Trend and Counter Trend: How do these TradeLink Indexes work?

Contents

Introduction

In the world of trading, there’s a well-established understanding of trend-following and counter-trend strategies:

— If you follow the current market movement, it’s a trend-following strategy.

— If you act against the movement, trying to “catch” corrections and pullbacks, it’s a counter-trend strategy.

TradeLink’s Trend and Counter Trend indexes operate according to this logic, with a few clarifications:

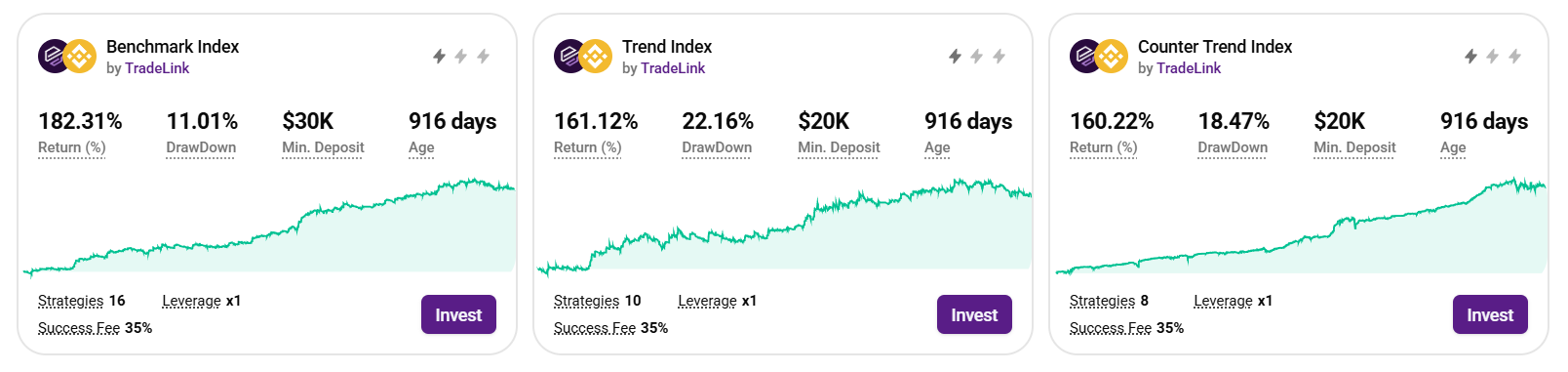

Trend Index

This index primarily consists of trend-following strategies, which open positions in the direction of the market movement. If the market shows steady growth or decline, the strategies in this index take positions aligned with the trend. This approach maximizes the potential benefits of stable trending conditions.

Note: On the TradeLink Marketplace, there are “composite” strategies that may include dozens of algorithms with varying ideas and principles. As a result, some strategies can simultaneously exhibit both trend-following and counter-trend characteristics.

Counter Trend Index

This index, on the other hand, is composed of strategies that respond to sharp market movements by opening positions against the impulse. For instance, if the market spikes upward, the strategies may take positions anticipating a pullback, and vice versa. This approach is especially effective during periods of volatility or sideways market conditions.

Benchmark Index

If you’re looking to earn consistently regardless of market conditions without trying to predict what’s coming next, consider the Benchmark Index. It combines strategies from both the Trend and Counter Trend indexes in equal proportions (50/50), offering balanced performance across various market scenarios.

Lite Indexes

Each index on the platform is available in two versions: standard and Lite. The Lite versions include the most successful strategies, making their composition narrower and more focused. These indexes are more accessible since their minimum investment requirements are lower. For example, Benchmark Index Lite requires a relatively small initial capital, whereas a larger deposit is needed for a more accurate replication of the broad Benchmark Index.

Despite the difference in minimum deposit amounts, both versions show similar performance. However, Lite versions may carry higher risks due to limited diversification.

Conclusion

Each TradeLink index is designed to align with different market environments. Choose the one that best fits your investment strategy and be ready to earn — whether in a steady trend or during chaotic market movements.