and demand. Due to the peculiarities of the work of the platforms, different levels of liquidity and activity of traders, prices for the same cryptocurrency may differ. This creates opportunities for arbitrage between exchanges.

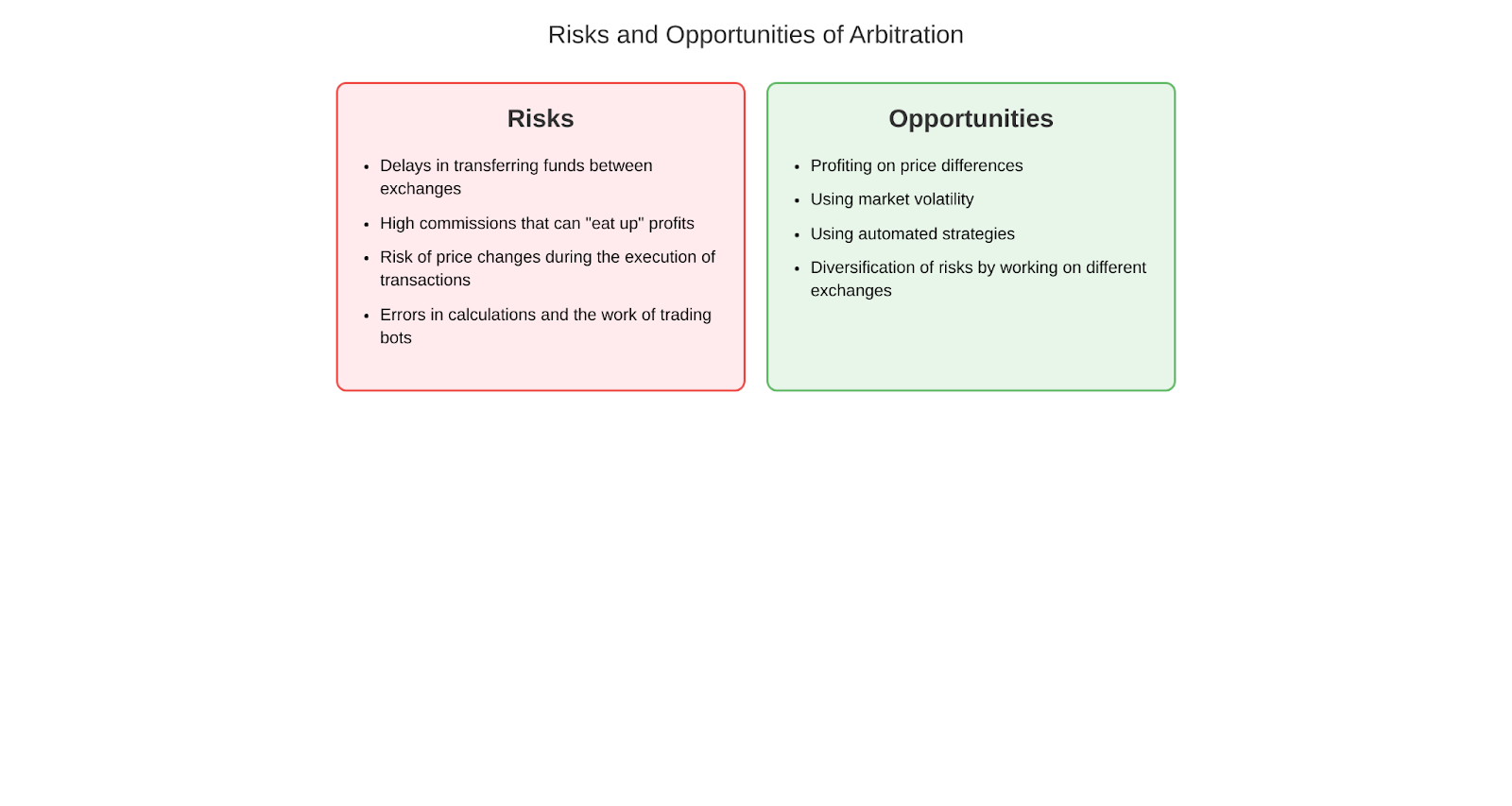

Risks and Opportunities of Arbitration

Arbitrage trading in the cryptocurrency market comes with both risks and opportunities.

Risks:

- Delays in transferring funds between exchanges.

- High commissions that can “eat up” profits.

- Risk of price changes during the execution of transactions.

- Errors in calculations and the work of trading bots.

Opportunities:

- Profiting on price differences.

- Using market volatility.

- Using automated strategies.

- Diversification of risks by working on different exchanges.

Main types of arbitration

- Inter-exchange arbitrage – finding and using price differences on different trading platforms. For example, buying BTC on exchange A and simultaneously selling it on exchange B.

- Intra-exchange arbitrage – searching for inefficiencies in a stack of orders on one exchange. For example, placing limit orders to buy and sell in order to get a spread.

- Triangular arbitrage – trading using three different currency pairs on one or more exchanges. For example, exchanging BTC for ETH, ETH for XRP, and XRP again for BTC in order to profit from the exchange rate difference.

Arbitrage in the crypto market

The cryptocurrency market provides unique opportunities to apply arbitrage strategies. The decentralized nature of trading, a large number of exchanges and high price volatility create ideal conditions for finding and exploiting market inefficiencies.

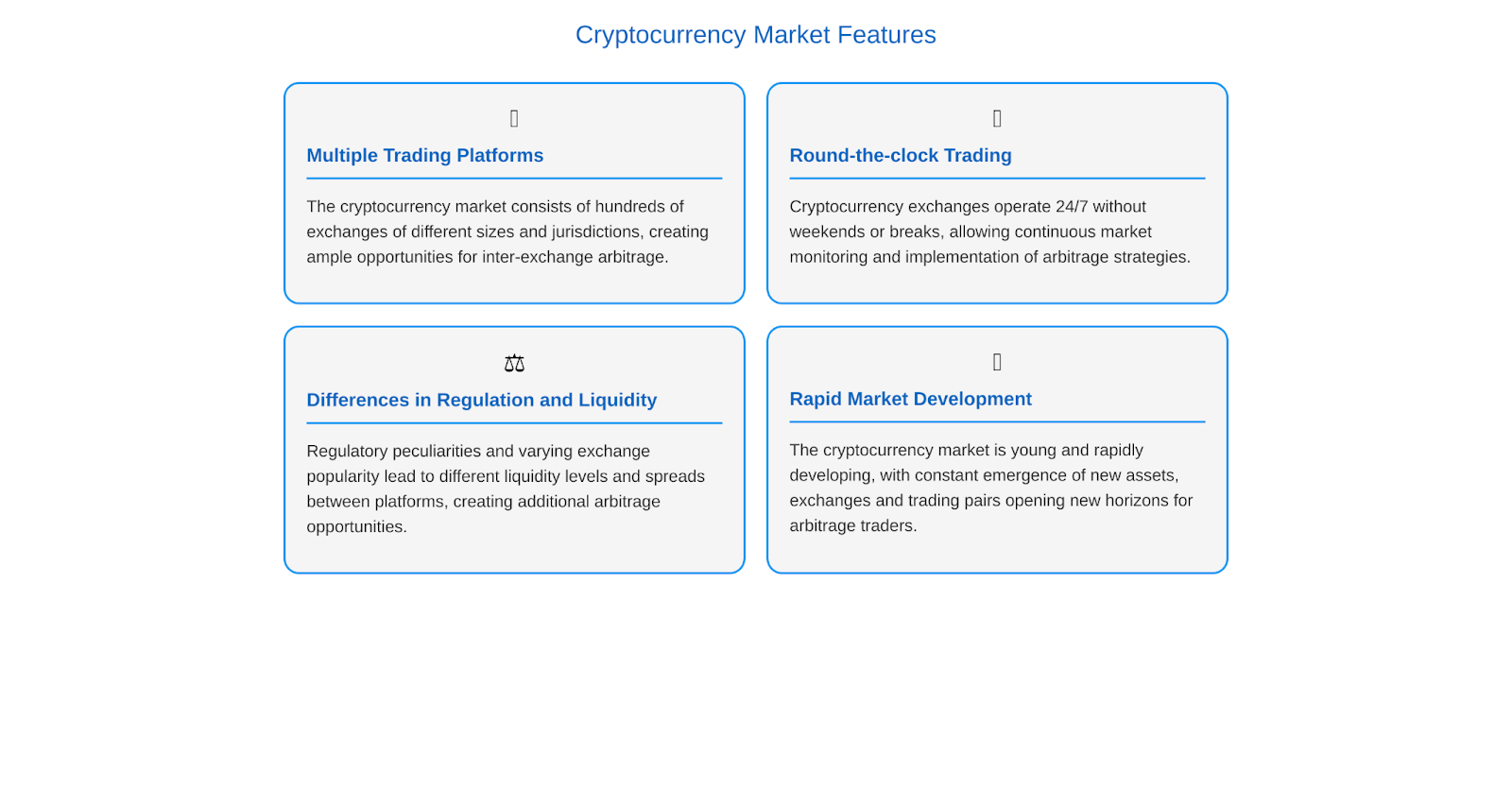

Features of the cryptocurrency market for arbitrage trading

- Multiple trading platforms

Unlike traditional financial markets dominated by a few large players, the cryptocurrency market consists of hundreds of exchanges of different sizes and jurisdictions. This creates ample opportunities for inter-exchange arbitrage.

- Round-the-clock trading

Cryptocurrency exchanges operate 24/7 without weekends or breaks. This allows traders to continuously monitor the market and implement arbitrage strategies at any time of the day.

- Differences in regulation and liquidity

Due to regulatory peculiarities and differences in the popularity of exchanges, the level of liquidity and spreads can vary greatly between platforms. This creates additional opportunities for arbitrage.

- Rapid development of the market

The cryptocurrency market is relatively young and rapidly developing. The constant emergence of new assets, exchanges and trading pairs opens new horizons for arbitrage traders.

Volatility and liquidity as success factors

Two key factors affecting the efficiency of arbitrage trading in the cryptocurrency market are price volatility and liquidity of trading pairs.

Volatility determines the potential size of profit from price differences. The higher the price fluctuations, the more opportunities for arbitrage. However, high volatility also carries the risks of rapid price changes during the execution of trades.

Liquidity affects the speed and cost of order execution. The higher the liquidity of a trading pair, the easier and cheaper it is to buy or sell an asset at the desired price. Low liquidity can lead to slippages and unfavorable transactions.

How does the arbitrage strategy work?

Arbitrage strategy in crypto trading is based on finding and utilizing price differences for the same asset on different exchanges or within the same trading platform. The goal of arbitrage is to make a profit by simultaneously buying and selling an asset at different prices.

The main steps in implementing an arbitrage strategy:

- Monitoring prices on various exchanges and identifying discrepancies.

- Calculation of potential profit taking into account commissions and transfer costs.

- Simultaneous opening of opposite positions (buying on one exchange and selling on another).

- Closing positions in case of price equalization and profit taking.

To successfully implement this strategy, it is necessary to quickly move funds between exchanges and execute trades at the same time. Delays can lead to lost profits or even losses if prices do not change in the trader’s favor.

Arbitrage tools and platforms

To effectively implement arbitrage strategies in the cryptocurrency market, traders use various tools and platforms. They help to automate the processes of price monitoring, data analysis and execution of transactions, which allows for the fastest possible response to emerging opportunities for arbitrage.

Use of trading bots and algorithms

Trading bots and algorithms are software solutions that automate various aspects of arbitrage trading. They can perform the following functions:

- Collect and analyze market data from multiple exchanges in real time.

- Detection of arbitrage opportunities based on specified parameters (price difference, trading volumes, liquidity, etc.).

- Automatic execution of trades at optimal prices on different exchanges.

- Risk management and capital control in accordance with established rules.

- Generation of reports and notifications on trading results.

The use of trading bots and algorithms allows arbitrage traders to significantly increase the efficiency and speed of their work, as well as reduce the influence of emotional factors on decision-making.

Overview of popular platforms for arbitrage trading

There are many platforms on the market offering tools for arbitrage trading in the cryptocurrency market. Here are some of the most popular solutions:

- Bitsgap: A platform for automated trading on the cryptocurrency market, including arbitrage tools. Bitsgap allows you to connect to over 25 exchanges, provides built-in trading strategies and bots, and supports custom JavaScript algorithms.

- HaasOnline: Comprehensive automated trading software that includes modules for arbitrage in the cryptocurrency market. HaasOnline offers a visual strategy editor, an extensive library of indicators and the ability to test algorithms on historical data.

- Quadency: A platform for cryptocurrency portfolio management and automated trading that provides tools for arbitrage. Quadency allows you to connect to more than 20 exchanges, offers ready-made trading bots and strategies, and supports the creation of custom scripts in Python.

When choosing a platform for arbitrage trading, traders should consider factors such as supported exchanges and trading pairs, speed of trade execution, functionality of analysis and automation tools, usability and cost of maintenance.

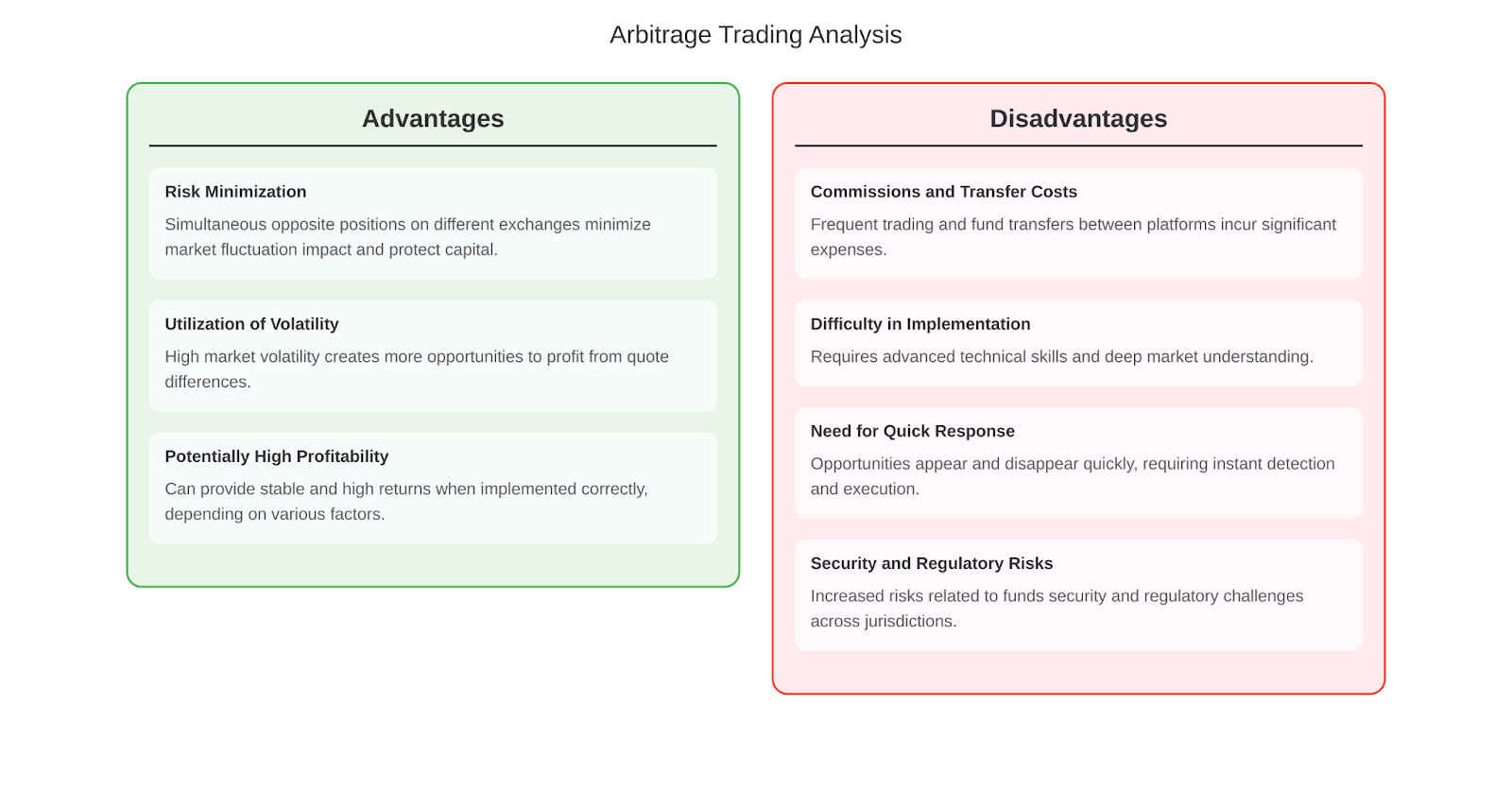

Advantages and disadvantages of arbitrage trading

Like any trading strategy, arbitrage in the cryptocurrency market has its advantages and disadvantages. Understanding these aspects will help traders make informed decisions and manage risks effectively.

Advantages of arbitrage trading

- Risk minimization

Arbitrage trading is considered a relatively low-risk strategy, as a trader simultaneously opens opposite positions on different exchanges. This allows minimizing the impact of market fluctuations and protecting capital from potential losses.

- Utilization of volatility

The high volatility of the cryptocurrency market, which is often seen as a disadvantage for traditional trading strategies, is an advantage for arbitrage. The higher the price fluctuations, the more opportunities to profit from the differences in quotes on different exchanges.

- Potentially high profitability

When implemented correctly, arbitrage strategies can provide stable and high returns. However, it is important to realize that the profitability of arbitrage depends on many factors, including the choice of trading pairs, the efficiency of the instruments used and the speed of execution.

Disadvantages of arbitrage trading

- Commissions and transfer costs

Realization of arbitrage strategies implies frequent opening and closing of positions on different exchanges, which entails commission expenses. In addition, the need to quickly transfer funds between trading platforms may be accompanied by additional costs. These factors can significantly reduce the profitability of arbitrage.

- Difficulty in implementation

Effective implementation of arbitrage strategies requires advanced technical skills and a deep understanding of the market. Traders must be able to quickly analyze large amounts of data, adjust trading algorithms and adapt to changing market conditions. Without the proper knowledge and experience, arbitrage can be too complex for novice traders.

- Need for quick response

Opportunities for arbitrage in the cryptocurrency market can come and go in a matter of seconds. To successfully implement this strategy, traders must have the tools to instantly detect price discrepancies and execute trades. Delays and technical glitches can lead to lost profits or even losses.

- Security and Regulatory Risks

Working with multiple cryptocurrency exchanges involves increased risks related to the security of funds and personal data. Traders should choose trading platforms carefully and use reliable methods to protect their accounts. In addition, differences in regulation of the cryptocurrency industry in different jurisdictions can create additional challenges for arbitrage trading.

Risks of arbitrage trading in the crypto market

Despite the potential profitability, arbitrage trading in the cryptocurrency market involves a number of specific risks that must be considered when developing and implementing strategies.

Liquidity and delay risks

One of the main risks of arbitrage trading is a possible decrease in liquidity on one or more exchanges during the execution of trades. If a trader is unable to quickly buy or sell the required volume of an asset at the expected price, this may result in lost profits or even losses.

In addition, delays in order execution and transfer of funds between exchanges can negatively affect the effectiveness of an arbitrage strategy. Even small delays can negate potential profits, especially in a highly volatile market.

Commissions and insignificant profits

Arbitrage trading involves frequent opening and closing of positions on different exchanges, which inevitably entails commission costs. In some cases, the size of commissions can be comparable to the potential profit from arbitrage, which makes the strategy less attractive.

In addition, as the cryptocurrency market develops and becomes more efficient, arbitrage opportunities become less and less significant. Traders have to work with small price differences, which limits potential profits and increases the importance of effective cost management.

Technical problems and errors

The implementation of arbitrage strategies largely depends on the reliability and smooth operation of trading platforms, exchanges and automation tools. Technical failures, errors in the work of algorithms or problems with connection to exchanges can lead to the inability to execute trades in a timely manner and, as a result, to losses.

In addition, errors in calculations or settings of trading bots can cause unintentional losing trades. Traders should pay special attention to testing and monitoring their arbitrage systems to minimize the impact of technical risks.

Conclusion

Arbitrage trading in the cryptocurrency market can be a profitable strategy for experienced traders who are willing to accept the risks involved. Success in arbitrage depends on the choice of reliable trading platforms, efficient automation tools and constant adaptation to changing market conditions.