RWA: Tokenization of Real-World Assets in Blockchain

Contents

- Introduction

- What Are RWAs

- How Real Assets Are Brought to the Blockchain

- Benefits of Tokenizing Real World Assets

- How RWAs Are Changing Trading

- Potential Risks and Challenges

- Conclusion

Introduction

A Brief Definition of RWAs (Real World Assets)

Real-world assets (RWAs) are physical assets in the real world. These include apartments, cars, land, gold, or company shares. On the blockchain, such assets are turned into digital tokens. A single token can represent a fraction or the entirety of an asset, allowing trading of real-world items in a digital format.

Why This Trend Is Gaining Popularity

Blockchain was initially used mainly for cryptocurrencies—everything operated within the realm of the digital economy. But now, more attention is shifting toward assets connected to the physical world.

People want to invest in things they understand. Many don’t trust tokens without any backing. But when a token is tied to an apartment, office, or gold, it inspires more confidence. Blockchain also simplifies such transactions, making them faster and more accessible. There is no need to go to a bank, deal with paperwork, or pay intermediaries. Everything works online and is open to verification.

These advantages have made RWAs one of the most talked-about trends in the crypto space. More and more projects are bringing real-world assets onto the blockchain to attract new investors and demonstrate stability.

What Are RWAs

Definition and Examples of Real World Assets

Real-world assets are physical objects that can be seen or touched. For example:

-

Real estate – houses, apartments, warehouses

-

Commodities – gold, silver, oil

-

Securities – stocks, bonds, funds

These assets are brought onto the blockchain and divided into tokens. These tokens can be bought, sold, or transferred. For instance, one token could represent 1% of a downtown apartment or 10 grams of gold stored in a vault. This allows people to invest in high-value assets with relatively small amounts of money.

How RWAs Differ from Traditional Digital Assets

Digital assets like Bitcoin or Ethereum have no physical backing. Their value depends entirely on market demand, news, and investor sentiment. They aren’t backed by gold, real estate, or companies.

In contrast, RWAs are always backed by something tangible. A token has value because it’s tied to a real object. For example, if a token represents an office building, its price may rise as rental income increases.

Another key difference is that cryptocurrencies can be created in minutes. RWAs, however, require valuation, legal verification, and documentation. Ensuring the underlying asset exists and can be legally transferred to a new owner is essential.

This connection to the real world makes RWAs more reliable. However, since they involve real property, not just numbers on a screen, they also demand more oversight.

How Real Assets Are Brought to the Blockchain

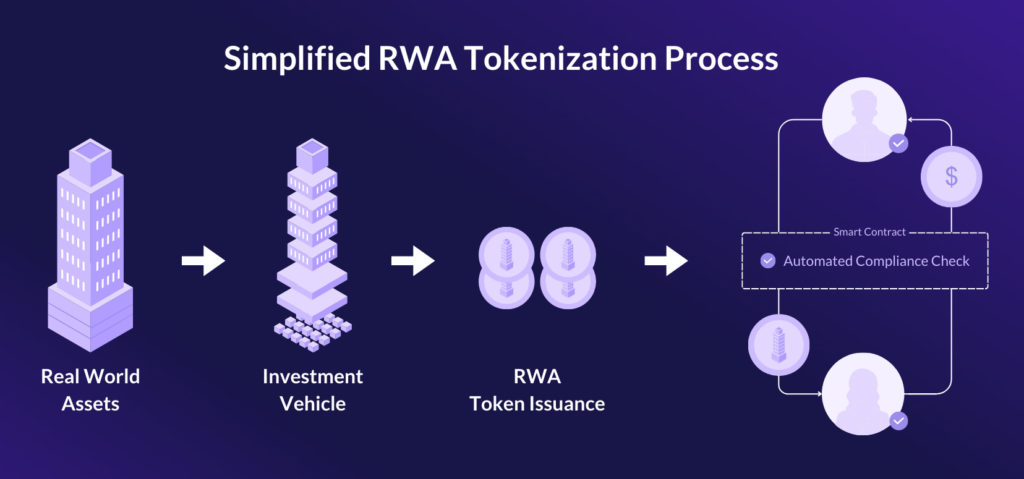

Tokenization of Assets: What It Is and How It Works

Tokenization is converting a real-world object into a digital token on the blockchain. Imagine someone owning an apartment—they could divide it into 1,000 tokens. Each token represents a small share of that property. These tokens can be traded just like regular cryptocurrencies.

Tokenization makes it possible to invest in expensive assets piece by piece. You don’t need a million rubles to invest in a building—just buy a few tokens and become a co-owner. All of this is managed through smart contracts—self-executing programs that handle the buying, selling, and transfer of ownership automatically.

Core Technologies and Blockchains Supporting RWAs

Several blockchains currently support the tokenization of real-world assets:

-

Ethereum – the most popular platform with extensive tools for creating and managing tokens

-

Solana – a fast, low-cost network suitable for high-frequency token trading

-

Polkadot enables interoperability between different blockchains, making flexible RWA projects possible

-

Avalanche, Polygon, and others – also active in the RWA space, offering various technical advantages

Each blockchain offers different benefits. The choice depends on the project’s goals, asset type, and speed and transaction cost requirements.

Regulatory and Legal Considerations

Since RWAs are tied to physical assets, legal compliance is crucial. For example, the issuer must prove legal ownership if a token is linked to an apartment. It’s also important to know who can legally buy these tokens—in some countries, a license or government approval is required.

Lawyers and regulators are beginning to address these concerns by creating guidelines to protect investors and improve transparency. A token might be declared invalid without clear regulations, leading to potential financial loss. That’s why every serious RWA project aims to resolve legal issues upfront.

Benefits of Tokenizing Real World Assets

Easier Access to Investment Opportunities

Traditionally, investing in real estate or gold required significant capital. It also involved banks, brokers, and a lot of paperwork. Tokenization simplifies this. You can buy a share of an asset directly online without the bureaucracy. This opens up investment opportunities to a much broader audience.

Improved Liquidity

Liquidity refers to how quickly an asset can be sold. Real-world assets are often illiquid—you can’t instantly sell part of a house or a gold bar. On the other hand, Tokens can be transferred almost instantly between users. This makes the market more dynamic and accessible, allowing people to freely buy and sell shares in different assets.

Lower Transaction Costs

Traditional transactions involving real estate or securities can be expensive. You need to pay agents, banks, and lawyers. With blockchain, many of these costs are eliminated. Smart contracts automatically handle most of the work, saving time and money.

Transparency and Security of Transactions

Blockchain stores a permanent, verifiable record of every transaction. Nothing can be tampered with or hidden. This reduces the risk of fraud and gives users more control over their assets. They manage their tokens directly, without relying on intermediaries.

How RWAs Are Changing Trading

Impact on Traditional Financial Markets

The market for real-world assets has long been dominated by institutional players: banks, funds, and wealthy investors. But RWAs are shifting the landscape. Now, everyday users can participate in deals that were once off-limits. This leads to capital redistribution, with funds flowing from traditional channels into tokenized products. Banks and exchanges are already taking notice and looking for ways to integrate blockchain solutions.

New Strategies and Opportunities

Trading RWA tokens unlocks new earning models. For instance, users can buy tokens tied to real estate and earn rental income. Or they can trade tokens linked to oil and metal prices without going through brokers. Some platforms even allow users to use RWA tokens as collateral for loans. These are new strategies that didn’t exist in the crypto world before.

Case Studies and Successful Projects

One example is Centrifuge, which allows companies to tokenize invoices and contracts in DeFi protocols. Another is RealT, a platform issuing tokens backed by U.S. real estate. Token holders receive rental income from tenants. Major investment firms are also experimenting with blockchain-based bonds and funds. These examples show that the RWA model is already working and delivering real results.

Potential Risks and Challenges

Market Volatility

Even if a real asset backs a token, its price can still fluctuate significantly. Factors include general market conditions, investor sentiment, and news cycles. Sometimes, a token may trade below the value of the underlying asset. This poses risks for investors, especially those unfamiliar with these markets.

Regulatory Restrictions

Laws vary across countries. In some jurisdictions, tokens linked to real-world assets are considered securities, requiring registration and strict compliance. Some projects face bans or restrictions. Users must understand how such assets are regulated in their country to avoid legal issues.

Technical Barriers and Trust Issues

RWAs require robust technical infrastructure, and smart contracts must be secure from hacks. Additionally, investors need to trust the token issuer. It’s not always easy for individuals to verify the existence of the underlying asset. Auditing firms and transparency solutions are emerging, but risks from technical flaws or dishonest developers still exist.

Conclusion

RWAs offer exciting new opportunities for trading and investment. They bridge the gap between crypto and the physical world. Anyone can invest directly in real estate, commodities, or bonds through the blockchain. But it’s essential to understand the risks. The market is still evolving, and many questions remain unanswered. With an innovative and cautious approach, RWAs can become a reliable tool in any investor’s portfolio.