What is MEV and why is it important for crypto traders?

In the world of blockchain and cryptocurrencies, there are more and more new concepts and terms that traders need to understand in order to trade effectively. One such concept is MEV (Maximal Extractable Value) – maximum extractable value.

Contents

- What is MEV?

- Types of MEVs

- Why is MEV important for traders?

- How do you minimize your exposure to MEVs?

- Challenges and the future of MEVs

- Conclusion

What is MEV?

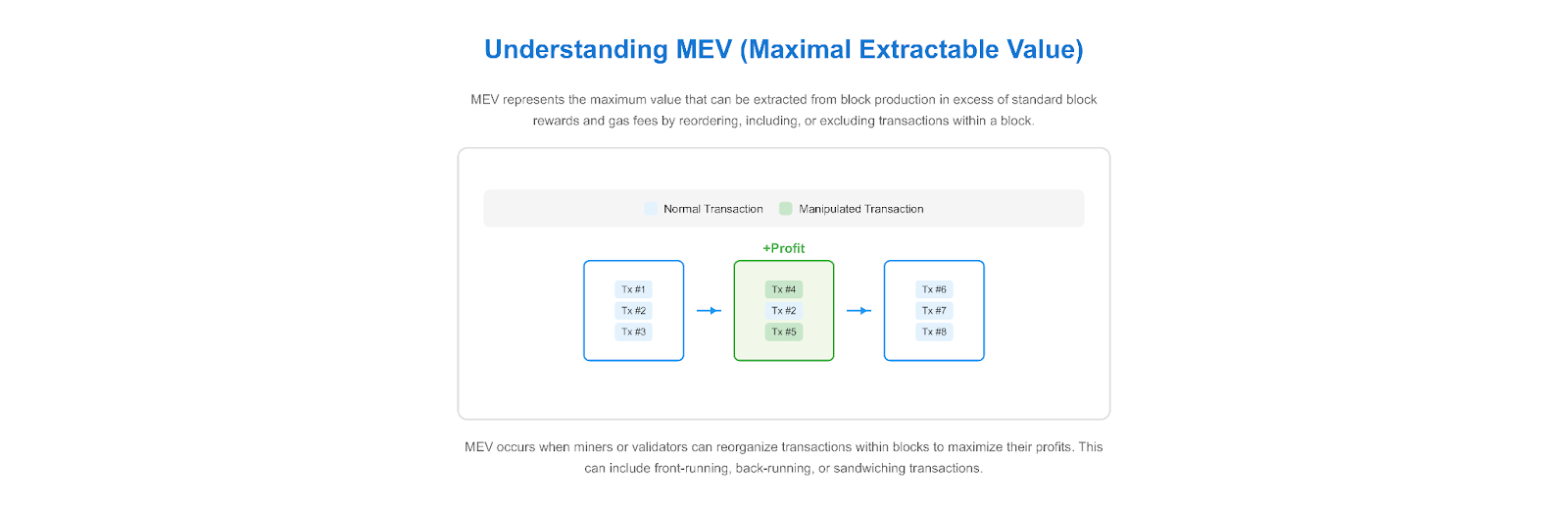

MEV (Maximal Extractable Value) is a term used in the context of blockchain and cryptocurrencies to refer to the maximum profit that network participants can make by manipulating the order of transactions in blocks. Simply put, MEV allows miners, validators, or other players to influence the system for financial gain.

The term MEV was first introduced by researchers Phil Davenport and Tara McCauley in 2019. They studied potential vulnerabilities and flaws in consensus mechanisms in the Ethereum blockchain. In their work, they described how network participants can extract additional value by strategically including or excluding transactions in blocks.

The emergence of MEVs is related to the peculiarities of blockchain networks. In traditional systems, the order of transactions is determined centrally, such as by exchanges or payment providers. On the blockchain, however, the order is determined by miners or validators who select transactions from a pool of unconfirmed transactions and include them in blocks.

This decentralized nature opens up opportunities to extract MEVs. By manipulating the ordering of transactions, participants can profit from differences in asset prices, fees, or other factors. This affects the operation of smart contracts, decentralized exchanges (DEX) and other blockchain-based applications.

MEVs can lead to frontrunning (getting ahead of other transactions), sandwich attacks (placing their orders before and after large transactions), arbitrage, and other strategies that we discuss in more detail below. Such manipulation reduces market efficiency, increases transaction costs for ordinary users, and undermines decentralization.

The MEV phenomenon raises important questions about the fairness, security, and sustainability of blockchain ecosystems. Developers are actively exploring ways to minimize the negative impact of MEVs by creating new protocols and consensus mechanisms. Nevertheless, maximizing value remains a pressing issue that all cryptocurrency market participants need to consider.

Types of MEVs

There are several basic strategies for extracting maximum value (MEV) on the blockchain. Let’s take a closer look at each of them.

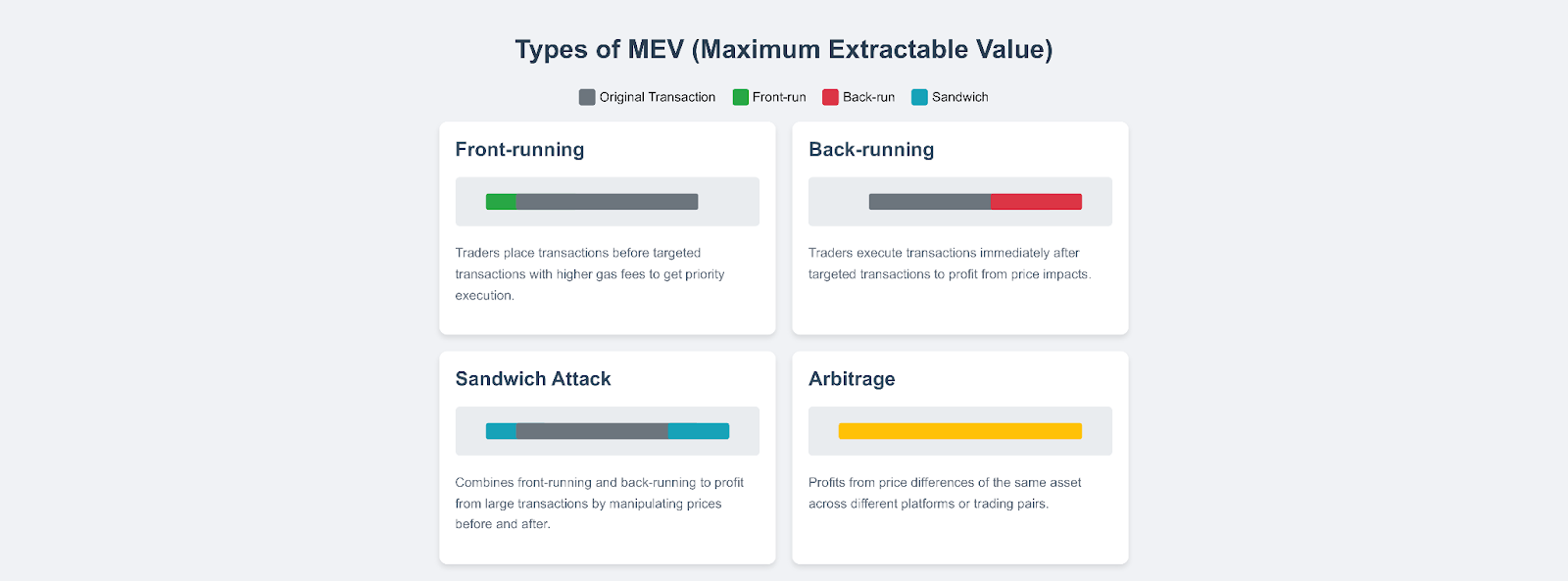

- Front-running

This strategy involves tracking a pool of unconfirmed transactions (mempool) and trying to get ahead of other transactions by including their transaction in the block earlier. Traders or special bots can analyze the mempool, identify potentially profitable transactions, and send their own transactions with a higher gas fee so that miners include them in the block first.

For example, if a bot notices a large order to buy a token on a decentralized exchange (DEX), it can quickly buy that token itself and then sell it at a higher price after the original order is executed. This is how frontrunners extract value at the expense of other market participants.

- Back-running

Unlike frontrunning, backrunning involves using information about transactions that have already been closed. Traders analyze executed transactions and try to profit by manipulating prices after they are closed.

For example, if a large order to sell a token caused the price to drop significantly, a backrunner may quickly buy up that token at an undervalued price and then sell it after the price recovers. In this way, they profit from short-term price fluctuations caused by the actions of other participants.

- Sandwich attacks

Sandwich attacks are a combination of frontrunning and backrunning. In this case, manipulators place their orders immediately before and immediately after a large transaction of another participant, creating a kind of “sandwich”.

For example, if a trader wants to buy a large amount of tokens on DEX, a manipulator can place their own buy order just before that transaction and then quickly sell the tokens immediately after it is executed at a higher price. This is how they extract value by artificially influencing pricing.

- Arbitrage

Arbitrage involves profiting from differences in the price of the same asset on different platforms or in different pairs. Traders track price differences and make a series of transactions to capitalize on them.

For example, if a token is trading at $100 on one exchange and $120 on another, an arbitrageur can quickly buy the token on the first exchange and immediately sell it on the second exchange for a risk-free profit. However, in the context of MEVs, it is important to consider gas costs and transaction speed in order to successfully realize the arbitrage opportunity.

All of these MEV strategies carry risks for ordinary users and undermine market efficiency. Blockchain developers are looking for ways to limit the impact of MEVs by implementing special protocols or consensus mechanisms, such as delayed disclosure of transactions or random selection of validators. However, it has not yet been possible to completely eliminate the potential for maximizing value, so traders need to consider these factors when developing their strategies.

Why is MEV important for traders?

The phenomenon of maximum extractable value (MEV) has a significant impact on cryptocurrency traders and their strategies. Understanding the mechanisms of MEV and the ability to adapt to them can determine the success of trading in decentralized markets.

Impact of MEV on liquidity and trading strategies

MEV directly affects market liquidity and pricing. When traders or bots use strategies such as frontrunning or sandwich attacks, they actually outperform regular users and extract value at their expense. This can lead to slippage and unfavorable price shifts for honest market participants.

In addition, the presence of MEVs forces traders to adapt their strategies. They must consider potential manipulations and think of ways to avoid them. For example, using special tools to divide large orders into smaller parts or choosing the time to make trades taking into account the activity of MEV bots.

Risks and opportunities for traders

On the one hand, MEVs create additional risks for traders. Manipulations can lead to unprofitable trades, increased slippage, and an overall decrease in trading efficiency. Traders may unintentionally lose some profits to frontrunners or fall victim to sandwich attacks.

On the other hand, understanding MEVs also opens up new opportunities. Traders who understand the mechanisms of value extraction can apply these strategies themselves to generate profits. For example, they can use special tools to track the mempool and identify potentially profitable trades. Or they can apply arbitrage strategies that take into account the impact of MEVs on pricing.

How MEV can affect trading performance and profitability

The presence of MEVs generally reduces the efficiency of trading in decentralized markets. Manipulation leads to distorted prices, increased spreads and reduced liquidity. This means that it becomes more difficult for traders to execute trades at fair prices and make the expected profits.

In addition, MEVs increase transaction costs. Traders are forced to pay higher gas commissions to get ahead of frontrunners and ensure their trades are included in blocks. This reduces the overall profitability of trading, especially for small and medium-sized traders.

At the same time, traders who know how to effectively adapt to MEVs can gain an advantage in the market. They can utilize advanced tools and strategies that take into account the impact of MEVs to extract additional profits. However, this approach requires a deep understanding of market mechanisms and technical aspects.

How do you minimize your exposure to MEVs?

Given the risks and potential negative effects of maximum extractable value (MEV) on traders, it is important to consider ways to minimize its impact. There are several approaches and tools that can help protect against MEV and provide a fairer trading environment.

Using decentralized applications and protocols to protect against MEVs

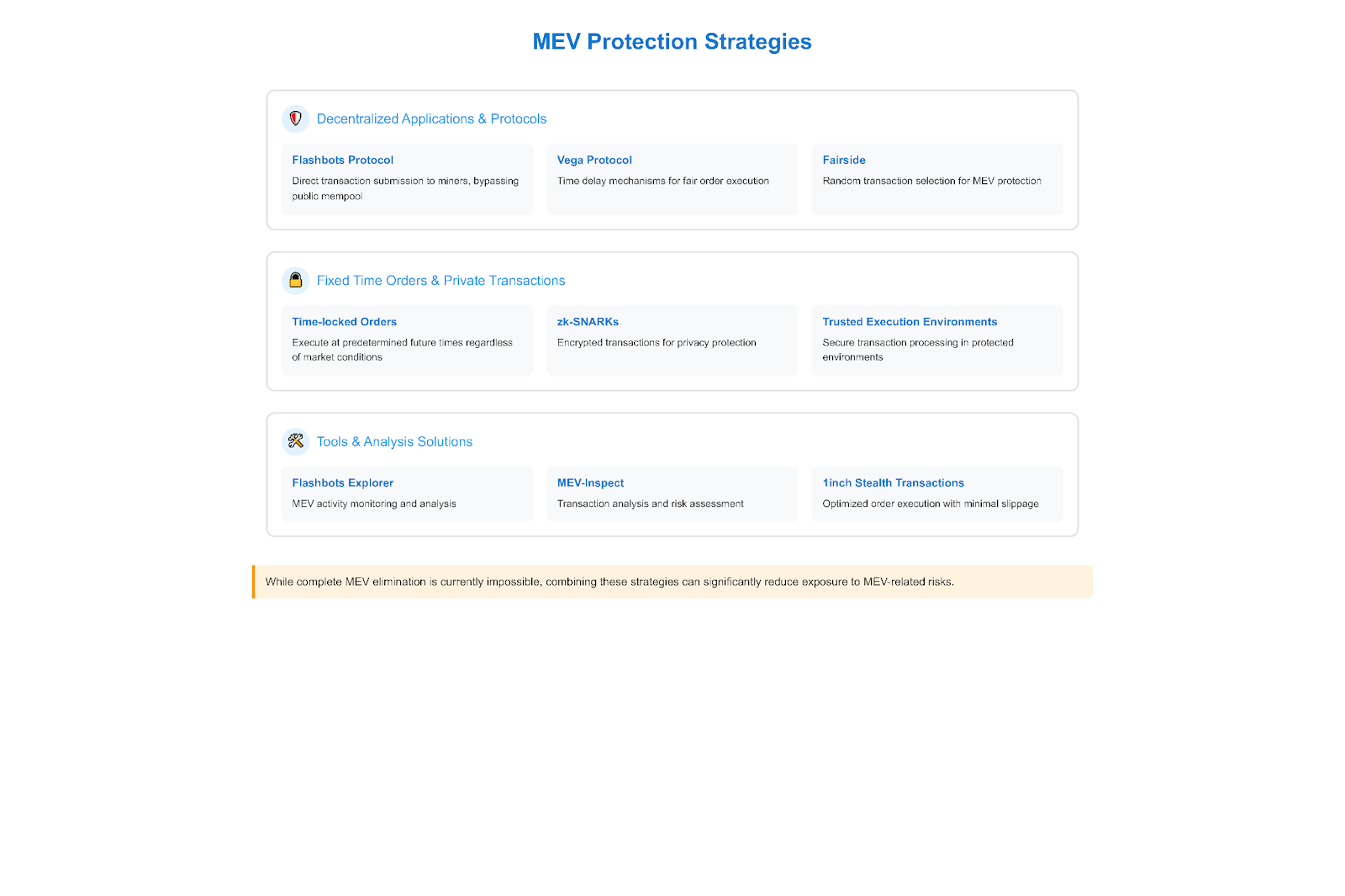

One effective way to combat MEVs is to use special decentralized applications (dApps) and protocols designed with this problem in mind. Such solutions can include defense mechanisms against frontrunning, backrunning, and sandwich attacks.

For example, the Flashbots protocol offers a special API that allows users to send transactions directly to miners, bypassing the public mempool. This reduces the risk of frontrunning, as transactions are not visible to other participants before being included in the blockchain. Other protocols, such as Vega or Fairside, use time delay or random transaction selection mechanisms to minimize MEV.

Role of fixed time orders or private transactions

Another way to protect against MEVs is to use orders with fixed execution times or private transactions. Such approaches allow to hide traders’ intentions from potential manipulators and reduce the risk of frontrunning.

Time-locked orders imply that the transaction will be executed only at a certain point in the future, regardless of price changes or other factors. This makes attempts at frontrunning pointless, as manipulators cannot get ahead of such an order.

Private transactions, in turn, hide the details of the transaction from prying eyes until the moment of its execution. This can be accomplished through technologies such as zk-SNARKs or Trusted Execution Environments (TEEs). Traders send encrypted transactions that are only disclosed and executed at the time of inclusion in the blockchain, reducing the opportunity for MEVs.

Tools and solutions for traders to help avoid MEVs

Traders can use various tools and services specifically designed to minimize the impact of MEVs. These solutions help analyze the market situation, optimize trade execution and reduce the risks of manipulation.

For example, mempool analysis tools such as Flashbots Explorer or MEV-Inspect can monitor MEV bot activity and identify potentially dangerous transactions. This helps traders make more informed decisions and avoid unfavorable transactions.

In addition, some services offer advanced order execution algorithms that adapt to current market conditions and minimize slippage. Solutions such as Flashbots Auction or 1inch Stealth Transactions help traders execute trades at optimal prices, reducing the impact of MEVs.

Raising awareness and educating traders about MEVs is also important. Understanding the mechanisms of value extraction, the ability to identify potential manipulation and knowledge of available protection tools help traders to manage risks more effectively.

It is worth noting that it is currently impossible to completely eliminate the impact of MEVs. However, a combination of the right tools, strategies and knowledge can significantly reduce risk and provide a fairer trading environment. As blockchain technologies evolve and new solutions to combat MEVs emerge, traders will have more and more opportunities to protect their interests in decentralized markets.

Challenges and the future of MEVs

The phenomenon of maximum extractable value (MEV) raises a number of ethical and technical challenges that affect the development of decentralized markets and the experience of traders. Let’s take a look at these challenges and possible ways to address them in the future.

Ethical and technical issues associated with MEVs

MEV raises important issues of fairness and equality of opportunity in decentralized markets. Manipulation, such as frontrunning or sandwich attacks, allows individual participants to gain an advantage at the expense of others, which contradicts the very idea of decentralization and openness of the blockchain.

In addition, MEVs can lead to undesirable economic consequences such as increased price volatility, reduced liquidity and higher transaction costs. This negatively affects market efficiency and user confidence in decentralized applications (dApps).

From a technical perspective, MEVs make blockchain networks and smart contracts more complex. Manipulations increase network load, consume computing resources, and potentially lead to failures or vulnerabilities in dApps. Developers have to consider the possibility of MEV when designing protocols and implement additional security measures.

Technology and regulatory developments that can make a difference

Both technological innovation and regulatory initiatives are needed to address the challenges associated with MEVs. Blockchain protocol developers are actively exploring new consensus mechanisms and algorithms that may reduce the opportunities for MEV extraction.

For example, approaches such as time delays for blockchain transactions, random selection of validators, or implementation of proof-of-fairness schemes can reduce the impact of MEVs. In addition, the development of Layer 2 solutions, such as state channels or plasma chains, can enable faster and more private execution of transactions outside the main blockchain.

From a regulatory perspective, clear rules and standards are needed to define acceptable practices in decentralized markets. Regulators can work with developers and the community to establish guidelines to prevent manipulation and protect the interests of users. However, it is important to strike a balance so that regulation does not stifle innovation or limit the potential of DeFi.

Perspectives for traders: how the market will change with the rise of MEVs

As DeFi grows in popularity and trading volumes on decentralized exchanges (DEX) increase, the MEV problem will become more and more relevant. Traders will have to adapt to new market realities and use tools that reduce the risks of manipulation.

Specialized services and protocols will probably be developed to provide traders with opportunities for safe and efficient trading in MEV conditions. These may be solutions for private execution of trades, algorithms for optimizing order routing, or tools for analyzing market data with MEV in mind.

We can also expect decentralized protocols and liquidity aggregators to grow in popularity, which minimize the impact of MEVs by aggregating liquidity from different sources and using advanced trade execution algorithms. Traders will seek platforms that provide better pricing, lower slippage and fairer trading conditions.

In the long term, as technology and regulation improve, the impact of MEVs on markets may gradually diminish. However, the potential for MEV extraction is unlikely to be completely eliminated, given the very nature of decentralized systems. Traders will need to constantly monitor developments, adapt their strategies and utilize advanced tools to trade effectively in the MEV environment.

Conclusion

MEVs remain an important factor affecting trading in decentralized markets. Understanding the risks and opportunities associated with MEVs is key to the success of traders. Despite the challenges, advances in technology and regulation can gradually reduce the impact of MEVs. Traders need to adapt, utilize advanced tools and keep up with DeFi innovations. Only through the joint efforts of the community can a fairer and more sustainable decentralized finance ecosystem be built.