Crypto vs Stock Market: Similarities and Differences

Contents

- Introduction

- Overview of the Cryptocurrency Market

- Overview of the Stock Market

- Correlations Between the Crypto and Stock Markets

- Key Differences Between the Crypto and Stock Markets

- Regulation: A Comparison of Regulatory Environments

- Risk and Volatility: Cryptocurrencies as High-Risk Assets

- Liquidity and Accessibility: Trading Platforms and Entry Barriers

- Trading Hours: 24/7 Crypto Trading vs. Limited Stock Market Hours

- Taxation and Legal Status: Differences in Policy and Classification

- Interaction Between Crypto and Stock Markets

- The Future of Crypto and Stock Markets

- Conclusion

Introduction

Cryptocurrencies have become a significant part of the modern financial world. More and more people are interested in how they work and differ from traditional assets. To understand this, it is useful to compare the crypto market with the stock market. This helps clarify how both markets operate, what drives them, and their key differences.

Overview of the Cryptocurrency Market

The cryptocurrency market is a space where people buy and sell digital coins. These coins exist only electronically and are based on a unique technology called blockchain. This is a digital system where all transaction data is stored in a chain of blocks. Each block is linked to the previous one, and the information inside cannot be altered.

A key feature of cryptocurrencies is decentralisation. This means no central authority or organisation is controlling them. For example, Bitcoin is not governed by banks or governments. The network participants make all decisions.

Cryptocurrencies are also often associated with anonymity. People can send funds without revealing their identities. However, complete anonymity is rare in practice. It depends on the specific coin and how it’s used.

Major Cryptocurrencies

The most well-known cryptocurrency is Bitcoin. It was the first to be created and remains the leader in popularity and market value. Bitcoin is often called “digital gold” because its supply is limited and can serve as a store of value.

The second most crucial cryptocurrency is Ethereum. Unlike Bitcoin, it is a store of value and a platform for building decentralised applications. This makes Ethereum flexible and valuable for new tech projects.

Besides these two, thousands of other coins are referred to as altcoins. Some are designed for specific purposes, such as fast transactions or enhanced privacy. Others copy existing ideas but try to add something new. Popular altcoins include Solana, Cardano, Avalanche, and more.

Advantages and Disadvantages of Cryptocurrencies

Cryptocurrencies offer several substantial advantages. First, they allow fast, borderless money transfers without intermediaries. Fees are often lower than those banks charge, especially for international transfers. Second, anyone with internet access can use them—there’s no need for a bank account, just a wallet.

Cryptocurrencies are also not affected by inflation in the same way as traditional currencies. For instance, there will never be more than 21 million Bitcoins, making them resistant to devaluation.

However, digital currencies have downsides. Their prices can fluctuate dramatically—even within a single day—making them risky investments. Additionally, not all countries allow the free use of crypto assets; in some places, they are banned altogether.

There’s also a risk of losing funds if a user forgets their wallet password or sends coins to the wrong address. Unlike banks, there’s no way to reverse transactions or recover access through customer support.

Overview of the Stock Market

The stock market is where securities such as stocks, bonds, and indices are traded.

-

Stocks represent ownership in a company. When someone buys a stock, they become a partial owner and can earn profits if the company grows.

-

Bonds are debt instruments. When you buy a bond, you’re lending money to a company or government, and you get paid back with interest over time.

-

Indices are collections of stocks from various companies. They reflect the general market mood. For example, if an index rises, most companies also perform well. Similar indices exist in crypto, too.

The stock market operates under strict rules. Participants know how transactions work, who is responsible for what, and what risks exist, making it more predictable than the crypto market.

Key Participants in the Stock Market

Several types of players participate in the stock market.

-

First are investors. They buy securities to profit from price increases or earn dividends.

-

The second are brokers. They help investors buy and sell stocks. Without a broker, an average person can’t access the exchange.

-

Third are the companies themselves. They issue stocks and bonds to raise capital for growth and must publish financial reports so investors can make informed decisions.

Financial Instruments and Their Roles

There are many financial instruments on the stock market, each with a specific purpose.

Stocks allow you to become a company’s part-owner, ideal for those looking to benefit from business growth.

Bonds appeal to those seeking stable income with lower risk. They’re generally considered safer than stocks.

Indices allow investors to put money into a group of companies at once, spreading risk across multiple assets.

There are also more complex tools like futures and options, but beginners are better off starting with simple assets like stocks and bonds.

Correlations Between the Crypto and Stock Markets

Though crypto and stock markets are different worlds, they sometimes behave similarly, especially during times of crisis, when assets across the board respond to the same global events.

Impact of Macroeconomic Factors

Both markets are affected when inflation rises or central banks increase interest rates.

For example, higher interest rates make borrowing more expensive. As a result, consumers spend less, companies earn less, and markets decline. This impacts stocks and cryptocurrencies.

Global crises, like pandemics or banking issues, affect the entire financial system. Investors move their money into safer assets like gold or the US dollar. In such moments, both crypto and stock markets may drop sharply.

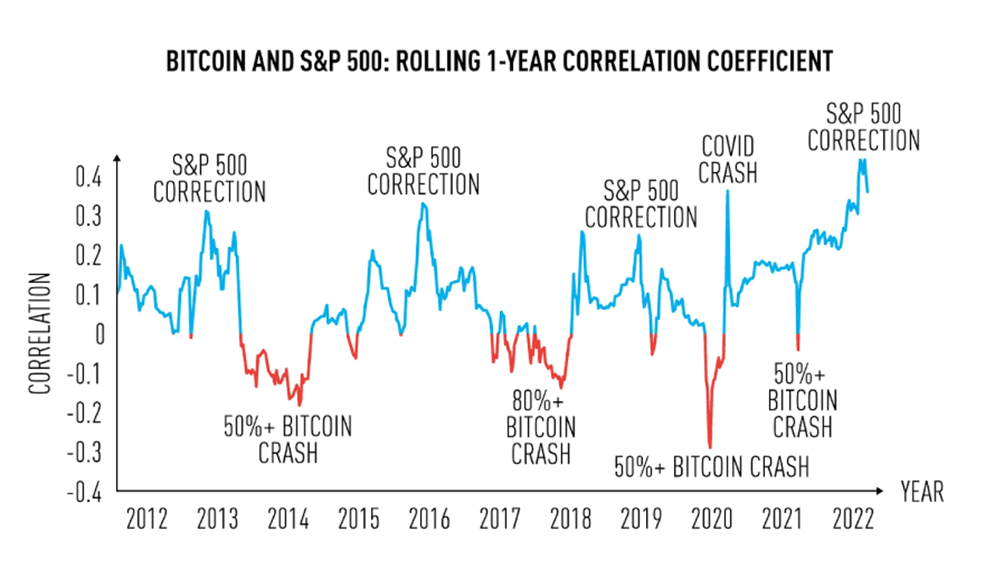

Correlation During High Volatility Periods

Both markets often react similarly during periods of extreme price movement. Investors tend to behave the same way in times of panic or euphoria.

For instance, if the stock market crashes, people may start selling crypto too, trying to protect their money, even if it means taking a loss. As a result, both markets fall.

The same applies during bull runs. When investor confidence grows, they invest in stocks and riskier assets like crypto, driving prices up across both markets.

Similar Growth and Decline Patterns in Certain Periods

There are times when crypto and stocks rise or fall together. This usually reflects broader economic trends.

After the 2020 crisis, for example, both markets surged. With low interest rates and strong economic stimulus, investors poured money into assets, boosting stock indices and cryptocurrencies like Bitcoin and Ethereum.

Such parallels aren’t always precise but are becoming more common, showing that crypto is starting to behave more like traditional markets.

The Role of Institutional Investors

In the past, crypto was mainly the domain of individual investors. Large players like funds, banks, and hedge firms have entered the space. These institutions have long been part of the stock market and now influence crypto.

When institutional investors make large buys or sales, they move markets. Their decisions are based on data, models, and forecasts, bringing more market structure but also increasing sensitivity to global factors.

If significant funds start selling stocks, they may exit their crypto positions. As a result, both markets now often respond to the same signals.

Key Differences Between the Crypto and Stock Markets

Regulation: A Comparison of Regulatory Environments

The stock market is highly regulated. Every transaction, company, and even advertisement must follow strict rules. Oversight from regulatory bodies helps reduce risk and protect investors.

The crypto world is very different. Regulation is still emerging. Some countries have explicit rules; others have none. This leads to issues with scams and unpredictable projects.

This contrast affects reliability. The stock market is a tightly controlled system with clear rules, while the crypto market remains an open field where anything can happen.

Risk and Volatility: Cryptocurrencies as High-Risk Assets

Crypto prices are highly volatile. A coin might be worth $30,000 one day and $25,000 the next. These sharp movements scare newcomers but offer profit opportunities for those who can react quickly.

The stock market is calmer. Stock prices also move, but usually more gradually. Even in crises, declines tend to be slower than in crypto.

This makes cryptocurrencies riskier. They can yield high returns, but losses can come just as fast.

Liquidity and Accessibility: Trading Platforms and Entry Barriers

Most stock market trades go through brokers. First, you must open an account, verify your identity, and sign documents. In some countries, the minimum investment is relatively high.

In crypto, it’s much easier. You just need to create a wallet and register on an exchange. Many platforms let you start with as little as $10, making it accessible even to students.

Liquidity also differs. While stocks of major companies are easy to buy and sell, liquidity in crypto varies by coin.

Trading Hours: 24/7 Crypto Trading vs. Limited Stock Market Hours

Stock markets have fixed hours. In the U.S., for example, exchanges are open from 9:30 AM to 4:00 PM on weekdays. Traders can’t react immediately if significant news breaks at night or on weekends.

Crypto markets operate 24/7. Exchanges never close—not on weekends or holidays. Anyone can trade at any time. This offers more freedom but adds stress, since the market never sleeps.

Taxation and Legal Status: Differences in Policy and Classification

Stocks, bonds, and other securities are well-integrated into tax systems. Rules are clear: if you sell for a profit, you pay tax.

Crypto is more complicated. Some countries treat it as property, others as digital assets, and some ban it altogether. This creates confusion.

People may not know when or how much tax to pay. Moreover, laws change rapidly. There may be no tax today, but one may be introduced tomorrow, which adds uncertainty and requires vigilance from investors.

Interaction Between Crypto and Stock Markets

The Influence of Crypto on the Stock Market

In the past, crypto had little effect on the stock market. It was too small and isolated. That’s changing.

Large companies now buy Bitcoin and launch crypto-related products, which attracts interest from stock market investors. When something major happens in the crypto world, related stocks often react.

For example, if Bitcoin crashes, the shares of exchanges or crypto-focused companies may also drop.

Cases Where Crypto Affected the Stock Market

There have been events where crypto caused significant reactions in traditional markets. One example is the collapse of FTX in 2022.

After this incident, investors began selling off stocks of companies linked to crypto. The entire sector was affected, and even firms with only indirect connections grew cautious.

Such episodes show that crypto is now part of the broader financial ecosystem. When it shakes, the impact is felt beyond its borders.

Investor Strategies: Diversifying with Crypto and Stocks

Many investors now diversify across crypto and traditional assets. The idea is not to put all your eggs in one basket.

If stocks drop, crypto might rise—or vice versa. This helps smooth out losses and balance a portfolio.

However, both markets can also fall at the same time. That’s why it’s crucial to monitor the share of each asset class and avoid overexposure.

The Future of Crypto and Stock Markets

Outlook Based on Current Trends

Financial markets are constantly evolving. Cryptocurrencies are no longer a niche topic—they’re now discussed at the highest levels. More people, companies, and even governments are paying attention.

Current trends show growing interest in digital assets. New projects offer faster transfers, transparent accounting, and protection from fraud, and people are beginning to trust these innovations.

The stock market is changing, too. Young investors are entering with fresh expectations—they want simple apps, fast transactions, and clear conditions. This is pushing traditional systems to modernise.

If this trend continues, crypto and stock markets may move closer together, and the line between them could eventually blur.

Impact of Innovation and Technology on Both Markets

Technology is transforming everything, and finance is no exception. In the past, stock trades were paper-based. Now, they’re executed with a click. But crypto goes even further.

It uses blockchain, a system storing information across thousands of computers. This boosts security and makes tampering nearly impossible.

We see the rise of smart contracts, tokenisation, and DeFi platforms. These innovations show the pace of development.

The stock market isn’t standing still either. It’s adopting automation, AI, and even blockchain. These tools reduce costs and speed up operations.

Both sectors are likely to use the same technologies in the future. This will foster convergence and open up new forms of investing.

Integrating Crypto into Traditional Finance

A few years ago, banks and major investors avoided crypto. That’s changing.

Some countries are developing their digital currencies, and big banks are launching crypto divisions. Services allowing Bitcoin or Ethereum payments for everyday goods are becoming more common.

This suggests crypto could be integrated into the traditional financial system. Yes, the road to full integration is long. It will require new laws, secure infrastructure, and public trust.

But crypto is no longer an outsider; the most crucial shift has happened. If the trend continues, digital assets may become part of everyday financial life.

Conclusion

Cryptocurrencies and the stock market are still quite different, but their connection is becoming clearer. Both sectors are evolving, learning from each other, and beginning to overlap.

The crypto market moves fast, offering new opportunities but with higher risks. The stock market grows more slowly, providing a foundation for long-term investors.

The future will show how these two systems can coexist. They may become a single space where digital and traditional assets complement each other. For now, investors need to explore both sides and make decisions with a complete understanding of the risks and rewards.