Breaking down strategies by tags: How to choose yours?

Contents

Breaking down strategies by tags: How to choose yours?

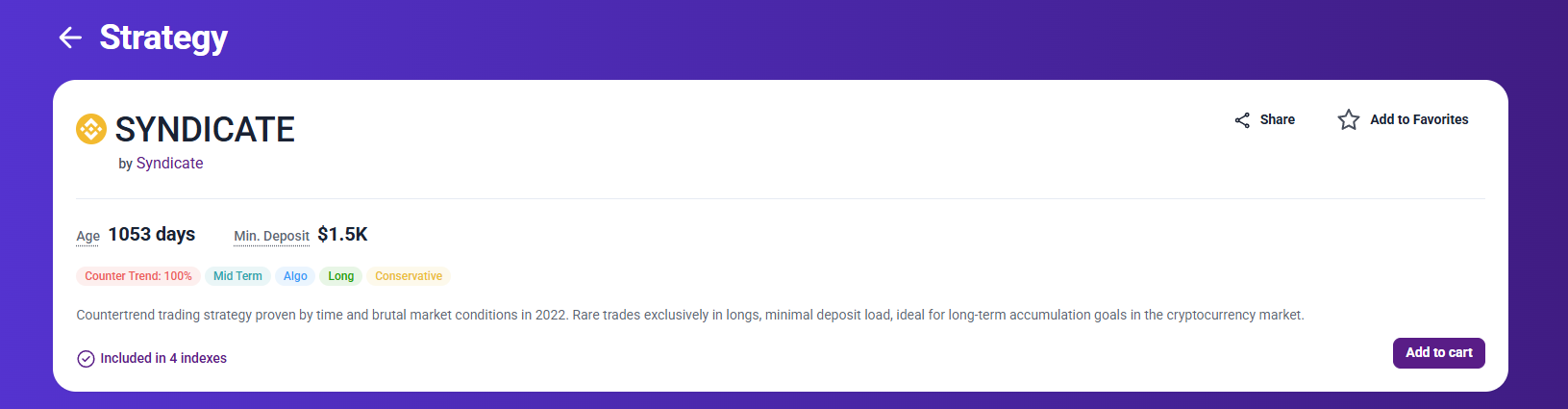

When selecting a trading strategy, it’s crucial to understand its logic and principles. At TradeLink Marketplace, we’ve made this easier — just take a look at the multicolored tags on a strategy’s page. These tags instantly provide key insights into the trading method, risk level, and market behavior of the algorithm.

There are five main tags, each representing a key characteristic:

- Market Direction – trend-following, counter-trend, or a combination of both. Trend-following strategies ride market momentum, counter-trend strategies catch reversals, and combined ones adapt to both scenarios.

- Trading Speed – scalping, mid-term, or long-term. Just like in manual trading, this reflects trade frequency, from rapid entries and exits to holding positions for extended periods.

- Management Type – in most cases, algorithmic. Fully automated strategies reduce emotional bias and ensure stable execution according to predefined rules.

- Position Type – a strategy may focus exclusively on long positions, short positions, or a combination of both. This depends on the logic and approach of its developer.

- Risk Level – conservative, medium, or high. Your choice should align with your risk tolerance and desired risk-reward ratio.

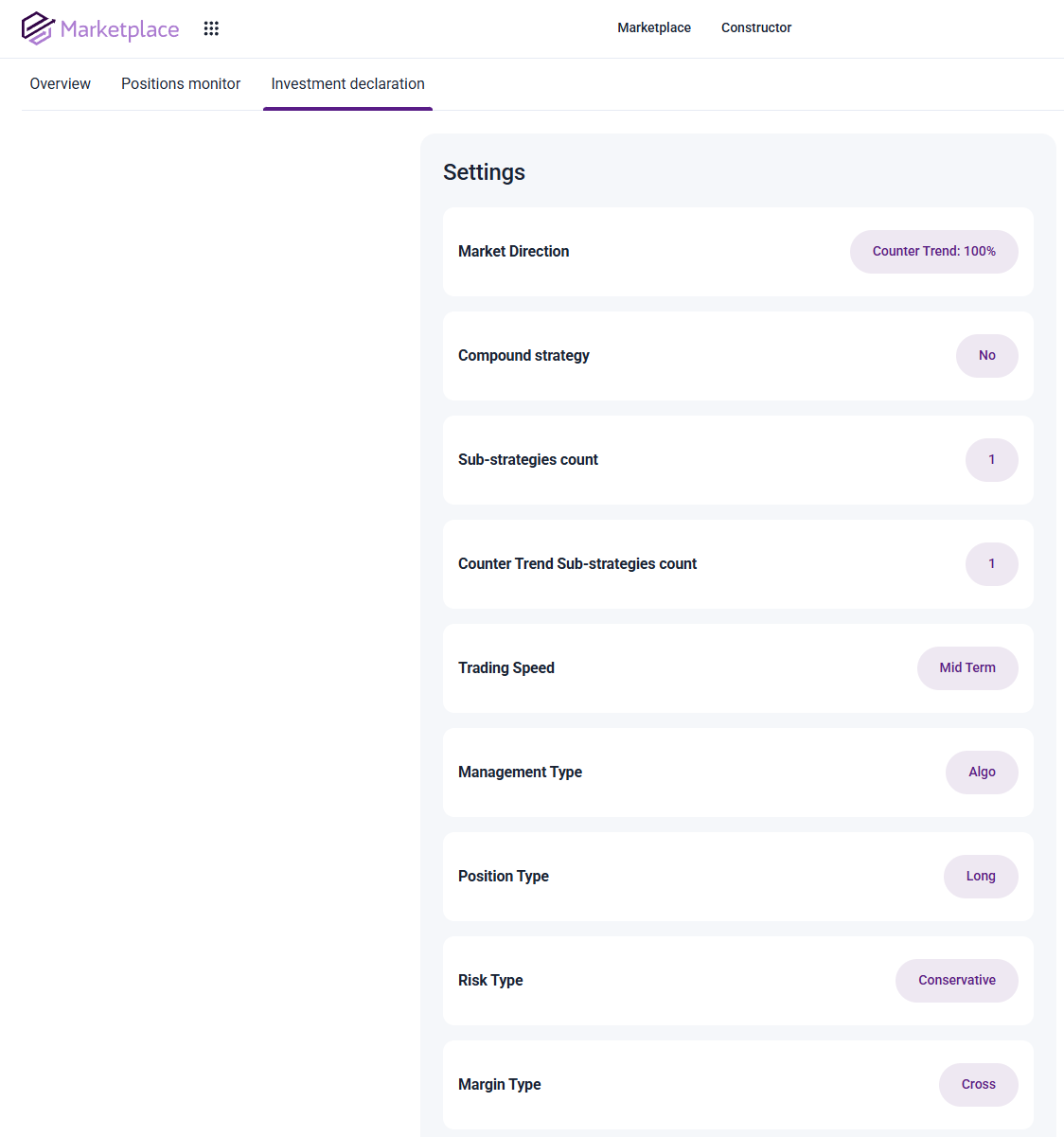

But these tags are just the tip of the iceberg. A strategy’s full description and key parameters are outlined in its investment declaration — a document that details all its rules and limitations. You can find it on the strategy’s page, so make sure to review it before investing.

Choose strategies that match your investment style. TradeLink Marketplace offers a selection of thoroughly vetted algorithmic strategies from experienced managers — you’re sure to find one that fits your goals.