Leverage in Cryptocurrency Trading: Justified Risk or Trap?

Contents

- Introduction

- How Leverage Works in Cryptocurrency Trading

- Advantages of using leverage

- Risks and pitfalls

- Who is suitable for leveraged trading?

- Leverage as a Beginner’s Trap

- Practical recommendations

- Conclusion

Introduction

Leverage — is simply the use of borrowed funds for trading in order to increase the potential profit.

Traders use leverage to increase their purchasing power and make trades with a volume greater than their personal funds.

The advantage of this trading system is that the trader will be able to make a profit significantly more than when trading on initial capital, but the greater the leverage, the greater the risk of potential loss.

How Leverage Works in Cryptocurrency Trading

The principle of margin trading

Margin trading – trading of funds borrowed from a trading platform or broker. On a margin account, the trader’s capital acts as collateral, which will be used to cover unprofitable trades. In addition, the profit will be reduced, as borrowed funds are usually subject to commission interest.

The basics of margin trading are leveraged funds and leverage, which essentially play the same role for both traders:

- Increase in trading volume

- Increase in profit

And for the broker:

- Loan fee

- Attracting traders

Thus, the broker’s conditions for commission and leverage provide potential profit for both parties.

Let’s look at examples of low and high leverage calculations in practice

| Parameters | Low Leverage 1: 2 | High leverage 1: 10 |

| Personal funds | $1,000 | $1,000 |

| Trade volume | $2,000 | $10,000 |

| Price change | 5% | 5% |

| Profit / loss | $100 | $500 |

You can see how a 5% price change affects profit or loss, depending on the level of leverage. We conclude that the higher the leverage, the greater the potential profit or loss with the same price changes.

Advantages of using leverage

Possibility of a significant increase in profitability

Thanks to the leverage system, even small changes in the price of assets can lead to large profits. For example, when using 1:10 leverage, a trader can earn 10 times more than if they used only their own funds, which makes leverage attractive for traders who want to make more profit in less time.

Leverage also opens up the possibility for a trader to control more assets with the same initial account, distributing risks between different strategies and assets, which can also increase profitability.

Accessibility for traders with small capital

Increased purchasing power and the ability to manage large amounts of capital are the main advantages of using leverage for traders with small amounts of capital. But there are a few other important benefits of leveraging your money.

- Beginners can invest less money initially while still trading enough volume for exchanges.

- The ability to trade expensive assets, where the requirements for minimum position values can reach large amounts

- Flexibility in the selection of assets and markets, testing different strategies by reducing restrictions in the form of initial capital. A trader can use the increased capital for several large trades at the same time. For example, hedge risks or use arbitrage opportunities.

Although leverage helps traders with small capital to make larger trades, but this approach requires caution and risk control, because it increases both potential profit and potential loss.

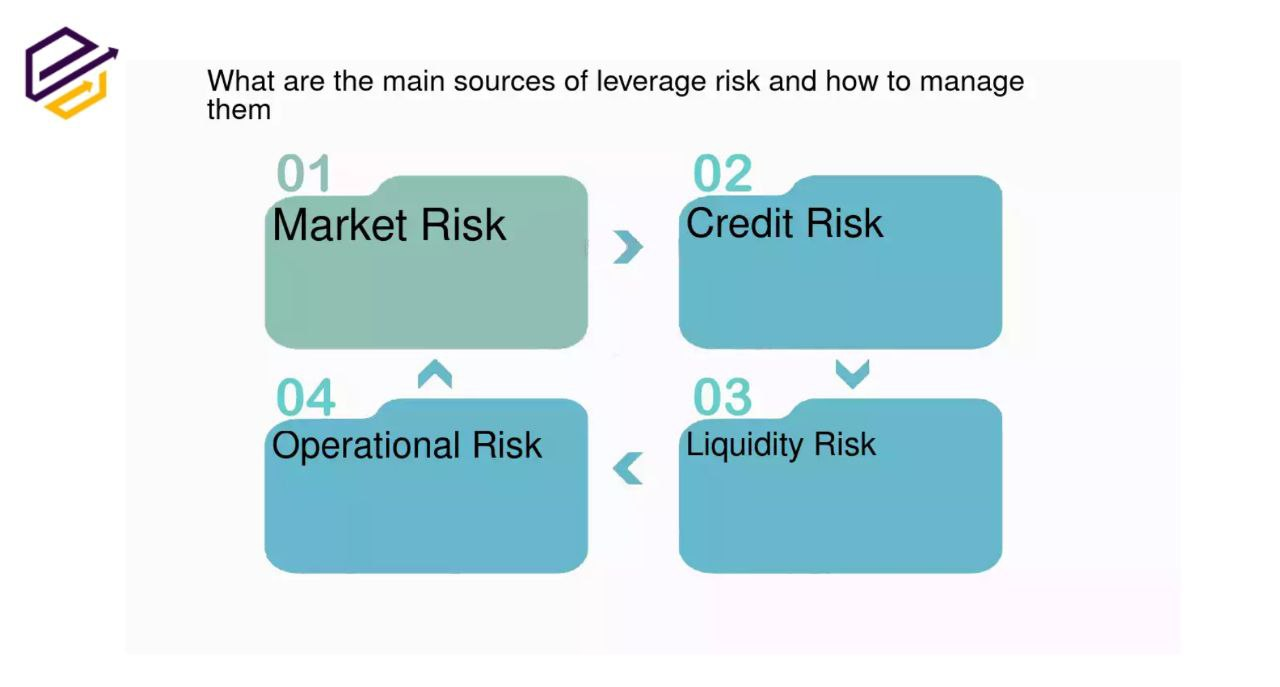

Risks and pitfalls

Risk of total loss of the deposit

Increased yield potential – additional responsibility for capital and risk management. In margin trading with 1:10 leverage, the trader risks completely losing his deposit if the asset price decreases by 10%.

And the high volatility of instruments with sharp and significant price changes combined with high leverage further increases the risk of a complete loss of the trader’s capital. When the total loss of positions reaches the level equal to the trader’s own margin, the mechanism of complete liquidation of positions is triggered, covering all losses with personal funds.

Often, traders simply do not have time to react and are not able to control their positions during sharp fluctuations in asset prices with high volatility.

Emotional stress and impact on decision-making

A high level of risk or an already recorded loss directly affects the trader’s emotional state, causing stress. And already in a stressful state, a trader can make rash actions.

Here are some examples of the consequences of increased stress in trading:

- Fear of capital loss and increased anxiety due to the understanding that large losses can quickly outgrow the invested funds.

- Impulsive actions. Greed appears, and under the influence of fear, a trader may start to prematurely close positions and make transactions for an increased volume, which may aggravate the situation.

- The desire to “recoup”. Aggressive and reckless actions to compensate for losses, which often leads to even greater losses.

- Violation of rational thinking. Under the influence of strong emotions, a trader may start to ignore their own trading plans and market analysis and rely on luck.

Rational approach, discipline, and risk management are key tools for minimizing the impact of emotions.

Who is suitable for leveraged trading?

Experienced traders vs. Newbies

Over time, the trader gains experience, limits risks, try not to lose on the same mistakes and uses leverage more effectively when the situation suits.

Beginners are often subject to emotions in trading, which can lead to rash actions and suffer losses. The solution can be a well-studied leverage strategy.

Examples of successful strategies:

- Scalping: short-term trades with relatively high leverage

- Multi-position trading: using leverage to open positions in different markets at the same time, distributing capital between several assets

- Arbitrage: A trader uses the difference in the prices of a single asset on different markets or exchanges. Leverage increases the return on such small price discrepancies.

How much a trader can earn from the market and how much he will lose directly depends on the level of his training. An experienced trader knows what exactly can lead him to a loss and how to protect himself by controlling risks and emotions and understanding the market. Novices should not use high leverage if they are not in full control of the situation.

Leverage as a Beginner’s Trap

Leverage becomes a trap for beginners when they overestimate their capabilities, ignore risk management, and give in to marketing tactics.

A beginner can open a large position based on luck, not analysis. And for example, with a deposit of $500, it uses a leverage of 1:50 and opens a position for $25,000. In this case, even a small correction of the asset price by 2% against the trader’s position leads to a complete loss of the deposit.

How large losses affect the trader’s further actions

Serious losses at the beginning of the journey leave a huge emotional mark, and the main consequences can be from loss of confidence to financial difficulties, such as when a trader can start borrowing if the funds invested were the last.

Of course, the trader’s further actions depend on himself, but often, after losing the conditional $1,000, the trader tries to restore the initial balance, using even more leverage. And a few unsuccessful trades with high leverage – liquidation.

When trading with high leverage, even a minimal market movement can significantly affect the account balance, which causes strong emotions.

Every trade must have a clear reason to enter, and trading based on emotions alone is a gamble. A trader under the influence of emotions makes transactions in the market relying on luck, which really resembles a casino.

Mechanisms used by platforms to promote leverage.

Trading platforms actively promote the use of leverage to increase trading volumes and their revenues.

Consider the main mechanisms:

- Availability: Trading platforms advertise the ability to trade with high leverage of 1: 100 and 1: 500

- Low minimum deposits: starting trading with a notional $10 encourages beginners to use high leverage

- Training programs with an emphasis on the benefits of using leverage.

But in order to use leverage more effectively, it is important to understand its features, be prepared for possible losses, and apply strict discipline in money management.

Practical recommendations

How to reduce risks when using leverage:

High leverage means high risks. To reduce possible losses, trading should be done with a fully thought-out strategy and a disciplined approach.

Proper trading with reduced risks consists of:

- Stop loss settings. Thus, the deposit can be insured against liquidations if open positions bring a large loss.

The trader may not notice how the market is moving against him, and at such moments, stop losses help prevent large losses of funds.

- Capital management and risk management. Namely, setting limits on risk in each transaction and the total use of capital. For example, a trader, having previously determined the allowable loss in a trade and a possible price correction against it, selects the appropriate trade volume.

- Choosing a moderate leverage. The trader must be able to correctly determine the appropriate leverage for a given situation, putting less volume into transactions that the trader understands less well.

Only properly selected and followed risk management reduces risks when trading with leverage. Especially trading in a highly volatile market requires more caution and compliance with risk management.

What should I pay attention to when choosing a trading platform?

You should choose the right trading platform not only because of favorable conditions for the trader, but also because of the security of personal funds and data. The conditions of some platforms do not provide full control over the invested funds of investors, and the right choice is a reliable trading platform with transparent commissions and clear conditions for the pledged risk.

A good example of a reliable trading platform is TradeLink, which is suitable for all parameters that should also be taken into account when choosing any other trading platform:

- Controlled risk. The investor’s funds are completely under his control, and the investor on the TradeLink Marketplace trading platform has the opportunity to both regulate the risk and stop investing at any time.

- Transparency of commissions. The investor pays a commission only on the actual profit received, with no hidden fees. There are no entrance and exit fees.

- Reliability and reputation. Lots of positive feedback and feedback, which improves the project for all users.

When choosing a trading platform, the most important thing is to carefully study the conditions provided by the platform, the leverage conditions, the commission structure, and the company’s reliability. This will protect you from unpleasant consequences and give you confidence about the safety of your personal funds.

Leverage Alternatives to Increase Profitability

High-leverage trading is not the only option to increase profitability. It is true that the higher the potential profit, the higher the potential loss, but there are also several other ways to increase profitability with less embedded risk than trading with increased leverage:

- Reinvestment

Use the profit from successful trades to increase the volume of subsequent positions, gradually increasing capital without increasing risks above the initial level.

- Portfolio diversification

Investing in various assets, strategies, and indices, increasing the chances of a stable income. Even if one of the assets shows a loss, others can compensate for the loss.

- Long-term strategies

Long-term investments in assets or indices with high growth potential, such as stocks of promising companies or indices with carefully tested strategies with a transparent trading history on the TradeLink platform.

- Trading with increased transaction frequency

Experienced traders can increase their earnings by increasing the number of trades based on well-thought-out short-term strategies (for example, scalping or intraday trading).

Conclusion

Leverage is a powerful tool that can both speed up a trader’s path to success and cause serious losses. To get the most out of it and minimize risks, it is important to approach trading consciously.

Although experienced traders can confidently use leverage to trade effectively, beginners should:

Use moderate leverage, limit losses with stop losses, and don’t bet more than you’re willing to lose. The ability to manage money is not only the key to financial security, but also the key to confidence in your actions.