Cryptocurrencies with the highest volatility: how to profit?

Volatility is a key term in the world of cryptocurrencies, which describes the variability of an asset’s price over a certain period of time. The higher the volatility, the greater the price fluctuations and the riskier but potentially more profitable short-term trading of a given cryptocurrency.

Contents

- Understanding volatility in cryptocurrencies

- How to capitalize on volatility?

- How to choose promising assets

- Risks and how to minimize them

- Useful tools for working with volatile cryptocurrencies

- Conclusion

Why does high volatility attract traders?

| Opportunity to make a quick buck | Large price fluctuations give traders a chance to make significant profits in a short period of time. Even a small percentage change can bring tangible profits. |

| Increased trading interest |

On volatile coins there is a high activity of participants, trading volumes and the number of transactions increase. This fuels excitement and the desire to earn money. |

| Abundance of trading opportunities | Frequent and amplitude price fluctuations allow you to open many transactions to buy and sell an asset in a short period of time. |

| Possibility of diversification | Adding volatile cryptocurrencies to a portfolio can increase its potential returns, albeit at the cost of increased risk. |

Understanding volatility in cryptocurrencies

Definition and key indicators

Volatility in cryptocurrencies is a statistical indicator that describes the variability of the price of a cryptoasset over a certain period. It reflects how much and how often the value of a coin or token fluctuates.

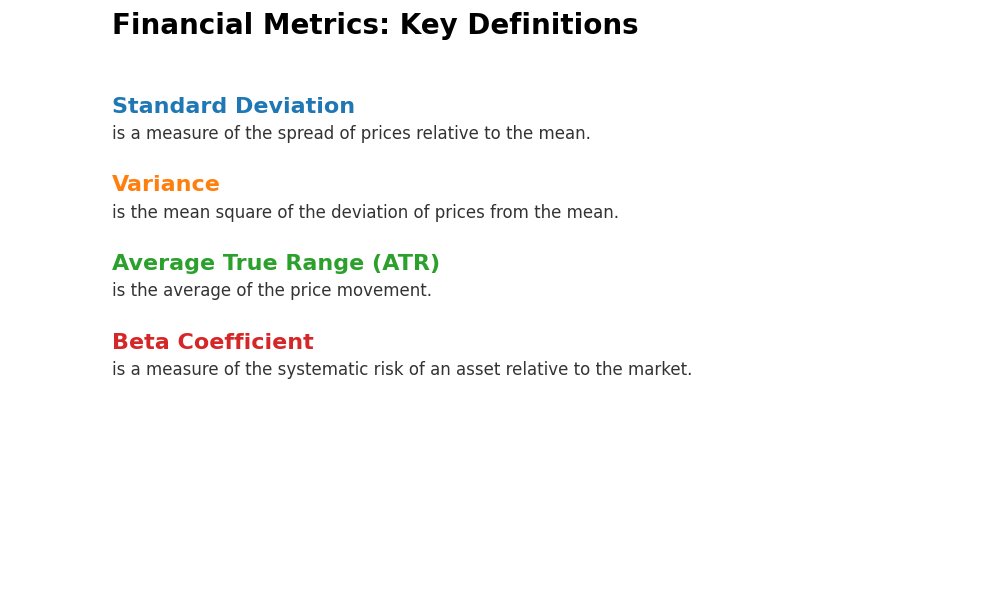

Key indicators of volatility:

- Standard deviation is a measure of the spread of prices relative to the mean.

- The variance is the mean square of the deviation of prices from the mean.

- Average True Range (ATR) is the average of the price movement.

- The beta coefficient is a measure of the systematic risk of an asset relative to the market.

The higher these numbers, the more volatile the cryptocurrency is and the greater the potential risk and return when trading it.

Reasons for high volatility

- News and Events. The cryptocurrency market is very sensitive to the information background. Positive or negative news about specific projects, decisions of regulators, tweets of famous personalities can cause sharp price spikes.

- Regulation. The actions of authorities in different countries regarding cryptocurrencies directly affect their value. Stricter regulation usually collapses the market, while friendly initiatives stimulate growth.

- Market liquidity. Many cryptocurrencies, especially new and little-known ones, are characterized by low liquidity. This means that even small trading volumes can move the price significantly in one direction or another.

- Speculative nature of the market. A significant part of crypto traders are aimed at quick profits rather than long-term investment. Their actions provoke impulsive price movements and general instability.

Examples of cryptocurrencies with high volatility:

- Dogecoin (DOGE) is a meme coin that shows strong fluctuations influenced by the community and Ilon Musk’s tweets.

- Shiba Inu (SHIB) is another memcoin whose volatility is fueled by hype and newsworthy occasions.

- XRP is a token of the Ripple project whose price was heavily influenced by news of the company’s lawsuit with the U.S. Securities and Exchange Commission.

- Many little-known altcoins (TRB, SUI, MOCA) from the lower part of the ratings are characterized by increased volatility due to low trading volumes and increased risks of investing in them.

The TradeLink Pro platform allows you to invest in volatile assets alongside profitable traders, providing protection against potentially high risks.

How to capitalize on volatility?

Day Trading

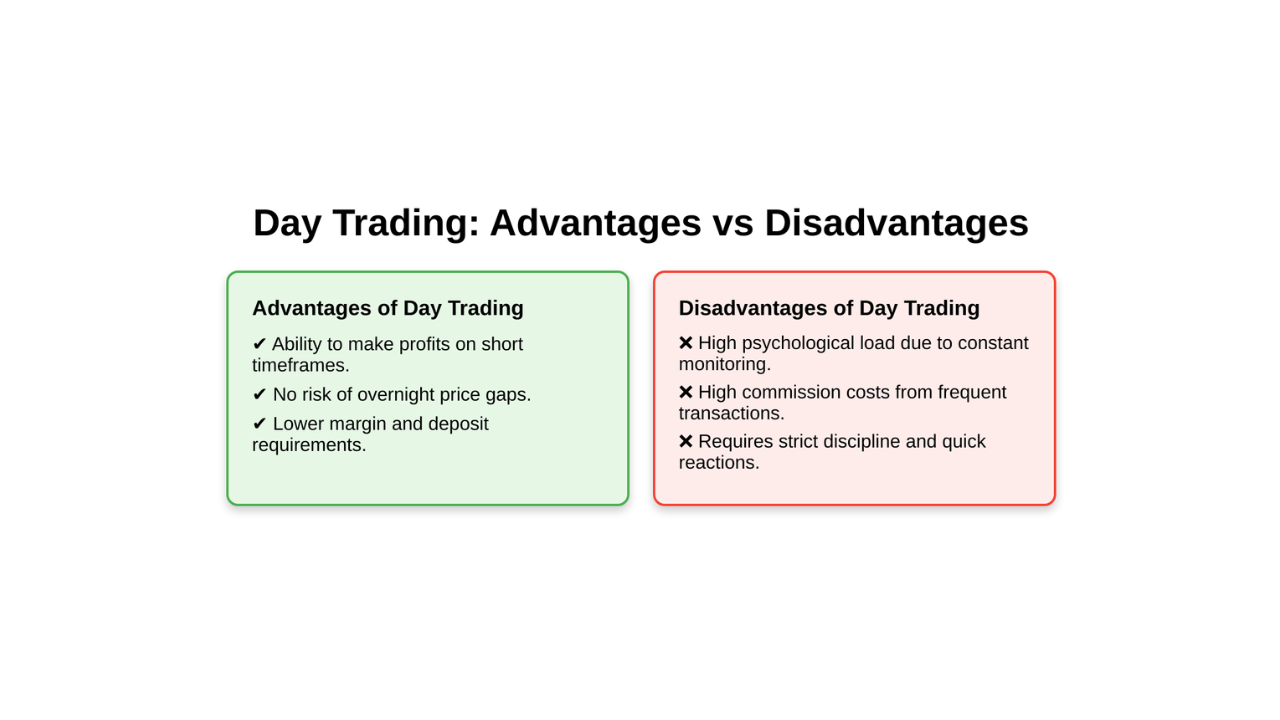

Day Trading is a strategy in which a trader opens and closes positions during one trading day without leaving open trades overnight. The goal of a day trader is to profit from intraday price fluctuations, which are especially significant in the volatile cryptocurrency market.

Advantages of day trading:

- The ability to make profits on short timeframes by taking advantage of short-term price movements.

- No risk of gaps (price gaps) that can occur between market close and open.

- Lower margin and deposit requirements compared to long-term strategies.

Disadvantages of day trading:

- High psychological load due to the need to constantly monitor the market and make quick decisions.

- High volume of commission costs due to frequent transactions.

- The need for strict discipline and quick reaction to changes in the market situation.

Key elements of successful day trading:

- Selecting highly liquid instruments with sufficient volatility to profit on short timeframes.

- Using technical analysis to identify support/resistance levels, trends and patterns.

- Strict risk management by using stop-losses and limiting the size of positions.

- Having a clear trading plan with rules of entry, exit and position management.

- Constant monitoring of the market and news background for timely response to important events.

Scalping

Scalping is a strategy that involves making a large number of short-term trades with small profits in each. Scalpers try to capitalize on the smallest price fluctuations by holding positions for a few seconds or minutes.

Benefits of scalping:

- Possibility to get stable profit even in the absence of a pronounced trend in the market.

- Less risk on each separate transaction due to the small size of stop-loss.

- Quick realization of profit, allows to use the capital efficiently.

Disadvantages of scalping:

- High requirements for the speed and stability of the Internet connection, as well as the performance of the trading platform.

- Significant impact of commissions on the overall profitability due to a large number of transactions.

- The need for constant market monitoring and readiness to react quickly to the slightest price changes.

Scalping MEUSDT 1M 46 trades

Arbitration

Arbitrage in trading is a strategy that involves profiting from the difference in prices of the same asset in different markets or at different points in time. A trader simultaneously buys an asset where it is cheaper and sells it where it is more expensive, earning on the difference.

Time Arbitrage (Time Arbitrage)

This type of arbitrage is based on price differences for the same asset at different points in time. The trader takes advantage of market inefficiencies in which the price of an asset temporarily deviates from its “fair” value.

If the price of a Bitcoin futures contract differs significantly from the spot price, the arbitrageur can buy the asset on the spot market and simultaneously sell the futures, locking in a profit.

Geographic Arbitrage (Spatial Arbitrage)

This type of arbitrage involves profiting from the difference in prices of the same asset on different exchanges or trading platforms. A trader buys an asset on an exchange where it is cheaper and immediately sells it on another exchange where the price is higher.

Risks and benefits of arbitration

Benefits:

- Possibility to gain profit irrespective of the general market direction.

- Low risk at correct execution of deals, as positions are opened simultaneously in different directions.

- High speed of obtaining results, as deals are closed almost instantly after opening.

Risks:

- The need for substantial capital to cover inter-exchange transfers and fees.

- Risk of changes in the price of the asset during transfers between platforms, which can reduce profits to zero.

- Technical problems, such as delays in order execution or hang-ups in transfers, may prevent positions from closing on time.

- Competition from other arbitrageurs and bots that quickly eliminate market inefficiencies.

Investing for the long term

Unlike short-term speculative strategies, long-term cryptocurrency investing involves holding assets for months or years to capitalize on global market growth. Investors primarily evaluate project fundamentals such as technological value, economic model, strong development team and potential for mass adoption.

- Dollar Cost Averaging (Dollar Cost Averaging)

This approach involves regularly buying a fixed amount of money into a selected asset regardless of market fluctuations. For example, an investor may purchase $100 worth of bitcoin every week. Thus, he buys more coins when the price is low and less when the price is high, reducing the average entry level of the position.

- Buy on dips (Buy the Dip)

Investors using this method seek to accumulate assets during significant market corrections when prices temporarily fall below their “fair” value. This requires having available funds and being prepared for further price declines that may last longer than expected.

- Portfolio rebalancing

This approach requires periodic adjustment of the investment portfolio structure to maintain the desired asset ratio. For example, if due to the growth of bitcoin price its share in the portfolio exceeded the planned 50%, the investor sells a part of BTC and buys other assets, restoring the original balance. This allows you to lock in profits on growth and direct them to undervalued coins.

How to choose promising assets

Fundamental analysis

Investors study the underlying characteristics of cryptocurrency projects to assess their long-term prospects. These include:

- Value Proposition: What real-world problem the project solves and the market demand for the solution.

- Technological foundation: How innovative and reliable is the underlying blockchain platform, and what advantages does it offer over competitors.

- Economic model: how the processes of issuing, distributing and burning tokens are organized, and what incentives the network participants have for its development.

- Project team: experience and reputation of key developers, advisors, investors.

- Development dynamics: achievement of stated goals in accordance with the roadmap, community activity, listing on exchanges.

Investors also analyze data available on public blockchains, such as:

- Network Hashrate: the computing power that secures the blockchain. Its growth indicates an increase in investment in mining equipment.

- Number of active addresses: the number of unique wallets making transactions. Positive dynamics indicates the growing acceptance of cryptocurrency.

- Transaction volume: the total value of coins transferred over a certain period. An increase in the indicator can indicate an increase in economic activity in the network.

- Supply concentration: the proportion of coins concentrated with the largest holders. The lower the concentration, the more decentralized and stable the network.

Risks and how to minimize them

Potential losses when trading volatile assets

The high volatility of cryptocurrencies means not only the potential for high profits, but also the risk of significant losses. Sharp and unpredictable price movements can lead to rapid capital loss, especially when using leverage.

The main risks of trading volatile cryptoassets:

- Significant drawdowns in moments of market panic

- Losses due to emotional, impulsive decisions

- Losses on ill-conceived high leverage trades

- Liquidation of margin call positions

Risk management tips

- Use of Stop Losses. A stop-loss is a predetermined price level at which a position is automatically closed. It allows you to limit losses to an acceptable amount. It is important to place stops at some distance from the current price to avoid premature triggering.

- Portfolio diversification. Distribution of capital across several crypto-assets, preferably from different market sectors, reduces the risk of serious damage to the portfolio when one coin falls. It is also wise to hold some funds in stablecoins or fiat for flexibility.

- Position Size Control. It is necessary to strictly limit the proportion of capital per trade depending on the volatility of the asset. The higher the potential fluctuations, the smaller part of the portfolio should be allocated to each individual position. The general rule is no more than 1-5% per one transaction.

- Market analysis. It is important to take into account the general market sentiment, support and resistance levels, trends on higher timeframes. It is better to open positions according to the trend and at confirming signals from indicators. It is desirable to wait for periods of low volatility to enter.

- Control of emotions. Emotional, impulsive trades are the main enemy of a trader. Strict discipline and following a clear trading plan are necessary. It is not worth chasing lost profits or trying to recoup losses by increasing the position.

Useful tools for working with volatile cryptocurrencies

The high volatility of the cryptocurrency market creates many opportunities for profit, but also requires traders and investors to use specialized tools for effective data analysis, risk management and automation of trading strategies.

Platforms and applications for market analysis

| TradingView | A popular platform for analyzing financial markets with an extensive library of indicators, flexible charting capabilities and an active social community of traders. |

| Glassnode | An on-chain analytics service that provides detailed data on the state of blockchain networks and the activity of their participants, such as the number of active addresses, transaction volumes, hashrate dynamics and other metrics. |

| Santiment | A platform for analyzing market sentiment and participant behavior based on data from social networks, news resources, online forums and search queries. |

| CoinGecko | A market data aggregator with a wide range of metrics for fundamental evaluation of cryptoassets, including trading volumes, price trends, community metrics, and Github developer activity. |

Algorithmic bots and trade automation

| TradeLink Marketplace | A platform for automatic investing in indices compiled from the strategies of professional traders. Investors can select indices according to their risk and return preferences, and then connect their exchange account to automatically copy trades. |

| Hummingbot | An open trading platform that allows you to create and customize algorithmic bots for market-making, arbitrage and other high-frequency strategies on various crypto exchanges. |

| 3Commas | Service for automation of trading with the help of bots working on the signals of technical indicators, such as moving averages, MACD, RSI and others. |

| Cryptohopper | A cloud-based trading robot platform that requires no programming skills and supports a wide range of strategies and exchange integrations. |

| Zenbot | Open trading bot with flexible customization options and support for popular indicators and strategies such as moving averages, RSI, Bollinger Bands and others |

Volatility indicators

| Bollinger Bands | An indicator that displays the upper and lower bounds around the moving average price of an asset. The width of the bands depends on volatility: the higher it is, the wider the boundaries. Price moving outside the bands is often interpreted as a signal of trend reversal. |

| Average True Range (ATR) | A volatility indicator that measures the average value of price movements over a certain period. High ATR values indicate increased volatility, while low values indicate a calm market condition. ATR is often used to calculate stop-losses and target levels. |

| Keltner Channels | The indicator is similar in construction to Bollinger Bands, but uses ATR instead of standard deviation in calculations. If the price goes outside the channel, it may indicate the continuation of the current trend. |

| Donchian Channel | Displays the highest and lowest price of the asset for the selected period. A wide channel indicates high volatility, while a narrow channel indicates low volatility. A breakdown of the upper or lower boundary is often regarded as a signal to open a trend position. |

Conclusion

Cryptocurrency market volatility is both a risk and an opportunity for traders and investors. Understanding the nature of volatility, its causes and impact on the market is key to successful trading.

Automating trading with algorithmic bots and copy-trading platforms such as TradeLink Marketplace allows traders and investors to effectively manage risk and profit from market volatility. Strict selection of successful strategies, portfolio diversification and full control over funds make automated investing an attractive choice for many market participants.

The experience of professional traders who have successfully traded in volatile markets emphasizes the importance of risk management and quick adaptation to changing conditions. Discipline and emotional control are fundamental factors in achieving stable results.