What is Swing Trading and How to Apply It in Cryptocurrency?

Contents

- Swing trading basics

- How swing trading applies to the cryptocurrency market

- Tools and indicators for swing trading in the cryptocurrency market

- Risks of swing trading in the cryptocurrency market

- Advantages and disadvantages of swing trading in cryptocurrency

- Conclusion

Swing trading basics

What is swing trading?

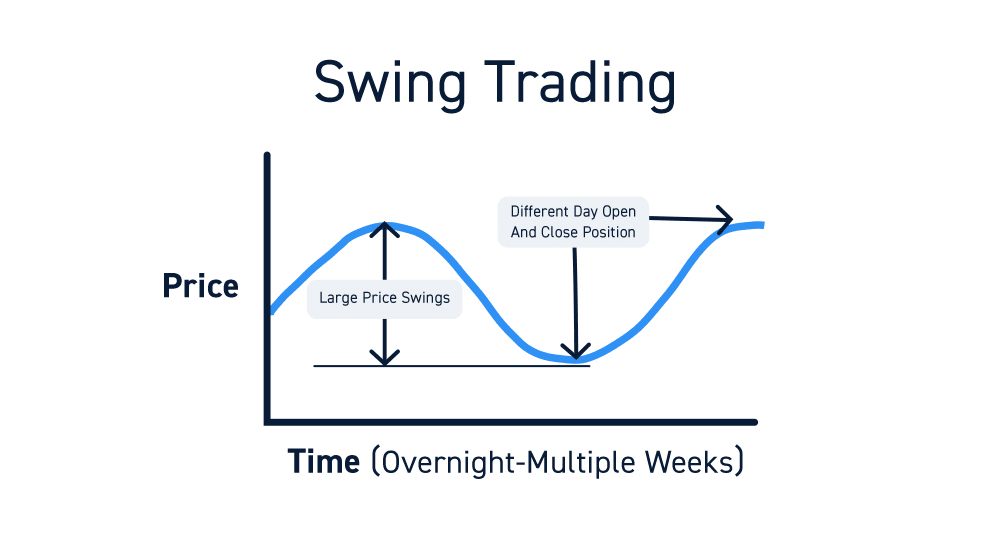

Swing trading is a trading strategy in which traders capitalize on short-term price movements that occur within a larger trend or correction. Traders tend to open a trade at a point near the local low and exit near the local high, taking profits from each price movement.

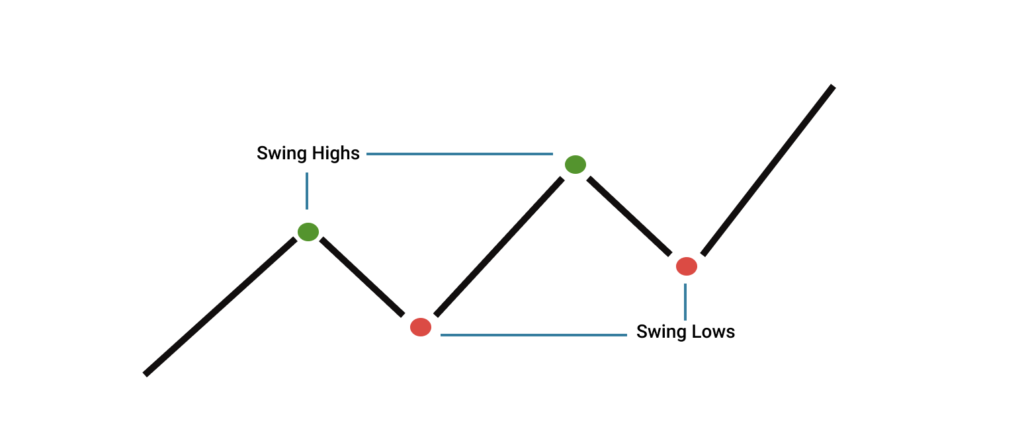

Operating principle: buying at the lows and selling at the highs

Swing trading is based on a simple but effective principle: buy an asset at a low price and sell it at a higher price, or vice versa. However, this simplicity hides the need for in-depth market analysis. Swing traders use technical analysis to identify key support levels (where the price usually stops falling and starts rising) and resistance levels (where price growth often stops) or vice versa. For example, if the bitcoin price has bounced off the $60,000 level several times, this could be a buy signal, while the $65,000 level, where the price previously reversed downward, is a sell signal.

Position holding time

One of the main features of swing trading is the duration of trades. Unlike intraday trading, where all positions are closed by the end of the day, or scalping, where trades last for minutes, swing traders keep positions open for several days. This allows them to capitalize on larger price movements without being tied to a screen 24/7. For example, a trader may open a position on Monday after noticing the start of an uptrend and close it on Friday when the price reaches the anticipated peak.

Main swing trading strategies

There are several strategies that are used in swing trading:

- Trend trading: a trader follows the main direction of the market, buying on pullbacks in an uptrend or selling on rebounds in a downtrend.

- Countertrend trading: open trades in anticipation of a price reversal, such as buying on strong support after a long decline.

- Breakout trading: entering a trade when the price overcomes an important resistance or support level, which often indicates the beginning of a strong trend movement.

Each of these strategies requires a different approach to analysis and patience to wait for the right time to enter and exit trades.

How swing trading applies to the cryptocurrency market

Features of cryptocurrency markets

The cryptocurrency market is unique in many ways.

- It never closes - trading goes on around the clock, giving traders more trading opportunities.

- Cryptocurrencies are still little controlled by central regulators, making the market freer, but also more unpredictable.

- Cryptocurrencies often react to news, from announcements by major companies to tweets by influential personalities such as Ilon Musk or Vitalik Buterin. These factors create good conditions for swing trading.

Volatility as an advantage

Volatility is something that scares beginners but pleases experienced swing traders. For example, the price of bitcoin can fall from $70,000 to $60,000 in a couple of days due to a correction, and then rise to $68,000 on the background of positive news. Such movements are a real gift for a swing trader, who can earn 5-10% profit in a week by choosing entry and exit points wisely.

Which cryptocurrencies are suitable for swing trading?

Not all cryptocurrencies are equally good for swing trading. It is best to choose assets with high liquidity, where there are many market participants, on such cryptocurrencies movements are smoother and clearer, unlike low-liquidity cryptocurrencies, where the price is managed by a small number of participants. Such cryptocurrencies include the following:

- Bitcoin (BTC): the king of cryptocurrencies, which often sets trends for the entire market.

- Etherium (ETH): the second most capitalized asset, which is no less popular than bitcoin

- Binance Coin (BNB): a token of the Binance exchange, the largest cryptocurrency exchange at the moment

- Solana (SOL): a widely known project that provides users with maximum decentralization, high level of security and easy network scaling process.

Lesser known coins (so-called “shieldcoins”) can also be interesting, but they are more risky due to low liquidity and a lot of manipulation on them.

Examples of successful transactions

Let’s look at a hypothetical example. At the beginning of February 2025, etherium (ETH) fell to $2,100. A swing trader analyzing the chart noticed a strong support level at this price and bought 1 ETH. A couple days after what happened, the price rose to $2,800. Selling at that price would have made $630 profit (about 30%) in a few days. Such opportunities are common in the crypto market, if you know how to find them, you can make good profits.

Tools and indicators for swing trading in the cryptocurrency market

Technical analysis

Swing trading cannot be imagined without technical analysis. Here are the key elements:

- Support and resistance: levels where the price often stops or reverses. For example, if bitcoin bounced off $90,000 three times, that’s strong support.

- Trends: determining the direction of the market (up, down or sideways) helps you choose a strategy.

- Volumes: an increase in volume often indicates the strength of the price movement.

Indicators

Technical indicators are mathematical tools that simplify analysis:

- RSI (Relative Strength Index): measures the strength of the trend. Values above 70 indicate overbought (possible downward reversal), values below 30 indicate oversold (possible upward movement).

- MACD (Moving Average Convergence Divergence): shows crossing lines indicating a possible trend change.

- Moving averages (MA): lines on a chart that smooth out price data over a period of time. The intersection of a short (e.g., 20-day) and long (50-day) average can be an entry signal.

Risks of swing trading in the cryptocurrency market

High volatility

Volatility is a double-edged sword. It creates opportunities, but it also increases risks. For example, if you bought bitcoin at $62,000, expecting it to rise to $65,000, and a negative news story comes out at night, the price could plummet to $58,000, leaving you with a loss. Therefore, it is always necessary to take risks and control your positions.

Risks of forecast error

Technical analysis does not provide a 100% guarantee. False breakdowns or unexpected events (exchange hacking, regulatory bans on cryptocurrencies) can ruin even the most elaborate plan.

Risk management

To minimize losses:

- Set stop losses: for example, if you bought $3,000 worth of ETH, a stop loss of $2,900 would limit your loss to 3%.

- Follow money management: risk no more than 1-2% of your capital in a single trade. If you have $10,000, the maximum risk is $100-200.

Advantages and disadvantages of swing trading in cryptocurrency

Advantages

- Profiting from price fluctuations: even in a sideways market you can find profitable situations.

- Less stress: there is no need to monitor charts every minute as with intraday trading.

- Flexibility: suitable for those who combine trading with their main job.

Disadvantages

- Need to analyze: you need to check the market regularly so that you don’t miss important points.

- High risk: errors in forecasts or sudden events can lead to significant losses.

Conclusion

Swing trading is a suitable trading method for those who want to make money in the cryptocurrency market without spending all day in front of a computer screen. It combines a moderate pace, profit potential, and relative freedom of action. However, success in this strategy requires knowledge of technical analysis, risk management skills and discipline. The cryptocurrency market with its volatility and round-the-clock operation provides ideal conditions for this. Start with small positions, test indicators and strategies on a demo account, analyze your trading and soon you will be able to find the right situations for trades. Perhaps swing trading will be your path to financial freedom in the world of cryptocurrencies!

And in situations where you don’t have much time but want to invest in cryptocurrency and earn without spending extra time trading and learning, check out our TradeLink Marketplace service.

We strive to make investing accessible and profitable for everyone by providing modern tools that help minimize risks and maximize profits. Our algorithmic indices are regularly updated and adapted to market changes, so that you can be confident in the stability and prospects of your investments.