May 2025 Report

Contents

TradeLink Passport Updates:

Supported API Keys with IP Restrictions on TradeLink Passport and TradeLink Marketplace

In May, we completed the development of functionality to support Binance API keys with IP restrictions on both TradeLink Marketplace and TradeLink Passport.

Now, you can connect API keys from any platform, including Finandy, WhiteList, TigerTrade, and others, where creating API keys without IP restrictions was previously impossible.

In the near future, we will add a guide with instructions to the platform. However, you can already contact our support team, and we will explain in detail how to do this.

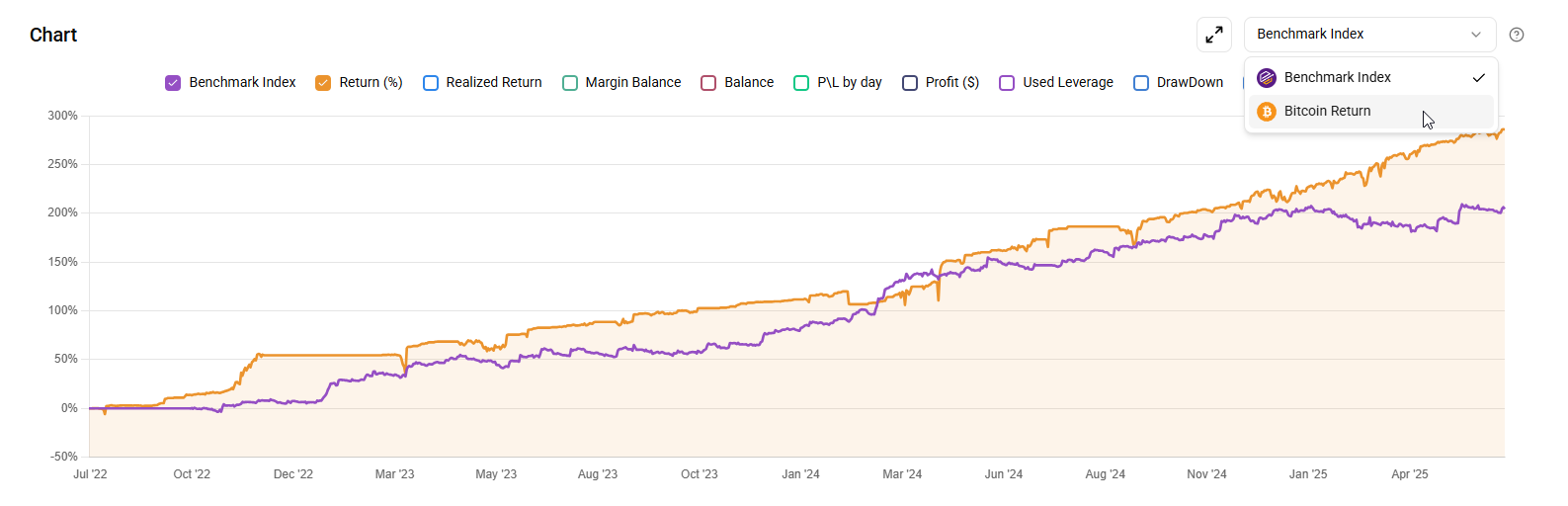

Added Benchmark Index to the Portfolio Page

We noticed that you frequently asked about the ability to compare portfolio performance not only with Bitcoin. To provide greater convenience and variety in comparing different instruments, we added the Benchmark Index, one of the indices available on TradeLink Marketplace.

Now, by default, the Benchmark Index will be displayed on any portfolio page. However, if you want to compare performance against Bitcoin, this option remains available—you can switch the display by clicking the window, as shown in the screenshot above.

You can explore this update yourself via this link.

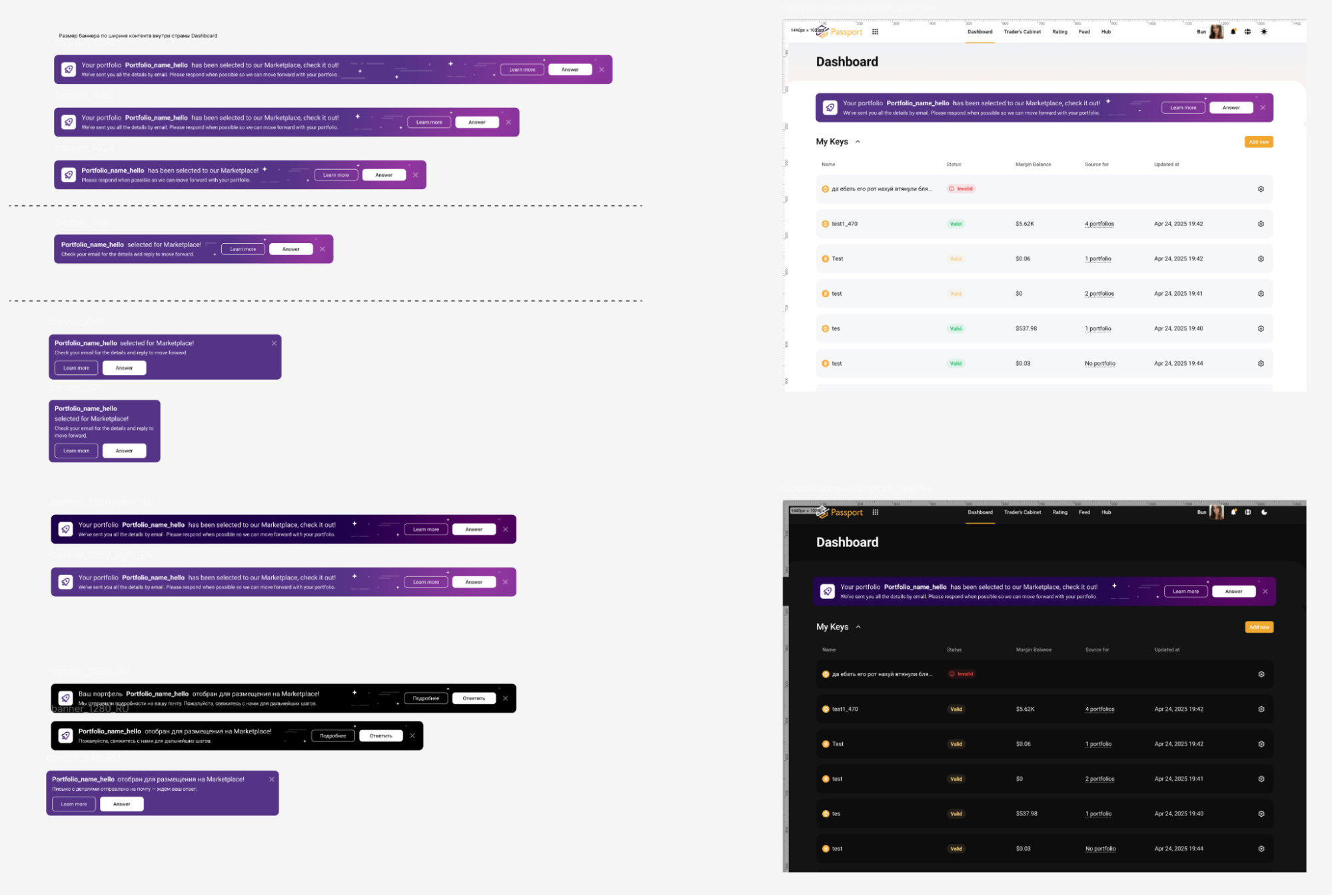

Added a New Informational Banner in the Dashboard

The new banner is designed for traders whose strategies we are interested in listing on TradeLink Marketplace.

It appears in the trader’s Dashboard if one of their strategies, added to TradeLink Passport, catches our attention. Therefore, if this banner appears for you, please get in touch with us!

TradeLink Marketplace Updates:

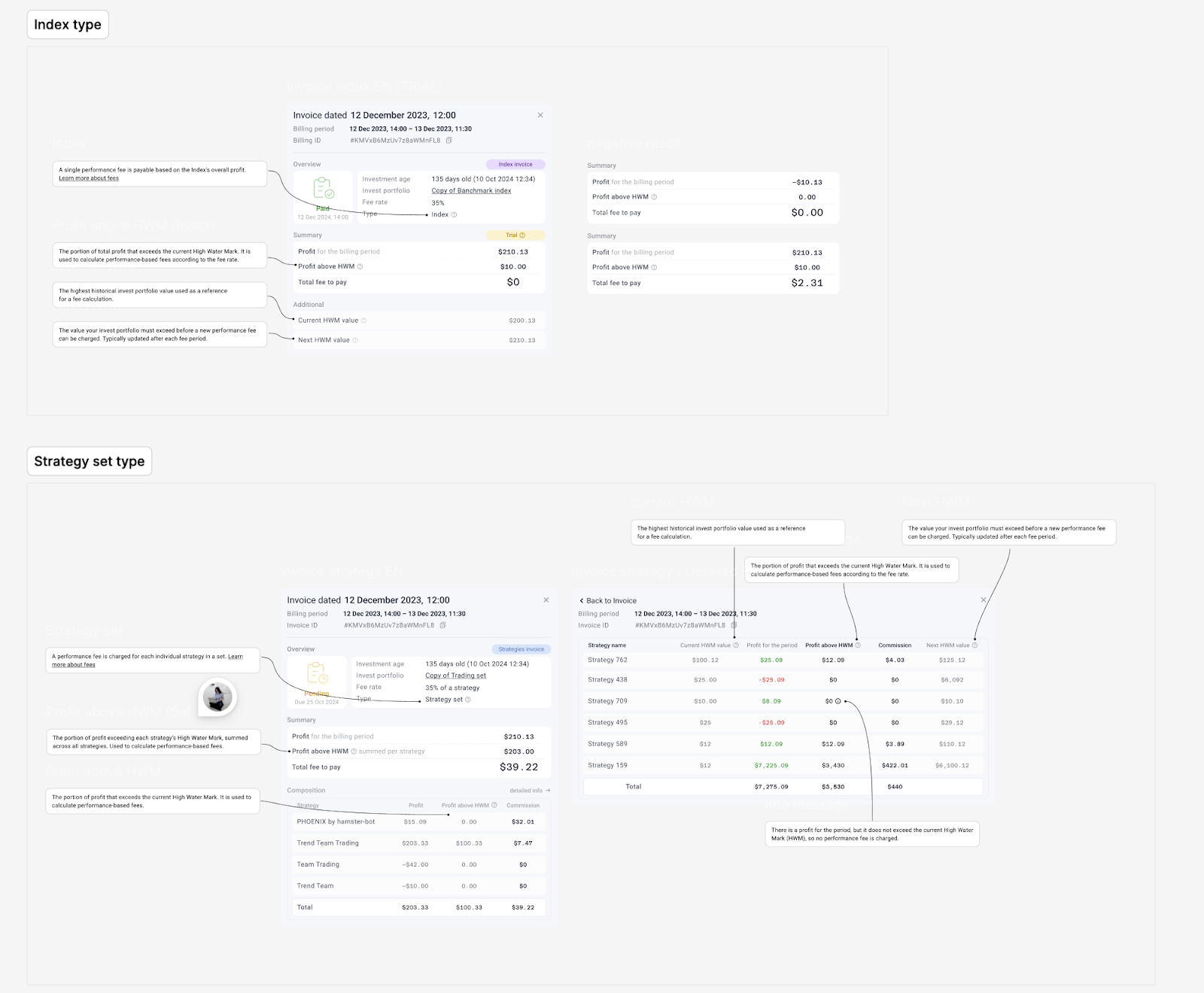

Implemented a New Commission Model

In March, we identified that the current “Per Strategy” billing model, where fees are charged based on the revenue of a specific strategy, was creating inconveniences for investors on the TradeLink Marketplace platform.

Despite the transparency and fairness of this model for strategy creators, it led to situations where investors received commission invoices even if their index did not generate a profit.

Therefore, we introduced a new model—the Index Commission Model, which applies exclusively to indexes.

For each active investment, a High Watermark (HWM) has been established, representing the profit level at the time of the last paid month.

Under the new model:

- An investor does not pay a commission until their profit exceeds the current HWM (they will receive zero-amount invoices).

- A commission will only be charged on profits exceeding the HWM.

The previous “Per Strategy” model will remain in place for investments in individual strategies or user-created presets via the constructor.

Learn more about the update here.

Improved Invoice Interface

After updating the commission calculation system for TradeLink Indexes, we needed to make changes to the commission payment window, so we decided to completely overhaul it.

The new Invoice window is now more informative and supports two scenarios: standard and index-based. In the updated version, you can see detailed information about the commission to be paid, the previous HWM, the future HWM, and the profit for the period for each strategy.

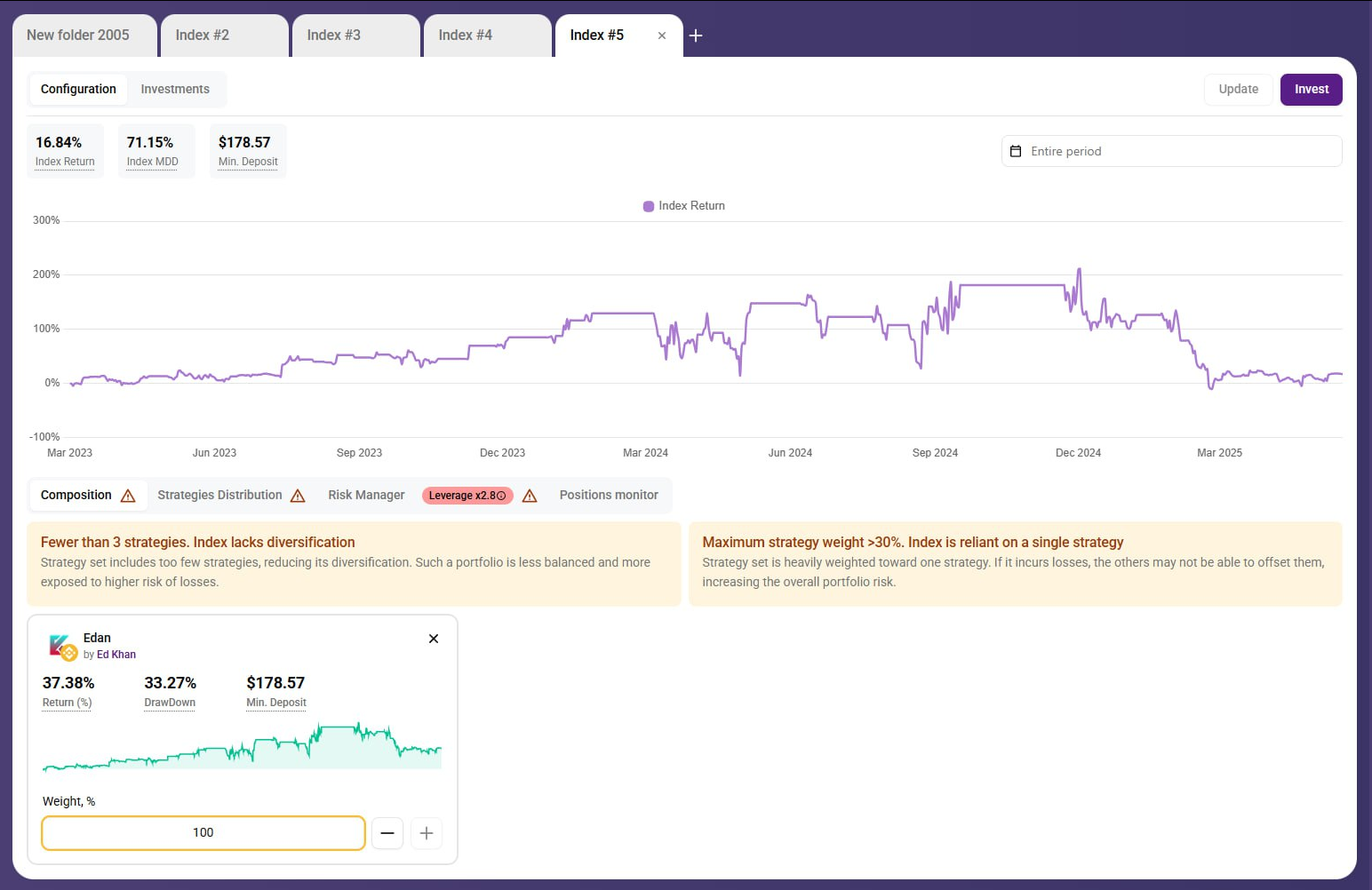

Implemented a Risk Warning System in the Index Constructor

After analyzing the results of indices created independently by users, we identified several patterns associated with increased risks:

- Users copying a single strategy over the long term earn less than those using diversified indices.

- The likelihood of reaching the maximum drawdown limit increases if you use trading leverage for investments.

- Indices with a high proportion of trend and counter-trend strategies (over 80%) are more sensitive to the current market phase.

To prevent unplanned losses, we implemented a risk warning system in the Index Constructor on the TradeLink Marketplace platform.

We expect this will enable you to create more resilient portfolios independently, which, in the long term, will positively impact the profitability of your investments.

Try the update on the constructor page.

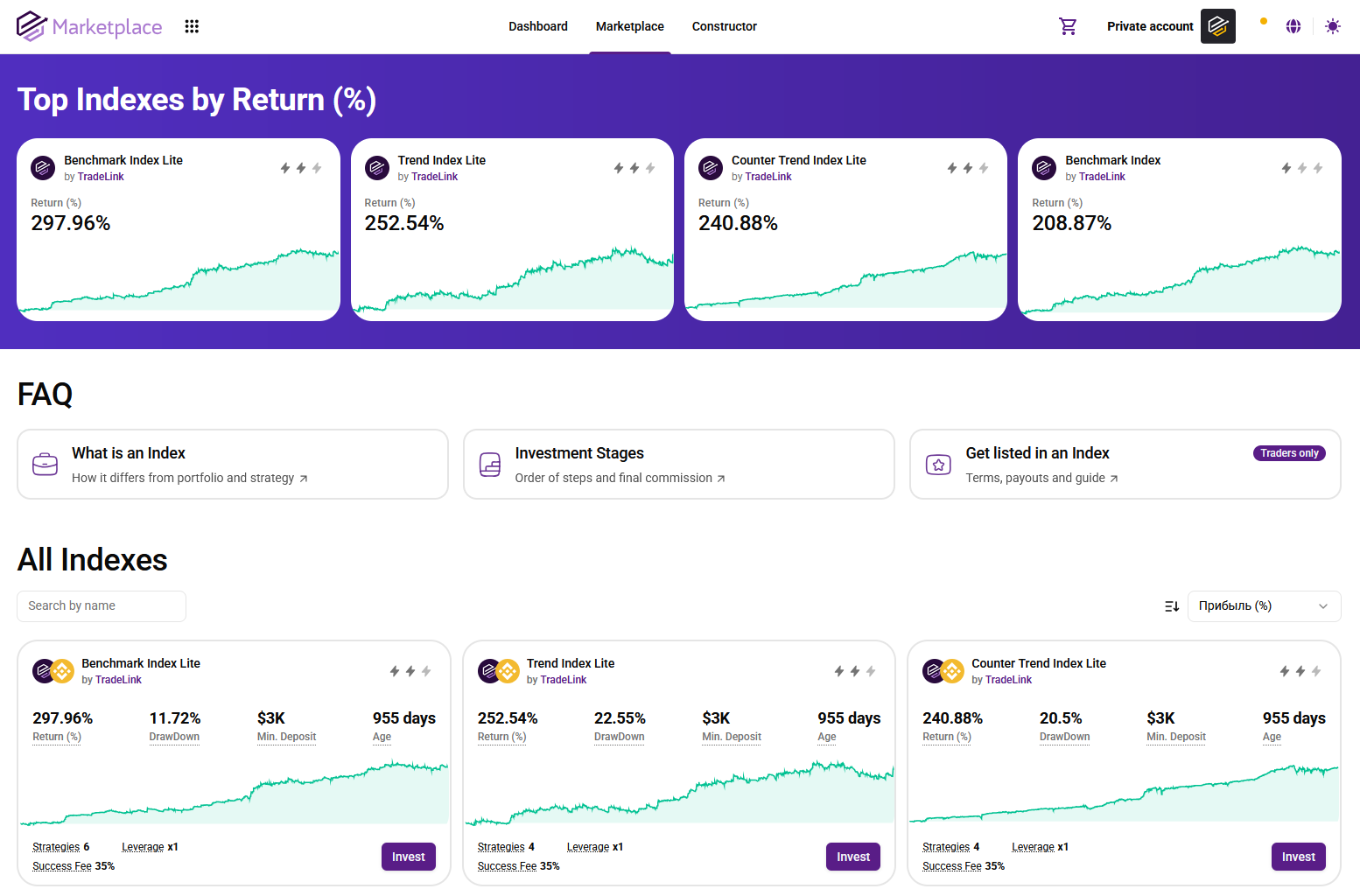

Added an FAQ Section to the Marketplace

We analyzed your most frequently asked questions and noticed that many of you prefer not to read documentation but want quick answers to key questions.

To enhance your user experience on the TradeLink Marketplace platform, we added an FAQ section to the catalog page. The new section provides concise information on the following:

- What is an Index? Information about indices, their differences from strategies, and how they are formed.

- Investment Stages: How to invest, requirements, commission details, and how to track investments.

- Get listed in an Index: Information for traders wishing to list a strategy on TradeLink Marketplace, including how to apply and details on listing and collaboration terms.

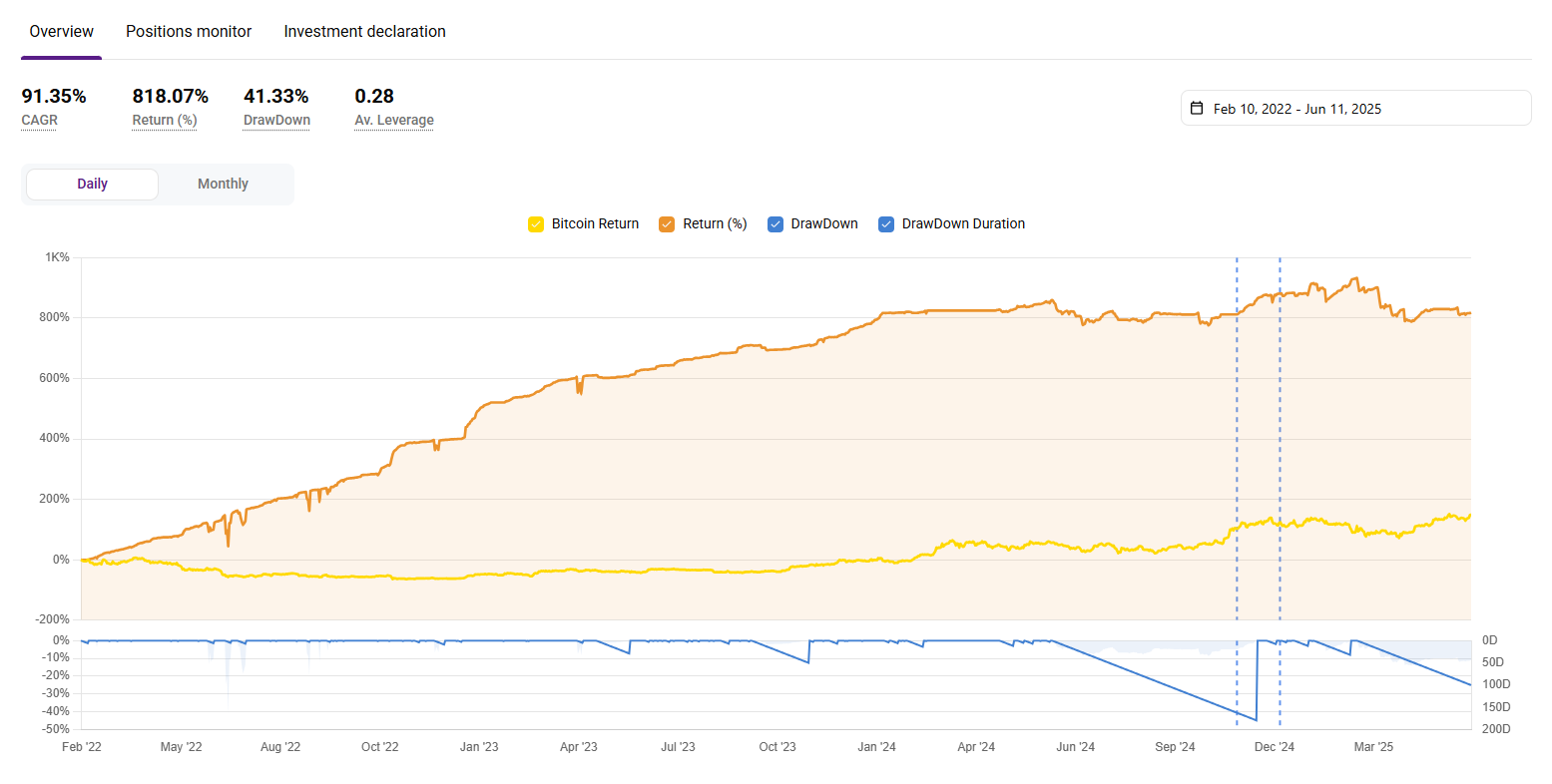

Added Bitcoin Return to the Strategy Page on TradeLink Marketplace

Following your feedback about the lack of a convenient tool to compare profitability on TradeLink Marketplace with Bitcoin, we decided to address this.

We added the Bitcoin Return indicator. Now, on each strategy’s page, you can compare its profitability with Bitcoin. We expect this update will make it more comfortable for you to select a suitable strategy for your investments.

View the implementation example here.

TradeLink Platform

Updates on Our Social Media

We published over 50 unique posts on our platform’s social media channels.

Among the published posts are explainers, announcements, notifications, as well as various marketing and analytical publications. We continue to concisely and clearly explain and showcase the platform’s capabilities, delighting you with content.

Blog Updates

During this period, we worked on writing thematic articles about cryptocurrencies, trading, and related topics. We created 33 engaging articles, which have already been published on our blog:

- Tilt in Trading: Causes and Ways to Combat It

- Top 5 Passive Income Sources in Cryptocurrencies

- Taproot Assets: The Future of USDT in Lightning

- Support and Resistance Levels: How to Identify Them

- Strategies for Earning in a Sideways Market

- Multisig or MPC Wallets: Which is More Reliable

- Liquidation in Trading: Causes and Protection Methods

- Launchpad: What It Is and How to Participate in Token Sales

- Hedging in Crypto: Risk Protection

- Impact of Listings on Token Prices: Mechanics Breakdown

- Elliott Waves in Trading: How to Apply Them

- DePIN: The New Decentralized Economy

- How to Avoid Crypto Scams in 2025

- Crowd Psychology in Crypto: Market Impact

- Top 5 Exchanges for Derivatives Trading in 2025

- Death Cross and Golden Cross: Important Trend Signals

- Trading Signals in Telegram: Can They Be Trusted?

- How to Determine if a Market is Overbought or Oversold

- DOM in Crypto Trading: Principles and Applications

- Correlation of Cryptocurrencies with Stock Indices

- Aroon Indicator: Determining Trend and Its Strength

- Accumulation and Distribution: Key Differences

- Wyckoff Accumulation Phase: How to Identify It

- Interval Candles in Crypto Trading: Renko and Heikin Ashi

- How to Identify a Trend Reversal in the Crypto Market

- Crypto Market vs. Stock Market: Similarities and Differences

- RWA: Tokenization of Real-World Assets in Blockchain

- Bitcoin Futures Trading on CME: Strategies and Analysis

- Gamma Squeeze in Crypto: Essence and Earning Opportunities

- Fractal Analysis in Crypto Trading: Examples and Strategies

- Crypto CDP: How It Works and Earning Opportunities

- API Key Protection: A Complete Guide for Traders

- Setting Up Alerts on TradingView for Cryptocurrencies

In addition to these publications, we created an article that thoroughly explains the mechanics of the new commission model on TradeLink Marketplace.

We also decided to adapt and publish articles from our blog on the company’s social media channels.

Apart from that

- Fixed and refined the FAQ component on the Marketplace catalog page.

- Fixed a bug with incorrect position display on the Marketplace strategy page.

- Fixed minor visual bugs on the platform.

- Fixed a bug with untimely updates of trading pairs for OKX, ensuring correct statistics display.

- Conducted a rebalancing of indices on the Marketplace.

- Slightly improved the UX for creating the first portfolio on TradeLink Passport.

- Fixed a bug preventing the automatic loading of Binance accounts with more than 1,000 trades per second.

- Fixed a bug with sending notifications for new invoices with zero payment.

- Fixed a bug with sending welcome notifications before a user’s first login to their account.

- Fixed a bug with incorrect XIRR calculations on the TradeLink Marketplace dashboard page.

- Fixed an issue with incorrect statistics display for Binance accounts with forced Mica asset conversion.

- Fixed a bug with continuous loading of portfolio positions in the widget, even when the position monitor was disabled.

- Fixed a bug with incorrect order statistics calculations on the portfolio page.

- Defined a new color structure, collected, and systematized a new color palette for the platform.

- Added a video explainer block to the TradeLink Marketplace homepage.

- Developed annual and monthly strategy performance indicators for the new index and strategy pages.