How to manage risks when investing in cryptocurrencies?

Investing in cryptocurrencies offers traders many opportunities for profit. However, the high volatility and unpredictability of the digital asset market carry significant risks. Improper approach to capital management and lack of risk minimization strategy can lead to serious financial losses.

Contents

- Types of risks when investing in cryptocurrencies

- Methods of risk management when investing in cryptocurrencies

- Psychology of investing and emotion management

- Risks in short and long-term investments

- Practical advice on risk mitigation

- Conclusion

Types of risks when investing in cryptocurrencies

Volatility

Volatility is a statistical indicator that characterizes the tendency of a market price or income to change over time. The higher the volatility of a cryptocurrency, the greater the fluctuations in its exchange rate. Digital assets are notorious for their extreme volatility. For example, bitcoin can rise or crash by 20-30% in just a few hours. On the one hand, this gives traders the opportunity to make good money on short-term speculations. On the other hand, it carries serious risks of capital loss.

High volatility makes it difficult to predict the price of cryptocurrencies. Due to sharp price spikes, it is more difficult for investors to make informed decisions. Many traders fall into the trap of emotion – they buy at the peak of the price for fear of missing out on profits (FOMO) and sell in panic when the rate collapses. This often leads to losses. In addition, trading on margin in a volatile market carries the threat of liquidating positions and losing money.

Liquidity

Liquidity in the context of cryptocurrencies means the ability to convert a digital asset into fiat money or other cryptocurrencies quickly and without significantly affecting the market price. Highly liquid coins such as Bitcoin Ethereum can be exchanged at any time for almost any other asset on major exchanges. But with little-known altcoins, problems can arise.

Low liquidity leads to a significant difference between the buy and sell price (spread), slippage (slippage) in the execution of orders, the inability to quickly get rid of the asset. All this threatens the investor with losses. If the coin is not traded on major exchanges and trading volumes are low, it is better to treat it with caution.

Regulatory risks

Despite their decentralized nature, cryptocurrencies cannot exist in a vacuum, independent of government regulators. The actions of the authorities can both stimulate the development of the industry and seriously hamper it. Some countries, like El Salvador, have legalized bitcoin as a means of payment. Others, like China, have banned any transactions with cryptocurrencies.

Regulations can change the balance of power in the market overnight. It is enough to remember how the bitcoin exchange rate plummeted after Ilon Musk announced that Tesla would stop accepting BTC as payment. Increased regulation often leads to a drop in cryptocurrency prices. Conversely, positive news from regulators can boost the market. It is important for investors to keep their finger on the pulse and monitor changes in the legislation of different countries.

Security risks

Security has always been the Achilles’ heel of the crypto industry. Exchange hacks and hot wallet thefts, phishing attacks and scam projects, vulnerabilities in smart contracts and 51% attacks are just some of the threats that investors face. According to Chainalysis, digital asset owners will lose more than $3 billion to hacker attacks in 2022.

Project liquidity risks

Thousands of cryptocurrencies on the market are technically vulnerable and financially unstable in the long term. Many coins are created for the sole purpose of attracting investor funds and quickly enriching developers. Unsuccessful tokenomics, unviable business model, lack of real application – these factors can lead to a drop in the price of the asset and its disappearance from the market.

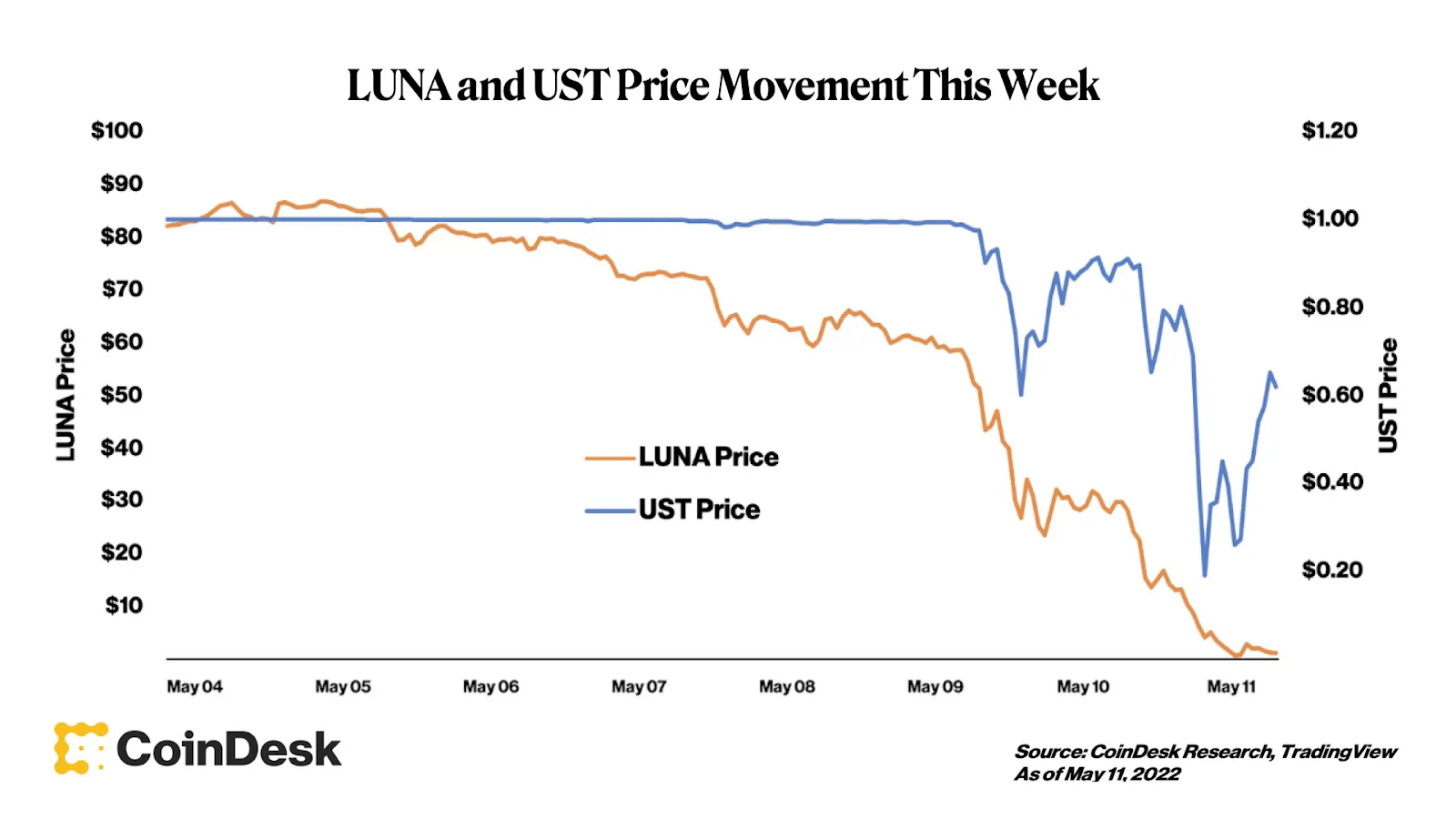

A prime example is the collapse of the Terra blockchain (LUNA) and the algorithmic stablecoin UST. As a result of failed attempts to maintain UST’s peg to the dollar, LUNA’s exchange rate collapsed to near zero and investors lost tens of billions. To reduce the risks associated with investing in dubious projects, you should carefully study white papers, analyze tokenomics and the actual use of the asset, and check the development team. It is also worth diversifying your portfolio and not keeping all your eggs in one basket.

Methods of risk management when investing in cryptocurrencies

Diversification

Diversification is a strategy of allocating capital between different assets in order to minimize risks. The old adage says: “Don’t put all your eggs in one basket”. This is especially true for the highly volatile crypto market. By investing in different digital assets, a trader protects himself from potential losses in case the price of one coin falls.

One of the options for diversification in the crypto market can be copy-trading through platforms like Tradelink. They allow you to create indices of several strategies selected according to certain criteria. This approach potentially reduces risks and smooths out fluctuations in returns compared to investing in individual strategies or assets. However, it is also important to choose your platform carefully, and to study the methodology of index compilation and the history of its results.

How to properly diversify your crypto portfolio? Here are some tips:

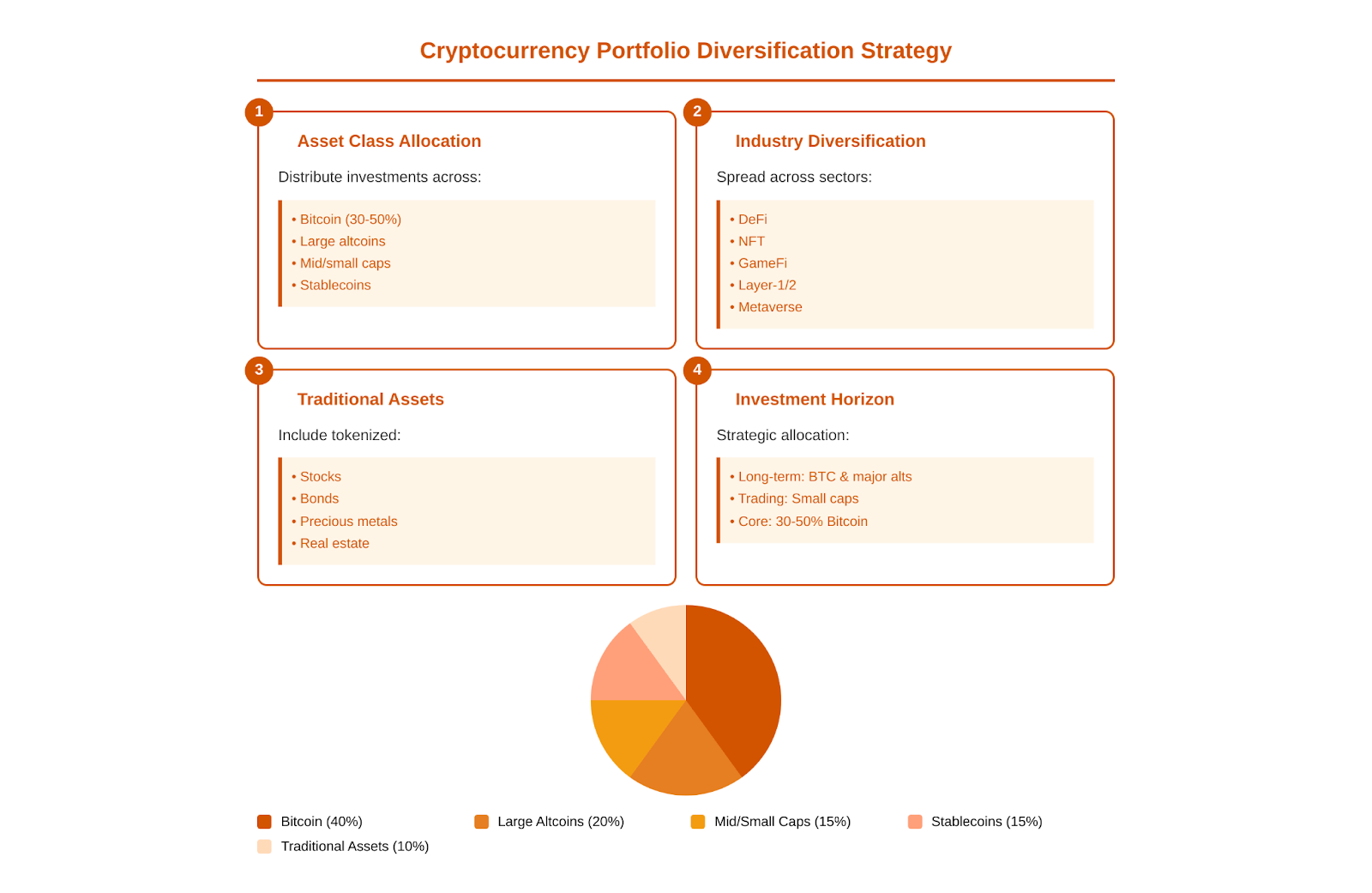

- Allocate capital between different asset classes: bitcoin, large altcoins (Ethereum, Litecoin, XRP), mid and small capitalization coins, stablecoins.

- Don’t limit yourself to one industry. Invest in projects from different spheres: DeFi, NFT, GameFi, Layer-1 and Layer-2 blockchains, meta-universes.

- Part of the portfolio can be invested in tokenized traditional assets: stocks, bonds, precious metals, real estate.

- Bitcoin and proven large altcoins are suitable for long-term investments. For speculative trading – more risky low-liquidity coins.

- The distribution proportions depend on your goals and risk appetite. But in any case, the share of bitcoin should be substantial – 30-50% of the portfolio.

Use of stop-losses and take-profits

Stop-loss is a stock exchange order to automatically sell an asset when a certain price reaches below the current price. It allows limiting the trader’s losses if the market goes against his position. Take-profit is an order to fix profit when the price reaches a certain level above the current one.

Stop-losses and take-profits are important tools of money management. They save a trader from the need to constantly monitor the market and make decisions based on emotions. At the same time, it is important to correctly determine the levels for their installation. A stop-loss that is too close may prematurely close a position due to market noise. A stop loss that is too far away can lead to excessive losses. The optimal placement of stops and profits depends on the volatility of the asset, your strategy and your risk/reward ratio.

The main disadvantage of stop losses is the possibility of slippage during strong market movements or low liquidity. Therefore, it is better to use limit stop orders instead of market stops. It should also be taken into account that stops are clearly visible to market makers, who can intentionally trigger them by moving the price.

Investing in cryptocurrency funds

Cryptocurrency investment funds are a convenient tool for those who want to gain access to digital assets, but are not ready to understand all the nuances of trading and safe storage of cryptocurrencies on their own. Such funds take on the role of professional managers, collecting the funds of many investors and distributing them in accordance with the stated strategy.

The pros of investing in crypto funds:

- Diversification. The fund allocates capital between different assets, minimizing risks.

- Professional management. Fund managers are usually experienced traders and analysts.

- Convenience. You do not need to understand the nuances of exchanges and wallets, monitor the market 24/7.

- Security. Funds use reliable custodial solutions and insurance.

Minuses:

- High management fees that “eat up” part of the profit.

- Risk of fraud and incompetence of managers.

- Limitations on withdrawal of funds, tied to the fund’s strategy.

- Lower profitability potential compared to independent trading.

To reduce risks, invest only in regulated funds with a proven track record, and read the documentation carefully.

Risk assessment before investing

Many traders treat cryptocurrencies as purely speculative instruments, trading on news and price charts without delving into the fundamentals of the projects. This is a risky approach. For successful long-term investing, it is important to be able to analyze the potential threats and prospects of coins.

What to look for when valuing cryptocurrency:

- Project team. The founders and developers have the necessary experience and reputation. Openness of the team, activity in social networks.

- Purpose and uniqueness of the product. Availability of a working product that solves real problems. Competitive advantages over analogs.

- Tokenomics. Model of issuance, distribution and incentivization of token holders. Number of coins in circulation and in the hands of the team/early investors.

- Blockchain metrics. Number of active addresses, transactions and volume of funds transferred, network hash rate.

- Code. Openness and quality of source code, results of smart contract security audits.

- Community activity. Number of subscribers and interaction in social networks, number of developers and projects in the ecosystem.

Analyze these factors comprehensively, do not blindly trust advertising and promises of high returns. The more careful you are in choosing an investment object, the lower your risks will be.

Using trading bots

Algorithmic trading with the help of bots is gaining popularity in the crypto industry. A trading bot is a program that interacts with an exchange API and automatically executes trades according to specified parameters. Bots can be used for arbitrage, marketmaking, scalping, and the implementation of complex strategies.

The benefits of bots in risk management:

- Strict adherence to the set rules for entering and exiting trades, trading volumes. No emotional decisions.

- Instant reaction to market events, working 24/7.

- Ability to test strategies on historical data before launching in real conditions.

- Simultaneous trading of several pairs on different exchanges.

- Broader diversification due to high speed of transactions.

At the same time, when trusting your money to a trading bot, you should be sure of the reliability of its code, the correctness of the strategy used and its adequacy to market conditions. You should also take into account the risks associated with the work of exchange APIs, the need to store funds and keys on centralized platforms. Use only proven open source solutions or develop bots on your own.

Psychology of investing and emotion management

Psychological factors play a huge role in trading and investing. Fear, greed, panic, euphoria – all these emotions can push traders to rash actions and lead to losses. This is especially evident in the cryptocurrency market with its extreme volatility and unpredictability.

Typical mistakes of investors under the influence of emotions:

- Buying at peak price for fear of missing out (FOMO – Fear of Missing Out). Example – the ICO boom in 2017 or Bitcoin soaring to $69,000 in 2021.

- Selling at the bottom due to panic caused by the market crash. Many investors got rid of bitcoin in March 2020 when its price dropped to $3800. BTC then rose 10 times its value.

- Over-diversification and investing in dubious projects out of greed and desire to maximize profits.

- Opening positions for amounts significantly exceeding the acceptable amount of risk per transaction.

- Delaying the fixation of profits in the hope of selling the coin at the very peak. Or on the contrary – premature closing of a position after the first small growth.

As you can see, emotions can seriously distort the perception of the market and push you to make critical mistakes. That is why it is so important to learn to keep your feelings under control and to base your trading on a clear plan rather than on impulsive decisions.

Here are some tips to help you deal with your emotions:

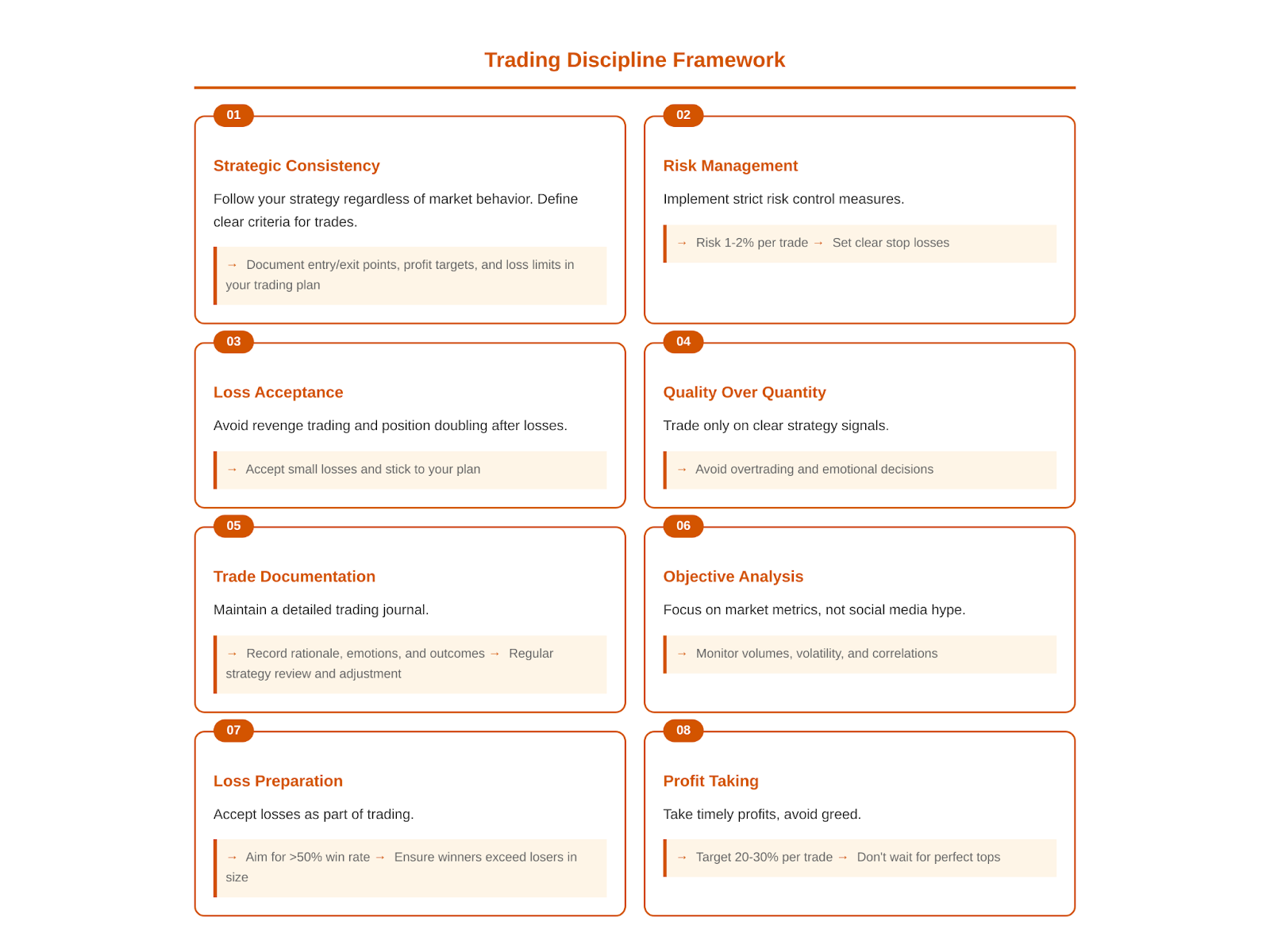

- Follow your strategy regardless of market behavior. Clearly define for yourself the criteria for entering and exiting trades, target profit levels and maximum allowable losses. Fix all this in a trading plan – and adhere to it strictly.

- Use risk management. Limit the amount of capital you can lose in each trade and for a certain period (week, month). It is optimal to risk no more than 1-2% of the trading account size in one transaction. Set stop losses to limit losses.

- Do not try to win back after a losing trade by doubling the size of the position. This is a sure way to drain your deposit. Just take a small loss and move on with your plan.

- Avoid excessive trading. Open a trade only when you see a clear signal according to your strategy. Mindless trading for the sake of the process usually leads to losses.

- Keep a trader’s diary, writing down the rationale for each trade, your emotions and thoughts about it, and the result. Analyze your mistakes and successes to adjust your strategy.

- Pay attention to objective market indicators, not emotional outbursts and social media hype. Use real metrics in your analysis – trading volumes, volatility, correlation with traditional markets.

- Be prepared for losses, they are inevitable. The main thing is that profitable trades should exceed losing trades in size, and the percentage of winning trades should be more than 50%. This will provide you with a positive expectation.

- Fix profits in time. Do not try to catch the very top of the rally. Be satisfied with a return of 20-30% per trade. This will save you from greed and frustration.

Of course, it is very difficult to completely abstract from emotions and make purely rational decisions on financial markets. We are all human beings, not robots. But realizing your inclinations, working on self-control and strictly following a proven strategy will help you to manage your emotions and not to follow them. If you still feel that it is difficult for you to cope with the psychological aspects of investing, it may be worth looking into algorithmic trading with the help of bots.

Risks in short and long-term investments

Short-term investments

Short-term trading, or trading, is a speculative strategy that involves making multiple trades throughout the day or week in order to profit from small price fluctuations. Traders try to guess the direction of the market in the short term using technical and fundamental analysis, following news and sentiment in the community.

- This approach can bring high profits in a short period of time, but the risks are very significant:

- Increased influence of emotions on decisions due to the need to react quickly to the market situation.

- High exchange commissions and spreads that “eat up” part of the profit in case of a large number of transactions.

- Risk of position liquidation in margin trading due to short-term price drawdowns.

- Stress and the constant need to monitor the market, which can lead to emotional burnout.

- Lack of clear understanding of fundamental factors affecting the price of an asset in the long term.

To reduce the risks of active trading, you need to:

- Use strict risk management. Limit possible losses to 1-2% of the trading account per transaction. Fix the size of profit 2-3 times more than the size of loss.

- Trade only with free funds, not using leverage, or using conservative leverage 1k2, 1k3.

- Diversify the portfolio, do not keep too many positions open at the same time.

- Keep a log of trades, analyze mistakes and follow a clear trading plan.

- Use proven strategies based on objective signals, not on emotions and intuition.

Long-term investments

Long-term investing in cryptocurrencies (“hodling”) involves buying digital assets with the intention of holding them for a long period of time (a year or more) with the expectation of significant growth in value. This is a more relaxed and balanced strategy that does not require constant market monitoring and active trading.

But it has its risks, too:

- The possibility of a prolonged “cryptozyme”, depreciation of the asset and loss of most of the capital, as, for example, happened with many altcoins after the ICO boom of 2017.

- The threat of hacking or collapse of exchanges and wallets through which cryptocurrencies were purchased. A high-profile example is the bankruptcy of the FTX exchange in 2022.

- Tightening of the screws on the part of regulators, up to a ban on ownership and transactions with cryptocurrencies in certain countries.

- Discovery of critical bugs and vulnerabilities in the code of blockchain protocols.

- Emergence of new technologies that surpass the current ones in terms of speed, security, scalability and make them irrelevant.

To mitigate these risks, you need to be very careful when choosing cryptocurrencies for long-term investment:

- Give preference to large coins with proven stability, high distribution and liquidity: Bitcoin, Ethereum, Litecoin, Bitcoin Cash.

- Evaluate how much the project product is in demand in the market and solves real business and user problems. Study fundamental indicators: development activity, number of transactions and active addresses, trading volume.

- Diversify your portfolio across different digital asset classes and crypto market sectors.

- Store coins only on safe, trusted wallets, preferably hardware wallets. Use reliable crypto exchanges for buying and selling, but not for storing.

Long-term investment in bitcoin and leading altcoins has brought impressive returns to many crypto-enthusiasts. But before embarking on this path, ask yourself questions: do you really have free funds that you are ready to part with for several years? Are you ready for a portfolio drawdown of 50-80%? Do you understand enough about blockchain technology to believe in its long-term potential? By weighing the pros and cons, you can make an informed decision.

Practical advice on risk mitigation

Setting the investment budget

One of the key principles of smart investing is to never invest more than you can afford to lose. This is especially true in the high-risk crypto market. Before you start investing, carefully analyze your finances and determine how much you are willing to spend on buying crypto-assets without jeopardizing your basic well-being.

Copytrading platforms often attract investors with promises of super profits, but you should treat them critically. Remember that in a volatile crypto market, even professional traders rarely perform consistently well over the long term. If you are interested in copytrading, look for platforms that, like Tradelink, verify the statistics of managers and carefully select strategies. But even in this case, your expectations should be moderate – any investment carries risks

Recommendations for setting an investment budget:

- Use only free funds that you will not need to cover your current expenses and obligations for the next few years.

- Set up a separate investment account and transfer a fixed percentage of your income to it every month. Investing gradually reduces the risks compared to investing a large sum of money in one lump sum.

- Diversify your investments between different asset classes: stocks, bonds, real estate, precious metals. It is recommended to allocate no more than 5-10% of your investment portfolio to cryptocurrencies.

- Clearly follow the established budget. Do not add funds to the account impulsively, succumbing to FOMO or the desire to recover from losses.

Determination of investment objectives

Each investor has his own goals and planning horizon. Some want to preserve capital against inflation, others want to quickly increase their savings. Some plan to spend their money in a couple of years, while others are saving for retirement. Depending on your personal goals, your approach to investing will differ.

A few tips for setting investment goals:

- Goals should be specific and measurable. Not just “make more money”, but “get 30% annual income in the next 5 years”.

- Goals should be realistic and achievable. “Increase capital 10 times in a month” is tempting, but practically unrealizable without extreme risks.

- Goals should be time-bound. Set clear dates by which you plan to achieve your desired metrics.

- Targets should be consistent with your risk profile. Conservative investors will be satisfied with a lower return for a more secure investment. Aggressive investors are willing to take higher risks for potentially higher returns.

Record your goals in your investment plan and refer to them when making trading decisions. Periodically evaluate your progress towards your goals and adjust your strategy if necessary.

Use of objective analytics

When making decisions about buying or selling cryptocurrencies, it is very important to be guided not by emotions and rumors, but by objective data and sober analysis. Unfortunately, many traders neglect research, preferring to act at random. This is a sure way to losses.

What analytics to use to inform decisions:

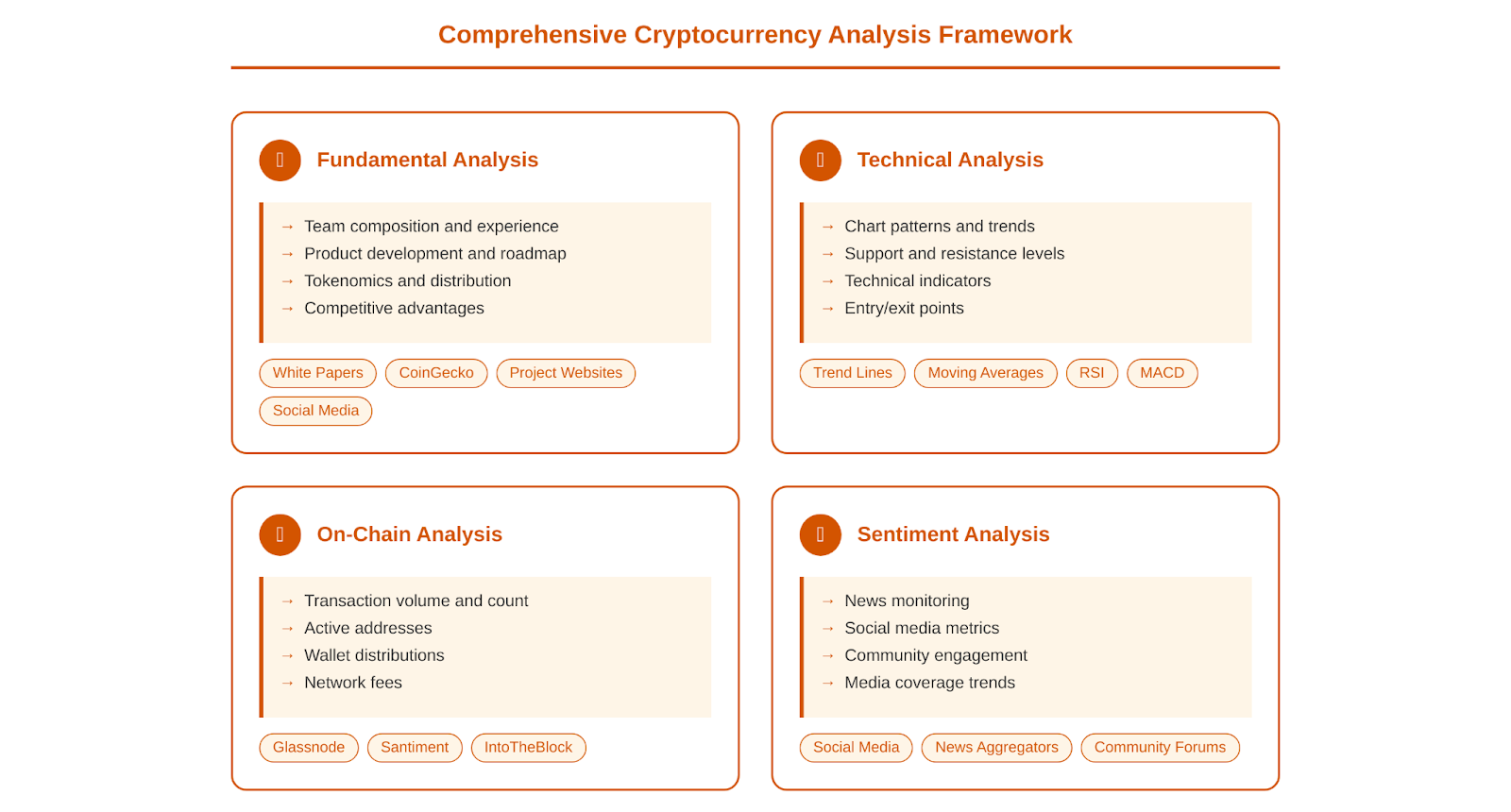

- Fundamental analysis. Study the basic indicators of cryptoprojects: team, product, tokenomics, competitive advantages, real use cases, ecosystem dynamics. Information can be found in white papers of projects, on their websites and social networks, on specialized resources like CoinGecko.

- Technical analysis. Use charts and indicators to find patterns in the price movement and determine entry and exit points. Basic tools: trend lines, support and resistance levels, moving averages, RSI, MACD. Learn to build and test trading strategies.

- Analyze on-chain metrics. Analyze data on blockchain activity: number and volume of transactions, active addresses, wallet balances, commissions. Glassnode, Santiment, and IntoTheBlock aggregate this information and provide insights into the behavior of market participants.

- Sentiment Analysis. Follow the news background and community sentiment, but filter the information. Sudden spikes in social mentions of coins, an influx of new users in project chats, increased media coverage may indicate growing interest and potential price rise. And vice versa – fading hype is often a bearish signal.

Conclusion

Investing in cryptocurrencies involves high risks due to market volatility and possible security threats. However, with a competent approach, risks can be minimized. Successful crypto-investing requires investing only free funds, careful study of projects, portfolio diversification and competent risk management. It is important to rely on technical analysis, make decisions based on data, constantly learn and start with small amounts. Cryptocurrencies are not a shortcut to wealth, but a tool that requires knowledge and experience. Evaluate your capabilities and risk tolerance before you start investing.