Why is it important to track Bitcoin dominance in the cryptocurrency market?

Bitcoin, being the first and most famous cryptocurrency, plays a key role in the digital asset market. Its influence is so great that the state of the entire cryptocurrency market is often assessed by the position of bitcoin. One of the key indicators reflecting this influence is bitcoin’s dominance.

Contents

- What is bitcoin’s dominance?

- Impact of bitcoin dominance on the cryptocurrency market

- Why is it important for investors to keep an eye on this metric?

- Historical data and trends

- Current situation and outlook

- Conclusion

What is bitcoin’s dominance?

Determining bitcoin’s dominance

Bitcoin Dominance is an indicator that reflects the share of bitcoin’s market capitalization in the total capitalization of the entire cryptocurrency market. Simply put, this indicator shows what percentage of the total value of all existing crypto-assets is accounted for by bitcoin.

The dominance of bitcoin is an important indicator for assessing the current state and trends in the development of the cryptocurrency market. By analyzing the dynamics of this indicator, traders and investors can better understand market sentiment, cycles and potential trend reversal points.

For example, high bitcoin dominance (over 50-60%) often indicates a bullish market mood and increased investor interest in cryptocurrencies in general. During such periods, both bitcoin and many altcoins usually rise.

On the other hand, a decline in bitcoin dominance in favor of altcoins may indicate a growing interest in other cryptocurrency projects and the potential start of the “alt season” – a period when investments in alternative coins bring higher returns than investments in bitcoin.

Market Cap BTC Dominance 1h, %

How the dominance index is calculated

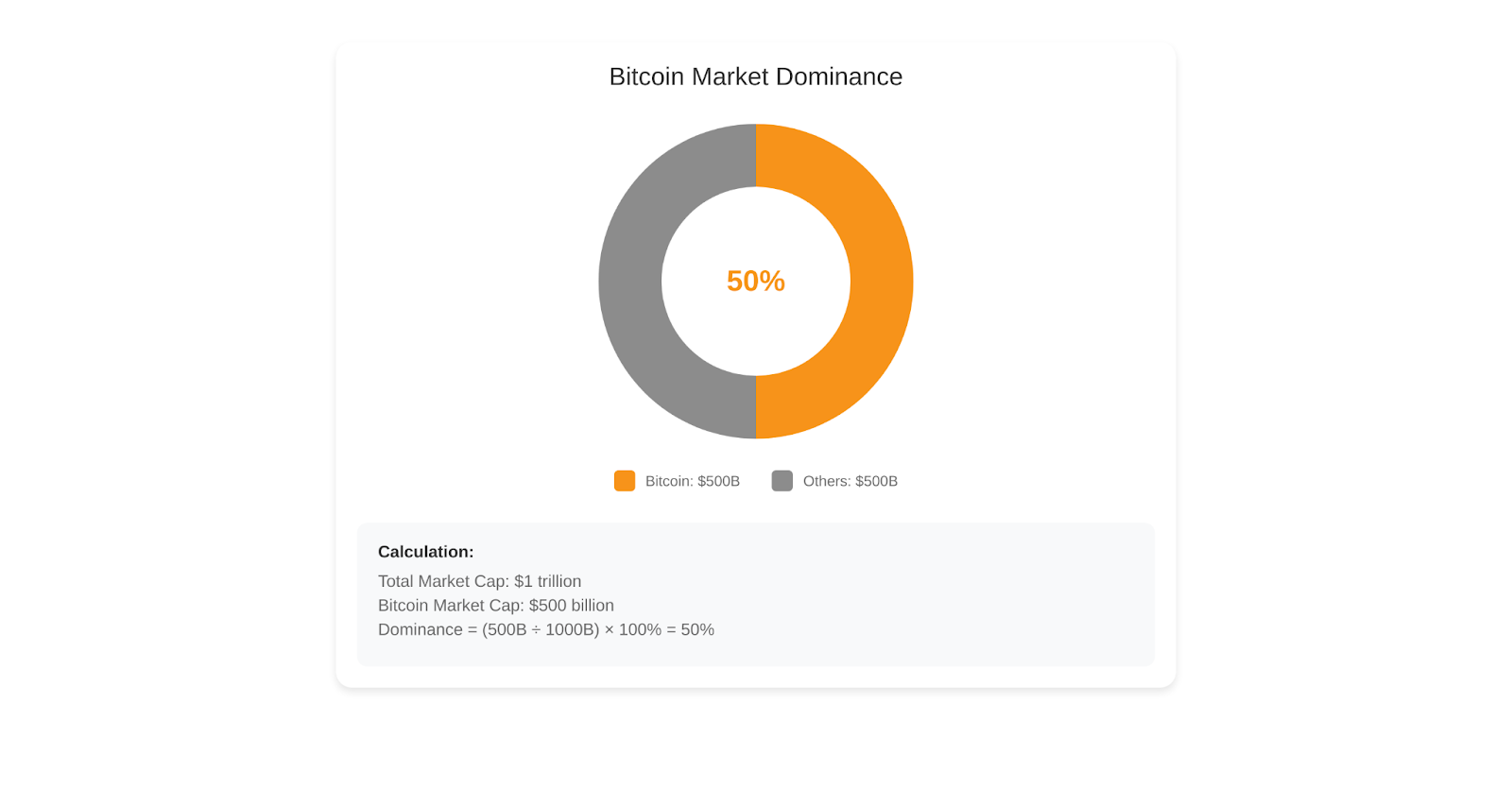

It is quite easy to calculate the bitcoin dominance rate. To do this, the market capitalization of bitcoin should be divided by the total capitalization of all cryptocurrencies and multiply the resulting number by 100%. The result will reflect bitcoin’s current dominance as a percentage.

Let’s say bitcoin’s market capitalization is $500 billion and the total capitalization of the cryptocurrency market is $1 trillion. Dividing 500 by 1000 and multiplying by 100%, we get 50%. This means that bitcoin currently dominates 50% of the entire cryptocurrency market in terms of market capitalization.

For convenience, the value of bitcoin dominance has already been calculated on most cryptocurrency analytics platforms and websites such as CoinMarketCap, CoinGecko, TradingView and others. A trader only needs to open a special widget or bitcoin dominance chart to track the dynamics of the indicator.

The role of bitcoin’s dominance in the overall cryptocurrency market capitalization

Bitcoin dominance is one of the key indicators to assess the maturity and structure of the cryptocurrency market. Analyzing the dynamics of this indicator, it is possible to identify certain patterns and cycles characteristic of different stages of the industry’s development.

Thus, at the dawn of cryptocurrency formation, when bitcoin was practically the only digital asset, its dominance tended to 100%. As new altcoins emerged, this indicator gradually decreased, although it remained at a very high level for the first few years.

Bitcoin’s dominance reached its historic low of about 35% in January 2018 at the peak of the cryptocurrency boom and the explosive growth of altcoins. After that, the indicator switched to growth again and has been fluctuating in a fairly wide range from 40% to 70% for the past few years.

By itself, the dominance indicator does not give direct signals to buy or sell bitcoin. However, when combined with other market metrics, it can indicate potential entry and exit points, as well as the likely direction of price movement.

January 2018 Market Cap BTC Dominance 1h, %

Impact of bitcoin dominance on the cryptocurrency market

Impact on altcoins and their capitalization

The dynamics of bitcoin dominance have a significant impact on alternative cryptocurrencies (altcoins) and their market capitalization. Typically, when bitcoin dominance increases, it is at the expense of altcoins’ declining share of total market capitalization.

During periods when bitcoin strengthens its position, investors usually prefer to invest in the most reliable and liquid asset, which is the first cryptocurrency. This leads to an outflow of capital from altcoins, which in turn negatively affects their price and capitalization.

On the other hand, when bitcoin’s dominance decreases, it often indicates growing investor interest in alternative cryptocurrency projects. During such periods, capital begins to flow from bitcoin to promising altcoins, which contributes to the growth of their price and increases their share in the total market capitalization.

Thus, during periods of so-called “altcoins” (periods of rapid growth of altcoins), bitcoin’s dominance usually decreases noticeably. For example, in January 2018, when the altcoin market reached its peak, bitcoin’s dominance dropped to a record low of 35%.

How dominance changes could affect altcoin prices

Changes in bitcoin dominance can serve as a kind of indicator of potential price movements for altcoins. Although there is no direct correlation between these indicators, certain patterns can still be traced.

When bitcoin dominance increases, it is often accompanied by a decline in altcoin prices. This happens because investors prefer to transfer their funds from riskier alternative coins to the “safe harbor” of bitcoin. This trend is especially pronounced during market corrections and downturns.

Conversely, when bitcoin loses market share, it is often a sign of potential altcoin growth. A decline in the dominance of the main cryptocurrency signals that investors are starting to look for higher-yielding opportunities in the market and are ready to invest in promising alternative projects.

However, it should be understood that far from always a decrease in the dominance of bitcoin means an automatic growth of all altcoins. Often, capital flows only into the most fundamentally strong and promising coins, while less successful projects may continue to lose value.

Market reaction to bitcoin share rise or fall

The cryptocurrency market is very sensitive to changes in bitcoin’s dominance. Sharp jumps in this indicator often lead to increased volatility and can serve as a trigger for the start of a new market cycle.

If the share of bitcoin begins to grow rapidly, it is usually perceived by the market as a signal to buy the first cryptocurrency. Traders and investors start actively buying bitcoin, which further strengthens its position and contributes to further growth of the rate.

At the same time, a sharp decline in bitcoin’s dominance often causes a revival in the altcoin market. Investors begin to actively invest in alternative coins, hoping to get higher returns. This leads to an increase in trading volumes and market volatility.

It is important to note that the market reaction to changes in the dominance of bitcoin is often non-linear. Sometimes the growth in the share of the main cryptocurrency can occur against the background of a general decline in the market, and sometimes, on the contrary, bitcoin can lose its positions even during a bullish trend.

Therefore, relying solely on the dominance indicator is not sufficient for effective trading and investing. It is necessary to analyze this indicator in conjunction with other market metrics such as trading volumes, volatility, investor sentiment and fundamentals.

In addition, it is useful to monitor bitcoin’s dominance dynamics over different timeframes. Short-term fluctuations in the indicator can provide signals for speculative trading, while long-term trends are more suitable for strategic investment decisions.

Why is it important for investors to keep an eye on this metric?

The bitcoin dominance indicator is one of the key indicators that every cryptocurrency investor should monitor. Analyzing the dynamics of this indicator allows you to better understand the current state of the market, predict potential trend reversals and adjust your investment strategy in a timely manner.

Predicting market trends

Bitcoin dominance can serve as a leading indicator to determine the general direction of the cryptocurrency market. Historically, periods of high bitcoin dominance often coincide with bullish trends in the market, while declines often precede the onset of “alt-seasons”.

By tracking dominance dynamics, investors can gain insight into the current phase of the market cycle and potential entry and exit points. For example, if bitcoin dominance begins to decline after a long period of growth, this could indicate an impending trend break and the potential start of a correction.

On the other hand, if bitcoin dominance reaches local lows and begins to reverse upward, this could signal the end of the accumulation phase and the beginning of a new bull cycle. Of course, these signals are not infallible and require confirmation by other indicators, but they can be very useful for making investment decisions.

Assessment of cryptocurrency market volatility

The dynamics of bitcoin dominance is closely related to the level of volatility in the cryptocurrency market. As a rule, sharp jumps in this indicator indicate increased volatility and uncertainty in the market.

If bitcoin dominance begins to rise or fall rapidly, this is often accompanied by increased price fluctuations of both bitcoin itself and altcoins. During such periods, the market becomes more volatile and risky, which requires investors to be more cautious and ready to react quickly to changes in the situation.

On the other hand, when bitcoin dominance is in a relatively stable range, it usually indicates a calmer and more predictable market condition. During such periods, volatility tends to be lower and prices move in tighter ranges.

Thus, by tracking fluctuations in bitcoin’s dominance, investors can better assess current risks and adjust their trading strategies. For example, during periods of increased volatility, it makes sense to reduce the size of positions and use more conservative strategies, while during calm periods, you can consider increasing your investments.

Predicting the probability of altcoin growth

One of the main reasons investors follow bitcoin’s dominance is the ability to predict the growth potential of alternative cryptocurrencies. As we have already found out, the decline in bitcoin’s market share often coincides with periods of rapid growth of altcoins.

By analyzing the dynamics of dominance, investors can determine the most favorable moments to enter positions in promising altcoins. If bitcoin’s share is at high levels and begins to turn downward, this may indicate an approaching “altcoin season” and a potential opportunity to gain increased returns on investments in alternative coins.

Of course, you shouldn’t blindly rely solely on the dominance index when choosing specific altcoins to invest in. It is necessary to carefully analyze the fundamental factors of each project, evaluate its team, technology, development prospects and potential risks.

Nevertheless, tracking bitcoin dominance dynamics can give investors an additional advantage and help them choose the most successful moments to diversify their cryptocurrency portfolio. By combining dominance analysis with a fundamental assessment of individual projects, investors can significantly increase their chances of success and increase the potential return on investment.

Historical data and trends

To better understand the current dynamics of bitcoin dominance and make forecasts for the future, it is useful to turn to historical data and analyze how this indicator behaved in the past. Retrospective analysis helps to identify certain patterns and trends characteristic of different phases of cryptocurrency market development.

A retrospective analysis of bitcoin’s dominance

In the early days of the cryptocurrency market, when bitcoin was virtually the only digital asset, its dominance tended to 100%. However, with the emergence of the first altcoins, this indicator began to gradually decline.

Thus, if at the beginning of 2017, bitcoin’s dominance was about 85%, by the end of the year it dropped to 40%. This was due to the explosive growth in the popularity of alternative cryptocurrencies, primarily Ethereum, which was able to take a significant part of the market.

Bitcoin’s dominance reached its all-time low of 35% in January 2018 at the peak of the cryptocurrency boom. After the altcoin market bubble collapsed, the figure started to rise again and by the end of 2018 it exceeded the 50% mark.

In the following years, bitcoin’s dominance showed quite high volatility, periodically dropping below 50% and recovering again to levels of 60-70%. A vivid example is 2021, when, amid the rapid growth of the DeFi and NFT market, bitcoin’s share fell to 40%, but then managed to recover a significant part of the losses.

Periods of increasing and decreasing dominance

Analyzing the historical dynamics of bitcoin dominance, we can distinguish characteristic periods of growth and decline of this indicator. As a rule, the share of bitcoin grows during general market uncertainty and in periods of global economic turmoil.

For example, in March 2020, against the backdrop of the collapse of global financial markets due to the COVID-19 pandemic, bitcoin’s dominance grew from 60% to 70%. In the face of increased turbulence, investors chose to move into bitcoin as the most reliable and liquid cryptocurrency asset.

On the other hand, periods of decreasing bitcoin dominance usually coincide with phases of active growth and development of altcoins. The ICO boom in 2017, the rise of DeFi tokens in 2020, and the fever around NFT in 2021 are prime examples. During such periods, investors actively move into alternative coins in search of increased returns.

Lessons from past changes in dominance

Retrospectively analyzing the dynamics of bitcoin’s dominance allows us to draw several important conclusions and valuable lessons for future investments:

- High bitcoin dominance does not always mean a bullish trend in the market. As practice shows, the growth of the share of the first cryptocurrency often occurs against the background of a general market decline and falling prices for altcoins.

- A sharp decline in bitcoin dominance often signals the potential start of the “altcoin season”. However, one should not expect absolutely all altcoins to grow equally well. It is important to choose projects with strong fundamentals for investment.

- After each period of declining dominance, bitcoin usually recovers its position. This suggests that the first cryptocurrency is still the key asset of the market, and it is not worth completely discounting it even during the active growth phases of altcoins.

- Historically, the most optimal strategy is to keep bitcoin as the underlying asset and simultaneously diversify the portfolio with high-quality altcoins. This approach allows you to capitalize on both the growing dominance of bitcoin and periodic spikes in the market for alternative coins.

- To effectively manage a cryptocurrency portfolio, it is not enough to blindly follow the dynamics of bitcoin dominance. It is necessary to analyze the market situation comprehensively, taking into account fundamental, technical and macroeconomic factors.

Current situation and outlook

Bitcoin’s modern dominance

The current dominance value is fairly typical for bitcoin in recent years. After reaching an all-time low of 35% in January 2018, the share of the first cryptocurrency has been fluctuating in the range of 40-70% for the last few years, periodically dropping to the lower end of the range during active phases of altcoin growth.

It is important to note that bitcoin’s current level of dominance is still well below the peak values of 2013-2015, when the figure was consistently above 90%. This suggests that despite its status as the main cryptocurrency, bitcoin no longer monopolizes the market as much as it used to, and alternative projects are beginning to play an increasing role.

Possible scenarios for bitcoin’s future dominance

It is quite difficult to give precise forecasts regarding the future dynamics of bitcoin dominance, given the high volatility and unpredictability of the cryptocurrency market. Nevertheless, several potential scenarios can be identified:

- Bitcoin-King scenario. In this scenario, bitcoin’s dominance will gradually grow and may return to levels above 60-70% in the long term. This may happen if institutional investors and large players increase their investments in bitcoin as the most reliable and liquid crypto-asset.

- The “altcoins are coming” scenario. In this case, on the contrary, a further decline in the share of bitcoin is expected against the background of rapid growth of alternative projects. The trigger for such a scenario may be the active development of DeFi, NFT, metaviews and other promising areas of the crypto industry, where altcoins dominate.

- “Stable balance” scenario. In this scenario, bitcoin’s dominance will be fairly stable and will continue to fluctuate in the current range of 40-60%. This scenario assumes that bitcoin and altcoins will develop in parallel without taking away a significant market share from each other.

Time will tell which of these scenarios will be closer to reality. However, in any case, investors should be prepared for different scenarios and adapt their investment strategies accordingly.

How competition with other cryptocurrencies could affect the market

One of the key factors influencing bitcoin’s dominance is competition with other major cryptocurrencies, primarily Ethereum. In recent years, ETH has significantly strengthened its position in the market and now ranks second in terms of capitalization after bitcoin.

Many experts believe that it is Ethereum that has the best chances to displace bitcoin from the position of the market leader. Several factors contribute to this:

- Broad capabilities of smart contracts and decentralized applications (dApps) based on Ethereum. This functionality opens up huge prospects for the development of the DeFi industry, NFT and other innovative areas.

- Active development of the Ethereum ecosystem and continuous improvement of the technology. A striking example is the network’s transition to the Proof-of-Stake (PoS) consensus algorithm, which should significantly improve the scalability and energy efficiency of the blockchain.

- Growing institutional interest in Etherium. Many large companies and investment funds are starting to consider Etherium as a promising asset for long-term investments alongside bitcoin.

If the trend of Ethereum’s position strengthening continues, it may lead to a further decrease in bitcoin’s dominance. In the long term, it is even possible that Ethereum will overtake bitcoin in terms of capitalization and become the new market leader.

However, we should not discount other promising altcoins, such as Binance Coin, Cardano, Solana and others. Each of these projects has its own strengths and potential for growth, which may also affect the distribution of market shares between cryptocurrencies.

Overall, increased competition between bitcoin and altcoins is likely to further develop and diversify the cryptocurrency market. Investors should closely monitor the development of leading projects and adjust their portfolios if necessary in order to capitalize on changing market conditions.

At the same time, it is important to realize that despite a potential decline in dominance, bitcoin is unlikely to completely lose its status as the main cryptocurrency in the foreseeable future. It still remains the most recognizable and liquid digital asset, with the greatest acceptance among institutional investors.

Conclusion

To summarize, we can say that the bitcoin dominance indicator is one of the key indicators that every cryptocurrency investor needs to monitor. This indicator reflects the current state of the market, allows you to forecast potential trend reversals and assess the growth prospects of altcoins.