Cryptocurrency Correlation with Stock Indices

Contents

- Introduction

- Overview of Key Stock Indices

- Theoretical Basis of Correlations

- Investor Behavior: Risk-On → Interest in Crypto, Risk-Off → Flight to Fiat

- Historical Dynamics

- Current Situation Analysis (Data for 2024–2025)

- Practical Takeaways for Investors

- Conclusion

Introduction

Briefly about the interest in cryptocurrencies

Cryptocurrencies have long ceased to be a niche topic and have become a full-fledged asset class. They are discussed not only in Telegram channels but also on television, in banks, and even in political offices. More and more people are buying crypto—some to preserve capital, some to make money, and some simply out of curiosity. Moreover, this interest is growing among ordinary users, large companies, investment funds, and institutional players.

Why Understanding the Correlation with Traditional Financial Indices Matters

The cryptocurrency market is no longer isolated. It increasingly reacts to events in the traditional economy. When the stock market falls, crypto often falls too. When the dollar strengthens, crypto feels the pressure. These movements are not random. They are driven by the fact that market participants are often the same. People shift money between stocks, bonds, dollars, and cryptocurrencies depending on the situation. That’s why it’s essential to understand how exactly crypto responds to changes in other financial market segments.

Overview of Key Stock Indices

The crypto market often doesn’t move on its own. It is linked to other parts of the global economy. To understand why Bitcoin is rising or falling, one must follow what’s happening with major stock indices and the dollar exchange rate. Below, we’ll look at three main benchmarks: the S&P 500, NASDAQ, and DXY.

S&P 500

What the Index Reflects

The S&P 500 shows how the 500 largest U.S. companies are performing. It includes giants like Apple, Microsoft, Amazon, and others. If this index rises, the country’s most significant businesses are doing well. If it’s falling, the economy is facing difficulties.

Its Significance for the Global Economy

The S&P 500 affects more than just America. It reflects the overall sentiment of the global market. Investors worldwide look to it to decide whether to invest in riskier assets. When the index rises, people feel more confident and willing to buy even crypto. If it falls, they tend to seek safer assets.

NASDAQ

Technology Focus of the Index

NASDAQ is an index composed mainly of tech companies. It includes many startups, IT firms, software developers, and digital service providers. Major NASDAQ players include Google, Meta, Tesla, and other tech leaders.

Impact on High-Risk Assets, Including Cryptocurrencies

Investors who are optimistic about tech growth often buy NASDAQ stocks and cryptocurrencies. This is because both are seen as risky but promising. If NASDAQ drops, it signals market fear of risk. In such moments, crypto can also lose value, as it falls into the same asset category.

DXY (Dollar Index)

What the Dollar Index Is and How It’s Calculated

The Dollar Index (DXY) shows the strength of the U.S. dollar against other currencies, such as the euro, yen, pound, etc. If DXY rises, the dollar strengthens. If it falls, the dollar weakens. The index is built based on the movements of the USD against a basket of other currencies.

Impact of a Strong/Weak Dollar on the Crypto Market

When the dollar strengthens, cryptocurrencies usually decline. This happens because investors prefer to hold dollars, as they appear more reliable. When the dollar weakens, people look for alternative stores of value, and interest in crypto rises. That’s why monitoring DXY is essential for understanding overall market sentiment.

Theoretical Basis of Correlations

Correlation as an Analytical Tool (Definition, Coefficients)

Correlation shows how two different assets move relative to each other. It’s a simple way to determine whether, for example, Bitcoin and the S&P 500 are linked.

If two assets have a positive correlation, they rise and fall together. If the correlation is negative, when one rises, the other falls. The correlation coefficient ranges from -1 to 1. A value closer to 1 indicates a strong positive relationship. A value closer to -1 indicates a strong inverse relationship. A value near zero means there is almost no connection.

This approach helps traders and analysts make conclusions, such as whether Bitcoin will likely fall if the stock market crashes or vice versa.

The Role of Macroeconomic Factors: Inflation, Fed Rates, Liquidity

Major economic events significantly impact cryptocurrencies. One key factor is the inflation rate. If prices for goods and services rise too fast, investors are scared. They seek ways to preserve capital and often turn to crypto.

The U.S. Federal Reserve (Fed) tries to control inflation through interest rates. When rates rise, loans become more expensive, reducing market activity and putting pressure on crypto. When low rates are in place, money becomes cheaper, and the market becomes more active.

Liquidity is another important factor. It refers to the amount of free money circulating in the system. More liquidity means more funds flow into the crypto market. When liquidity dries up, demand for crypto drops.

Investor Behavior: Risk-On → Interest in Crypto, Risk-Off → Flight to Fiat

Investor behavior changes depending on perceived risk. When the market is calm and the economy is stable, participants are more willing to invest in high-risk assets, including cryptocurrencies. They hope for quick profits and are ready to take risks for higher returns.

But when problems loom—crises, rate hikes, falling indices—investors flee to safer assets. Primarily, these are the dollar and government bonds. In such times, interest in crypto drops, as it appears too volatile.

Understanding this behavior helps assess why crypto rises or falls at a particular time.

Historical Dynamics

How Bitcoin and Ethereum Performed Relative to S&P 500 and NASDAQ in 2020–2024

In recent years, Bitcoin and Ethereum have increasingly moved in sync with stock indices, especially during significant market swings.

-

In 2020, after the onset of the pandemic, all markets initially crashed, then began to rise. Crypto rose alongside stocks. This was the first significant signal that crypto was starting to mirror traditional market behavior.

-

In 2021, the growth continued. The S&P 500 and NASDAQ hit new highs. Bitcoin and Ethereum also surged. Many investors began seeing crypto and equities as part of a diversified portfolio.

-

In 2022, the situation changed. The Fed started raising interest rates. Stock markets declined, and crypto followed, with Bitcoin losing its value. Ethereum also fell sharply. This showed that crypto was no longer functioning as a “separate world.” It had become part of the broader financial system.

Examples of Elevated Correlation During Crisis Periods (COVID-19, Fed Rate Hikes)

When COVID-19 began in March 2020, everything crashed almost simultaneously. Bitcoin fell along with stocks. It was a panic moment. Investors sold everything indiscriminately. Correlation between Bitcoin and the S&P 500 spiked.

Later, markets began to recover as the Fed and other central banks injected liquidity into the economy. Crypto rose with them. The connection became especially noticeable—the more liquidity, the higher the demand for risk, including crypto.

In 2022, as the Fed tightened policy again, correlation increased. Rate hikes pressured the stock markets, and Bitcoin and Ethereum declined alongside them. This was especially evident when key economic data was released—crypto reacted almost identically to stocks.

Inverse Correlation with DXY During Liquidity Crunches

The Dollar Index (DXY) reflects the dollar’s strength against other currencies. When DXY rises, the dollar strengthens. During such periods, investors exit risk assets, including crypto.

In 2022, as the Fed aggressively raised rates, DXY surged. This coincided with a sharp drop in the crypto market, and the inverse relationship became clear: strong dollar—weak crypto.

When liquidity drains from the market, the dollar attracts capital. Bitcoin and Ethereum lose interest from institutional investors. When liquidity returns, the situation flips, and crypto gains momentum again.

These observations make it clear that crypto cannot be viewed in isolation. DXY, like stock indices, has become a key reference point for forecasting price movements.

Current Situation Analysis (Data for 2024–2025)

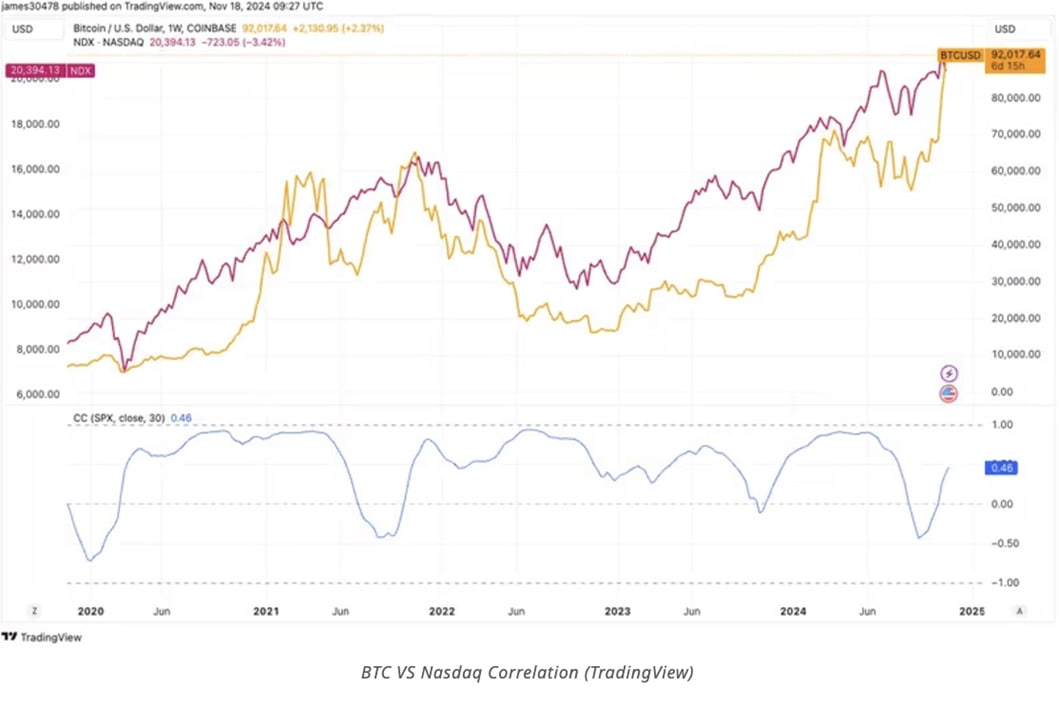

Current Correlation Coefficients Between Cryptocurrencies and Indices

Index | Year | BTC | ETH | Explanation |

S&P 500 | 2024 | 0.19 | 0.17 | In 2024, the correlation between Bitcoin and the S&P 500 declined, indicating growing independence of cryptocurrencies from traditional markets. |

2025 | 0.87 | 0.84 | At the start of 2025, correlation increased significantly, reflecting stronger ties between cryptocurrencies and stock indices amid macroeconomic shifts. | |

NASDAQ | 2024 | 0.46 | 0.44 | The correlation between Bitcoin and NASDAQ dropped to one of the lowest levels in the past five years, indicating a divergence in asset movement. |

2025 | 0.77 | 0.74 | In early 2025, correlation increased again, possibly due to the tech sector’s growing influence on the crypto market. | |

DXY | 2024 | -0.50 | -0.48 | Negative correlation between Bitcoin and the dollar index indicates that falling crypto prices often accompany a stronger dollar. |

2025 | -0.54 | -0.50 | This trend continues into 2025, highlighting the sensitivity of cryptocurrencies to changes in the value of the U.S. dollar. |

Note: Correlation coefficients range from -1 to 1. A value near 1 indicates a strong positive correlation, near -1 a strong inverse correlation, and near 0 no correlation.

Market Reactions to Fed Announcements and Geopolitical Risks

When the Fed makes key announcements, markets immediately react. This applies to stocks and crypto. For example, investors begin selling Bitcoin and Ethereum if the Fed chair hints at rate hikes. The market sees this as a signal that liquidity will shrink, so risk must be reduced.

If the Fed indicates it may pause tightening, crypto finds support. At such times, traders expect prices to rise. They buy assets that might yield high returns in the future, and Bitcoin becomes attractive again.

Geopolitics also plays a role. Investors seek “safe havens during global tensions,” usually the dollar and gold. In such conditions, crypto feels pressure. But exceptions exist—if fiat currencies lose credibility, Bitcoin is seen as an alternative and can rise despite instability.

Institutional Investor Behavior

Large players have long entered the crypto space. Today, they behave as they do in traditional markets—monitoring macroeconomic trends, assessing risks, and acting cautiously.

When bond yields rise, funds reduce crypto holdings. When rates fall, interest returns. This is especially evident in asset management reports. When the Fed softens its tone, institutions buy more Bitcoin and Ethereum.

Another key factor is trust in infrastructure. After some crypto platform failures, large players proceed cautiously. They don’t enter the market without due diligence. However, overall, they now view crypto as part of a portfolio. If market conditions are calm, their interest grows. In times of panic, they are the first to exit.

Practical Takeaways for Investors

Should Stock Indices Be Used to Forecast Crypto Movements

Stock indices can help gauge overall market sentiment. When the S&P 500 and NASDAQ rise, crypto often moves in the same direction. When indices fall, Bitcoin and Ethereum usually lose value as well. This isn’t a rule, but the correlation is noticeable, especially during volatile periods.

Therefore, stock indices can serve as hints. They don’t provide precise forecasts, but they help identify trends. Investors who monitor these indicators can react more quickly to market phase shifts.

Hedging Opportunities Through Traditional Assets

Investors can use traditional tools to reduce portfolio risks. For example, holding some funds in gold or bonds may make sense if Bitcoin is rising while the dollar is falling. This acts as a hedge if the crypto market suddenly turns.

Hedging doesn’t eliminate risk but helps preserve capital in unstable conditions. Simple steps, like holding cash, can help during a market dip. The key is not to rely solely on crypto but to diversify wisely.

What Signals from the Stock Market Can Be Indicators for Crypto Investors

Several key signals are worth watching. First, the behavior of DXY. If it rises, crypto may weaken. Second, the performance of major tech stocks. When they fall, crypto often loses support, too.

Fed announcements are also critical. If the regulator speaks of rate hikes, crypto may suffer, as investors flee to safer assets. If the Fed softens its stance, there’s room for growth.

Tracking these signals is a valuable habit. It helps one better understand the market phase and, most importantly, to make decisions based on facts, not emotions.

Conclusion

Summary of Key Observations

Cryptocurrencies are increasingly showing ties to traditional financial markets. The S&P 500 and NASDAQ influence the overall direction of Bitcoin and Ethereum. The Dollar Index often moves inversely—when the dollar rises, crypto weakens. These relationships are shaped by Fed policy, inflation, and investor sentiment.

Outlook: Will Crypto Continue to Mirror Stock Market Behavior Over Time

As the crypto market matures, its behavior increasingly mirrors that of the stock market. More institutional players are entering and applying traditional strategies, strengthening correlations with indices. This connection is likely to deepen, especially with more regulation and transparency.

Reminder of Risks and the Importance of Diversification

Despite observed correlations, the crypto market remains volatile. It can change direction abruptly and without warning. Therefore, investors must not rely on a single asset class. A sound strategy includes allocating funds across various markets—stocks, crypto, bonds, and cash. This approach helps minimize losses during tough periods and maintain stability.