Wrapped Tokens in Crypto: What They Are and Why They Matter

Contents

- Introduction

- What Are Wrapped Tokens

- How Wrapped Tokens Work

- Tokenization of Assets and New Opportunities

- Benefits and Risks

- How to Create and Use a Wrapped Token

- Conclusion

Introduction

Wrapped tokens have long been part of the cryptocurrency ecosystem. They emerged as a way to use assets from one network within another. For example, they make it possible to use Bitcoin on the Ethereum network and interact with decentralized applications that don’t natively support BTC. This solves the compatibility issue between blockchains and opens up new opportunities for trading, investing, and working with DeFi.

In this article, we’ll explore wrapped tokens, how they work, and why they’re needed, and review examples, risks, and key technical details.

What Are Wrapped Tokens

Definition of Wrapped Tokens

Wrapped tokens are digital assets that represent copies of other cryptocurrencies but operate on a different network. Simply put, it’s a “wrapper” that places one token inside another. For instance, you can take Bitcoin and “wrap” it into a token that functions on the Ethereum network. This token is known as Wrapped Bitcoin (WBTC).

A wrapped token maintains the same price as the original asset. One WBTC is always worth roughly the same as one actual BTC. The key difference is that WBTC functions as an ERC-20 token, which can be used across all Ethereum-based applications and protocols. This is especially important for those looking to use Bitcoin in DeFi — decentralized financial services built initially for Ethereum.

Wrapped tokens address blockchain incompatibility by not transferring the original asset to a new network but by creating its equivalent, which is usable in a different ecosystem. These tokens are often issued through bridges, which lock the original asset and release a wrapped version on another network. This retains the value of the original token while enabling use in DeFi, smart contracts, or other applications where it was not natively supported.

Examples of Popular Wrapped Tokens

Wrapped Bitcoin (WBTC): A token fully backed by actual bitcoins. When WBTC is created, real BTC is held in custody, and an equivalent amount of WBTC is issued. These tokens can later be unwrapped to retrieve the original BTC.

Wrapped Ethereum (WETH): Although Ethereum runs on its network, ETH is not compliant with the ERC-20 standard, complicating its use in DeFi. WETH solves this by wrapping ETH into an ERC-20 compatible format.

In addition to WBTC and WETH, many other wrapped tokens allow different coins to be used within other technical standards:

-

Wrapped BNB (WBNB) – The wrapped version of BNB used in the Binance Smart Chain ecosystem. Suitable for farming, staking, and swapping.

-

Wrapped Litecoin (WLTC) – Litecoin is in a format compatible with Ethereum and is used in DeFi protocols and DEXs.

-

Wrapped SOL (WSOL) – Enables the use of SOL in Solana smart contracts that require a standardized token format.

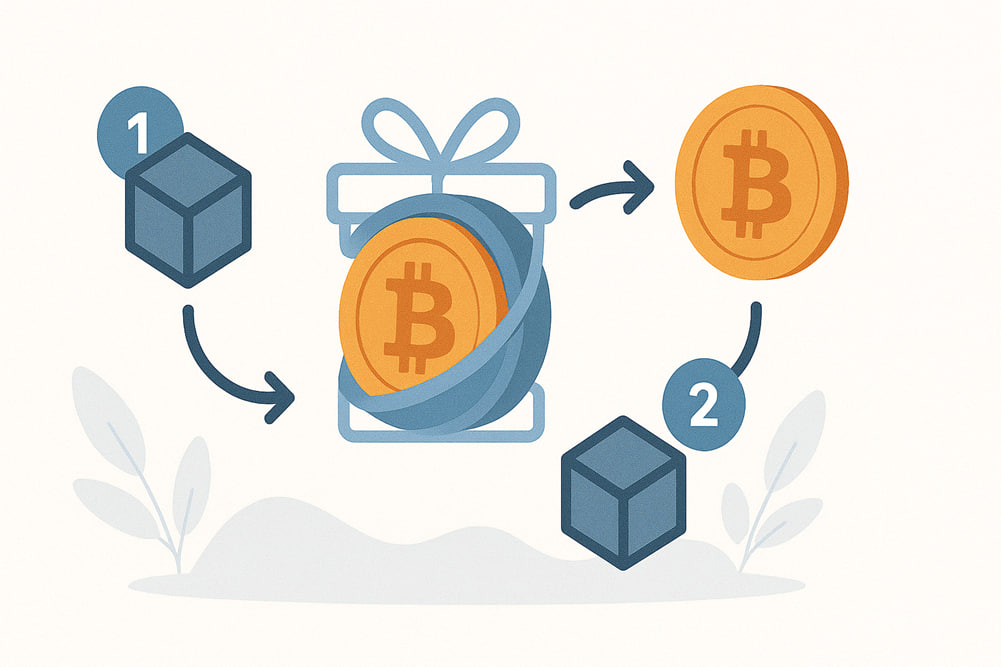

How Wrapped Tokens Work

Smart Contracts and Standards

Wrapped tokens don’t appear out of nowhere. Their creation and operation are managed by special programs known as smart contracts. These lines of code recorded on the blockchain act according to predefined rules. Thanks to them, everything works automatically and without intermediaries.

When someone wants to receive a wrapped token, the system locks the original asset and issues its equivalent on a new network. For example, to create Wrapped Bitcoin, the actual BTC is sent into storage, and in return, the user receives a WBTC token on the Ethereum network.

Such tokens are issued following specific standards to interact appropriately with other services. The most well-known are ERC-20 for the Ethereum network and BEP-20 for Binance Smart Chain. These standards make tokens “recognizable” by wallets, exchanges, and applications. A token can be used in any supporting service if it conforms to the standard. It’s like a set of common rules that all participants in the ecosystem understand.

Wrapped tokens could not participate in smart contracts, transfer between users, or be stored in most wallets without these standards.

Cross-Chain Bridges and Conversion

One of the main reasons wrapped tokens exist is the inability to transfer assets from one network to another directly. For instance, Bitcoin and Ethereum are two separate blockchain systems. They are structured differently and cannot natively exchange data or assets. Cross-chain bridges are used to establish interaction between such networks.

Bridges are a combination of programs and services that allow the transfer of assets from one network to another. The process works as follows: a user sends their token on the first blockchain, the bridge records the operation, and creates a wrapped version of the token on the second blockchain. Meanwhile, the original asset is frozen or stored in reserve until the process is reversed.

Conversion is carried out via trusted operators or decentralized protocols. They ensure that for every wrapped token issued, there is an equivalent amount of the original asset in another network. This maintains the token’s value and prevents the system from “overissuing.”

Use in DeFi

Wrapped tokens have broad applications in decentralized finance (DeFi), a sector where all operations are performed without banks or centralized platforms. In DeFi, compatibility, transparency, and access to diverse assets are essential. Wrapped tokens help solve all of these tasks.

Liquidity Pools and Yield Aggregation

Many users add wrapped tokens to liquidity pools, specialized repositories on decentralized exchanges where tokens are swapped. The more tokens in a pool, the easier for others to trade.

For example, someone with WBTC and ETH can deposit them into a pool. In return, they receive some of the fees traders pay when exchanging assets. This is known as liquidity provider income. It allows users to earn from their assets without selling them.

Some platforms combine such pools with additional opportunities and create tools for yield aggregation. The user deposits the token, and the system automatically routes it to where it can earn the highest return. All of this works via smart contracts and without intermediaries.

This article provides a complete breakdown of passive income strategies in decentralized services, including participation in liquidity pools.

Tokenization of Assets and New Opportunities

Wrapped tokens are not limited to cryptocurrencies. They can also represent other forms of value, such as gold, stocks, or real estate. These are referred to as RWA (Real World Assets), and tokenization allows them to be operated digitally. One token can represent a fraction of a physical asset, which can then be transferred, sold, or used as collateral.

Tokenization makes expensive assets more accessible. It becomes possible to purchase a small fraction of Bitcoin, gold, or even equity instruments previously unavailable in such a format. This provides more flexibility in portfolio management and lowers the entry threshold.

Benefits and Risks

Access to Global Liquidity

Wrapped tokens allow users to utilize assets beyond their native networks. This provides new opportunities that were previously unavailable:

-

Access to other blockchains. For example, a Bitcoin holder can access Ethereum protocols via WBTC.

-

Integration with DeFi. Users can participate in liquidity pools, use tokens as collateral, and trade on DEXs.

-

Lower barriers to entry. No need to buy new tokens to join an ecosystem — users can work with what they already own.

-

Fast onboarding. Wrapped tokens simplify access to decentralized services without requiring deep integration with different network infrastructures.

Vulnerabilities and Potential Attacks

Despite their convenience, wrapped tokens carry certain risks related to technical flaws and trust:

-

Smart contract bugs. If vulnerabilities exist in the code, attackers may drain funds. Such incidents have occurred.

-

Bridge attacks. Hackers frequently target cross-chain bridges, which handle large sums, and one failure can lead to significant losses.

-

Centralization. Some bridges rely on custodians who store the assets. If a custodian is unreliable, users may lose their funds.

-

Lack of transparency. Not all wrapped tokens are guaranteed to be backed by reserves. If reserves are missing or unverified, trust in the token declines.

To mitigate risks, it is essential to use only reputable platforms and monitor the credibility of those who issue and manage wrapped tokens.

How to Create and Use a Wrapped Token

Step-by-Step Issuance Process

Creating a wrapped token requires technical setup, but the process is simple. Let’s look at Ethereum as an example:

-

The user sends the original asset, such as BTC, to the address of a custodian or bridge smart contract.

-

After confirming the transaction, the operator locks the asset or places it into secure custody.

-

A smart contract on the Ethereum network issues the equivalent of an ERC-20 token—in this case, WBTC.

-

The user receives the wrapped token in their wallet and can use it in Ethereum-based applications.

If the user wants to return the original asset, they burn the wrapped token. The operator then returns.

Exchange and Storage

Wrapped tokens can be used almost the same way as regular cryptocurrencies. They are traded on decentralized and centralized exchanges and supported by wallets and DeFi platforms.

To exchange wrapped tokens, you need to choose a suitable platform. Each has features: supported networks, available tokens, and transaction speeds. Some work in a single ecosystem, while others offer greater flexibility. Below is a table of popular services and key parameters to help you choose.

Platform | Examples of Wrapped Tokens | Network Fees | Key Details |

WBTC, WETH, wMATIC, wUSDC, etc. | Ethereum network fees (depend on congestion) | Operates on Ethereum. ETH is required for gas fees. Supports DeFi tools. | |

WBTC, WETH, wUSDT, wDAI, wMATIC | Varies by network (Ethereum, Polygon, BNB) | An aggregator that finds the best price across exchanges. Suitable for the best rates. | |

WBNB, wUSDT, wBTCB, wETH | BNB Smart Chain fees (cheaper than Ethereum) | For Binance ecosystem users. Requires BNB for fees. Fast and user-friendly. |

It’s best to store wrapped tokens in a secure wallet that supports the appropriate token standard — for example, MetaMask or Trust Wallet. Be sure to enable two-factor authentication and stay informed about security updates.

If your token is held on an exchange, the platform may impose restrictions or temporarily freeze accounts.

Conclusion

Wrapped tokens have become an essential part of the crypto economy. They solve the problem of blockchain incompatibility and open up access to decentralized financial services for a broader audience. They allow users to utilize familiar assets in new ecosystems and explore ways to increase their income.

Wrapped tokens come with risks like technical bugs, bridge attacks, and dishonest operators. But with a thoughtful approach, these risks can be minimized. The key is to use trusted platforms and carefully choose your tools.

In the future, wrapped tokens could form the foundation for even greater blockchain interoperability. This will help the market grow and enable users to move freely between ecosystems without unnecessary barriers.