Expert guide to trading strategy testing vol. 1

You have an idea for a trading strategy. You have implemented it in some known way, hired a coder or you did it yourself.

But it is very important to understand, whether your idea is viable, and whether it will bring you income or not?

How do you do it? Well, I will describe how I do it, within this and 2 upcoming articles.

With my extensive experience, I roughly understand its strengths and weaknesses when I create a trading algorithm. Some algorithms are simple and usually, the most effective, and some are more complicated and have their own advantages, but we will discuss this later.

I will show you an example of the simplest strategy: ” The Crossing of 2x EMA” We put two moving averages, a slow one and a fast one, on the chart. When the fast one crosses the slow one from below it is a buy signal, and when the fast one crosses the slow one from above it is a sell signal. This is a trend strategy of reversal type, i.e. signal to buy always = signal to close the current sell trade. And vice versa. I hope it is clear.

This strategy will have two parameters for optimization:

• EMA fast (Efast)

• EMA slow (Eslow)

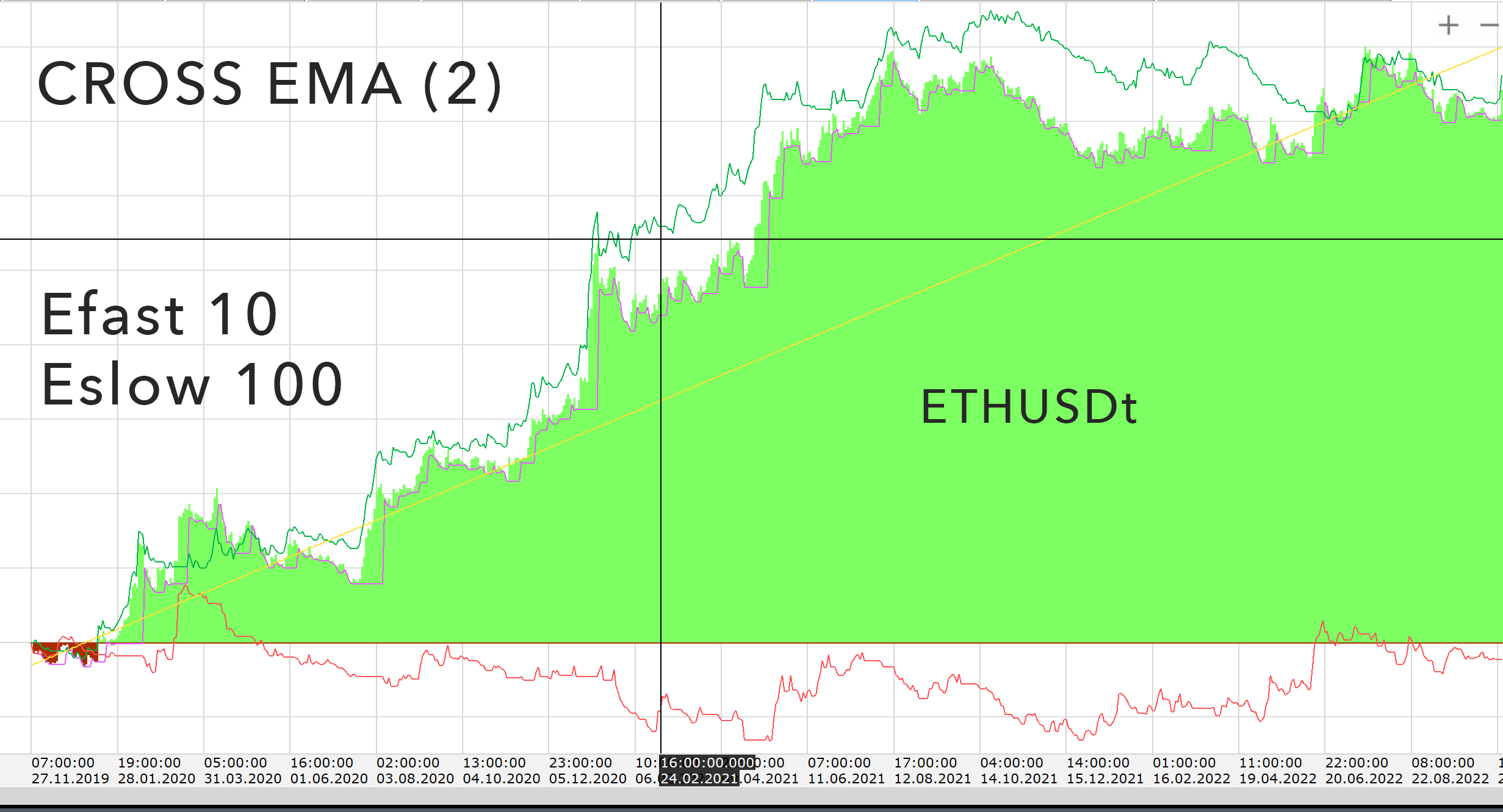

Different settings will give different Equite, for example: Setting Efast 10 and Eslow 100 on tests will show the following returns on the ETHUSDt trading pair over 3 years:

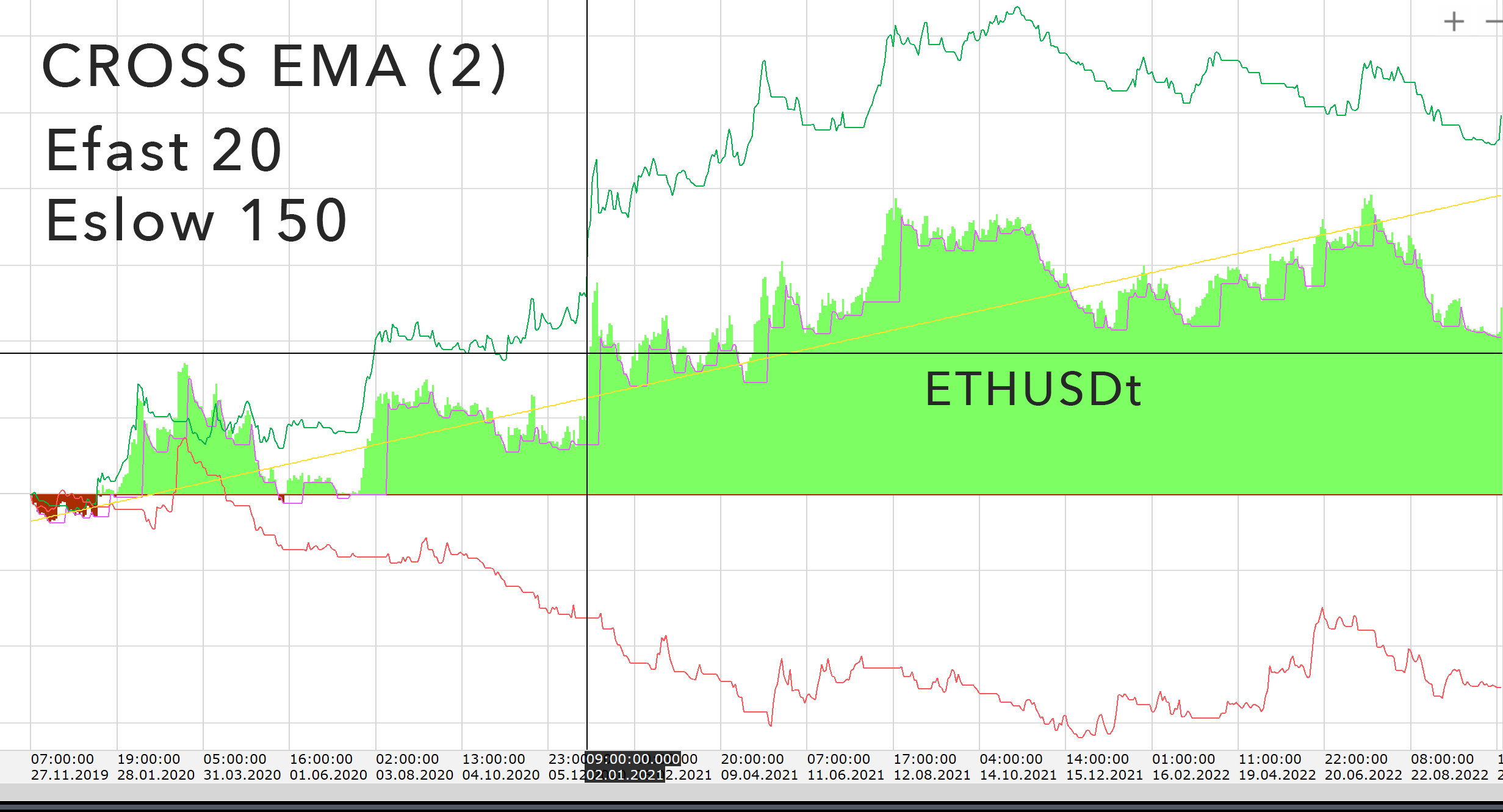

Setting up Efast 20 and Eslow 150 on tests will show a different return on the ETHUSDt trading pair over 3 years:

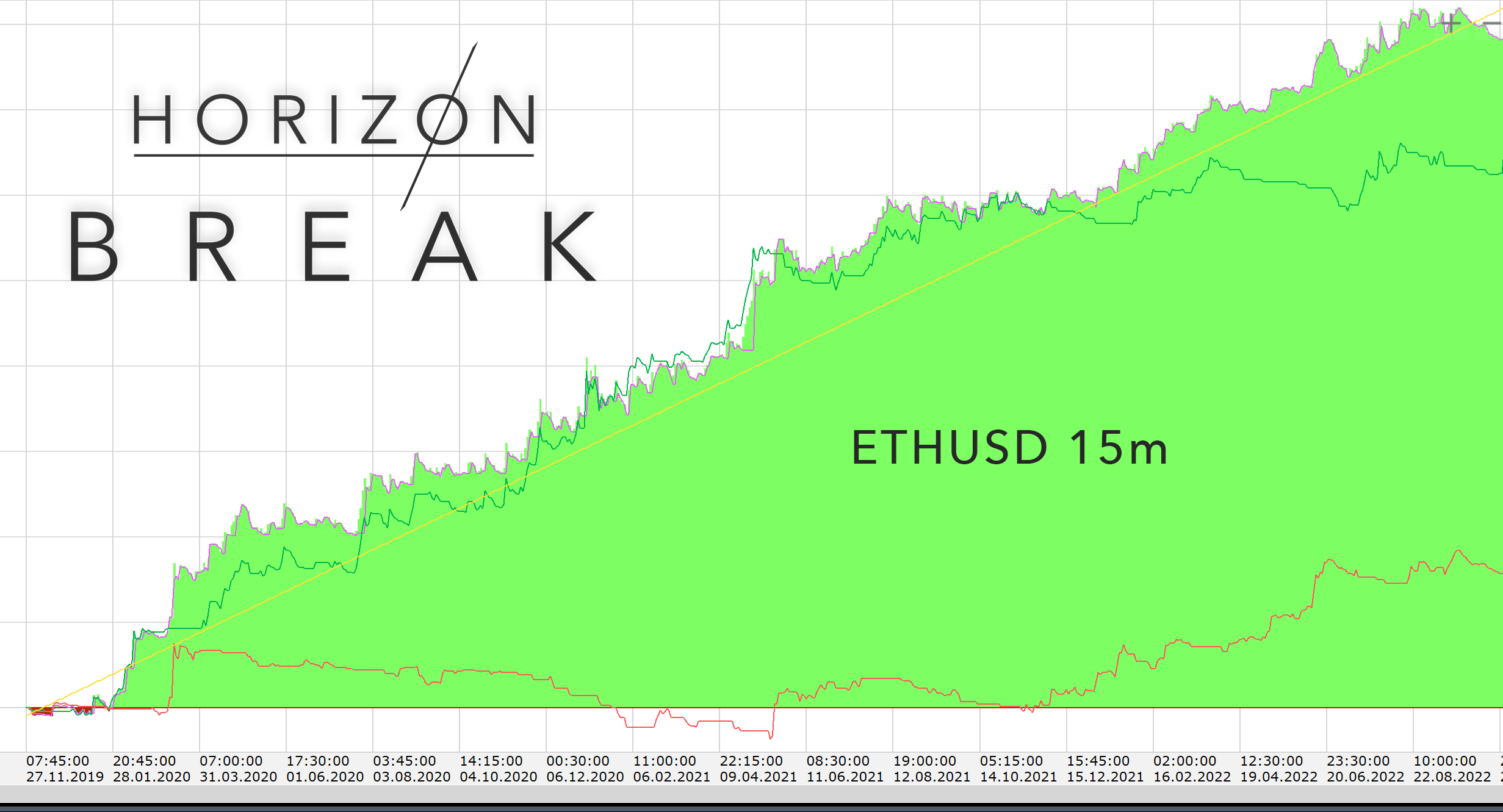

It is important for us to determine which settings will give the best returns on the 3-year history, on the cryptocurrency market unfortunately there maximum available timeframe, If we refer to BINANCE FUTURES.Of course, it is also important to consider the maximum drawdown factor, and that EQUITE itself should be as smooth as possible, a good example:

This is a test of the HORIZON BREAK strategy on the trading pair ETHUSDt over 3 years.

So you found those very good parameters, you see the good performance, and you anticipate that after you launch the algorithm, it will bring you a lot of money…But it’s not that simpleMany traders miss the fact of ADJUSTING

ADJUSTING – is when parameters of a strategy show themselves well on tests, on history. But at the same time in live trading, you will almost certainly lose capital. Therefore, why does this happen? It may seem that the strategy is performing well on history, so why is it losing on LIVE trades?So it happens because the market is changing one way or another. And these changes are much deeper than simply “Flat” or “Trend”.You may not even notice them with the untrained eye, but your strategy and balance will feel it right away. After all, we’re in the system trading.So. There is a problem. It is indeed a problem. It needs to be solved somehow. It is necessary to optimize the trading strategy, and the trading algorithm in such a way, that it would eventually become profitable in LIVE trading.

How to do it?

In fact, there are several methods of testing and optimization of trading strategies, which I will describe in my next article, as it would be very long and boring if I covered them here.I utilize these technologies when optimizing, picking, and analyzing my trading strategies. For that reason, I will write in the first person. But that will be in the following articles.

Telegram: Jeck SAVINSKYI

Telegram channel: SAVINSKIY

Twitter: Jeck SAVINSKIY